by Neil Kearney | Oct 9, 2018 | Boulder County Housing Trends, Statistics

The market is slowing as we move towards winter view the slideshow and read more below.

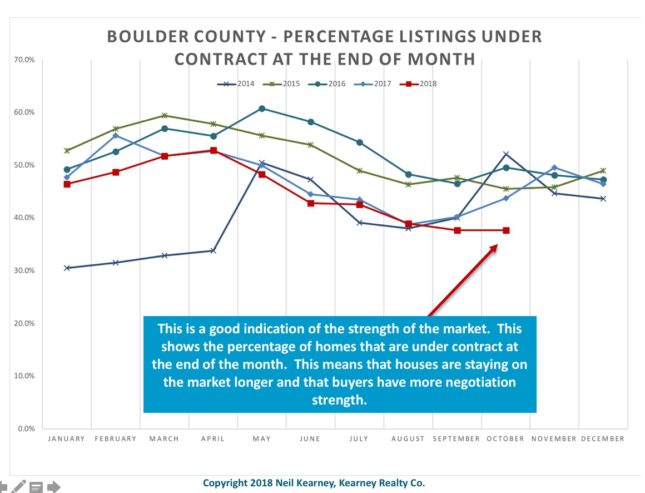

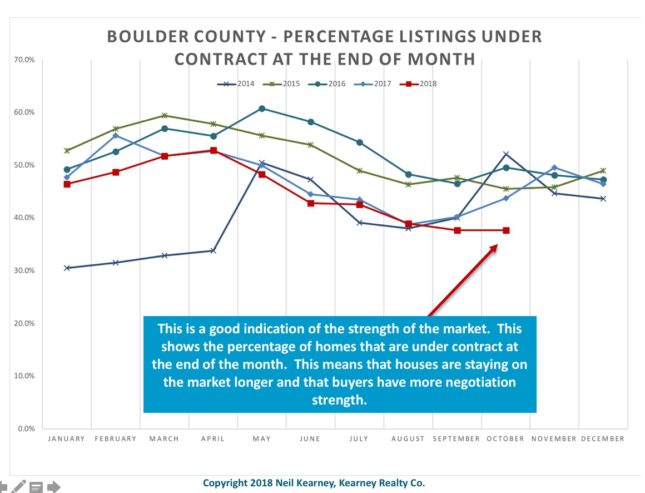

This month we are seeing a few statistics break from the pattern we have seen during the past four plus years. Sales were down by 3.4% for the month but that isn’t the story. Actually year-to-date sales are just down 2.4%. This month for the first time we saw the percentage of under contract properties (compared to all listed properties) fall to 37% which is the lowest number we have seen in over 4 years. What this means is that listed homes are staying on the market longer, fewer are selling and buyers have more choice.

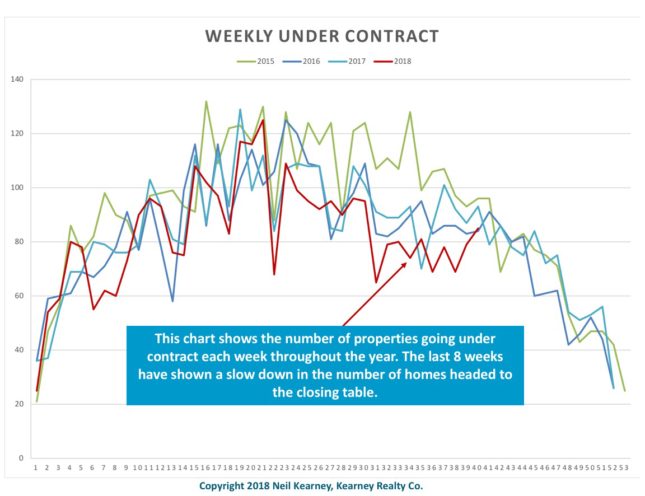

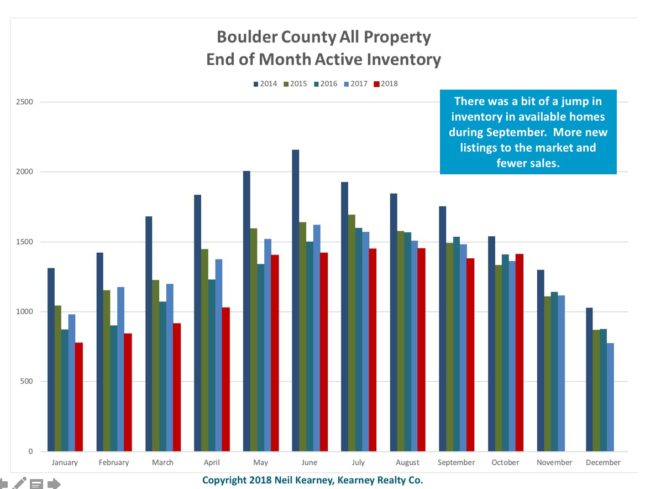

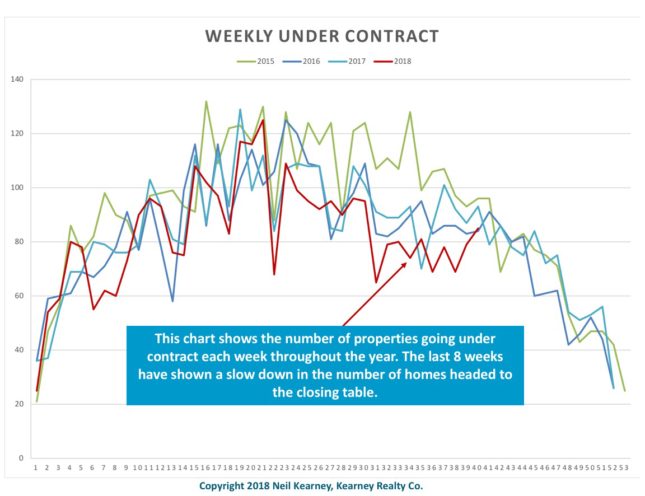

This isn’t a big change but a continuation of a trend that we have been seeing since this statistic peaked in April of this year with over 50% of the market already under contract. Another statistic that shows that our market might be slowing is the number of properties that go under contract in Boulder County on a weekly basis. Over the past twelve weeks the weekly contracts have noticeably lagged the previous years shown. Take these in conjunction with a bump in inventory and it points to a slower market.

by Neil Kearney | Sep 19, 2018 | Boulder County Housing Trends, Statistics

When someone asks me about the real estate market most of the time they are really asking about price appreciation. Are prices rising? Those who already own are cheering for it to continue and for those who don’t yet own they feel small beads of sweat starting to rise on the back of their necks as they continue to see the market moving away faster than they can catch up.

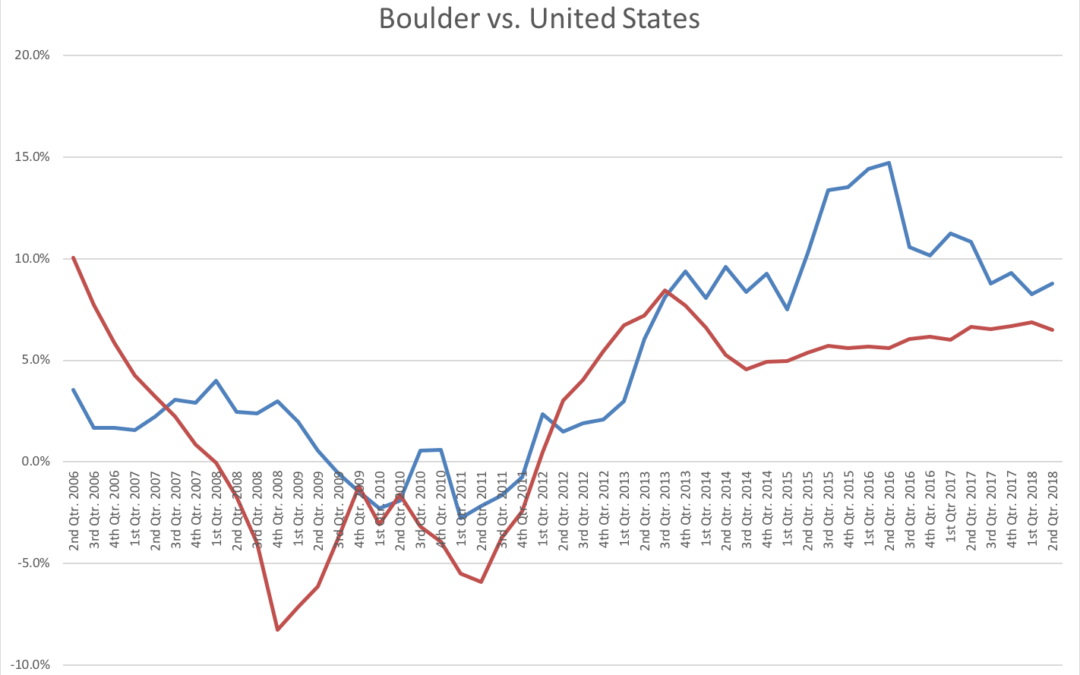

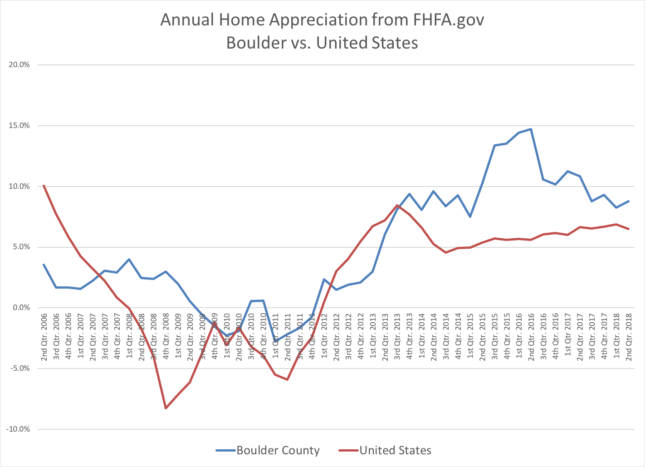

Home price appreciation in Boulder County has been notably strong and consistent over time. According to FHFA.gov, a home that was purchased in January of 1992 (this is when I began selling real estate in Boulder) is now worth $961,702. A 380% increase! More impressive is the stability of that growth (Boulder County is the #1 housing market in the US for growth and stability according to SmartAsset.com). In the spring of 2016 our market was the top ranked market in the U.S. for home appreciation with 14.72% for the year and 4.9% for the second quarter alone. Two years later our market has slowed a bit. No longer are houses being mobbed by would be home buyers the first day, racing to compete with 8 other home buyers. Our market has moved a bit closer to balanced.

The most recent quarterly data from FHFA.gov shows that we are ranked 65th in the nation in terms of annual appreciation with 8.76% (still a very strong number!). What was most interesting to me was that 4.77% of that appreciation took place in the second quarter alone. This ranks 21st best in the U.S. This tells me that the buyer’s demand in our area, although a bit subdued is still plenty strong to absorb the available inventory and push the prices up. In my opinion, since the end of June our market hasn’t kept up this pace of appreciation but I may be surprised when the numbers for the third quarter come out in a few months.

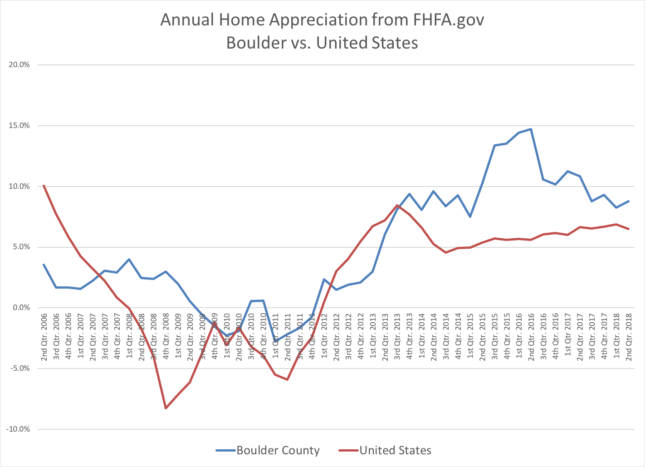

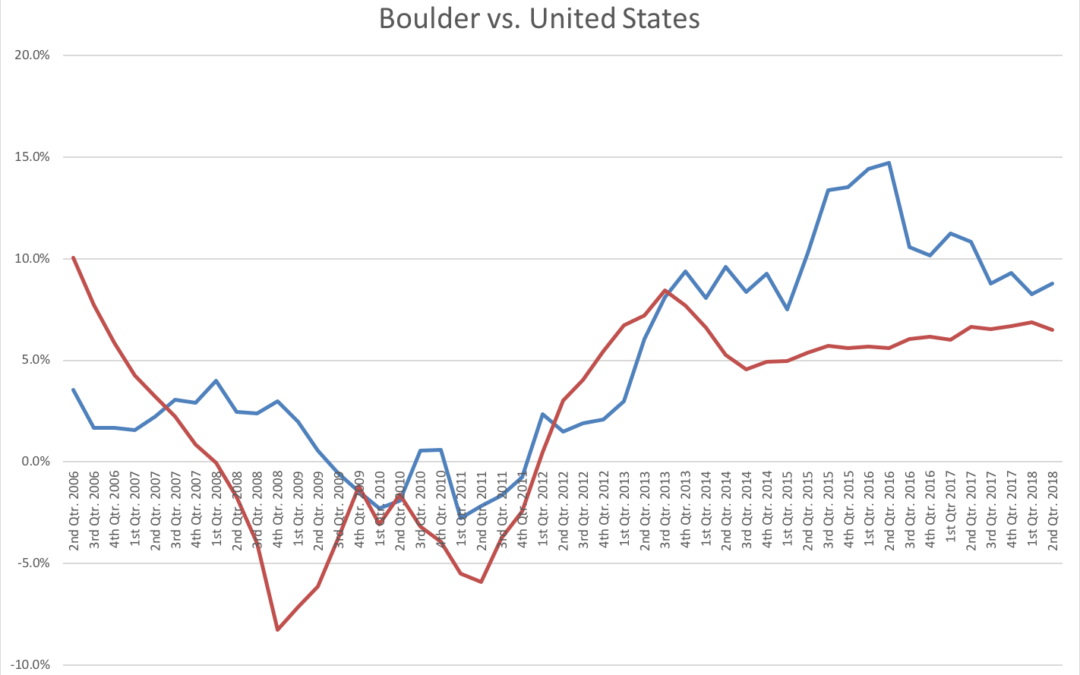

This first graph shows the annual appreciation on quarterly basis for the United States (red) and Boulder County (blue). What stands out to me is what a great investment Boulder real estate has been. A good stock portfolio has been described as one that exceeds the market average in a good market, and goes down less than the market in a bad market. That is exactly what we have seen in our area over the past cycle.

The second graph (below) shows how Boulder has compared to the other 245 Metropolitan Statistical Areas around the United States. A low number shows that we are near the top of that ranking and a higher number show we are near the bottom. As I mentioned earlier, right now we are ranked at 65th.

by Neil Kearney | Sep 7, 2018 | Boulder County Housing Trends, Statistics

The real estate market has been fairly strong this year. Not off the charts like 2016 and a bit subdued by the low inventory of available listings, but strong nonetheless. Sales through August are down 2.5% from a year ago, not much of a change. However, we are seeing fewer listings, fewer multiple offer situations and more listings staying on the market longer. These are the bigger story. When you compare YTD sales to 2015 we are behind by 17%. If you look at the inventory numbers from 2015 you will see that they are much higher than now. More listings mean choices for buyers and end up in more transactions. Fewer listings in a strong market almost guarantee high appreciation. And we continue to see prices rise, although that seems to be at a slowing pace.

As always, this time of year is an important one. It is common that after the spring surge of activity that there is a summer slow down. We usually see the market pick up again in the fall. And we usually see that happen right after Labor Day. Let’s see what happens.

For more detailed statistics and analysis take a look at the embedded slide presentation below.

by Neil Kearney | Jul 23, 2018 | Boulder County Housing Trends, Statistics

The Kearney Report – Second Quarter 2018

The Kearney Report – Second Quarter 2018

Click this link to view the report – The Kearney Report 2nd Quarter 2018

During the second quarter of 2018 the Boulder area real estate market continued to be a strong seller’s market.

During the second quarter of 2018 there were 1,452 sales in Boulder County which is roughly the same as it was a year ago. The median sales price during the quarter was $535,550 which is 7.1% higher than it was a year ago during the same time frame. Inventory this year has not improved. A trend of fewer homes on the market has continued to keep the pressure on buyers to act quickly and pay top dollar for homes.

Overall the market is good! We again had a very active spring market. Overall sales are down 3% from a year ago. Homes are still selling quickly but there have been fewer multiple offers. When there have been multiple offers the premiums paid are not quite as high (3.5% rather that over 4% on average). This is the time of year when we see some slowing prior to school starting. Here are some graphs that show the trends in the market.

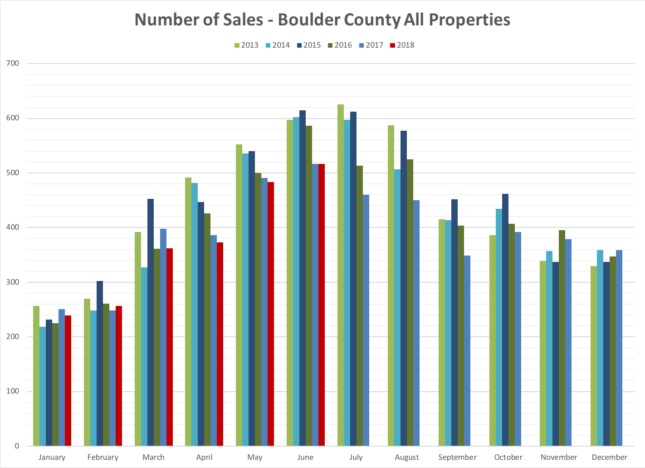

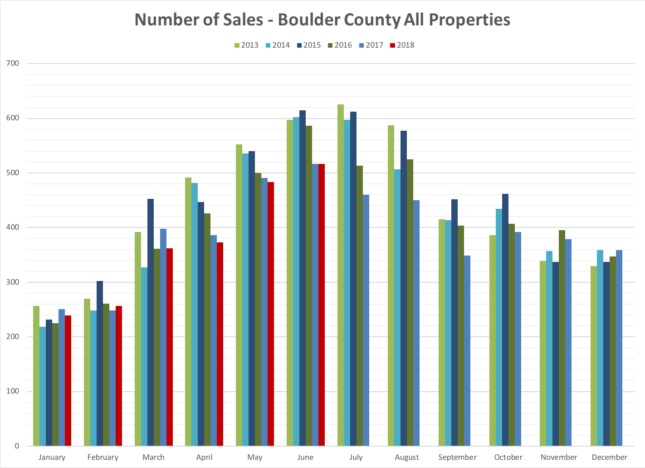

This first graph shows residential sales in Boulder County by month over the past five years. Red bars indicate 2018 sales. Like all other years we are following the basic pattern of sales that peaks in June or July and then tapers off. Subtract 30-45 days for when the contracts were actually written.

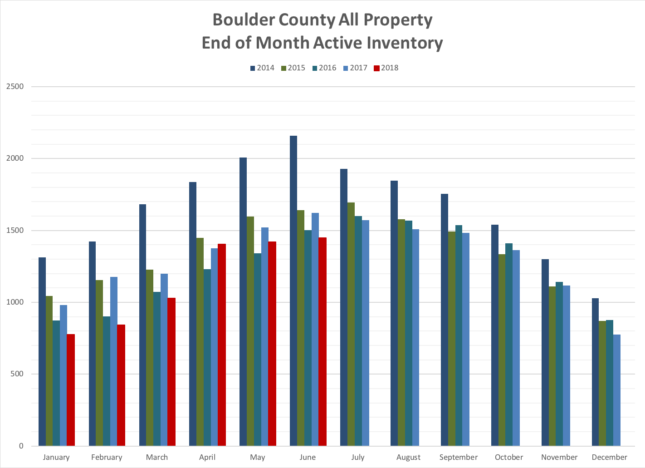

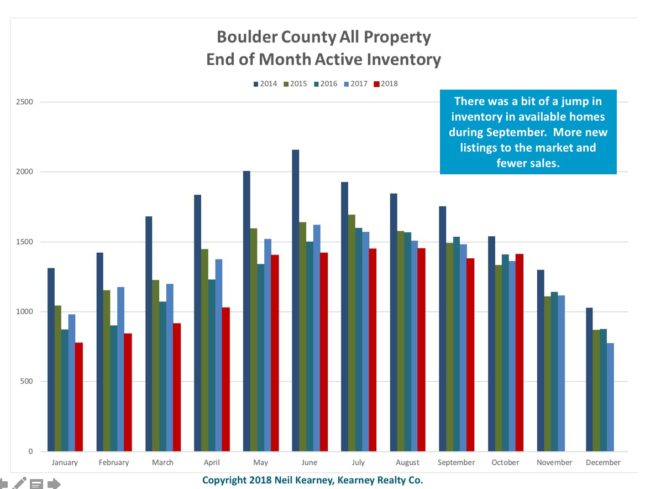

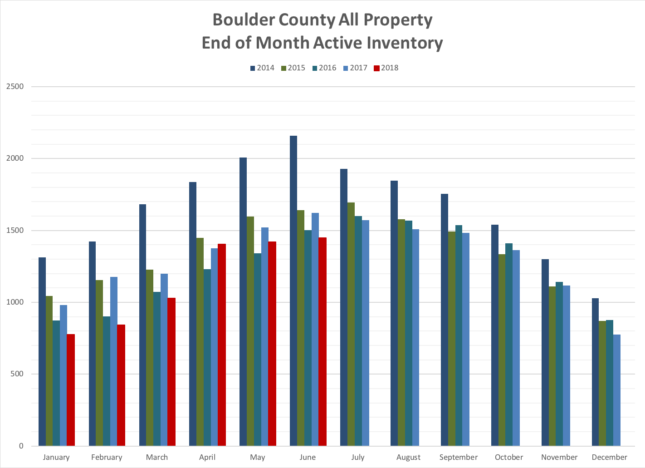

The second graph shows the inventory of active homes at the end of each month over the past five years. 2014 (the tall bar) shows a historical more normal level for active homes. Our low inventory over the past four years corresponds directly to very high appreciation. Low inventory also inhibits sales because there are a large number of buyers trolling around waiting for “the house” to come on the market.

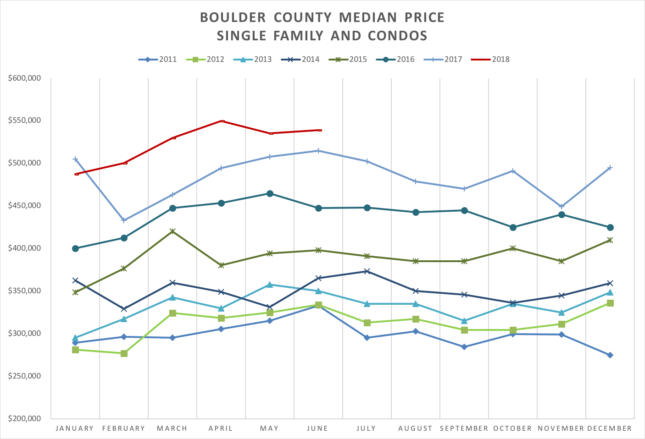

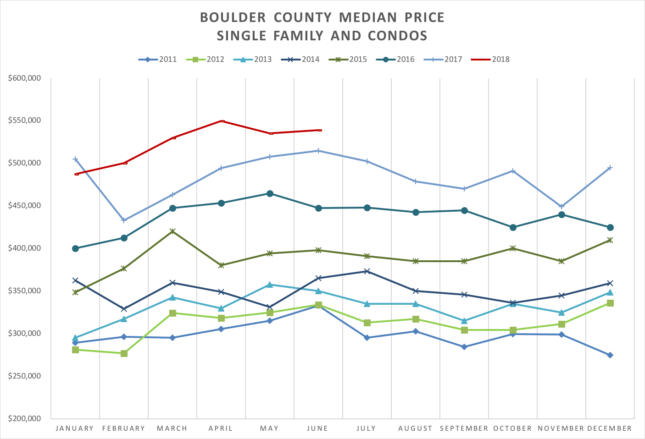

The graph below shows median prices by month over the past over the past eight years. The steady growth looks like a layer cake with each year higher than the one before. In summary, inventory continues to be low, sales are similar to where they were a year ago and prices continue to rise. Enjoy the report!

by Neil Kearney | Jun 16, 2018 | Boulder County Housing Trends, Statistics

The number of sales in the month of May in Boulder County were down by just over 4%. Year-to-date sales are also down by roughly the same amount.

This spring the market has again been strong. In many ways it was similar to the past few years. 37% of sales during the first five months of the year resulted in a price above the list price with an average premium of 3.68% for those that did sell above list price. Last year that number was was similar. Sales are down roughly 4%for the year and from my experience in the market representing both buyers and sellers is that there have been fewer bidders in multiple offer situations. More like two rather than five.

Here are the current months of inventory by price range:

$0- $500k – 2.6 months

$500k – $1M – 4.2 months

$1M – $1.5M – 6.8 months

$1.5M – $2M – 6.7 months

$2M – $2.5M – 5.8 months

$2.5M – $3M – 19.6 months

>$3M – 25 months

A balanced market is 6 months. Anything less is a seller’s market any more is a buyers market.

by Neil Kearney | May 27, 2018 | Boulder County Housing Trends, Statistics

The low inventory throughout Boulder County has resulted in a decrease in sales compared to last year. Sales are down roughly 4% through the first four months of the year.

One trend that is new list year is the large increase of sales in the highest price ranges (greater than $2 million). During the first four months of 2017 there were 16 sales over $2,000,000. this year during the same time frame there have been 39 sales. This is a mix of new construction and resales.

The market is moving quickly and we are still seeing many buyers moving in from out of town.