by neil kearney | Feb 23, 2010 | Boulder County Housing Trends, Statistics

Overview of the luxury condo market it downtown Boulder

During 2002 and 2003 One Boulder Plaza changed the landscape of downtown Boulder by inventing a new category in the local real estate market. That first successful project merged the Downtown Boulder location and luxury finishes. The result was a paradigm shift to what a buyer would pay for a square foot of residential living space. As sales mounted and a new buyers were attracted to the area other developers became encouraged and decided to continue the concept. Soon new projects were built and early on the local and national real estate market (as well as the financing) were robust enough to provide buyers for the newest and best projects. Competition has been tough with buyers preferring to choose their finishes and buy “new” rather than pay a similar price for a resale.

Since 2007 the combination of difficult credit conditions, an economic slump, stock market losses and out of state real estate losses have hit the local luxury market severely. Here is a graph showing all properties sold in Boulder County over $1,000,000 which were listed in the MLS since 1997.

As you can see the number of sales has dropped significantly since the peak year of 2007. However, sales in this category are not dead. During 2009, 78 condo properties sold in Boulder area above $500,000. Sixteen of those sales were over $1,000,000. The average price per square foot for properties in the downtown area under $900,000 was $503 and $697 for properties over $1,000,000.

I think going forward the strength of this market going forward depends upon outside forces such as; the strength of the housing market in general both locally and nationally, the ability of the luxury market to withstand a high inventory position while not losing too much value and the availability credit for buyers.

Market Data

Since January 1, 2009 there have been 16 sales of condo units in Boulder Colorado over $1,000,000. To view a detailed spreadsheet showing all of the sales, the price per square foot of each unit and the sold date, click here. I welcome you to delve into the details but here are the details. The sales ranged from $1,000,000 to $5,317,000 for Jared Polis’s custom built penthouse unit at the Walnut. The average price per finished square foot for the entire bunch was $697. This is about $100 higher than it would be if we threw out the sales over $2 million.

Currently, there are 25 condos listed in Boulder over $1 million. This number understates the true market a bit because there are some properties listed for sale that are not in the MLS. Most notablyThe Arete has just five properties listed for sale while I think the true number available is close to double that.

by neil kearney | Feb 11, 2010 | Boulder County Housing Trends, Statistics

The real estate market is off to a quick start this year. I see three major reasons why we are seeing increased activity. The first is the extended tax credit. The second is low interest rates. The next reason is less quantifiable but just as valid. I see the third cause of the improved market so far this winter as an overall improved confidence. Many people have been slogging along over the past 18 months, listening to bad news, cutting their spending and hoping it doesn’t affect them too much. Just like a farmer’s tentative first steps out of the cellar after the tornado, most people pick up a few sticks and are glad the tornado hit the next town. It’s time to start living again.

Showings are very strong and contracts are just starting to react. You will see that total sales in Boulder County were just about the same as they were last January. Not great, the feel going forward is totally different. Last January the phones were silent and people were in shock. This year contracts are up and we are ready for an early spring.

It feels like we have a lot of “mass” behind the early sales. Most of the early activity is still in the lower price ranges. However, there are currently 16 homes under contract which are listed above $1,000,000 in Boulder County. Let me know if you questions. But for now I need to get back to work.

The slideshow is best when viewed in “full screen”. Just hit the second button in on the top right corner.

by neil kearney | Jan 29, 2010 | Boulder County Housing Trends, Statistics

The real estate market in Boulder County is starting to get its legs for spring. Showings have been very strong for this time of year but up until this past week contracts have been lagging. The chart above shows two data sets collected every Thursday morning since last April. The blue line shows the number of homes that went under contract during any given week and the red line shows the number of properties that sold during any given week. You can see that the sales for January reflect the typical slower activity over the Holidays. However, the far right side of the blue line shows a definite trend toward strong activity for the spring.

by neil kearney | Jan 22, 2010 | Boulder County Housing Trends, For Buyers |

If you have ever purchased a home with less than 20% down you have most likely heard the term “mortgage insurance”. Mortgage insurance is required to be purchased by the buyer when the equity is not sufficient to cover the risk. Different loan types require either an up-front payment or monthly payments. The mortgage insurance companies then insure the mortgage holders from some of their loss on that house in case of foreclosure, etc. Mortgage insurance companies only lose money when values drop and they are very careful (now more than ever) where they will insure properties and what they charge for their insurance.

Mortgage insurance companies are a great source for market information. They do research throughout the nation regarding the strength of local real estate markets. I thought it would be useful to see how a few companies see the Boulder and Denver markets. It is great information from companies who have much to lose if their risk projections are wrong.

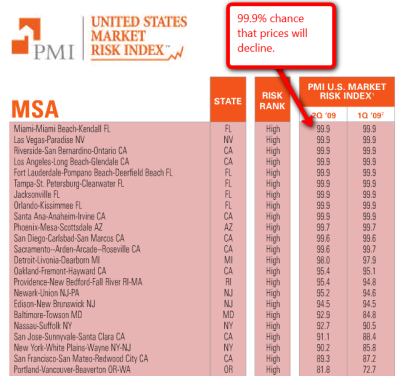

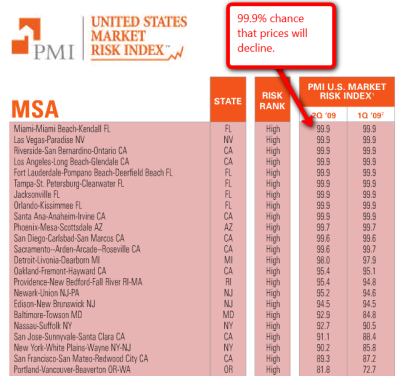

First let’s look at PMI. PMI uses a statistical model that assigns each Metropolitan Statistical Area (MSA) with a risk factor. This risk factor tells the percentage chance that the prices will fall over the next year. The chart below shows the highest risk areas. These markets show a 99.9% chance that prices will drop during the next year.

Boulder County has its own MSA and our prices have been pretty steady. Over the next year PMI says that there is only a 12% chance that prices will drop over the next year. This, for them Boulder is a low risk area.

Another company who does this type of analysis is MGIC.

MGIC ranks the largest MSA’s nationwide and gives a prediction on which direction the market is headed. They don’t rank Boulder, but they do rank Denver. Denver, which includes 11 metro counties, is listed as soft but “improving”. This is the only market in the country which is classified as an improving market. These third parties who are notoriously conservative see a brighter than average future for our area and this reinforces my optimism.

by neil kearney | Jan 15, 2010 | Boulder County Housing Trends, Statistics

http://viewer.docstoc.com/

2009 Boulder County Real Estate Statistics –

The slides above show a comprehensive review of the area real estate market in Boulder County. Click through the slides for an annotated view of the market trends in Boulder, Louisville, Lafayette, Longmont, Erie, Superior, the Suburban Plains and the Suburban Mountains.

Here are a few highlights:

- Total Sales in Boulder County are down 38% from the peak in 2005 and down 15% from 2008.

- Median Prices in Boulder County were down 3.6% and 3.9% in 2008 & 2009.

- In the City of Boulder, sales of single family homes are down 45% from 2004 and were down 25% from a year ago.

- Sales of Boulder Condos are down 30% from the peak in 2005 and down 16% from 2008.

- Prices within the city limits of Boulder have been fairly stable. Median prices for homes were down 2.2% & 2.4% over the past two years and condos were up 3.7% and down 3.6%.

- On average it would take 6 ½ months to sell all of the current inventory of single family homes given the sales pace over the past year.

- Median prices for all residential real estate in Boulder was down 1.7% during 2009.

- Median prices have risen each year since 2000 in Louisville.

- Median prices in Longmont have spent most of the decade between $210,000 and $230,000

- Sales in Superior were up 7% in 2009.

- After a meteoric rise, the number of properties selling over $1 million has fallen 46% over two years.

by neil kearney | Jan 14, 2010 | Boulder County Housing Trends

Here are the top trends in the Boulder County real estate market as I see them. Some are specific to this area and some have a broader scope.

First let’s discuss 2009:

- Number of sales down 15% countywide.

- Homes below the “median price” are selling. Different prices for different areas, price ranges that are moving in Boulder are considered too high in Longmont.

- Higher priced homes have trouble finding buyers. In December there was a 4 year supply of homes priced over $1.5 million in Boulder County.

- Slow start to the year and then improving as the year progressed. The first quarter was dead – the fourth quarter was not so bad.

- Outside influences included – tight credit, tax credits for first time buyers and low interest rates for conventional loans (up to $417,000).

- Consumer confidence begins a slow return.

- Opportunities in the market – foreclosures, motivated sellers.

Check back in a day or so for my full 2009 market report. This will include statistics for homes sales in Boulder, Louisville, Lafayette, Erie, Longmont, Superior, Suburban Plains and Suburban Mountains. To get the report right to your email send a request to Neil@NeilKearney.com

Here is what I expect for 2010

- Quick start due to extended tax credit and low interest rates. If you are considering a move in 2010, making it happen before April 30th is a good idea.

- Interest rates will rise during the year – most predictions say interest rates will start with a “6” this time next year.

- Foreclosures and short sales will continue to be a large segment of the market.

- Look for more distressed sales in the upper ranges.

- I think 2010 will be a recovery year – heading the right direction. We won’t see a big recovery until jobs come back in droves.

- Look for real estate on the Front Range to recover much more quickly than other areas.