Most real estate buyers can’t afford their home. A first time buyer who saves up for a down payment, has good credit still can’t afford their home. Being able to afford their home means paying cash. When a buyer says that they can afford a $300,000 home for example what they actually mean is that their budget allows for them to afford the payment on the mortgage that goes along with a purchase price of $300,000.

Most real estate buyers can’t afford their home. A first time buyer who saves up for a down payment, has good credit still can’t afford their home. Being able to afford their home means paying cash. When a buyer says that they can afford a $300,000 home for example what they actually mean is that their budget allows for them to afford the payment on the mortgage that goes along with a purchase price of $300,000.

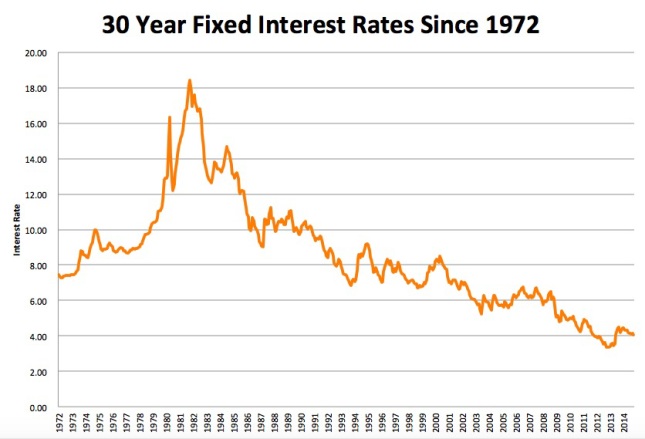

When a buyer is in the market for a home, the search process is usually short enough so that the mortgage interest rates are relatively stable. But this is not always the case. For a long time now, interest rates have been historically low but as you can see from the attached graph they are still historically VERY LOW. At a recent meeting I attended, the Chief Economist of the National Association of Realtors predicted that interest rates would rise .5% by spring and be up near 6% by the end of 2016. These are big jumps in a market where we have gotten very used to low rates. I fear that many potential buyers are beginning to expect the rates to stay where they are. And I hate to be the bearer of bad tidings, change is the only constant and the cycle for increasing interest rates is coming. When I broke into the real estate business as a green agent in Boulder Colorado in 1992 8% was a great rate. Now 4% is considered a great rate.

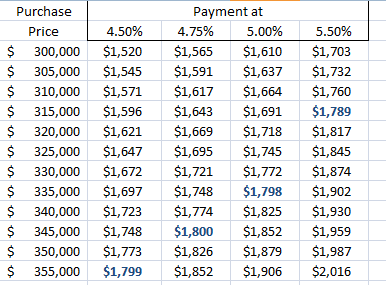

So when interest rates do go up the issue will not be how expensive a house you can afford, it will be how big a payment a buyer can afford. So, let’s look at how sensitive a payment is to changes in interest rates. This is called payment elasticity. Let’s consider the following scenario.

- A buyer has been pre-qualified for a mortgage payment (not including taxes or insurance) of $1800 per month. Let’s assume a current interest rate of 4.5%, at this rate they qualify for a top home price of $355,000.

- They are excited about their home search and on their first time out with their Realtor (hopefully me :)) they see some really great homes. They are happy with the type of home they can get, but decide to keep looking.

- They have a trip planned and then people coming into town, so they are not able to look at homes for a number of weeks. After that they find that there isn’t much to look at. The time between first looking at homes and their second viewing trip is two months. During that time interest rates increase from 4.5% to 5%. The next time out they find a house listed for $355,000 and write an offer for $350,000. The offer gets accepted and everyone is really excited until they talk to their lender who informs them that “interest rates have increased and they can no longer qualify for the house they have a contract on. Their top price range is now $335,000”. Crushed! Disappointed! Upset! Betrayed! These are just a few words that come to their minds as they quickly cancel the contract.

It’s called interest rate risk and it can really happen. In my scenario, the buyers lost $20,000 of purchasing power in a short amount of time as interest rates climbed just 1/2%. To see how this looks with real payments take a look at the chart below. In this scenario for every 1% increase in interest rates they lose $40,000 of purchasing power. If in our scenario the buyers find a way to qualify their payment just went up $106 per month or

Moral of the story – Don’t ignore interest rates. If you are happy with your payment and happy with a house, jump on it. This could become an issue in the near future.

Moral of the story – Don’t ignore interest rates. If you are happy with your payment and happy with a house, jump on it. This could become an issue in the near future.

My source for the historical interest rates is FeddieMac