If you own property in Boulder County, you most likely received a 2011 Notice of Valuation in the mail this weekend. If you were like me seeing new assessed value of my property(s) was very interesting.

As you look at your valuation notice here are a few things to keep in mind:

- The property value shown as the current actual value is based on the actual value on the appraisal date of June 30, 2010.

- The current actual value is the value that taxes will be figured from beginning next January.

- The property value was computed using comparable sales from July 1, 2008 through June 30, 2010.

- The value shown is the taxable value, not an actual value that your home would sell for. The County Assessor tries to approximate this value and in recent years has become much better in doing so, but there are still many differences in particular homes which cannot be detected by the assessor.

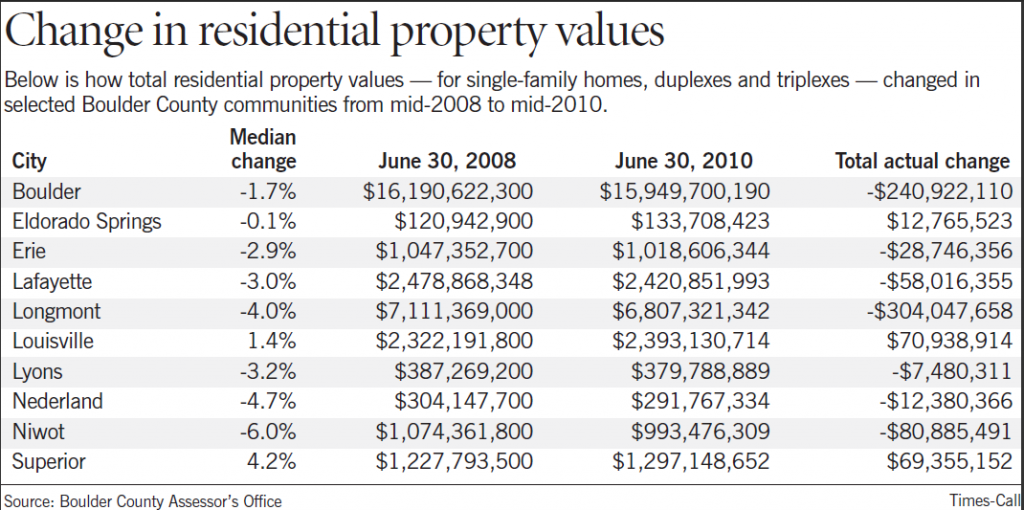

During the two year period between assessments, the average property value in Boulder County decreased by 2.6%. The values for individual areas varied widely. Here is a chart compiled by the Longmont Times Call which shows overall valuations for individual areas in Boulder County.

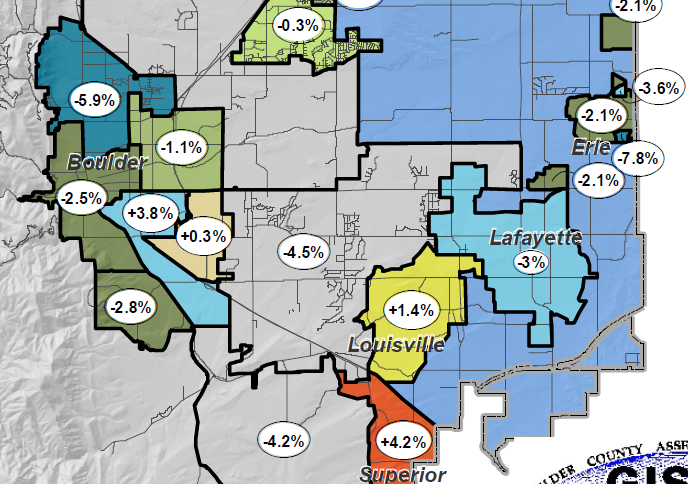

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

So how will this affect your 2011 property taxes? This is a really good question. On the Notice of Valuation you will see an estimate of property taxes. If the value of your home decreases the taxes will go down as well. This makes sense. But property taxes payable are set based on two variables; assessed value (now set) and mill levy which is to be set later in the fall. The mill levy is set every year by city councils, county commissioners, school boards and any special district directors (fire etc.) in the fall. Each of these interests have a budget to keep. Knowing that the assessments have fallen I have a hunch that the mill levy will increase. In the end taxes may not decrease at all. We will have to see.

You have the right to appeal the current actual value of your property. The appeal must be postmarked no later than June 1st 2011, so you have roughly 1 month in which to do your homework. Your appeal can be based upon two categories: the first is a discrepancy in your property description (does it say you have 4 bedrooms when you only have 3?), secondly you can disagree with the comparable sales used and provide others for consideration.

How to appeal your property tax valuation. The appeal process is outlined here and the appeal can be done online or in writing. The assessor has provided some online tools to help with the appeal process. Each comparable sale will need to be adjusted using their time trending table. They provide lists of comparable sales but they don’t show pictures. I am happy to provide some comparable sales with photos to you if you plan to appeal, just let me know.

I appealed the value of one of my rental properties two years ago. I had purchased the property right in the middle of the assessment period for $239,000 and they had assessed the property for $274,000. I provided some good comps in addition to the actual sale and they turned down the appeal. Do you have a story about your property valuation appeal? Please share it by leaving a comment.