by Neil Kearney | Jan 25, 2017 | Boulder County Housing Trends, Statistics

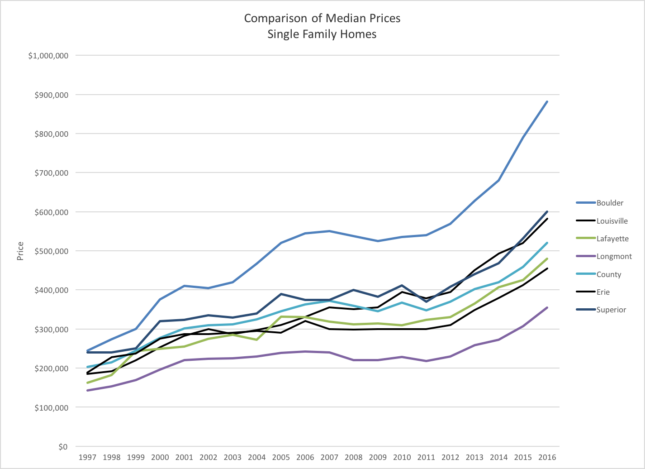

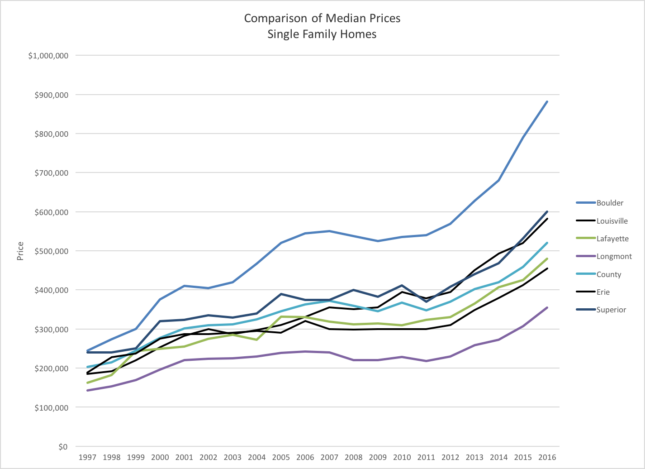

The median price of residential (including single family and attached dwellings) home sales in Boulder County during 2016 was $450,000. This was up roughly 12.5% for the year. But this is far from the whole story regarding home prices in Boulder County. As we break the statistics down into the individual communities throughout the county we start to get a broader sense of what is happening. The first graph below shows the median single family home prices of each of the local communities since 1997. Over the last twenty years Boulder has really outpaced the other communities in the area.

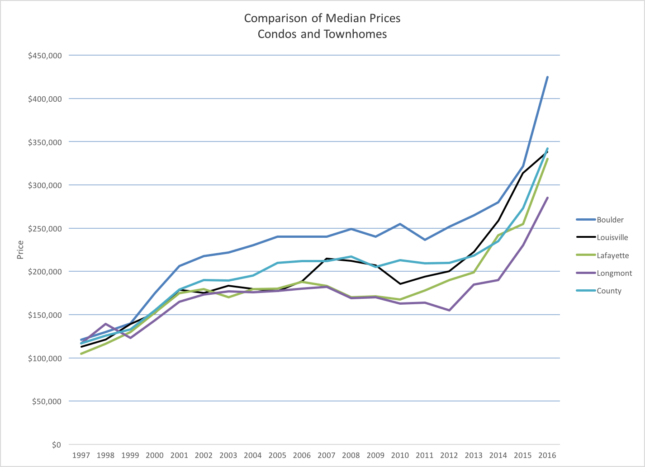

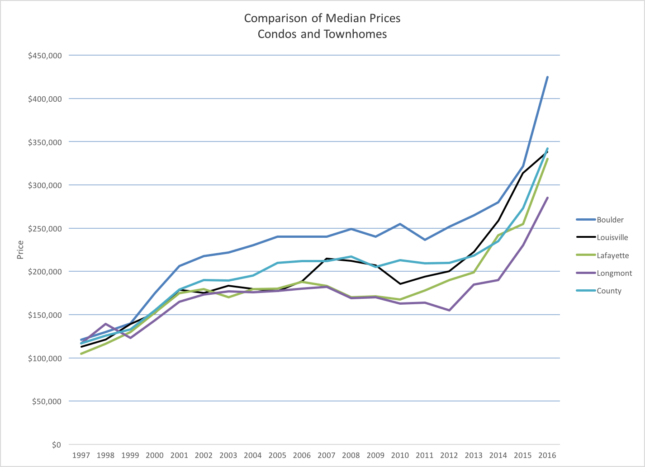

The comparison for attached dwellings (condos and townhomes) is similar but not quite so differentiated.

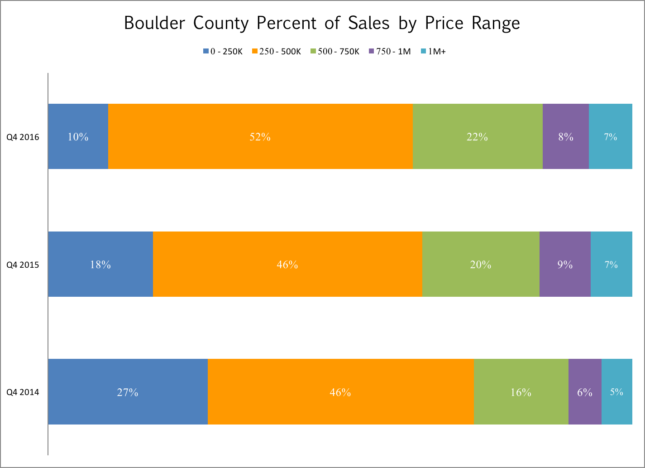

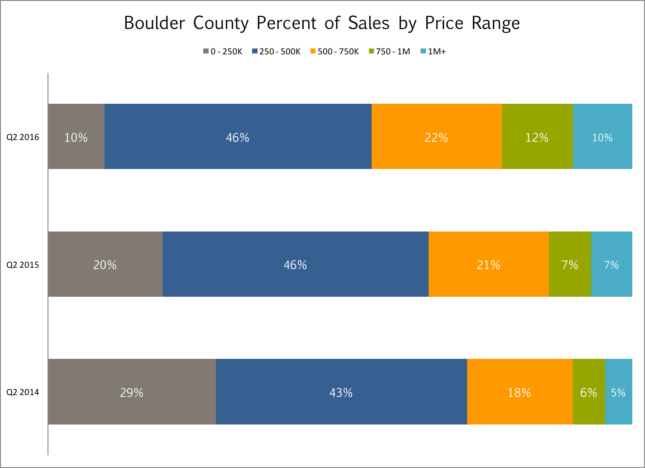

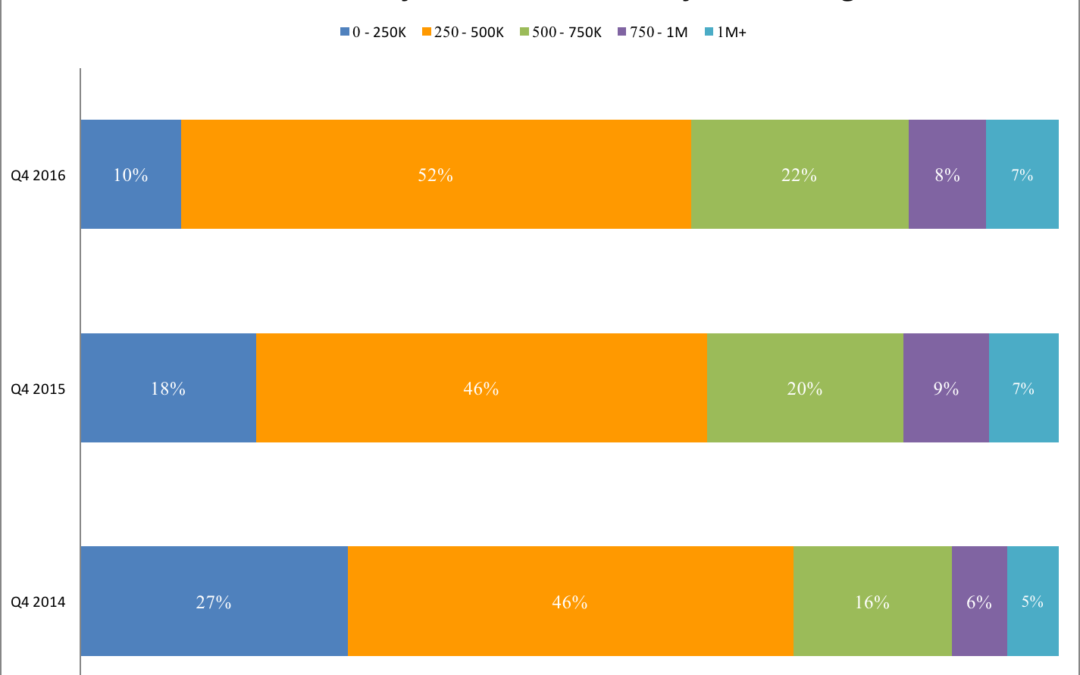

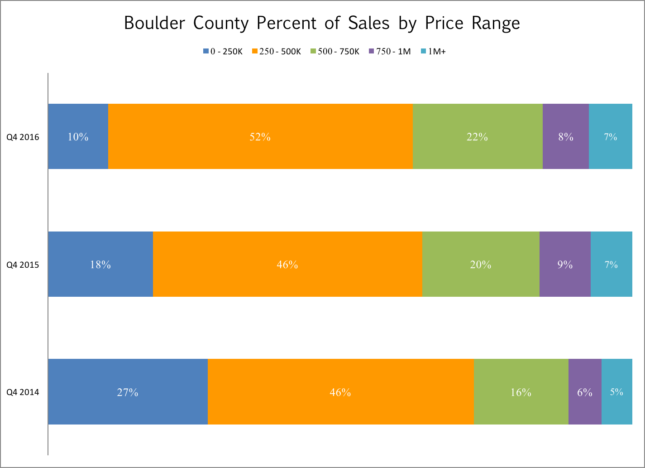

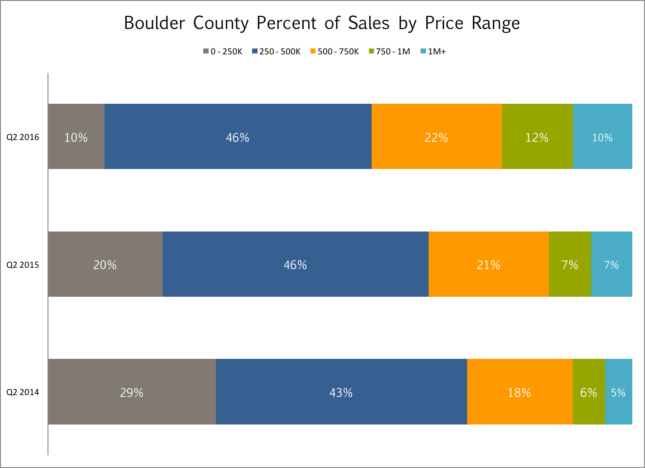

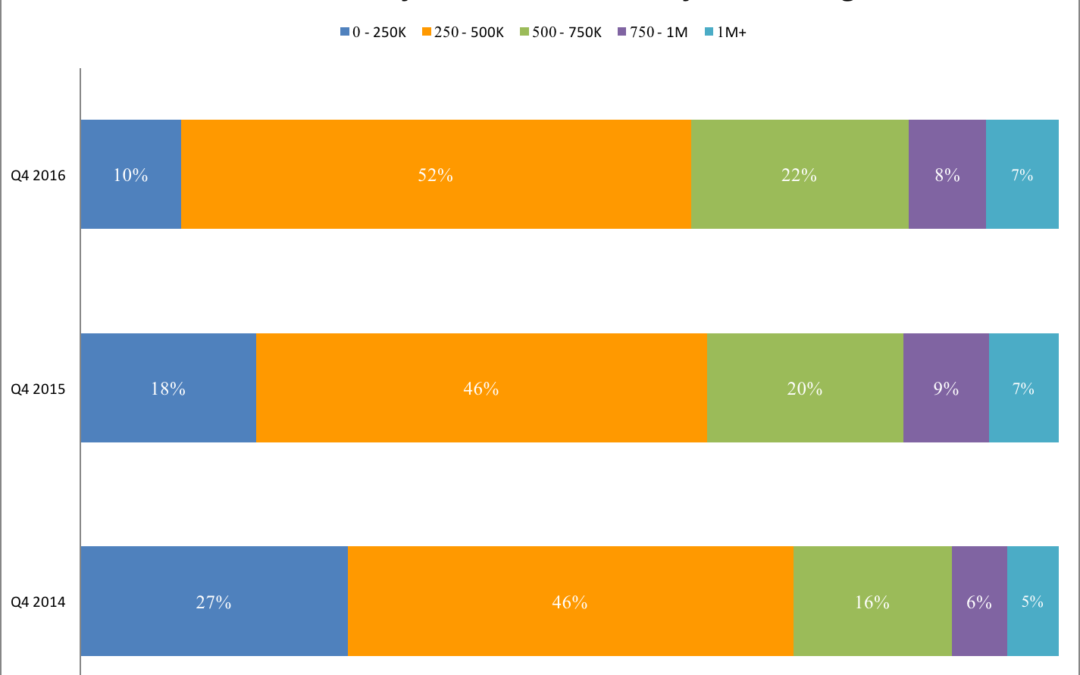

Another way to look at the prices in different communities is to break down by price range where the sales took place in each community. First let’s start with the county as a whole.

During the most recent quarter 62% of all sales were less than or equal to $500,000. This percentage has been relatively stable over the past three years (comparing just 4th quarters). However, the lower price range ($0 – $250,000) has decreased 17% and those sales have moved to the right.

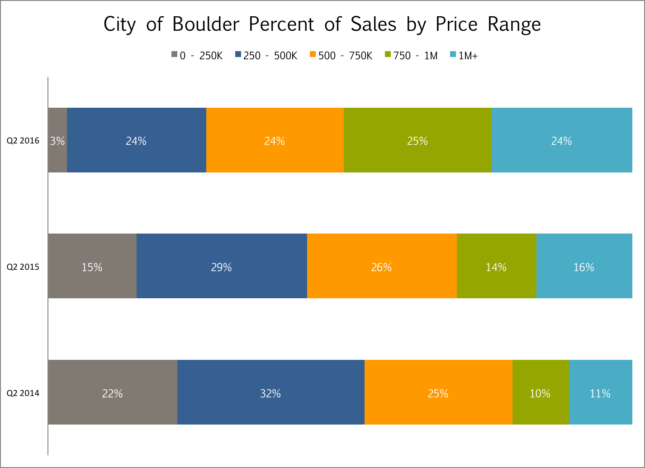

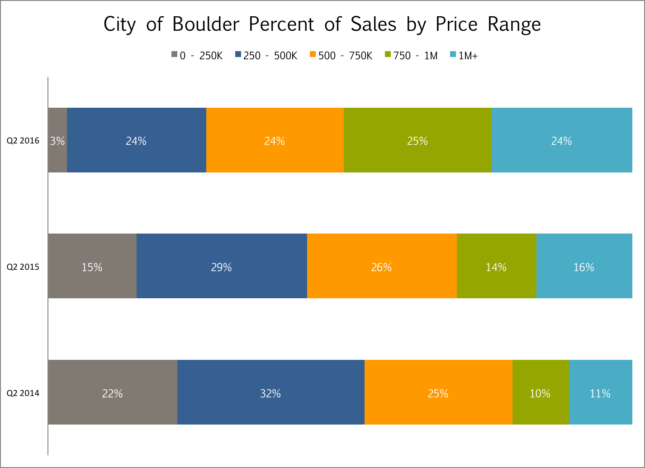

Boulder is more expensive! This isn’t news. Just 36% of all sales were $500,000 and below. It’s interesting to look at the more equal dispersion of sales across all price ranges. Over the last three years the entry level has shrunk by 2/3 and the high end has increased.

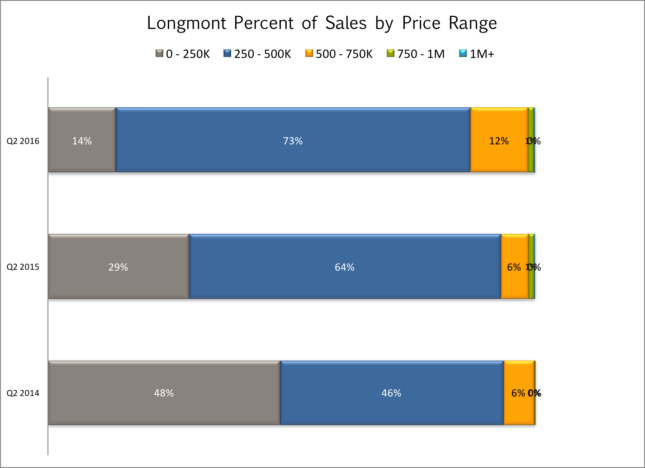

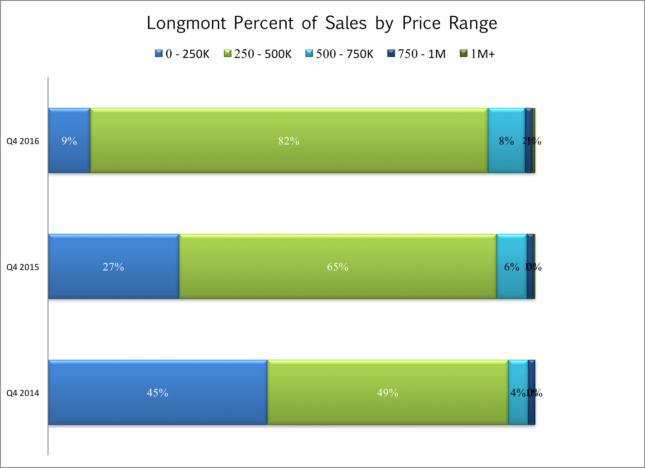

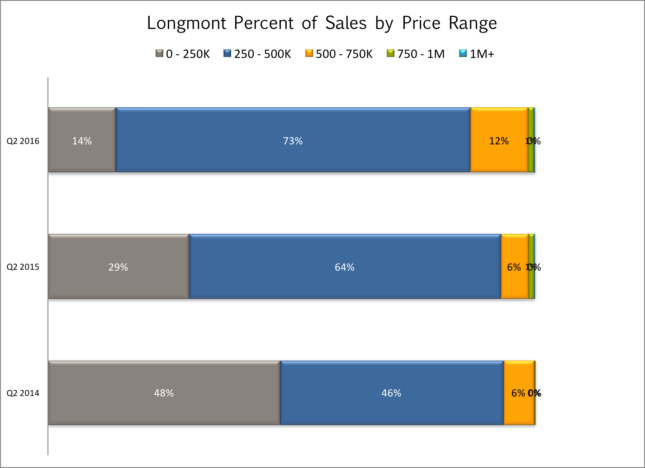

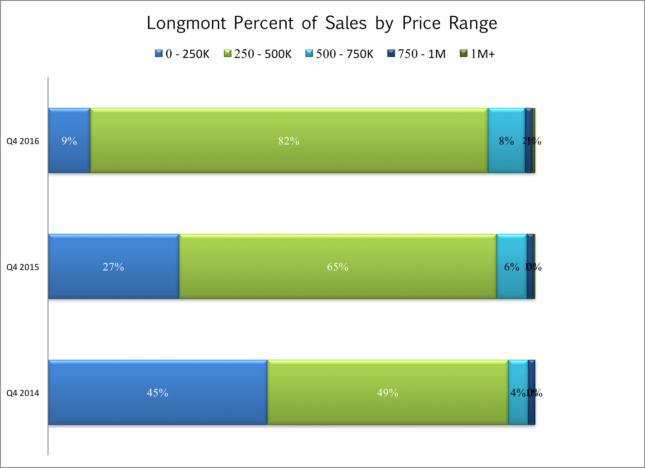

The sales mix in Longmont is completely different that Boulder. 91% of sales are $500,000 or below. 82% of sales are between $250,000 and $500,000 and over the last three years the entry level has shrunk from 45% to just 9%.

The sales mix in Longmont is completely different that Boulder. 91% of sales are $500,000 or below. 82% of sales are between $250,000 and $500,000 and over the last three years the entry level has shrunk from 45% to just 9%.

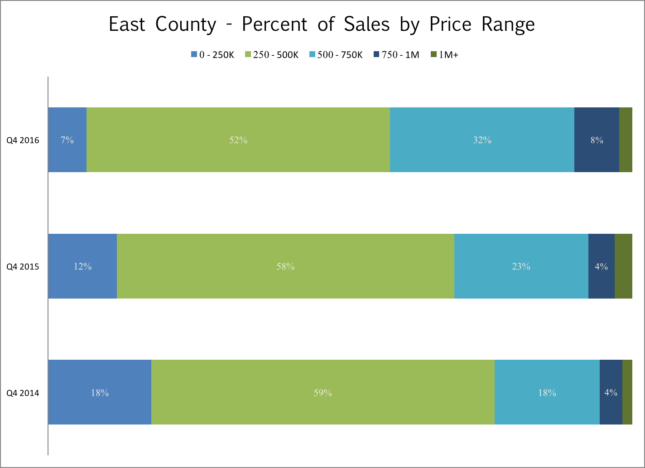

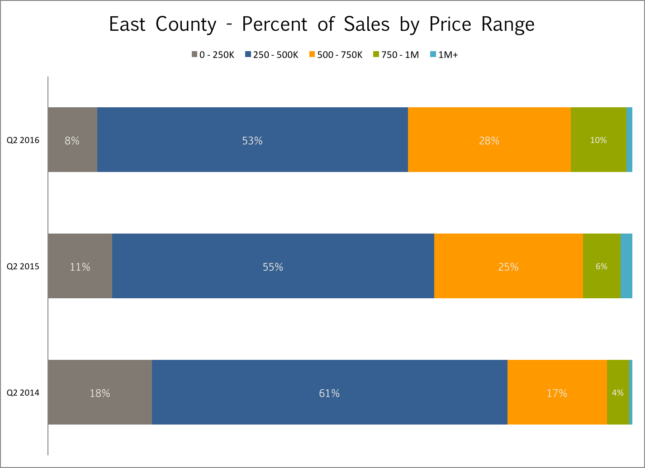

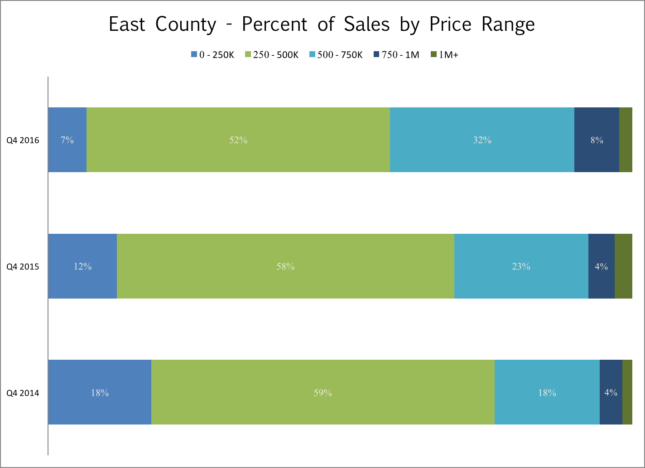

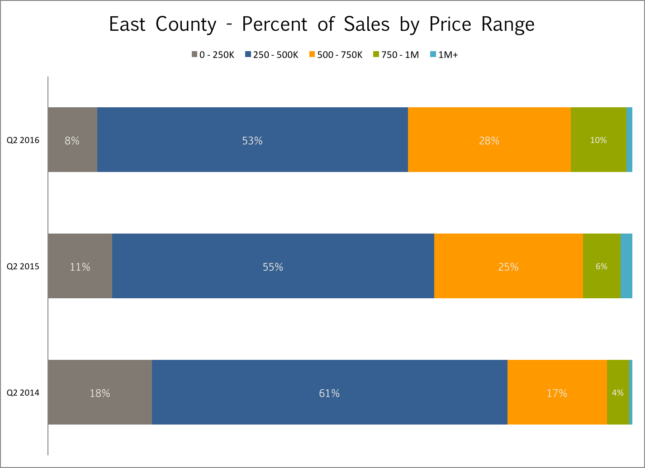

In between Boulder and Longmont are the other communities in East County. The graph below puts Erie, Superior, Lafayette and Louisville together. During the most recent quarter in those communities 59% of sales took place at or below $500,000. The $500,000 to $750,000 price range is really growing and$1 million plus sales are still rare in those communities (doesn’t include unincorporated Boulder County).

Prices are rising but there is still a nice mix of price ranges within a reasonable commute to anywhere in Boulder County. It’s always been a trade-off between price, location and condition. But now the entry point is higher.

by Neil Kearney | Nov 1, 2016 | Boulder County Housing Trends, Statistics

I have just published The Kearney Report for the 3rd Quarter of 2016. I have streamlined the design and hope you are able to find the key information more easily. The entire report can be viewed below on this page or you can download the PDF link here The Kearney Report 3rd Quarter 2016

I have just published The Kearney Report for the 3rd Quarter of 2016. I have streamlined the design and hope you are able to find the key information more easily. The entire report can be viewed below on this page or you can download the PDF link here The Kearney Report 3rd Quarter 2016

Real Estate Market Update

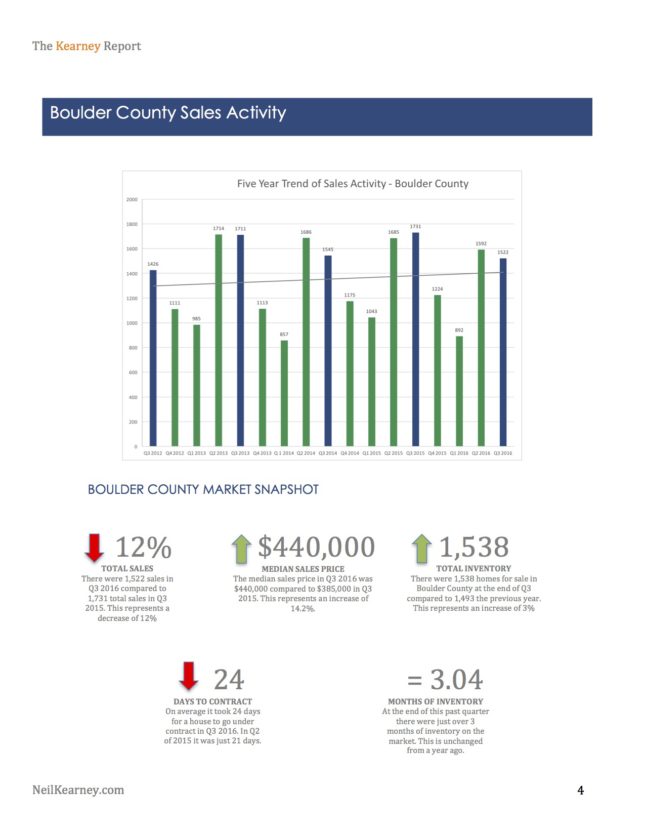

At the end of the second quarter the Boulder County real estate market was ranked #1 in the nation for annual home appreciation. It was a testament to the unrelenting demand, low inventory and the pent up frustrations of buyers who had finally realized that the price they needed to offer didn’t have anything to do with what the last home in the neighborhood sold for. Since June the market has slowed down. In the same way a car eventually needs to refuel and a horse needs to cool down, a market, real estate or otherwise can’t run at full speed forever.

Don’t get me wrong the market is still good, houses are still selling. In fact, in the 3rd quarter 42% of all sales sold for over the asking price (down from 50% in the 2nd quarter). The difference I have been seeing in the market over the last few months is this; inventory is slowly rising, houses are staying on the market longer, when a house does get multiple offers it’s more commonly two or three offers rather than a dozen, there are more price reductions happening, there have been fewer showings per listing. It is no longer a given that a house will sell. It’s back to reality, where a house must be priced correctly compared to the competition in regards to condition and location.

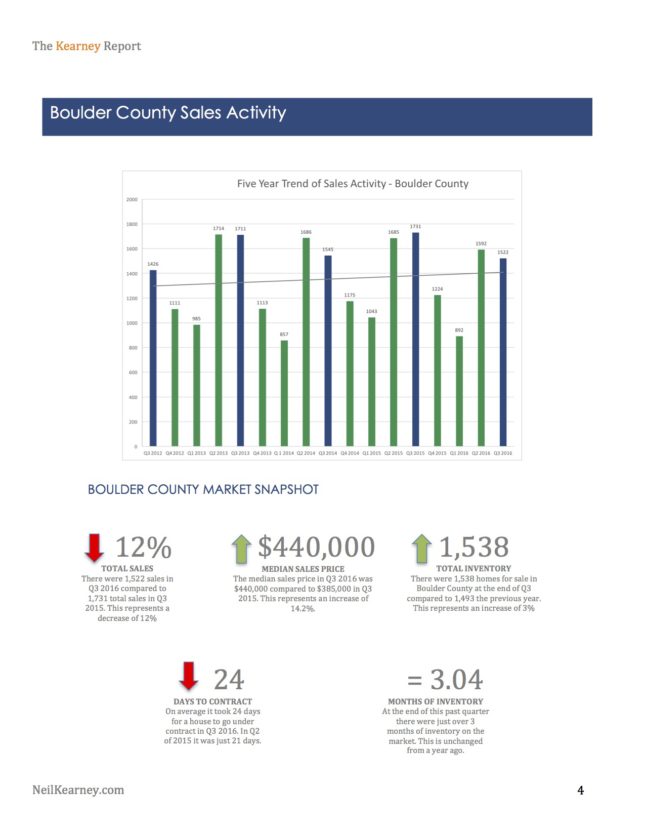

The total number of residential sales in Boulder County is down roughly 10% year-to-date. Third quarter sales were down 4% from the second quarter of this year and down 12% from Q3 of 2015. Interestingly, sales within the City of Boulder are down 24% from Q3 of last year. This steep decline within the City has been noted in six of the past seven quarters. In looking at the sales mix by price range for Boulder during the quarter, it seems that the sales declines in the lower price ranges are not necessarily translating into increases in the upper ranges.

Change in sales in the City of Boulder During the 3rd Quarter by Price Range

$0 – $250,000 Down 82%

$250,000 to $500,000 Down 25%

$500,000 to $750,000 Down 16%

$750,000 to $1 Million Up 5%

Over $1 Million Up 5%

Total Sales Down 12%

Another sign that the market has cooled a bit is the fact that prices decreased 5% from the second quarter. This doesn’t necessarily mean that the market has shifted (prices are still up 14% above where they were a year ago) it just means that the homes that sold during the most recent quarter didn’t follow the torrid pace of the second quarter. Most likely when the FHFA.gov Home Price Index comes out for the third quarter we will no longer hold the top spot. But I predict that we will still be near the top since the results are cumulative.

Could this slight slow down in the market be just a downshift, a pause before even more people to move to Boulder and its surrounding area? Absolutely, I don’t see anything out there that has fundamentally changed what is fueling our market. Vestros Real Real Estate Solutions, a company who provides real estate risk analysis to the mortgage industry predicts that Boulder will have another 10.5% appreciation over the next year. Second nationally only to Denver.

Interest rates are still favorable, people are still moving to our area and Google’s new offices are still under construction. Speaking of Google, other areas in which they have set up a large office have seen a fundamental shift in the real estate market after they arrived. Many predict that Boulder will follow this trend. It seems that we already have a head start.

You may have noticed that there are not many for sale signs out there. The inventory of “for sale” homes in Boulder County at the end of the 3rd quarter is up 3% from a year ago but down 12% when compared to 2014. Fewer homes are coming on the market and those homes are selling quickly. Even though inventory has increased slightly, it’s still slim pickings for buyers.

Here is our advice for buyers and sellers in the current market.

Buyers – After two years of frustration this might be a good time to step into the market again. This time of year you typically have a bit more time to make a decision regarding a home purchase and you may just get lucky and find a diamond in the rough that has been overlooked by the market. On average, homes are still selling for just below asking price. In the 3rd quarter 21% of homes sold closed at the asking price; 42% sold for above asking price (on average a 4% premium was paid) and 37% sold for under the asking price (at an average of a 3.4% discount).

Sellers – Properties are still selling. This may be a good time to lock in the price gains over the past few years. Condition matters! You may have more competition so it’s important to have your home ready to go in order to maximize price. If you are planning to sell in the winter let me know so that I can come out now to take some exterior photos before the snow flies.

by Neil Kearney | Aug 12, 2016 | Boulder County Housing Trends, Statistics

The Kearney Report – Second Quarter 2016 If you are looking for a comprehensive look into the real estate market in Boulder County look no further than the latest version of The Kearney Report. In the report I have outlined the highlights of the Boulder County...

by Neil Kearney | Jul 28, 2016 | Boulder County Housing Trends, Statistics

Boulder’s real estate market has lately been explained in the press with headlines such as; “Cost of Average Home Surpasses $1 Million” and “What Bubble? Boulder County Ranked As Most Stable Housing Market In U.S.”. At first these seem contradictory. How can a market that has appreciated by 308% be the most stable? The personal finance company SmartAsset analyzed sales data since 1991 and found that Boulder County had steady appreciation without any significant periods of depreciation. In other words, the Boulder real estate market has reaped the rewards without the risk. Since the 1980’s our area has had three periods of rapid appreciation (frenzied market) and we are currently in the midst of the fourth. During the past cycles we have seen four years of rapid price growth followed by a evening of the market. We have not seen a time where we have had a price correction. We have had both strength and stability.

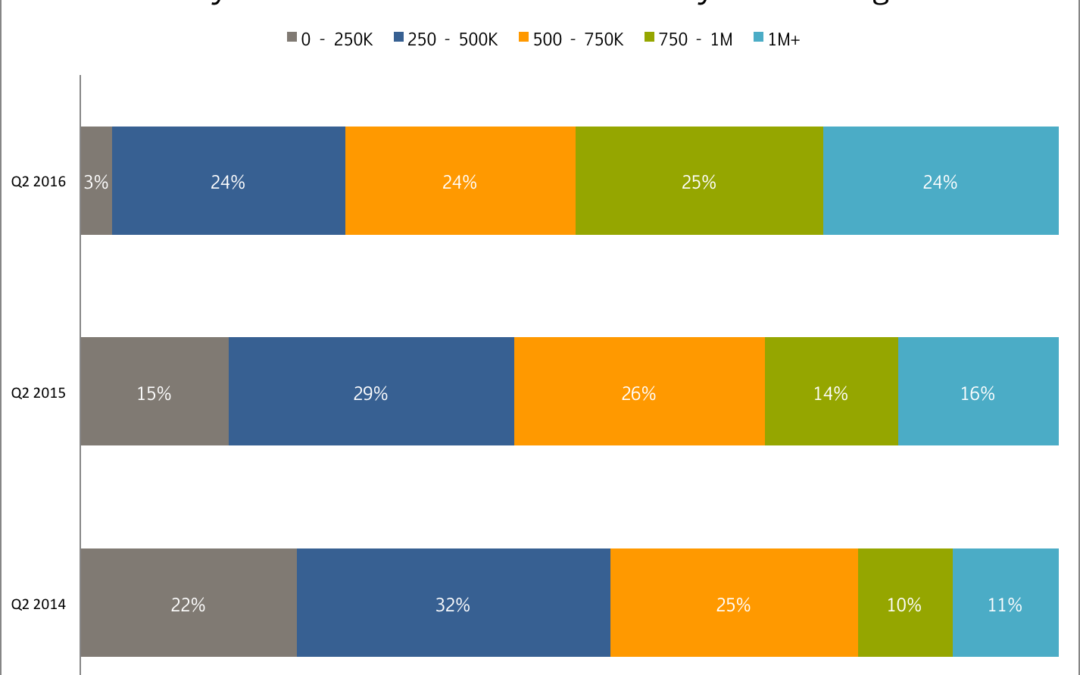

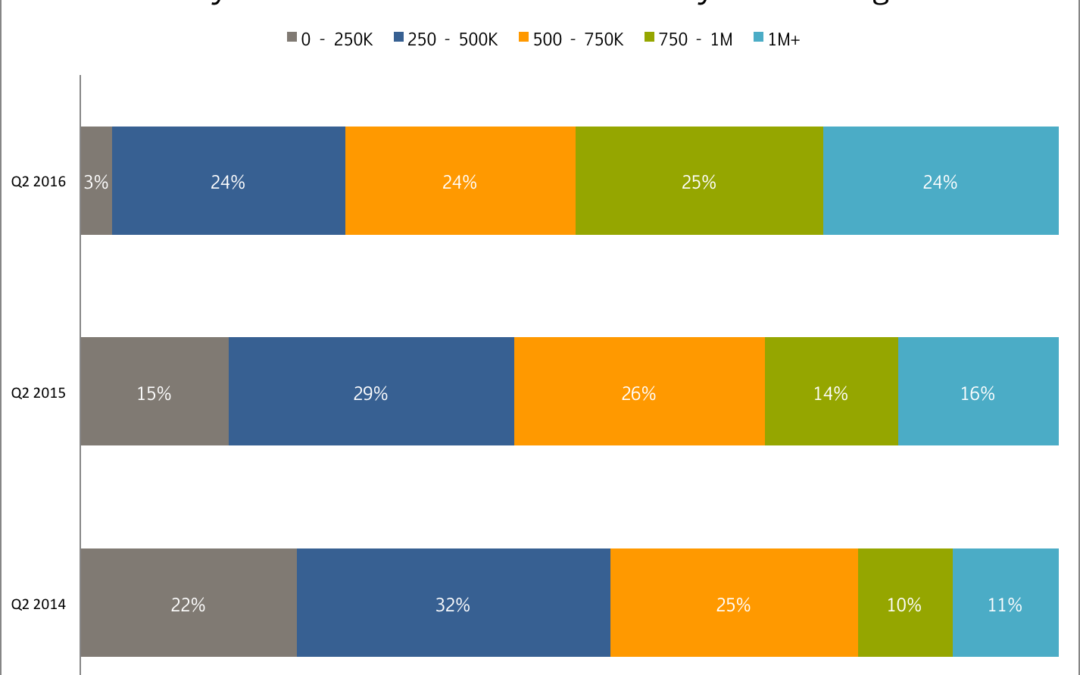

During our current appreciation cycle we have seen between 10% and 15% appreciation each year. For the one year period ended on March 31, 2016 our annual appreciation was 14.4% which ranks our area 2nd in the nation out of 263 areas for that time frame. (FHFA.gov) I recently finished compiling my statistics through the second quarter and I found that a particular graph that shows the sales mix across price ranges compared over the past three years illustrates the price appreciation we have experienced well. What I find most interesting is the rapid disappearance of the starter house/condo under $250,000. In the charts below the most recent quarter is shown on top and is compared to one year ago and two years ago below. In each of the areas (Boulder County, Boulder, East County, and Longmont) the sales mix shift to the right is dramatic.

In Boulder County as a whole the entry level price range has dropped from 29% to 10% over the past two years and sales over $1 million have increased from 5% to 10% of the market.

In the City of Boulder these trends are even more dramatic. The entry level has decreased from 22% of the sales to just 3%. There are just a few one bedroom condos left under $250,000. At the same time, homes with a sales price of $750,000 or more have increased from 21% of the market just two years ago to 49% of the market sales.

Longmont is still the most affordable area in the County with a median price of just under $340,000 and has very few homes that sell above $750,000. However, over the past two years the number of entry level sales has dropped from 48% to 14%.

Longmont is still the most affordable area in the County with a median price of just under $340,000 and has very few homes that sell above $750,000. However, over the past two years the number of entry level sales has dropped from 48% to 14%.

The sales mix in Louisville, Lafayette, Erie and Superior has changed as dramatically as other parts of the county. There has been a shift to the right but prices in those areas are consistently more in the middle.

The pressure of a frenzied market has relieved a bit as of late, but at the moment it’s unclear whether it’s a pause or a shift in the market. Since it’s normal for activity to slow down this time of year we won’t really know until September. Stay tuned!

by Neil Kearney | Jul 5, 2016 | Boulder County Housing Trends, Boulder Real Estate

What a difference a few months make. Back in April every new listing was inundated with buyers. Open houses were flash mobs and multiple offers were the norm. Since Memorial Day it seems to be a different market and I’m trying to figure out if the fundamentals have changed or if everyone is just away on vacation.

First of all, this is not an unusual trend. The common perception is that summer is “the” time for real estate sales. That might be true in other places, but in Boulder County spring is king. Every year the market slows down for the summer. Most years it’s in June, last year it was in late July and this year it appears (in hindsight) that it was late May.

Let’s be clear, the market conditions in Boulder County are still good, transactions are still happening, buyers are still out looking, new listings are coming on the market and deals are closings are still happening but it seems that the pressure in the market has waned. Especially in the high end of each towns market.

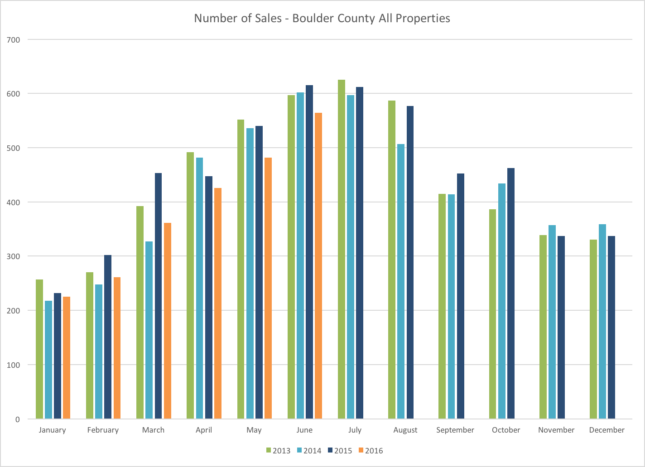

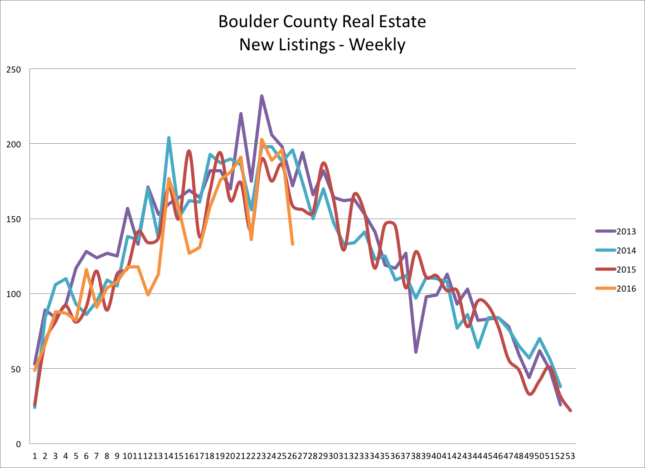

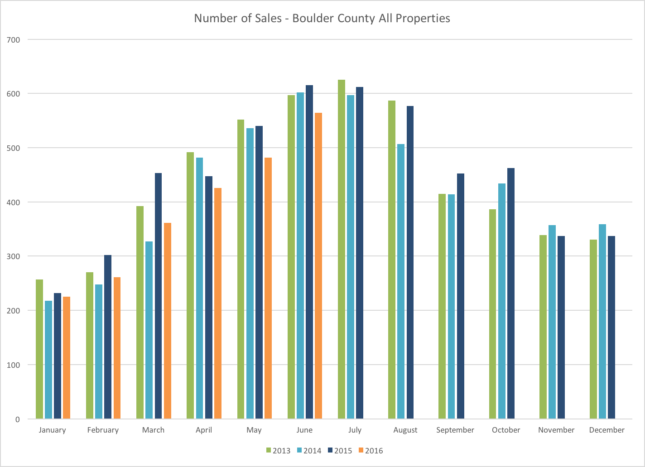

In this article I will present a number of different measures that measure market activity. Cutting to the chase it isn’t clear cut. Let’s begin by looking at sales. This first chart shows the number of closed transactions in Boulder County each month over the past five years. The orange line shows sales in 2016 and it’s clear that we are not keeping up with last year’s torrid pace. Through the first half of the year sales are down 10% from 2015. Inventory is low compared to past years and this has definitely been a cause for the lower activity. When buyers don’t have many houses to see the chances that they find one to buy goes down. This next chart shows the flow of new listings to the Boulder County market (all price ranges and types) on a weekly basis. It appears that new listings peaked back at the end of May and if we follow the trend will be decreasing for the rest of the year.

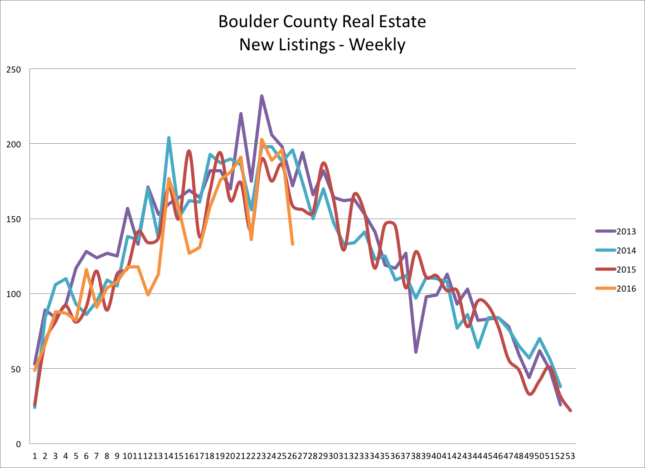

Inventory is low compared to past years and this has definitely been a cause for the lower activity. When buyers don’t have many houses to see the chances that they find one to buy goes down. This next chart shows the flow of new listings to the Boulder County market (all price ranges and types) on a weekly basis. It appears that new listings peaked back at the end of May and if we follow the trend will be decreasing for the rest of the year.

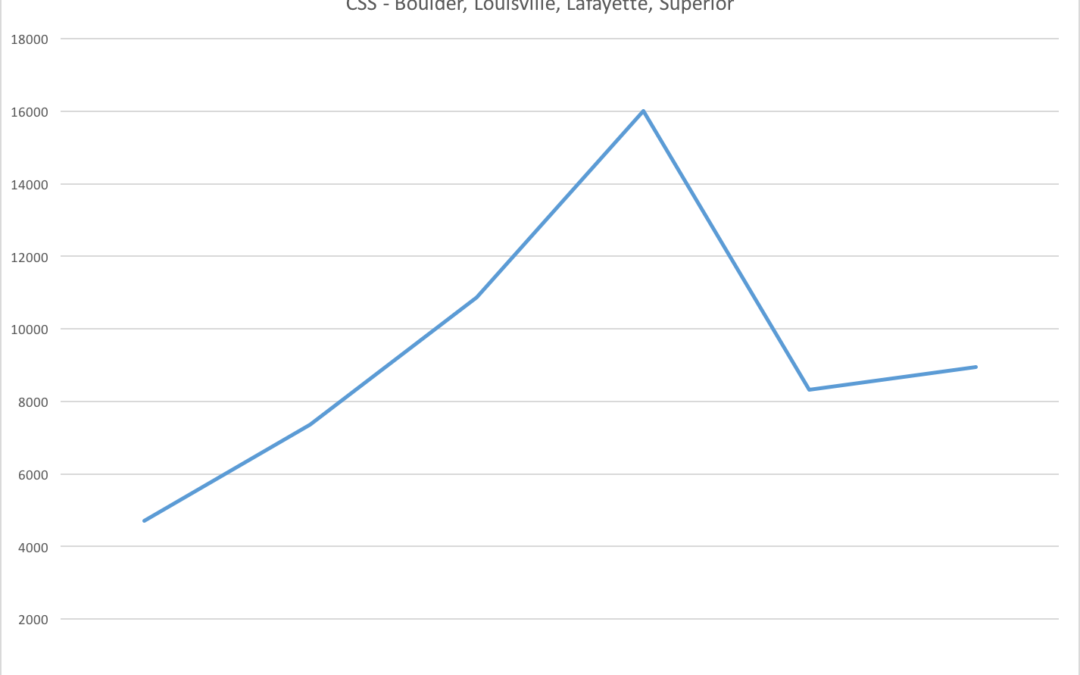

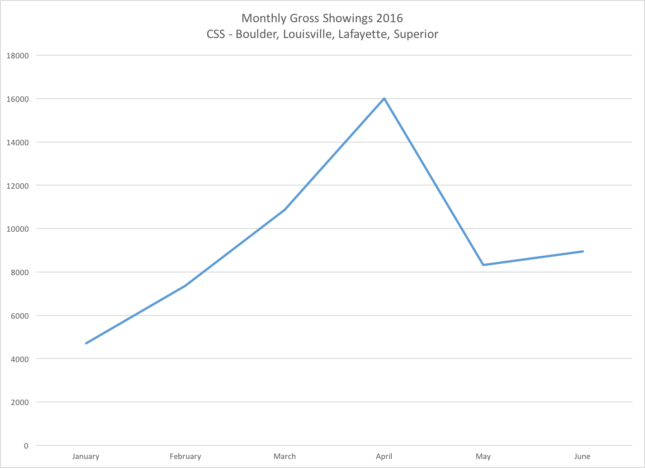

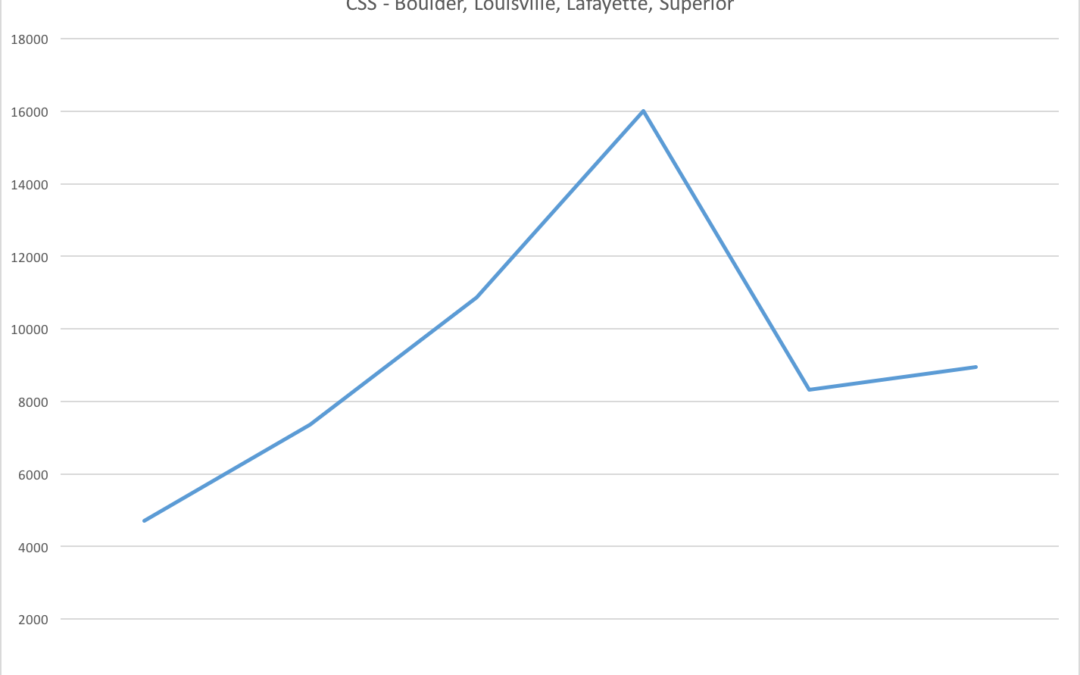

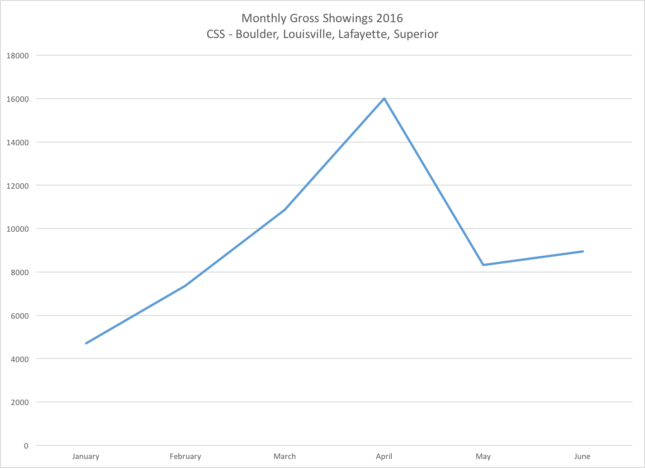

Unfortunately, showings started falling just as more new listings were coming to the market. More listings and fewer showings means that buyers didn’t have the sense of frenzy as they did back in April. The graph below shows the gross showings by month in Boulder Louisville and Lafayette as set by Centralized Showing Service. They don’t handle every showing in town but they have a very significant number and the sample is large enough to call it representative.

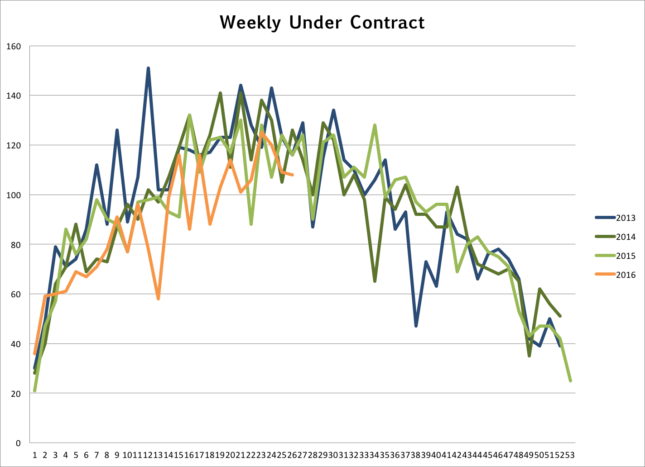

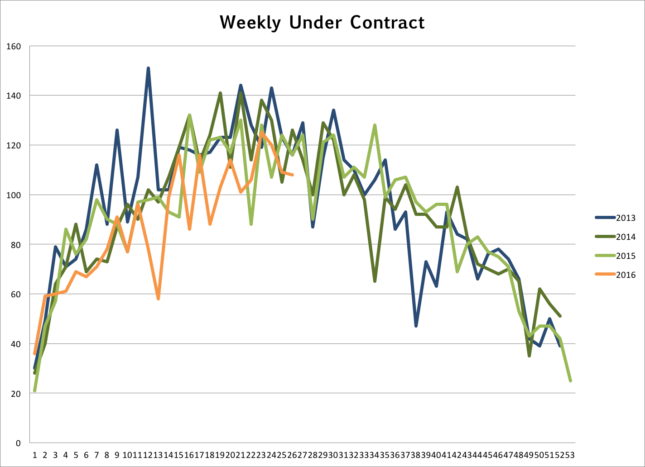

So far everything makes sense. This is where it gets a bit fuzzy. I track the number houses that go under contract each week in Boulder County. From the graph below it appears that sales are still brisk. This shows equal or more contracts even while there were fewer showings. Obviously there are still buyers out there and finally with less competition they can jump on a property and get their offer accepted. It’s been all too common these past few years for buyers to look around a quite a few houses, find the right one, get beat out in a multiple offer situation and then be forced to start anew. Wash, rinse, repeat! This cycle pumps up showings. In the old days, a new listing comes on the market, buyer sees the listing, buyer likes the listing and then buyer buys the listing. Maybe we are getting back to that. Refreshing!

So far everything makes sense. This is where it gets a bit fuzzy. I track the number houses that go under contract each week in Boulder County. From the graph below it appears that sales are still brisk. This shows equal or more contracts even while there were fewer showings. Obviously there are still buyers out there and finally with less competition they can jump on a property and get their offer accepted. It’s been all too common these past few years for buyers to look around a quite a few houses, find the right one, get beat out in a multiple offer situation and then be forced to start anew. Wash, rinse, repeat! This cycle pumps up showings. In the old days, a new listing comes on the market, buyer sees the listing, buyer likes the listing and then buyer buys the listing. Maybe we are getting back to that. Refreshing!

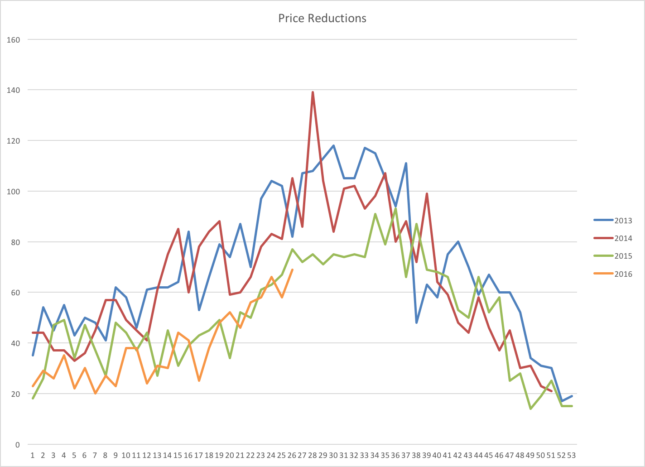

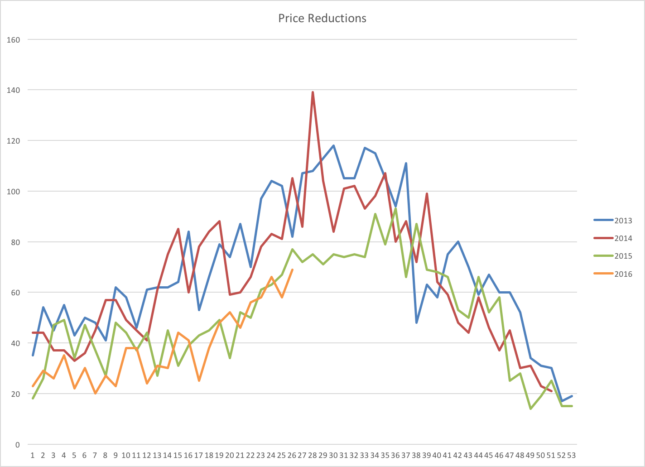

Before I started checking any of these statistics I felt the market slowing. Fewer listings for my buyers to see, not so many people at open houses and houses staying on the market a bit longer (what’s longer than immediately?). In an extreme sellers market sellers sometimes get greedy and when they don’t get their price in the first week to ten days they come back to reality a bit. So it would make sense that there would be more price reductions. Looking at the graph below we can see that the answer to that query is technically yes, but it doesn’t support the hypothesis that the market has changed.

Given the information below it seems that the market has slowed but it seems more like a vacation than something more permanent. If you need to sell your house this summer you may need to lower the price. If we are patient, we will most likely feel the pressure rise when the buyers are back in town.

Given the information below it seems that the market has slowed but it seems more like a vacation than something more permanent. If you need to sell your house this summer you may need to lower the price. If we are patient, we will most likely feel the pressure rise when the buyers are back in town.

The sales mix in Longmont is completely different that Boulder. 91% of sales are $500,000 or below. 82% of sales are between $250,000 and $500,000 and over the last three years the entry level has shrunk from 45% to just 9%.

The sales mix in Longmont is completely different that Boulder. 91% of sales are $500,000 or below. 82% of sales are between $250,000 and $500,000 and over the last three years the entry level has shrunk from 45% to just 9%.