by Neil Kearney | Apr 19, 2016 | Boulder County Housing Trends, Statistics

The major themes for the real estate market in Boulder County have been constant over the past three years; low inventory, high buyer demand and rising prices. During the first quarter and the month of March in particular these themes were exasperated. There are many buyers out there and the percentage of active homes that are already under contract is still over 50%. So why were sales down 20% in March and down 14% year-to-date? Low inventory. There just are not enough houses out there on the market to satisfy the demand in the market. So when a house does come on the market it gets multiple offers. For the quarter homes sold for 99.35% of the list price throughout the county but houses sold for above list price in Boulder, Louisville, Lafayette, Erie and Gunbarrel. It’s a good time to be a seller!

To see all of the real estate statistics for Boulder County, check out the slideshow below.

by Neil Kearney | Mar 30, 2016 | Boulder County Housing Trends, Boulder Real Estate, Statistics

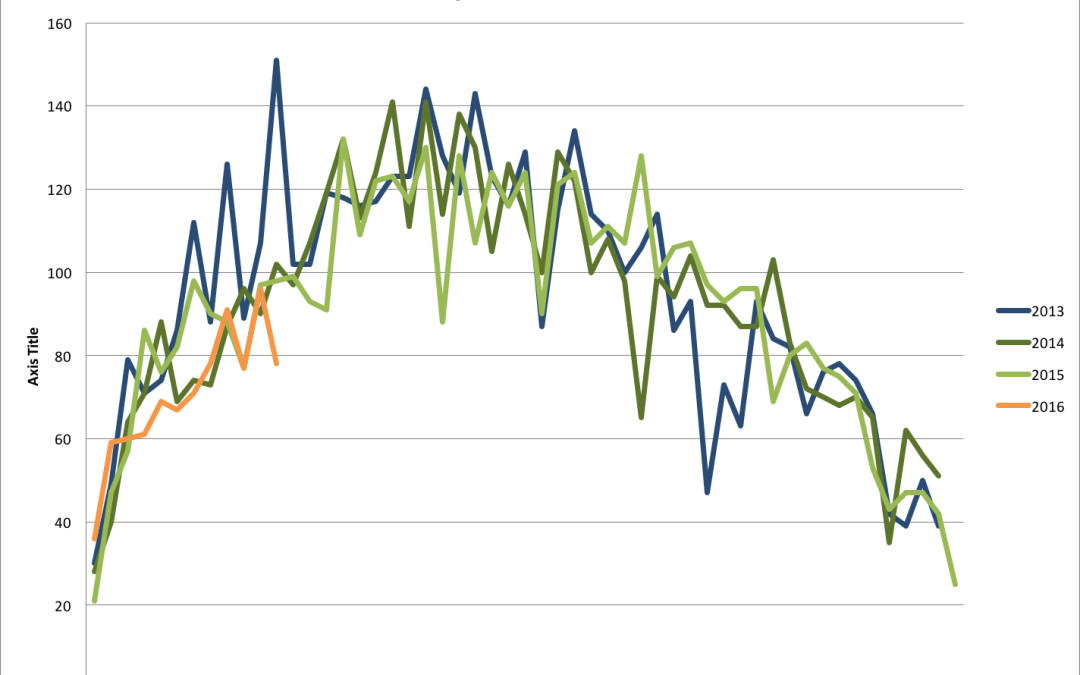

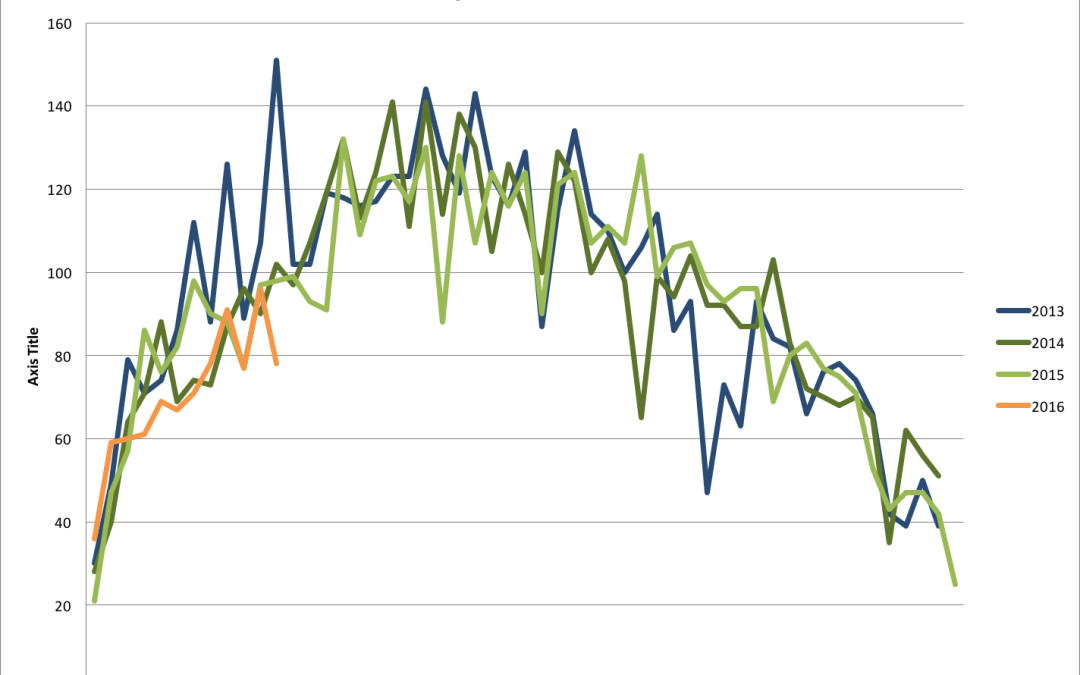

There seem to be plenty of buyers out there looking for houses in Boulder County. But the number of new listings is losing steam and the number of sales is following. Through the end of February sales are down 9% compared to 2015. During February sales were down 13.5% from a year ago. The first chart below shows the number of new listings coming on the market on a weekly basis over the past four years. The activity this year is represented in orange.

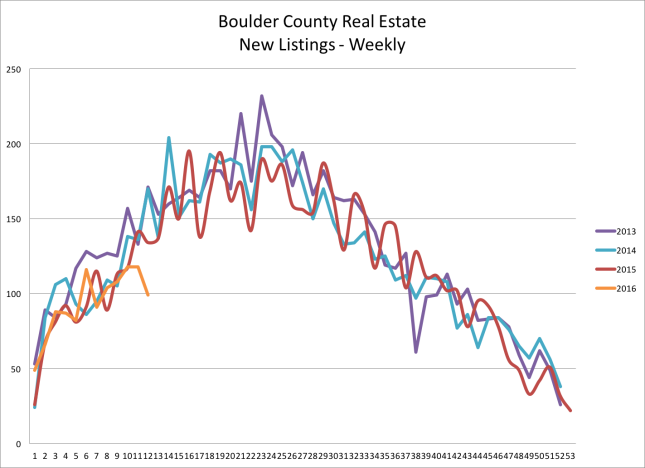

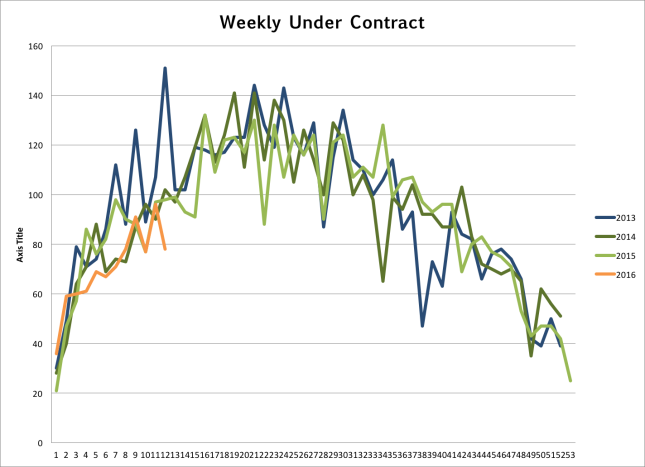

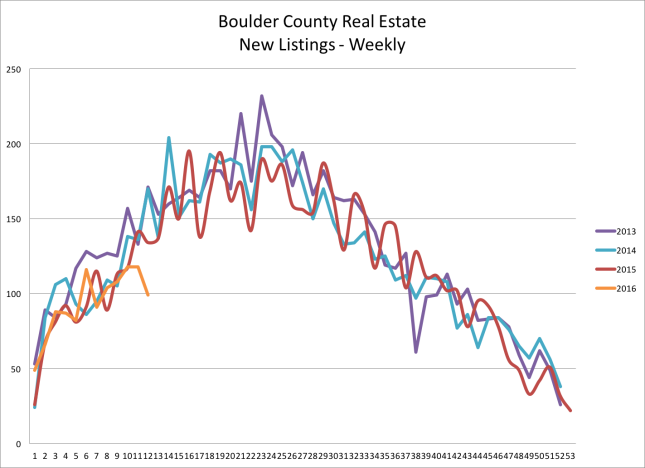

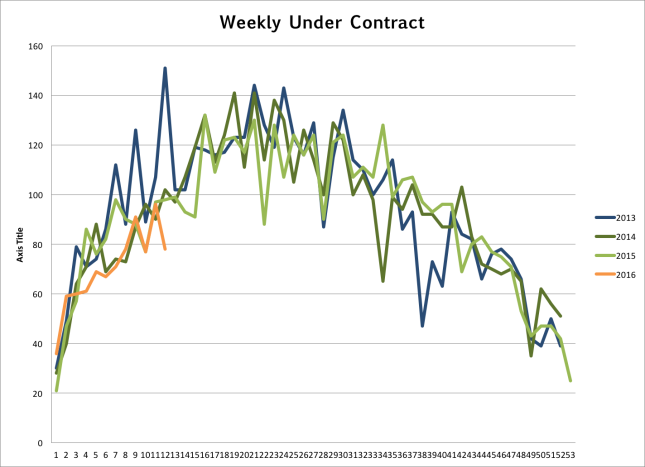

A forward indicator to future sales is the number of properties that go under contract. The usual gestation period between a house going under contract and getting to the closing table is between 30 and 45 days. The chart below shows the flow of properties going under contract on a weekly basis. The last few weeks have been trailing the average we expect to see this time of year. This leads me to believe that March and April’s sales will not be making up ground on last years closing. The slideshow below shows more statistics that give a broader picture about what is going on in the Boulder County real estate market.

A forward indicator to future sales is the number of properties that go under contract. The usual gestation period between a house going under contract and getting to the closing table is between 30 and 45 days. The chart below shows the flow of properties going under contract on a weekly basis. The last few weeks have been trailing the average we expect to see this time of year. This leads me to believe that March and April’s sales will not be making up ground on last years closing. The slideshow below shows more statistics that give a broader picture about what is going on in the Boulder County real estate market.

by Neil Kearney | Mar 9, 2016 | Boulder Real Estate, For Buyers, For Sellers, Visiting Boulder

Boulder Neighborhood Guide

Boulder Neighborhood Guide

I realized a few years ago that people coming from out of town were having a hard time characterizing the different neighborhoods within Boulder. In response I created the Boulder Neighborhood Guide. In this report I have split Boulder into eleven different areas and present the lifestyle highlights, schools, shopping districts, local recreation and real estate statistics for each area. If you’re interested in learning more about the different neighborhoods within the City of Boulder this is your guide.

Click this link to view and download the report. Boulder Neighborhood Guide 2016

It is recognized that Boulder is a great place to live but the neighborhoods in Boulder are a bit hard to peg. Boulder was developed over time in a piece-meal fashion. The result is that many of the neighborhoods are only a few hundred homes in size. It is common to have two adjacent neighborhoods developed at different times and with completely different price ranges. While this report is not comprehensive, it will give the reader valuable information from which to start understanding the real estate market in Boulder. I will highlight the major neighborhoods in each area.

Here are some highlights from within this years report.

Last year homes in Boulder County appreciated roughly 13.52%. But the appreciation varied between areas and price ranges. Within Boulder neighborhoods as I have split them in the report gains in median prices ranged between 6.6% to 35% depending upon the area. Here is the list of neighborhoods sorted by median price appreciation last year:

- Wonderland Lake / Dakota Ridge = 35%

- North Boulder East = 28%

- North East Neighborhoods = 28%

- Whittier = 24%

- Chautauqua / University Hill = 16%

- Gunbarrel = 13%

- Retail / Industrial Core = 12%

- South Boulder / Table Mesa = 11%

- East Boulder = 7%

- Newlands – 6.7%

- Mapleton Hill = 6.6%

A Few Notes: Wonderland Hill / Dakota Ridge is in the far NW portion of town and this is where there are the newest houses coming online. It is also west of Broadway which always means premium prices. Newlands and Mapleton Hill have some of the highest priced real estate in Boulder. The luxury market did not increase in price as much as other, lower priced markets so those areas saw the smallest average appreciation.

Click this link to view and download the report. Boulder Neighborhood Guide 2016

by Neil Kearney | Mar 5, 2016 | Boulder County Housing Trends, Statistics

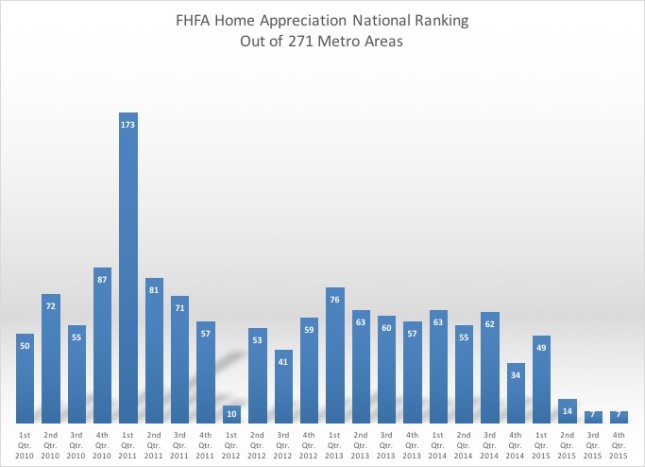

Boulder Home Appreciation Ranked 7th In the Nation

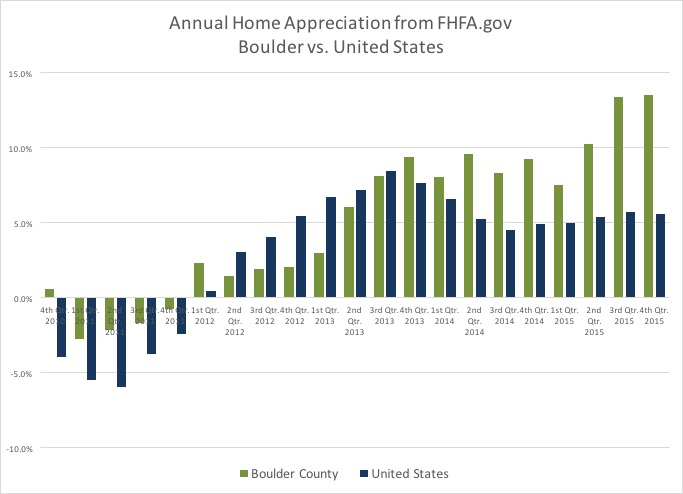

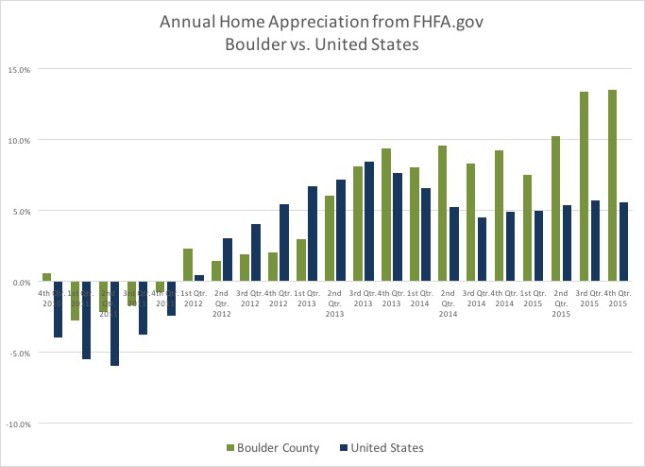

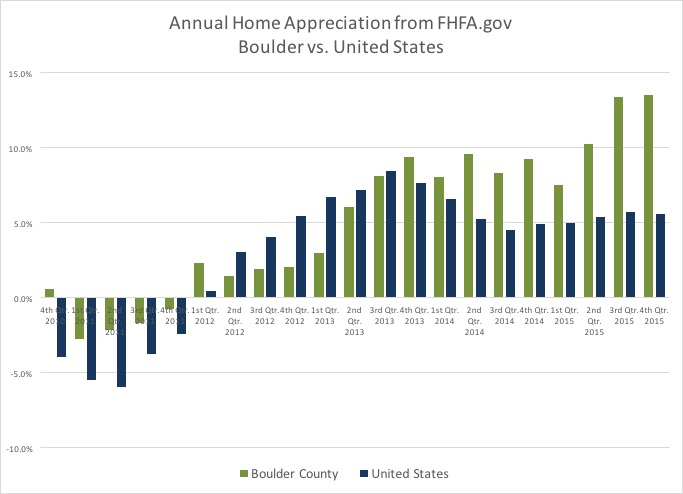

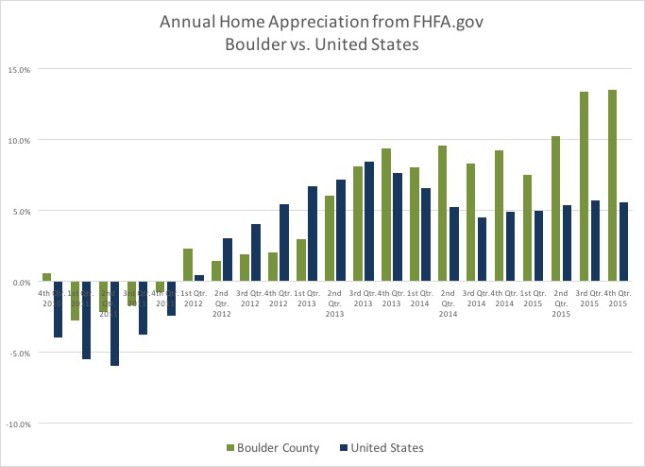

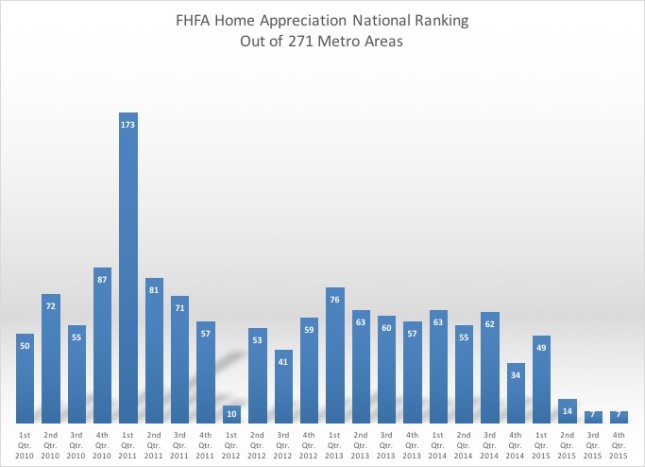

FHFA.gov recently released their report on home appreciation for the period ending December 31, 2015. In the report it shows that Boulder home appreciation is the 7th highest for the year among the 271 largest metropolitan areas in the United States. Boulder had a 13.52% appreciation for the one year period and 2.27% for the fourth quarter alone. The quarterly appreciation for our area ranks 5th in the nation and one of the areas ahead of us was Denver. For our area a strong quarter ended up a very strong year.

The United States average for the one year period was 5.76%. Colorado ranked second among the states with 10.91% appreciation for the year.

Here are a few charts that represent this data visually. The first one shows Boulder’s appreciation compared to that of the U.S. and the second one shows Boulder’s appreciation national ranking over time. This is the most active market we have had in terms of appreciation since 1999 when we were ranked #1 in the nation.

by Neil Kearney | Feb 22, 2016 | For Buyers, General Real Estate Advice, Real Estate 101

During 2015 43% of all homes sold in the City of Boulder sold for more than asking price (see more context in my year end report) . Presumably most of these homes had multiple buyers making competing offers. So what does it take to be the winner of a multiple bid situation? Here are seven strategies for winning multiple offers. I liken these ideas to a set of arrows in a quiver.

- Price – The most effective way to win the hearts and minds of a seller is to give them the most money. In theory it’s easy give them more than anyone else. In practice, given limited information, it’s very difficult to know what others who are exactly in your position will do. On average in 2015, those homes that sold for a price over asking price sold for 4% above. The range is from just a few hundred dollars over to 20% over. Now that’s using a sharp and effective arrow!

- Escalation Clause – This could be a subheading under price but I think it’s worth giving it top billing. An escalation clause is a paragraph inserted in the contract which states; that the buyers agrees that if their offer isn’t high enough their offer will be automatically increased to beat any competing offers by $X,000 up to a cap price. Some sellers and their agents announce that they will not accept escalation clauses because they view them as a hedge (we are willing to go higher but only if we need to). For a buyer an escalation clause is a good way to state your intentions to the Seller without paying way more than you need to. If a buyer is going to use an escalation clause, I recommend that the contract price be strong as well. If you offer $10,000 lower than asking price but are willing to go up t0 $30,000 above if pushed the seller may not see this as earnest as an offer who offers $25,000 over the asking price right off the bat.

- Financing – Sellers want the most money with the smallest potential of the contract cancelling. It doesn’t do any good to get a great price and then not be able to close. As a buyer you can tie into this fear by making your financing as clean as possible. Cash is king. And it removes many contingencies as well. But if you don’t have cash you can do well by having your financing in order. Get pre-approved not just pre-qualified. Have your lender picked out. Choose a local lender. Make sure your lender is available to answer questions about you.

- Waive the Appraisal – Your lender will require an appraisal but if you are putting enough money down you can still waive the right to object to the appraisal. In a fast appreciating market the appraisal contingency is something sellers worry about and if the appraisal doesn’t match the price as explained in #1 above the transaction has a real chance of not closing. But as a buyer if you are putting enough money down (think at least 25%) you can talk to your lender and see if waiving the appraisal provision is a possibility.

- Inspection – Some buyers come in really strong during the negotiations and then try to re-negotiate during the inspection period. As an earnest buyer you can promise the seller that you will not negotiate after the inspection. To do this we add a clause to the contract that states that the buyer will take the property in as-is condition but that they still retain the right to terminate the contract if they find something big or unexpected during the inspection.

- Personal Letter – Earlier this year I had a listing that received three offers. The two best offers were nearly identical; same price, same escalation clause, closing date within a week of each other, local lenders with the same down payment. There was nothing in either of the contracts that was swaying the seller. The only difference was that one buyer sent with their offer a personal letter that introduced themselves and let the seller know how much they loved their home. Winner, winner chicken dinner!!

- Clean Contract – Your agent needs to do their part by writing a “clean” offer. This means that the contract is filled out correctly, all required paperwork is attached, all dates in the offer are reasonable and make sense, all negotiable payments like HOA transfer fee and title closing fee are at least split if not. Small things that cost a few hundred dollars can make all the difference when you are competing. Also, if you like working with your agent chances are that the listing agent likes working with them as well. This cooperation is essential and it’s a feather in your cap to work with an agent who has experience and is known as easy to work with. Working with an agent with a tag line of “The Enforcer” (this is made up) may be an indication that they may like to fight and win and not cooperate. When given a choice agents like to work with other cooperative agents.

Good luck out there. These multiple offer strategies have worked well for my buyers over the past couple of years. If you are looking for quality representation please let me know.

Boulder Neighborhood Guide

Boulder Neighborhood Guide