by Neil Kearney | May 2, 2011 | General Real Estate Advice, Real Estate 101

If you own property in Boulder County, you most likely received a 2011 Notice of Valuation in the mail this weekend. If you were like me seeing new assessed value of my property(s) was very interesting.

As you look at your valuation notice here are a few things to keep in mind:

- The property value shown as the current actual value is based on the actual value on the appraisal date of June 30, 2010.

- The current actual value is the value that taxes will be figured from beginning next January.

- The property value was computed using comparable sales from July 1, 2008 through June 30, 2010.

- The value shown is the taxable value, not an actual value that your home would sell for. The County Assessor tries to approximate this value and in recent years has become much better in doing so, but there are still many differences in particular homes which cannot be detected by the assessor.

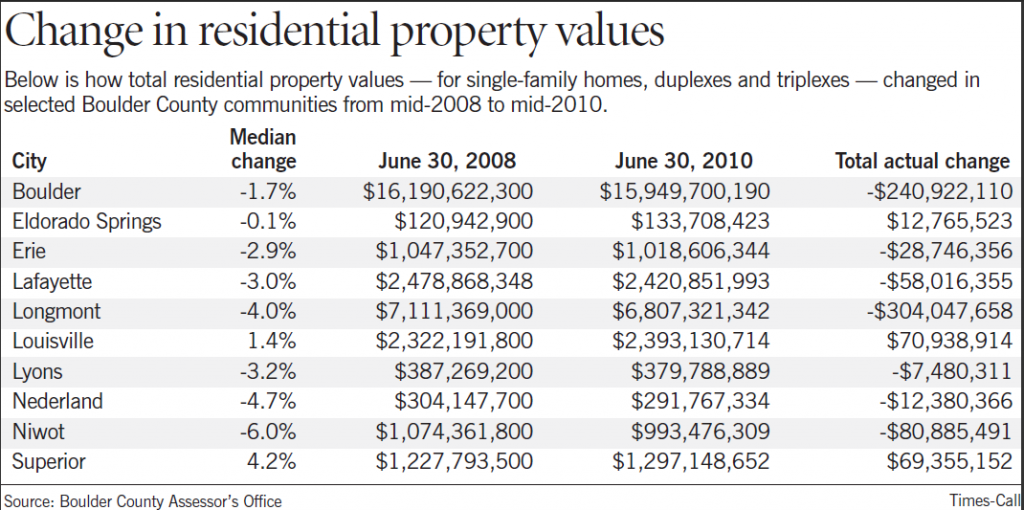

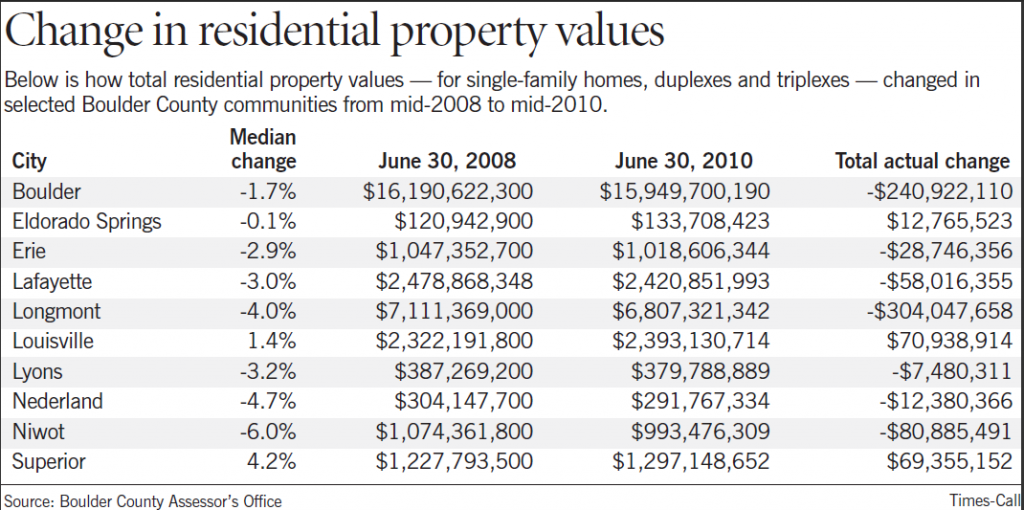

During the two year period between assessments, the average property value in Boulder County decreased by 2.6%. The values for individual areas varied widely. Here is a chart compiled by the Longmont Times Call which shows overall valuations for individual areas in Boulder County.

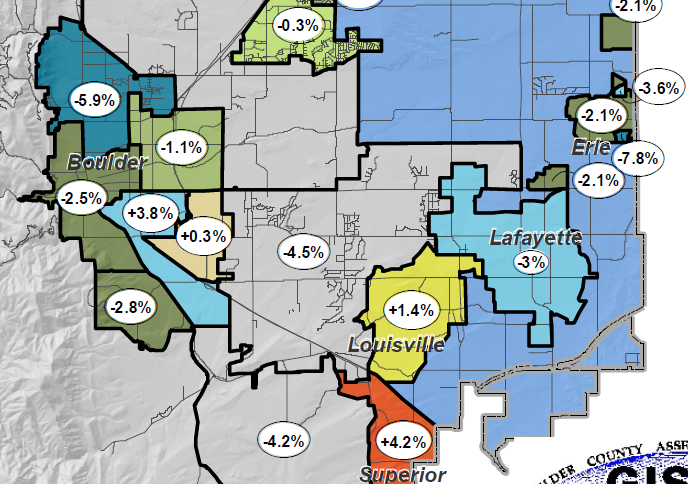

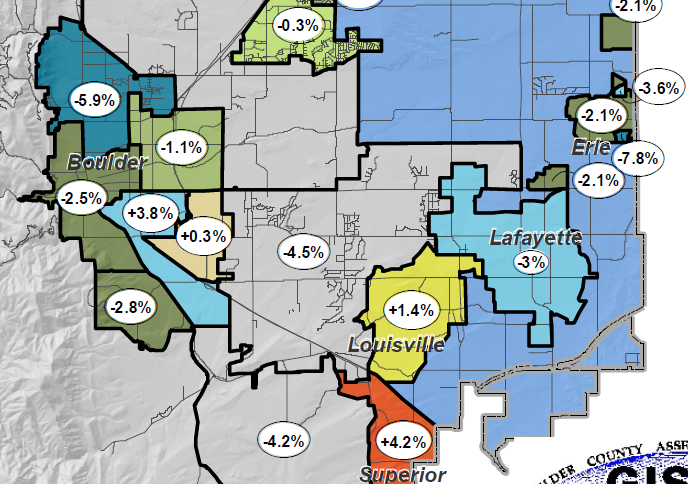

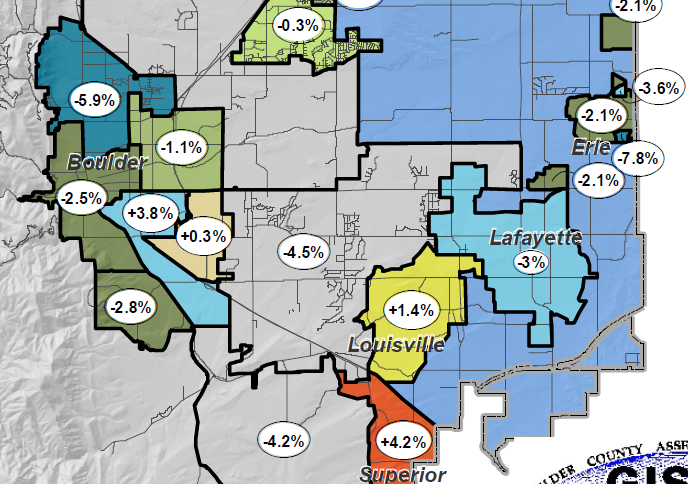

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

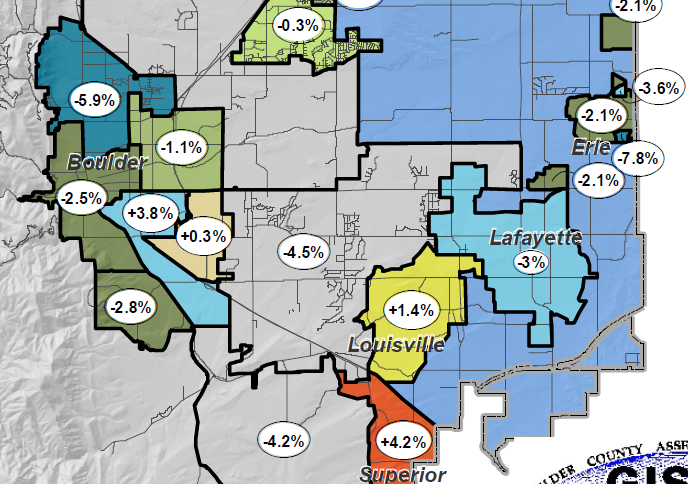

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

So how will this affect your 2011 property taxes? This is a really good question. On the Notice of Valuation you will see an estimate of property taxes. If the value of your home decreases the taxes will go down as well. This makes sense. But property taxes payable are set based on two variables; assessed value (now set) and mill levy which is to be set later in the fall. The mill levy is set every year by city councils, county commissioners, school boards and any special district directors (fire etc.) in the fall. Each of these interests have a budget to keep. Knowing that the assessments have fallen I have a hunch that the mill levy will increase. In the end taxes may not decrease at all. We will have to see.

You have the right to appeal the current actual value of your property. The appeal must be postmarked no later than June 1st 2011, so you have roughly 1 month in which to do your homework. Your appeal can be based upon two categories: the first is a discrepancy in your property description (does it say you have 4 bedrooms when you only have 3?), secondly you can disagree with the comparable sales used and provide others for consideration.

How to appeal your property tax valuation. The appeal process is outlined here and the appeal can be done online or in writing. The assessor has provided some online tools to help with the appeal process. Each comparable sale will need to be adjusted using their time trending table. They provide lists of comparable sales but they don’t show pictures. I am happy to provide some comparable sales with photos to you if you plan to appeal, just let me know.

I appealed the value of one of my rental properties two years ago. I had purchased the property right in the middle of the assessment period for $239,000 and they had assessed the property for $274,000. I provided some good comps in addition to the actual sale and they turned down the appeal. Do you have a story about your property valuation appeal? Please share it by leaving a comment.

by neil kearney | Jan 27, 2011 | For Sellers, General Real Estate Advice

The end of January is when the real estate market in Boulder Colorado just starts to get moving. New listings are coming on the market full of hope. But what if you have been on the market for awhile? Here are a few tips to make sure you haven’t lost your showing edge.

The end of January is when the real estate market in Boulder Colorado just starts to get moving. New listings are coming on the market full of hope. But what if you have been on the market for awhile? Here are a few tips to make sure you haven’t lost your showing edge.

Here is the typical scenario; During the first few weeks it is common to have many showings because there is a pool of buyers waiting for new listings. Once the initial few weeks have passed that the showings slow considerably and only new buyers to the market set up showings. So what if your house was not priced correctly or did not otherwise compare well with the competition and remains on the market without offers or interest. I have recently shown homes that have been listed for close to a year. What if you own one of these homes and need to get the house sold. Here are some ideas:

- Lower the price – The market has spoken and if your home has not sold in a reasonable time as other homes in the neighborhood get listed and sold, your price is too high.

- Make the house look better – Sometimes you have to spend money to make money. Take an objective look at your house, maybe it needs a paint job, some new counter tops or a replacement for the green shag carpet. I have nothing against green shag, I grew up with green shag. I love it, you love it but buyers DO NOT love it.

- Do some staging – Maybe you have all the pieces, but they are all in the wrong places. A little staging goes a long way in making that all important first impression.

- Make sure your curb appeal is the best on the block – Do some landscaping, buy some flowers, or this time of year make sure the snow is shoveled.

by Neil Kearney | Dec 14, 2010 | General Real Estate Advice

The video below is from the website TED.com. Ted is a series of live presentations compiled on video, featuring thought leaders in all aspects of modern life. I watch these all the time but this is the first one I have shared. This one has to do with high level negotiations and the role of a third party. After watching the video I thought that the ideas brought forth by William Ury had direct correlation to the role of Realtors in bringing buyers and sellers together in a negotiation.

all aspects of modern life. I watch these all the time but this is the first one I have shared. This one has to do with high level negotiations and the role of a third party. After watching the video I thought that the ideas brought forth by William Ury had direct correlation to the role of Realtors in bringing buyers and sellers together in a negotiation.

Basically what Mr. Ury is saying is that sometimes it takes a third party to bring two parties together. In real estate there are usually two third parties, namely the two Realtors involved in the transaction. Good Realtors bring to their clients a calm, non-threatening environment in which to think, good information, a broad perspective, clear communication, real life experience and knowledge and a strong emotional barrier. If you have two good Realtors on both side of the transaction doing their jobs it makes it much easier for a negotiation to come together.

I whipped up the chart below to show how the roles of the Realtors intersect. In the interaction of the agents there is an opportunity for synergy. When two agents are working together problems get solved, ideas get clearly communicated, the emotions of the transaction are left behind and the spirit of cooperation toward a common goal takes over.

I pride myself in keeping calm and level headed throughout a transaction. I think this gives my clients the best opportunity to keep the right perspective and achieve their goals not just win small battles. Enjoy the video.

I pride myself in keeping calm and level headed throughout a transaction. I think this gives my clients the best opportunity to keep the right perspective and achieve their goals not just win small battles. Enjoy the video.

http://video.ted.com/assets/player/swf/EmbedPlayer.swf

by Neil Kearney | Nov 15, 2010 | For Sellers, General Real Estate Advice, Real Estate 101

I get calls all the time asking for advice on whether it would be smart to do a particular remodeling project around their home.  Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Okay, we have established that you won’t get back all of your money if you do a home project but what if that scares you into paralysis? Say you have owned your home for 15 years and during that time you have done nothing but change the filters in the furnace. This strategy, in my opinion works even worse than improving your home right before closing. In the case of the do-nothings, the value of their home will lag behind the neighborhood in general. Their home will stay on the market longer and in the end sell for a lower price. Again not a way to get rich quick.

I think the best strategy for maximizing the value of your home over time is to make incremental changes over time. Take on a project every six months or 1 year. For example, take a six month period to remove the old wallpaper and repaint. Next, re-do the powder room by removing the wall sized mirror and replace with a framed mirror and replace the lighting. Next re-tile the master bath. After a few years your house will start looking refreshed and will be one of the nicer ones on the block. And when you go to sell it you won’t have much to do to get maximum value. Also, you get to live in a much nicer home. Not just fix it up for someone else. There is value in that!

Here is a sample of the value of Midrange projects and their pay back in the Denver market:(ranked in order of pay back percentage):

- Garage Door Replacement – cost $1,228 – cost recouped 93.1%

- Steel Entry Door Replacement – cost $1,165 – cost recouped 86.1%

- Minor Kitchen Remodel – cost $21,035 – cost recouped 79.6%

- Vinyl Window Replacement – cost $10,330 – cost recouped 77.1%

- Wood Deck Addition – cost $10,721 – cost recouped 75.1%

- Major Kitchen Remodel – cost $53,032 – cost recouped 73.5%

- Master Suite Addition – cost $100,775 – cost recouped 74.5%

- Family Room Addition – cost $79,383 – cost recouped 70.6%

- Basement remodel – cost $62,115 – cost recouped 63.2%

- Roofing Replacement – cost $17,943 – cost recouped 61.8%

For copyright reasons I can’t display the report on my website but if you would like a copy of the full report which includes midrange and upscale projects and defines the scope of each please let me know. I can send you one if you request one to neil@neilkearney.com.

To see the associated web page go here.

For more information this topic see my post on list price vs. condition.

From HGTV a before and after.

by Neil Kearney | Sep 15, 2010 | For Buyers, For Sellers, General Real Estate Advice

The recent fires in our area bring to my mind the importance of homeowners insurance. During my 19+ years of selling real estate in and around Boulder homeowners insurance has never been a big part of the transaction. Years back it was a last minute detail, many times lined up the day before closing. Now there is a specific deadline on the contract in which the buyer has the right to cancel the contract if reasonable (in the buyers subjective opinion) homeowners insurance is not available for the property they want to purchase. Usually this contingency period is 10 – 14 days after an accepted contract.

Most people think about insurance in two ways. For 99% of the time they want to know they are covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

So, with this in mind I asked my friend and insurance agent Ryan Brooks from Allstate to give some quick tips on making sure you are adequately covered. Here are a few tips:

- Don’t just shop for the cheapest plan out there. Yes it will save you on a monthly basis but this approach is penny wise and pound foolish. In case of a catastrophic loss you could be lacking some important coverages.

- The best scenario in setting up a policy is to sit down with an agent (not online) and go over your specific situation. Ask questions and tell them about your personal situation. Do you have art, expensive jewlery, memorbilia? Telling the claims adjuster after a fire will not fly, it needs to be disclosed in advance.

- Here are a few items that you want to make sure you have on your policy.

- Cost of Living – this coverage gives you money to live in a home of similar size and quality while your home is being re-built or repaired. If you don’t have this coverage it can quickly cost you tens of thousands of dollars.

- Adequate Liability Coverage – Make sure you have enough liability coverage. In most cases this is $1,000,000 or more. This covers you if someone would slip and fall off your deck during a party, etc.

- Building Codes Coverage – This coverage is especially helpful in the case of an older home. This allows for modification of the house to meet current code if the covered repair needs to be re-worked in order to meet code. Think of an old home with a steep pitched roof.

- Condo Coverage – If you are a part of a homeowners association there is most likely a master HOA policy which covers the structure. However, this policy does not cover the individual owners possessions, or the interior finishes (drywall, plumbing , cabinetry, carpet). Make sure your condo insurance has adequate building structures coverage which will rebuild the interior of the unit. Many times this is capped out at 10% of the contents coverage and this is not enough.

- Loss Assessments – Speaking of condos. Loss assessments coverage covers you if a covered loss (roof, liability) on the part of the HOA results in a special assessment. This coverage runs around $10 a year and is well worth it.

- Sewer and Groundwater – Losses from sewer backup and water coming into the home are not usually covered unless there is a specific rider on the policy.

- Personal Property – Make sure the limits on your policy grow over time. The amount of personal property a typical household has grows ever time. We have much more in our home when we are 60 years old than when we were 20.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Tip: Take an extensive video of your home, including closets, drawers, garage etc. and store either online (private Youtube) or in a safe deposit box. This will be a good inventory of personal property and will allow you to remember items that would have slipped your mind. Everything has value make sure your homeowners insurance is up to snuff.

by Neil Kearney | Sep 1, 2010 | General Real Estate Advice

Five years ago I had never heard the term ‘short sale’, now I hear it almost every day. Even if you own your home free and clear knowing what a short sale is and how it works will keep you up to date in today’s real estate market. Currently of the roughly 50 million households in the U.S. 2.5 million are in foreclosure and 7.2 are delinquent. A related number which encompasses many of these households are the 11 million homeowners (Corelogic) who owe more than what their home is worth. In order for these people to sell their house and move on they either have to come to the closing with money or negotiate with the bank who hold the mortgage.

your home free and clear knowing what a short sale is and how it works will keep you up to date in today’s real estate market. Currently of the roughly 50 million households in the U.S. 2.5 million are in foreclosure and 7.2 are delinquent. A related number which encompasses many of these households are the 11 million homeowners (Corelogic) who owe more than what their home is worth. In order for these people to sell their house and move on they either have to come to the closing with money or negotiate with the bank who hold the mortgage.

The Basics: Wikipedia.com definition – A short sale is a sale of real estate in which the sale proceeds fall short of the balance owed on the property’s loan. It often occurs when a borrower cannot pay the mortgage loan on their property, but the lender decides that selling the property at a moderate loss is better than pressing the borrower. Both parties consent to the short sale process, because it allows them to avoid foreclosure, which involves hefty fees for the bank and poorer credit report outcomes for the borrowers. This agreement, however, does not necessarily release the borrower from the obligation to pay the remaining balance of the loan, known as the deficiency.

Owners Perspective: These would be sellers are stuck. They would like to (need to) sell but for any number of reasons (bought for too much, negative amortizing loans, second loans, etc.) they cannot find a price a buyer will pay for the home and pay off the existing loans and the closing costs. Convincing the lender is not an easy job. First of all there must be a compelling hardship where the seller absolutely cannot keep up the payments nor come up with cash to close. Once all of the documentation is complete a package including the sales contract signed by buyer and seller is sent to the bank for approval. This is the tough part, it takes patience. It can take up to 5 or 6 months but usually no fewer than 8 weeks to get an answer from the bank. If the short sale is approved, the sale goes through at a lower amount the sellers credit is hurt (although not as bad as a foreclosure) and the bank still has the right to claim and try to collect a deficiency.

Buyers Perspective: Short sales provide a unique value opportunity. Many times banks approve a price which is a great deal for the buyer. The main downside for a buyer is the uncertainty. The bank has the right to accept other offers so even if you were the first offer in to the bank, by the time they get around to reviewing it there may be multiple offers. It might take two or more months to figure out that the bank will not approve the list price of the house. Buying a short sale is not for someone who has a certain date in mind or is not willing to be patient while the weeks tick by without any word. There is no countdown, there are no numbers. You hear when you hear and the news is not always what you had hoped for. For the right buyer it is a good opportunity but it is certainly not for everyone.

Page 7 of 9« First«...56789»

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas. Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.