by Neil Kearney | Dec 8, 2014 | General Real Estate Advice, Real Estate 101

In Colorado, when there is more than one buyer or entity purchasing real property, the buyer(s) can specify how they will hold title. On the Colorado approved “Contract to Buy and Sell Real Estate” in section 2.1 buyers have the option to take “title to the Property described below as Joint Tenants, Tenants in Common or Other. Below I will spell out the main differences between joint tenants and tenants in common.

Joint Tenants

Joint tenancy is characterized by right of survivorship. When a property is owned by joint tenants, and one of the owners dies, the interest of the deceased owner automatically gets transferred to the remaining surviving owners. For example, if five joint tenants own a house together and one of them dies, each of the four remaining joint tenants ends up with 1/4 share of the property. Regardless of what the deceased owners will says. In 2008 the laws were changed to allow for unequal interests in the property by the owners. For example, instead of an elderly parent owning a 1/2 share along with their child to whom they would like to leave the house, the ownership could be split 99% / 1%. When the parent dies the child would then own 100% interest in the property.

Joint tenancy is most often used by married couples or multi-generational families who own real estate together.

Tenants in Common

There are three main differentiating characteristics of tenants in common ownership. The first is, like joint tenancy the ownership interest can be split up into different percentages. For example Owner A can own 60%, Owner B 15% and Owner C 15%. The second feature is that the mix of owners and the percentage of ownership can be changed at any time. Owners can be added or subtracted at any time by mutual execution of legal documents. Tenants in common doesn’t have rights of survivorship. If in our example Owner A dies, his 60% interest would go to his estate unless his will specifies that his interest shall be split between the remaining parties.

Tenants in common is most often used by unrelated parties such as friends, un-married couples, business partners or family members where one person is putting down more assets than the other.

This article isn’t intended to give legal advice. Please seek professional guidance when making legal decisions.

by Neil Kearney | Dec 4, 2014 | For Buyers, Real Estate 101, Statistics

Most real estate buyers can’t afford their home. A first time buyer who saves up for a down payment, has good credit still can’t afford their home. Being able to afford their home means paying cash. When a buyer says that they can afford a $300,000 home for example what they actually mean is that their budget allows for them to afford the payment on the mortgage that goes along with a purchase price of $300,000.

Most real estate buyers can’t afford their home. A first time buyer who saves up for a down payment, has good credit still can’t afford their home. Being able to afford their home means paying cash. When a buyer says that they can afford a $300,000 home for example what they actually mean is that their budget allows for them to afford the payment on the mortgage that goes along with a purchase price of $300,000.

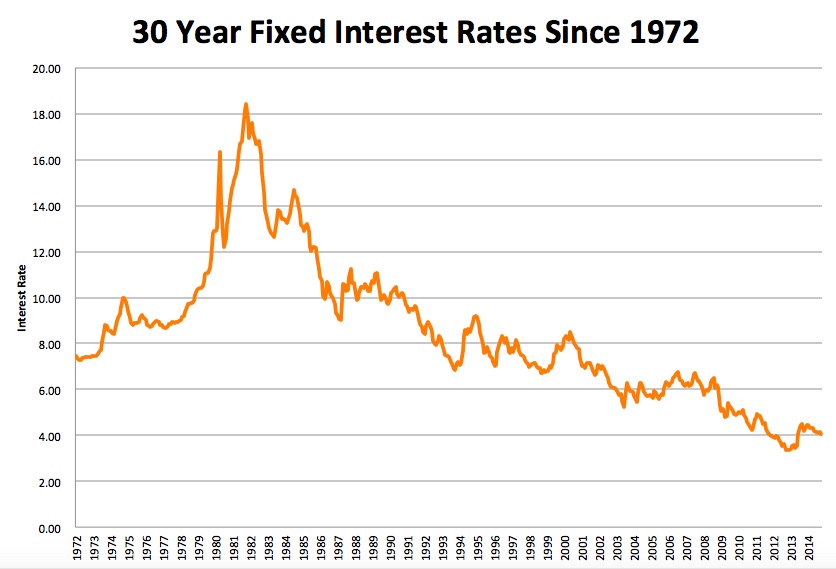

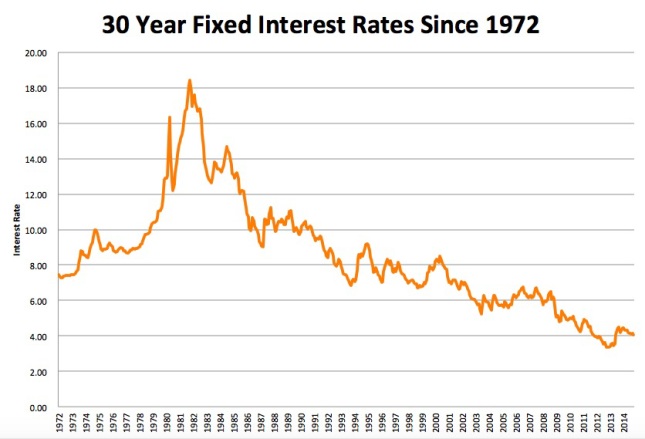

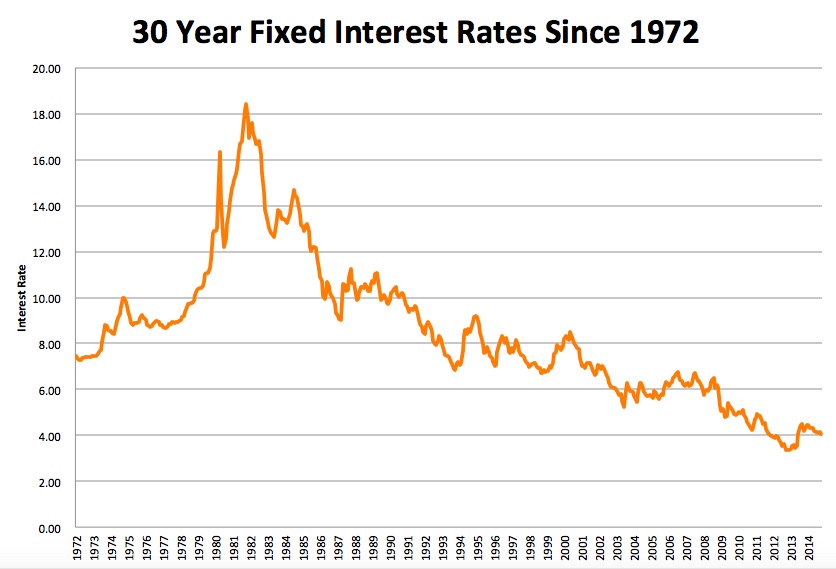

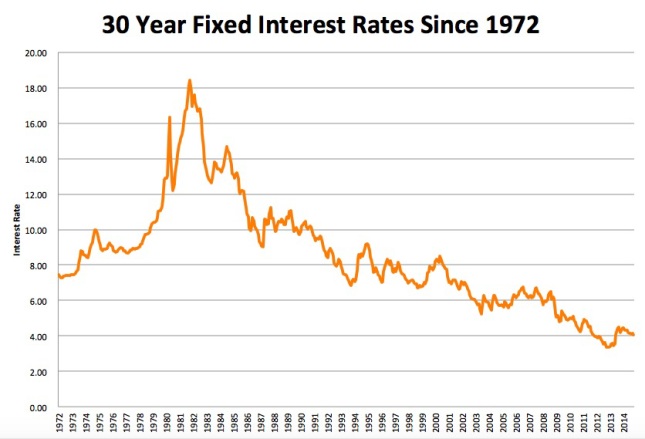

When a buyer is in the market for a home, the search process is usually short enough so that the mortgage interest rates are relatively stable. But this is not always the case. For a long time now, interest rates have been historically low but as you can see from the attached graph they are still historically VERY LOW. At a recent meeting I attended, the Chief Economist of the National Association of Realtors predicted that interest rates would rise .5% by spring and be up near 6% by the end of 2016. These are big jumps in a market where we have gotten very used to low rates. I fear that many potential buyers are beginning to expect the rates to stay where they are. And I hate to be the bearer of bad tidings, change is the only constant and the cycle for increasing interest rates is coming. When I broke into the real estate business as a green agent in Boulder Colorado in 1992 8% was a great rate. Now 4% is considered a great rate.

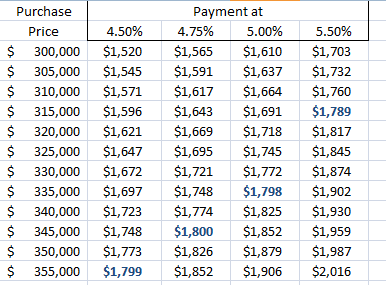

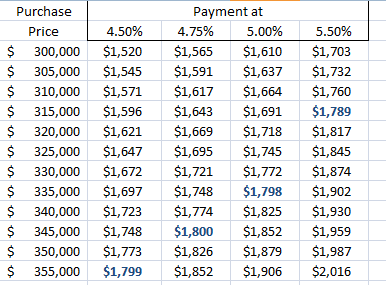

So when interest rates do go up the issue will not be how expensive a house you can afford, it will be how big a payment a buyer can afford. So, let’s look at how sensitive a payment is to changes in interest rates. This is called payment elasticity. Let’s consider the following scenario.

- A buyer has been pre-qualified for a mortgage payment (not including taxes or insurance) of $1800 per month. Let’s assume a current interest rate of 4.5%, at this rate they qualify for a top home price of $355,000.

- They are excited about their home search and on their first time out with their Realtor (hopefully me :)) they see some really great homes. They are happy with the type of home they can get, but decide to keep looking.

- They have a trip planned and then people coming into town, so they are not able to look at homes for a number of weeks. After that they find that there isn’t much to look at. The time between first looking at homes and their second viewing trip is two months. During that time interest rates increase from 4.5% to 5%. The next time out they find a house listed for $355,000 and write an offer for $350,000. The offer gets accepted and everyone is really excited until they talk to their lender who informs them that “interest rates have increased and they can no longer qualify for the house they have a contract on. Their top price range is now $335,000”. Crushed! Disappointed! Upset! Betrayed! These are just a few words that come to their minds as they quickly cancel the contract.

It’s called interest rate risk and it can really happen. In my scenario, the buyers lost $20,000 of purchasing power in a short amount of time as interest rates climbed just 1/2%. To see how this looks with real payments take a look at the chart below. In this scenario for every 1% increase in interest rates they lose $40,000 of purchasing power. If in our scenario the buyers find a way to qualify their payment just went up $106 per month or

Moral of the story – Don’t ignore interest rates. If you are happy with your payment and happy with a house, jump on it. This could become an issue in the near future.

Moral of the story – Don’t ignore interest rates. If you are happy with your payment and happy with a house, jump on it. This could become an issue in the near future.

My source for the historical interest rates is FeddieMac

by Neil Kearney | May 23, 2014 | For Sellers, Real Estate 101, Uncategorized

Selling a home can seem like a daunting process. Especially if you haven’t done it before. There are many facets to the process and enlisting a good Realtor is a very important piece of the puzzle. I help people list their homes all the time and for many it’s their first time. Here is a detailed overview of the process of selling your home.

Selling a home can seem like a daunting process. Especially if you haven’t done it before. There are many facets to the process and enlisting a good Realtor is a very important piece of the puzzle. I help people list their homes all the time and for many it’s their first time. Here is a detailed overview of the process of selling your home.

Preparation

There are three factors in which your home will be judged; location, condition and price. Location is fixed, after you purchase the property you can’t do much about it. An appropriate price can make up for deficiencies in the location and condition. Condition is what you, as a seller has most control over. The question you should be asking yourself as you prepare your house for the market is “how will my house compare with others in this neighborhood and price range?”. If your home compares well, you will be rewarded by your home appealing to more buyers and this will result in a quicker sale and more money. Your home needs to have finishes that appeal to buyers and be in really good showing condition. This article on when to upgrade may be of help to you as you consider some last minute upgrades to your home. Here are some tips on getting your home ready to sell. Your Realtor will be able to give you advice as to what needs to be done. Here is an article on the top 5 ways to maximize value that you may be interested in reading. Be sure to have the house ready for photos. The photos posted represent the initial showing for all potential buyers. If the house doesn’t look good in the photos many buyers won’t take a look in person.

Another part of the preparation process is to review and sign the listing paperwork prepared by your Realtor. Filling out a Sellers Property Disclosure is part of this process. In Colorado there is a standard form which helps in this process. My advice as you fill out this form is to be through and clear in your disclosure. Don’t leave the buyer asking for more information. If you indicated that you have had a past roof leak give all the information you have; when it happened and how it was fixed. In my experience, the more information on the disclosure, the more confidence the buyers have in the sellers and the transaction. This is also a good time to gather any documents that would supplement the disclosure. You will be asked for these in the buy/sell contract so it would be good to start gathering anything that is of material fact about the house (roof warranty, survey, past inspection, insurance claim, etc.)

Showings

Showings

In order for your house to sell it must make an emotional connection with a buyer. In order to make an emotional connection with a buyer your house must be a clean and inviting environment. They must be able to picture themselves living there. Here are a few tips for creating a successful showing.

- Leave it to the buyers – Many Sellers think that they can be of help during a showing, answering questions or giving a tour. This is what the buyers agent is for. Sellers get in the way and buyers tend to rush through and showing and are not able to talk openly about the home.

- Light and Bright – It’s best if the house shows brightly. This means that the blinds are open, interior doors are open and many of the lights are on.

- Neat and Clean – You only have one shot to make a first impression so make sure that the house looks as good as possible as you leave each morning.

- The Extra’s – You may want to go the extra mile and put out refreshments and play some tasteful music. These are not required and especially with the music should be done with discretion. When there is music being played I usually turn it down to see what noises the music is covering up.

Offer

If all of the above goes well you can expect an offer! In most cases the buyer has their own agent who represents them and will prepare and deliver the offer to your agent. Your agent will then meet with you to discuss the merits of the offer. Some of the criteria your agent will help you think through are: price, closing date, financing terms and qualification, inclusions, inspection dates and additional provisions.

If you are lucky enough to get multiple offers you will want to read this article. In a normal situation you will have one offer who will submit an offer that isn’t exactly what you are offering. Your agent will then help you formulate a negotiating strategy and prepare a counterproposal to send to the buyers. This process continues until the buyers and sellers reach an agreement or it doesn’t come together and you wait for a new buyer.

If you are lucky enough to get multiple offers you will want to read this article. In a normal situation you will have one offer who will submit an offer that isn’t exactly what you are offering. Your agent will then help you formulate a negotiating strategy and prepare a counterproposal to send to the buyers. This process continues until the buyers and sellers reach an agreement or it doesn’t come together and you wait for a new buyer.

From Contract to Closing

Finding a buyer and agreeing to an acceptable price and terms with a buyer is one of the high points of a real estate transaction. No more daily showings, no more uncertainty, making plans for the future, it’s exciting stuff. But then comes the realization that you are only part way to the finish line. There is still work to be done. This is a checklist of items that the seller is responsible for between contract and closing.

Order Title Commitment – In Colorado the seller is responsible to providing the buyer a title insurance policy in conjunction with a real estate purchase. The first step of this process is ordering the title commitment. The listing agent usually handles this for the seller. This is also a great time to provide to the title officer the information on your existing loans which will need to be paid off at the closing.

Homeowners Association Documents – As per the Colorado approved real estate contract the seller will provide the buyer a copy of the relevant HOA documents. This shall include bylaws, rules and regulations, financial documents, minutes from the most recent meetings. Again, this is something that the listing agent usually tries to supply (at least I do) but sometimes the information is embedded in a members only website and the Realtor might need help with this.

Gather Paperwork – The buyer will want to have any relevant documentation regarding the home. In conjunction with the disclosure requirements the seller must supply the buyer any prior inspections or reports that give insight to the condition of the home. This would also be a good time to gather any manuals and warranties and set them aside before your packing gets into full gear.

Prepare for Inspection – Just because most of the showing activity has subsided it doesn’t mean that you are off the hook for keeping the home looking good. I would argue that the inspection is your most important showing and the house should be prepared as well as possible. In addition to the general cleanliness here are a few tips to help the inspection. Replace the furnace filter and clean the humidifier filter if you have one. Move boxes and or furniture away from access points for plumbing, heating and electrical. It is common that a buyer will perform a radon test and the protocol for a radon test is that the house will be closed up for 12 hours prior to closing as well as 48 hours throughout the test. However, it is a really good idea to “air out” the lowest level of the home prior to the closed house conditions.

Make Your Arrangements – Start making arrangements for moving, storage, packing and cleaning. Consult with your Realtor so that you are sure that you understand the timing of when you need to be out and cleaned. After the inspection it is also a good idea to contact the utility companies to let them know about an upcoming transfer in service. Once the deal is rock solid, put in your change of address request to the postal service.

Inspection Items – Once the inspection has been done and the agreements surrounding the inspection has been made, some work will need to be done. My advice here is to get the work done as soon as possible, don’t cut corners and follow the letter of the agreement to a “t”. The listing agent is there to help you get this work done if you need help.

Clean and Closing – The days surrounding closing will be busy days. You will need to pack, clean and supervise work maybe at two locations. My advice regarding how you leave the home is based on two things. Look at the contract and make sure you are doing the minimum required and then consult the Golden Rule. How would you really like a home to be left for you? When the house is really left in good shape and the buyers feel that they are being treated well, the closing is much easier for all involved.

Costs

Costs

Many of the traditional closing costs like appraisal, discount points, inspection fees are handled by the buyer but here are the costs that the seller is responsible for.

Commissions – The commission fee that you agree to with your agent when you sign the listing papers includes fees for both the listing agent and buyers agent.

Title Insurance – Sellers in Colorado customarily pay for the title insurance policy that insures that the property is transferred free and clear. The fees vary on sales price but a typical fee for a $400,000 sale is around $1,450.

Paying off and Settling up – At closing the title company will make sure that all of the financial obligations of the seller regarding the house are settled. This means paying off any loans or liens and prorating the taxes (don’t forget they are paid in arrears) and HOA fees.

This list is based on my experience and is from the sellers perspective for a sale in Colorado. If you hire a good listing agent, many of these items will happen seamlessly and you will be left to focus on getting your stuff packed and ready to go. I have been a Realtor based in Boulder Colorado since 1991 and I love doing those small things that make it easier for you. When you are ready to list, give me a call – Neil Kearney 303-818-4055

by Neil Kearney | Mar 13, 2014 | For Buyers, For Sellers, General Real Estate Advice, Real Estate 101, Uncategorized

Home ownership is a long term relationship. And just like other long term relationships in our lives, it needs constant attention and care.

Let’s imagine a typical situation. A family purchases a new home and uses most of their savings to do so.  The first few years are spent installing landscaping and furnishing and personalizing the rooms. Everything is new and fresh and all is good with the world. After awhile the house is either just the way you want it or good enough. For a long time the homeowners live happily in the relatively new home, not much to be done but enjoy.

The first few years are spent installing landscaping and furnishing and personalizing the rooms. Everything is new and fresh and all is good with the world. After awhile the house is either just the way you want it or good enough. For a long time the homeowners live happily in the relatively new home, not much to be done but enjoy.

As many years go by the house starts showing some wear and tear and features that were once fresh and hip are now showing up on the “before” side of the “before and after” shows on HGTV. But the house still works so you live in it and fix something when it breaks. Unexpectedly you get a new job out of town and you have to sell your home in a hurry. Your realtor comes in for a meeting and nicely tells you that your home is dated. There’s not enough time or money to upgrade everything at once so the only option is to set a low price and hope for the best. It might take many years to get to this point but I see it time and time again.

The other option is to proactively upgrade your house over time. Yes, there is a honeymoon period on a brand new home where you don’t need to upgrade, but after five or six years you will want to start looking at your property with a discerning eye to determine what project is next. When you take one reasonable project at a time you will be continually improving your investment. Using this strategy you will not only keep your investment on the top end of neighborhood values you will be able to enjoy and take pride in your house as you live in it.

Here are some ideas of yearly projects to consider for your home:

- Replace flooring in a bathroom.

- Upgrade the light fixtures throughout the house (sconces, bathroom light bars, chandeliers)

- Upgrade the countertops in the kitchen

- Replace the furnace and air conditioning

- Re-carpet

- Replace the vanity in a bathroom

- Paint the exterior or interior of the home

- Replace the front concrete walk with something more eye catching

- Replace the appliances (non matching appliances are not a good selling point)

- Re-stain or install a new deck

Take on one project a year and when the time comes to sell you will be ready to maximize the value.

by Neil Kearney | Apr 2, 2013 | For Sellers, General Real Estate Advice, Real Estate 101, Uncategorized

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet.

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet.

I don’t sell cars, appliances or stocks so I will comment on what I know and work with every day. In a recent post I commented on the best practices of the home buyer in a hot real estate market. Today I’m going to share my ideas on how to be a smart home seller in a sellers market.

Price it Right

In the Boulder area real estate market we are seeing very low inventory and high demand. This causes a shortage of homes and results in smart sellers getting multiple offers and selling their homes for more than they thought they might.

But this isn’t happening to all sellers. Here is a scenario I’m seeing a lot right now – Mr. and Mrs. Seller recognize that the market conditions favor them so they decide to price their home 10 – 20% higher than what the recent sales in the neighborhood show. Buyers come out to see the home in great numbers over the first week and the general sentiment is that the house would be acceptable but it’s not a house they want to break the neighborhood record on and they move on. The Sellers recognize a few weeks later that they are not going to get their “dream price” so they reduce it by 5%. Still too high for the market but by this time the market wave of activity for a new listing has passed and they are chasing.

A smart seller in this market looks at the recent sales and the competition with their Realtor and decides on a fair market value. They recognize that the market will bear a good price but they know that the house must appraise and be in good condition. If it is listed at a reasonable price near market value and in good condition there is a good chance there will be multiple offers.

Take Advantage of the First Wave

As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.

As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.

At any one time there are (hopefully) many buyers who are in the market for homes in any given area or price range. In a market with low inventory they soon sift through the current listings (either in person or online) and decide that they are not willing to buy any of the current homes on the market. So they focus on what is coming on the market. Here is where a good Realtor is invaluable. This buyer cannot wait for an open house or wait for the Sunday paper. Buyers are trolling online at all times. I have automatic searches sending results to hot buyers three times a day. So when a new listing hits the market buyers flock to see if this is the “one”. If it is they want to be first. The current buyers waiting for new listings are the first wave and right now it is a strong wave that lasts 3-4 days and comes in strong. In this market it is not uncommon to have 15 showings within the first four days. These are the most likely buyers.

If a home lasts through the first wave without an offer you know something is off (price, condition, location). After the first wave passes you, as a seller, are counting on people who are new buyers and those who were not available to see the property over the first days. This is a smaller pool. You are in the backwash.

Multiple Offers

If you have priced the home correctly the hope is to get multiple offers on your home. This puts the seller in a advantageous position and with guidance from their Realtor, they can compare the merits of multiple offers and choose the best one. I find it’s best to give all potential buyers in a multiple offer situation equal information. For me, that means each offering party knows when the offers will be considered and how many offers they are competing against. As a sellers agent I encourage buyers to bring their highest and best offers and give everyone a chance to revise their offers if they choose to do so. I then go through each offer with the seller and let them decide which offer gives them the best chance to close for the most money.

Get a Backup Offer

There are many reasons that a house that is under contract doesn’t close. Here are a few:

- Buyers Remorse – This is especially common when the buyer feels pressure to make a quick offer and then feels that they have paid too much after beating out multiple bids.

- Inspection – When there is time pressure to submit an offer there is not time to look at the home carefully or to show family members. This makes getting through the inspection especially important.

- Appraisal – Just because a buyer is willing to pay a certain amount for a home doesn’t mean that the appraiser or the bank will agree. If the appraisal comes in low and the buyer doesn’t have additional funds available to mitigate the banks risk the contract will terminate unless the seller is willing to re-negotiate. And if there were multiple offers, it is a good chance that the sellers will not re-negotiate.

It’s for these reasons it is smart to encourage a backup offer. And the best time to get a backup offer is when there are multiple offers. All it takes is to create a quick counterproposal with appropriate language. It is a no risk insurance policy which is usually a win-win.

Inspection Issues

If a buyer has paid a premium price for a home it is common for them to be very picky on the inspection. They feel the home should reflect the price and unless an “as-is” clause was included in the contract you can expect to be negotiating again on some inspection issues. As a seller your negotiation position is greatly enhanced if you have a backup offer. A good gauge as you consider the buyers requests is whether another (the next buyer) would likely require the same items. If so, it might be a good idea to negotiate in good faith and move forward.

Finding a Replacement Home

The advantages of a tight market on the selling side lead to difficulty if the seller needs to find a replacement home that will not require a double move. In a strong sellers market, the sellers must have a plan of where they are going to go. Don’t get stuck in a situation where you are homeless for a period of time. Plan ahead!

Since each transaction is different it is hard to anticipate all scenarios but those are some of the major considerations when a seller is looking to list their home in a sellers market. If you are looking for expert representation in Boulder County call me, I have been successfully working in this market since 1991.

by Neil Kearney | Oct 24, 2012 | Featured, For Buyers, For Sellers, Real Estate 101

Even though we are in a slower time of year, houses are still selling. All year I have been seeing a shortage of good listings in the  market. Right now there are 15% fewer available homes on the market than last year at this same time. This means that if a serious buyer is out looking for a nice home the cupboards are fairly empty. Right now there are many leftover homes on the market. I define leftover homes as those listings that haven’t sold for a specific reason whether it be price, location or condition. This shortage leads to heavy activity on those homes that come on the market ready to sell. Those homes are well priced, in good condition and in a location that doesn’t raise a red flag. This leads to multiple buyers being interested in the same house at the same time. Here is some advice for handling multiple offers from the buyer and seller perspective.

market. Right now there are 15% fewer available homes on the market than last year at this same time. This means that if a serious buyer is out looking for a nice home the cupboards are fairly empty. Right now there are many leftover homes on the market. I define leftover homes as those listings that haven’t sold for a specific reason whether it be price, location or condition. This shortage leads to heavy activity on those homes that come on the market ready to sell. Those homes are well priced, in good condition and in a location that doesn’t raise a red flag. This leads to multiple buyers being interested in the same house at the same time. Here is some advice for handling multiple offers from the buyer and seller perspective.

From The Buyers Perspective:

- Check to see if you have competition. Your agent will call the listing agent to announce your intention to write an offer. Make sure you know if you are competing with another buyer. At the same time have the agent ask for the sellers preferred closing date and for any items that will be excluded from the offer. All of the information below assumes that there is another offer.

- Make your decisions quickly. Getting your offer in a day ahead may make a big difference. Ask for a quick acceptance deadline.

- Do your homework: Check comparable sales and decide the maximum price you will be willing to pay. Also, think about how you would feel if you would lose this house over a couple of thousand of dollars.

- Do a thorough walk-through: When you see a house you are interested in, take your time. Check on the condition of the house, what would you need to do to make it yours. Are the systems (furnace, roof, windows) in good condition?

- Prepare a clean offer: Don’t ask for Sellers to pay for appraisal, cleaning, HOA transfer fees etc. When the seller is considering two similar offers, $50 can make a big difference and send a signal that the buyers asking for all of the small stuff will be tougher to work with down the road on inspections etc.

- Have your financing in place and make sure to include a letter from a lender along with the offer. I prefer to see a local lender who can jump in and make the closing work in a difficult situation rather than somebody who is working a toll free line.

- A nice touch is to write a personal letter to the seller explaining who you are and why you love their house. The seller has an emotional attachment to the house and wants to sell to someone who will take care of their house.

Consider an escalation clause. When the house is a good value and you know there is competition one effective method is to write in an escalation clause. This clause in the contract automatically raises the bid price if another offer beats theirs financially. For instance it could read “the offer price shall be automatically raised to a price $1,000 above any other bonefide offer, the purchase price shall not exceed $xxx,xxx”. This is where the buyer has to know how much they are willing to pay; is it full price or $5,000 over?

From The Sellers Perspective:

- If you are attracting more than one offer it shows that you have taken care of your home and priced it correctly.

- You want to make sure that all interested parties have a chance to submit an offer. Have your agent communicate to each agent who has shown the property recently to gauge interest.

- When reviewing offers look at these main points: net price to you after all closing costs, dates and terms and buyers ability to pay and close. (more…)

Page 3 of 9«12345...»Last »