by Neil Kearney | Oct 21, 2010 | Boulder County Housing Trends, Statistics

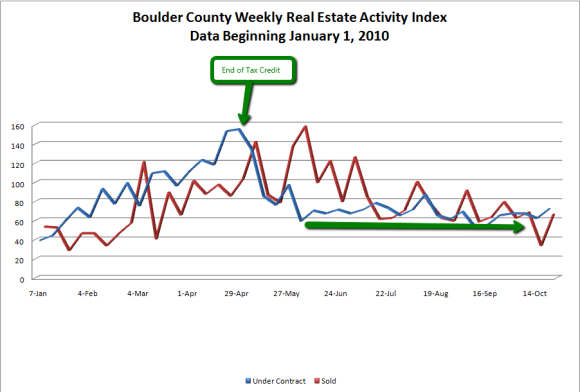

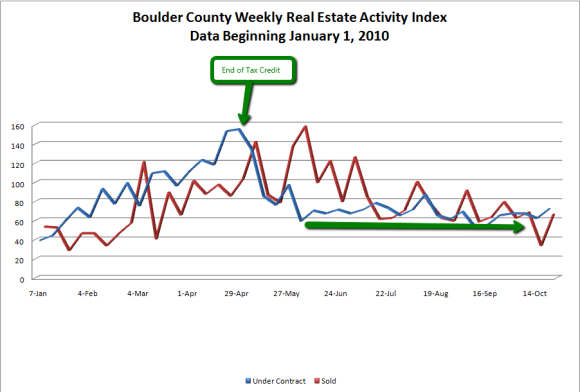

The chart above shows the activity of the Boulder County real estate market this year on a weekly basis. The blue line represents the number of properties which went under contract during any given week and the red line shows the number of properties that closed during a week. I have highlighted two sections of the chart. First, the end of April was when the tax credit expired. The number of contracts fell off immediately and the number of closings tapered and then dropped significantly after June.

Since the end of the tax credit our market has been chugging along at roughly between 60 and 80 contracts per week. Not record setting numbers but what I like about it is the consistency. Usually our market starts to tail off at the end of summer and closings in each successive month show a decline from the previous. This year, after the tax credit expired we have been on a straight line and I think this is great. This shows a baseline in the market. It shows that buyers are out there and this gives the market strength going into the winter, right when we need it.

Inventory is dropping. Fewer houses are coming on the market and other sellers are withdrawing their homes from the market after an unsuccessful attempt over the summer. This means that there are fewer homes for buyers to choose from. Sellers, hang in there.

by Neil Kearney | Oct 13, 2010 | Boulder County Housing Trends, Statistics

With so much talk of foreclosures, short sales, tax credits and interest rates sometimes it’s easy to forget about the luxury home market in Boulder. The luxury home market, where interest rates don’t matter as much as the state of the stock portfolio.

forget about the luxury home market in Boulder. The luxury home market, where interest rates don’t matter as much as the state of the stock portfolio.

Not surprisingly, the luxury home market peaked in 2007. That year there were 215 homes or condos that sold for over $1 million in Boulder County. Then credit got tight, and the bubble started bursting in 2008. Many of the buyers who buy luxury homes in Boulder, choose Boulder after making their money elsewhere. When the bubble burst on the coasts many of those potential buyers were stuck with homes that were not selling or had lost significant value. When the economic crisis went into overdrive in the fall of 2008 stock portfolios lost value and some people realized that their dream to live in Boulder needed to wait.

Just over the last few weeks I have noticed a number of high priced listings going under contract. Here is what I see happening now in the Boulder area luxury home market.

Quick Facts about the luxury home market in Boulder County:

- Currently we are at a sales pace of just about half of the peak year of 2007.

- Through October 13th, there have been 105 sales of homes or condominiums in Boulder County. This represents 3.5% of the market.

- Currently there are 333 properties on the market above $1 million. This represents about 12% of the active market.

- Right now 5.4% of luxury homes on the market are under contract. That is 8 homes have buyers and contracts to close in the near future and 315 homes are listed for sale and do not have a buyer.

- The current inventory of homes on the market represents a 21 month supply.

- The value of homes under contract right now listed above $1 million is $32,195,500.

- There are currently 3 homes under contract above $2 million with the top listing price at $3,450,000.

- The top sales price of a home this year so far is $4,450,000.

- The average negotiation off of list price averages 8.2%.

- 90 of the 333 homes on the market were built in 2007 or after!

That last number is a big one. Frankly, when 400 homes over $1 million sold in 2006 and 2007 many builders, developers and investors did the math and thought that they could cash in if they too built a luxury home and sold it. The problem was that the demand was cut in half and the supply kept growing. Building a luxury home or condo doesn’t happen overnight and while they were designing and building the market changed.

That last number is a big one. Frankly, when 400 homes over $1 million sold in 2006 and 2007 many builders, developers and investors did the math and thought that they could cash in if they too built a luxury home and sold it. The problem was that the demand was cut in half and the supply kept growing. Building a luxury home or condo doesn’t happen overnight and while they were designing and building the market changed.

The 333 homes on the market doesn’t include the homes that have tried the market and have decided to rent it out or wait it out. There are a significant number of homes that do not show up as active but would love to sell if the market would allow.

Going forward, I see more of the same. There will always be buyers for Boulder’s luxury homes. Boulder is a desirable place to live and the homes available are attractive. Many buyers of luxury homes defy the general economy. While others sweat an interest rate jump, some luxury buyers float well above the fray. Ready to write a check for what they want, when they want it.

It will take quite a while for the inventory to meet the demand so the stability of prices depends upon the wherewithal of the individual owners. Those who are in distress or in a hurry will need to offer their homes at a price that is really low. Below replacement cost, below what they bought it for, below what the neighbors paid… Buyers who are lucky enough to come upon one of these sellers will reap the rewards in the future. If too many sellers have to sell quickly market prices will begin to fall. We have already seen this happening. So far this year the average negotiation off of list price for a home in Boulder County under $1 million is 3.2%, for those sales over $1 million it is 8.2%. These figures do not include prior price reductions.

The property photos included in this post are of 772 Circle Drive in Boulder. It is listed by our company for $5,900,000 and is absolutely beautiful. For more information about this property go to www.772circle.com.

by Neil Kearney | Oct 7, 2010 | Boulder County Housing Trends, Statistics

During September the market continued to lag. Sales were down 20% from the same month last year and after making such strong gains earlier in the spring sales in Boulder County are up just 1.7% year-to-date. Despite the slow sales lately inventory is falling. It seems that sellers are taking their homes off the market after realizing what it takes to sell in a tough market. Just so you know, what it takes is a very low price and a house in good condition.

Median prices show that they have gained ground lately but I suspect this has more to do with the sales mix rather than actual home appreciation in the Boulder area. Once the the incentive for first time home buyers expired that segment of the market dropped and of the remaining sales higher priced homes had a larger piece of the pie. It feels to me that there is some negative price pressure on the market right now as sellers push to sell homes to buyers who seem unmotivated. Take a look at the slideshow (fullscreen is best) to get a graphical display of the market and more insights.

by Neil Kearney | Sep 21, 2010 | Uncategorized |

I had my first opportunity to go into the Fourmile Fire burn zone today. I visited the site of a friends home. As you can see it was quite devastating. Almost everything was charred but the birdbath and the saint were left standing. My friend has such a great attitude and is seeing only the good that can come from change. Where a door shuts another one opens.

She shared the following haiku with me, she did not write it:

Now that my house burnt down I have a better view of the rising moon.

It will take quite a while for the fire scars to go away but I have to say that I never looked at that parcel of land in quite the same way. It was exposed. The possibilities of the future were all laid out. Maybe not so pretty at the moment but in the spring the grass will come back up and in time trees.

by Neil Kearney | Sep 15, 2010 | For Buyers, For Sellers, General Real Estate Advice

The recent fires in our area bring to my mind the importance of homeowners insurance. During my 19+ years of selling real estate in and around Boulder homeowners insurance has never been a big part of the transaction. Years back it was a last minute detail, many times lined up the day before closing. Now there is a specific deadline on the contract in which the buyer has the right to cancel the contract if reasonable (in the buyers subjective opinion) homeowners insurance is not available for the property they want to purchase. Usually this contingency period is 10 – 14 days after an accepted contract.

Most people think about insurance in two ways. For 99% of the time they want to know they are covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

So, with this in mind I asked my friend and insurance agent Ryan Brooks from Allstate to give some quick tips on making sure you are adequately covered. Here are a few tips:

- Don’t just shop for the cheapest plan out there. Yes it will save you on a monthly basis but this approach is penny wise and pound foolish. In case of a catastrophic loss you could be lacking some important coverages.

- The best scenario in setting up a policy is to sit down with an agent (not online) and go over your specific situation. Ask questions and tell them about your personal situation. Do you have art, expensive jewlery, memorbilia? Telling the claims adjuster after a fire will not fly, it needs to be disclosed in advance.

- Here are a few items that you want to make sure you have on your policy.

- Cost of Living – this coverage gives you money to live in a home of similar size and quality while your home is being re-built or repaired. If you don’t have this coverage it can quickly cost you tens of thousands of dollars.

- Adequate Liability Coverage – Make sure you have enough liability coverage. In most cases this is $1,000,000 or more. This covers you if someone would slip and fall off your deck during a party, etc.

- Building Codes Coverage – This coverage is especially helpful in the case of an older home. This allows for modification of the house to meet current code if the covered repair needs to be re-worked in order to meet code. Think of an old home with a steep pitched roof.

- Condo Coverage – If you are a part of a homeowners association there is most likely a master HOA policy which covers the structure. However, this policy does not cover the individual owners possessions, or the interior finishes (drywall, plumbing , cabinetry, carpet). Make sure your condo insurance has adequate building structures coverage which will rebuild the interior of the unit. Many times this is capped out at 10% of the contents coverage and this is not enough.

- Loss Assessments – Speaking of condos. Loss assessments coverage covers you if a covered loss (roof, liability) on the part of the HOA results in a special assessment. This coverage runs around $10 a year and is well worth it.

- Sewer and Groundwater – Losses from sewer backup and water coming into the home are not usually covered unless there is a specific rider on the policy.

- Personal Property – Make sure the limits on your policy grow over time. The amount of personal property a typical household has grows ever time. We have much more in our home when we are 60 years old than when we were 20.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Tip: Take an extensive video of your home, including closets, drawers, garage etc. and store either online (private Youtube) or in a safe deposit box. This will be a good inventory of personal property and will allow you to remember items that would have slipped your mind. Everything has value make sure your homeowners insurance is up to snuff.