by Neil Kearney | Aug 23, 2019 | General Real Estate Advice, Real Estate 101

Millions of dollars are being poured into the real estate industry through venture capital and much of that money is going into a segment called “iBuying”. IBuying is when a consumer sells their home to a corporation whose business it is to purchase homes using a streamlined process for a price derived by an algorithm, The sales transactions are cash purchases and can be completed quickly. In this article I will provide a high level overview of what it is, who is involved, the nuts and bolts of the process and the pros and cons of working with an iBuyer.

Millions of dollars are being poured into the real estate industry through venture capital and much of that money is going into a segment called “iBuying”. IBuying is when a consumer sells their home to a corporation whose business it is to purchase homes using a streamlined process for a price derived by an algorithm, The sales transactions are cash purchases and can be completed quickly. In this article I will provide a high level overview of what it is, who is involved, the nuts and bolts of the process and the pros and cons of working with an iBuyer.

The concept isn’t new. We have seen homemade signs tacked to power poles and post cards offering to buy your “ugly house” for decades. The idea has always been to provide convenience to a small segment of the market who values the idea of selling their house quickly over getting every dollar out of the house. The logistics of how to get to your next house while dealing with the unknowns (time, price) of selling your current home are often a huge factor in the reason why people decide to stay put. Providing a method that simplifies that puzzle is a much needed service. But are the associated costs worth it?

The main entrants into the iBuying space are public companies (Zillow), venture capital backed startups (Opendoor, OfferPad, Knock), and brokerages like Keller Williams and Redfin. For these companies there are three possible revenue streams: 1) The return on buying a property for a discount and then selling it (sometimes at a much later date after renting it out or renovating it) for a higher price. 2) Fees collected as part of the transaction. These fees can run up to 10%. 3) The value of the name of the potential sellers who turn down the offer. Let me explain a bit more about each of these.

- Each company will generate an offer priced based on available data fed into their proprietary data stream. I can imagine that the algorithms include recent sales, forward looking market trends, assessor data, neighborhood statistics and more. After asking for an offer, the seller can expect an offer within 24 hours. There is no opportunity for negotiation. The price offered includes a discount for the liquidity provided and the risks to the company that include; condition risk and market risk (this hasn’t been tested in a stagnant or falling market). The price offered, while competitive is less than what the algorithm thinks that the house is worth. They are after all looking for positive investment returns and providing a convenience for the seller. They hope to buy as low as they can and sell later for a positive return.

- On top of the lower than market price there are fees associated with selling to an iBuyer. Reportedly these range between 7% and 10% of the agreed upon price.

- One figure I saw while researching this article said that as many as 90% of sellers turns down the offer. In today’s economy good data is money and qualified leads are money. These companies including Zillow realize that brokerages and individual agents will pay good money for a stream of seller prospects who have indicated that they are ready to sell. Like relocation companies who fund their services by charging hefty referral fees to Realtors, this data source will be an increasing source of revenue for the companies involved.

After requesting an offer from an iBuyer you can expect to receive a price within one day. If you accept the price and associated transaction costs in the offer you can then expect an inspector to visit your home to see if there are any repairs needed. If there are any repairs needed you can expect that the offer price to be adjusted to reflect the work needed. If the transaction proceeds past this stage you can expect to close as quickly as you need to.

Pros

Here are some of the reasons a seller may choose to work with an iBuyer.

- Fast closing schedule.

- Fewer unknowns, knowledge of what you are going to get up front.

- No showings. No prepping the house for showings.

Cons

Here are some of the reasons that a seller may choose not to work with an iBuyer.

- Not maximizing the sales price. Lower price given for a quick guaranteed offer. Just one offer, no supply and demand factors at work.

- Costs are typically 7-10% of the agreed upon purchase price. This is more than a typical commission.

- Not available for every home or in every market. Currently iBuyers are expanding quickly but are only available in 20 markets. They are not typically interested in luxury homes or higher price ranges.

In summary, iBuyers are expanding. It provides the seller with the peace of mind and convenience of a guaranteed offer and a flexible closing date. However, that convenience comes with a hefty price tag. It’s not for everyone but for those in a pinch it might be a good option. If you are considering working with an iBuyer it would be prudent to call a Realtor as well to get an opinion of price and an estimate of net proceeds after expenses. That way you will have the information you need to properly weigh your decision. Let me know if I can help in this manner.

by Neil Kearney | Jun 13, 2019 | For Buyers, For Sellers, General Real Estate Advice, Real Estate 101

When the weather gets hot and the big thunderheads grow in the afternoons along the Front Range of Colorado, there is a chance that ice will fall from the sky. Most of the time these hail storms are very localized and most of the time the size of the hail isn’t large enough to cause property damage. But when the conditions are right, the hail stones can grow to be quite large and cause massive damage to cars, roofs, fences, windows and gutters (not to mention damage to plants, flowers and crops).

When the weather gets hot and the big thunderheads grow in the afternoons along the Front Range of Colorado, there is a chance that ice will fall from the sky. Most of the time these hail storms are very localized and most of the time the size of the hail isn’t large enough to cause property damage. But when the conditions are right, the hail stones can grow to be quite large and cause massive damage to cars, roofs, fences, windows and gutters (not to mention damage to plants, flowers and crops).

Last year we had a series of hail storms in Boulder County that caused extensive damage. I was working on a number of home sale transactions when the storms took place, so I have a good sense of the contractural obligations and practical steps needed in order to keep the sale moving forward. Before I go any further I’d like to say that I’m not an attorney and I can’t give legal advice. Use this article as a guide, not as gospel.

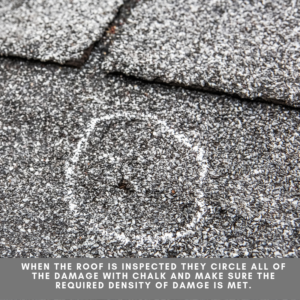

The good news is that with most roofs and with most insurance companies, if there is enough hail damage it will be covered by your homeowners insurance. Your only obligation is to pay your deductible. The first step after a hail storm that has caused damage is to call your insurance company. One clue that damage has been done (besides the earsplitting sound of hail on your roof) is that you might start seeing roof contractors in your neighborhood, they may even knock on your door and ask to inspect your roof.

If your home is listed for sale but has not yet gone under contract with a buyer, your main obligation in terms of the real estate transaction is disclosure. In addition to communicating with your agent and revising your Sellers Property Disclosure, I would recommend taking the steps necessary with your insurance company quickly so that you know if the damage is covered by the insurance policy. Once you know it is covered start taking steps so that a new roof can be installed. Having the time to interview contractors and get bids is a luxury that becomes more rare once a buyer is involved. A new roof is a good selling feature and any damage will come up during the future inspection process once you find a buyer, so taking proactive steps is a smart way to go.

If your home is listed for sale but has not yet gone under contract with a buyer, your main obligation in terms of the real estate transaction is disclosure. In addition to communicating with your agent and revising your Sellers Property Disclosure, I would recommend taking the steps necessary with your insurance company quickly so that you know if the damage is covered by the insurance policy. Once you know it is covered start taking steps so that a new roof can be installed. Having the time to interview contractors and get bids is a luxury that becomes more rare once a buyer is involved. A new roof is a good selling feature and any damage will come up during the future inspection process once you find a buyer, so taking proactive steps is a smart way to go.

If the hail storm happens after you are already under contract with a buyer paragraph 19 of the Colorado Contract to Buy and Sell Real Estate (CBS1-6-18) is a good guide as to the rights and obligations of both the Buyer and Seller. It is printed below, but here are a few of the high points:

- Once the property is under contract, the seller has an obligation to deliver the house at closing “in the condition existing as of the date of this Contract, ordinary wear and tear excepted”.

- If the damage is less than 10% of the price on the contract and the Seller can repair or replace the damaged item with something of at least similar size, age and quality, then the contract moves forward. Be sure to disclose to the Buyer what has happened and what is being done.

- If the damage is more than 10% of the price of the home or the repairs cannot be made in time to meet the scheduled closing date, the Buyer has the right to terminate the contract and get their earnest money back. Buyers rarely choose this option because if they hang in there they will get the house and a new roof.

- Paragraph 19.1 deals with property damage that will be covered by insurance.

- Option 1: If work can’t be done by the closing and Buyer and Seller do not agree to extend closing, and the Seller has received the insurance proceeds, the Buyer has the right to the insurance proceeds in the form of a credit including the amount of the deductible. In practice, if there is a lender involved they don’t like this option. They require to see the roof completed prior to the closing or an escrow set up that ensures that the roof will be done. The insurance company also holds back a portion of the proceeds to make sure that the roof is done.

- Option 2: If acceptable to the insurance company and the Buyers lender, an agreement stating that the the insurance proceeds will be assigned can be agreed to. In practice if there is a lender involved they don’t like this option for the same reasons stated above.

- Option 3: Enter into a written agreement drafted either by an attorney or the parties to the contract (Buyer and Seller, not the agent) that outlines what will happen, when it will happen, who will pay, who gets to choose the style, etc. In the transactions I worked on last year where there was not enought to to install a new roof prior to closing, this type of agreement was signed by the parties. In one case the Seller wrote it and in the other the Buyer hired an attorney to write it.

From the Colorado Approved Contract to Buy and Sell Real Estate:

Except as otherwise provided in this Contract, the Property, Inclusions or both will be delivered in the condition existing as of the date of this Contract, ordinary wear and tear excepted.

In the event the Property or Inclusions are damaged by fire, other perils or causes of loss prior to Closing (Property Damage) in an amount of not more than ten percent of the total Purchase Price and if the repair of the damage will be paid by insurance (other than the deductible to be paid by Seller), then Seller, upon receipt of the insurance proceeds, will use Seller’s reasonable efforts to repair the Property before Closing Date. Buyer has the Right to Terminate under § 25.1, on or before Closing Date, if the Property is not repaired before Closing Date, or if the damage exceeds such sum. Should Buyer elect to carry out this Contract despite such Property Damage, Buyer is entitled to a credit at Closing for all insurance proceeds that were received by Seller (but not the Association, if any) resulting from damage to the Property and Inclusions, plus the amount of any deductible provided for in the insurance policy. This credit may not exceed the Purchase Price. In the event Seller has not received the insurance proceeds prior to Closing, the parties may agree to extend the Closing Date to have the Property repaired prior to Closing or, at the option of Buyer, (1) Seller must assign to Buyer the right to the proceeds at Closing, if acceptable to Seller’s insurance company and Buyer’s lender; or (2) the parties may enter into a written agreement prepared by the parties or their attorney requiring the Seller to escrow at Closing from Seller’s sale proceeds the amount Seller has received and will receive due to such damage, not exceeding the total Purchase Price, plus the amount of any deductible that applies to the insurance claim.

Should any Inclusion or service (including utilities and communication services), system, component or fixture of the Property (collectively Service) (e.g., heating or plumbing), fail or be damaged between the date of this Contract and Closing or possession, whichever is earlier, then Seller is liable for the repair or replacement of such Inclusion or Service with a unit of similar size, age and quality, or an equivalent credit, but only to the extent that the maintenance or replacement of such Inclusion or Service is not the responsibility of the Association, if any, less any insurance proceeds received by Buyer covering such repair or replacement. If the failed or damaged Inclusion or Service is not repaired or replaced on or before Closing or possession, whichever is earlier, Buyer has the Right to Terminate under § 25.1, on or before Closing Date, or, at the option of Buyer, Buyer is entitled to a credit at Closing for the repair or replacement of such Inclusion or Service. Such credit must not exceed the Purchase Price. If Buyer receives such a credit, Seller’s right for any claim against the Association, if any, will survive Closing.

What happens if the hail damage is discovered after the closing?

What happens if the hail damage is discovered after the closing?

This happened to me last year as well. The Sellers were not aware of any damage and we had a successful closing. Soon after closing the Buyers noticed roofing contractors working on their street and had a contractor look at the roof. Damage was found. The Buyer’s contacted me and I in turn contacted the Sellers. The insurance company was called and it was determined that there was damage and that the last storm (they track these things closely) happened while the Sellers still owned the home and their policy was in place. The outcome was that the Buyers got a new roof and the Sellers had to pay their deductible and their insurance company funded a new roof.

Lessons learned:

- Keep the lender involved in the discussions. Different lenders handle this situation differently. Some allow credits and post closing escrows and some don’t.

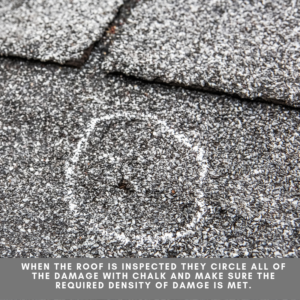

- It’s helpful but not required to have a contractor meet the insurance adjuster at the house for the initial inspection.

- Some policies have depreciating coverage as the roof ages. This does not relieve the obligation of the Seller to replace the roof.

- After a hail storm it is really difficult to schedule contractors. Real estate contracts are time sensitive. Call quickly and be first on the schedule!

As I mentioned before, this is not exhaustive but I hope it does give you some useful information regarding hail and how it affects a real estate transaction.

by Neil Kearney | Jan 9, 2018 | For Buyers, For Sellers, General Real Estate Advice, Real Estate 101

The recently passed federal tax bill will definitely have an impact on real estate. In general markets with high taxes and high values will be most affected. Despite the recent increase in local property taxes, Boulder County is considered a low property tax area compared to other parts of the country. However, we are a high value market. Here is a summary of the main points of the tax bill that affect real estate.

The recently passed federal tax bill will definitely have an impact on real estate. In general markets with high taxes and high values will be most affected. Despite the recent increase in local property taxes, Boulder County is considered a low property tax area compared to other parts of the country. However, we are a high value market. Here is a summary of the main points of the tax bill that affect real estate.

Mortgage Interest Cap – This is in regards to how much of the interest paid for mortgages can be used as a deduction. For those whose mortgages balances are less than $750,000 this will not affect anything. Previously the cap was $1 million and it has now been reduced to $750,000. Not many people have loans in excess of $750,000, but in our area where the luxury home market is very robust, we may see fewer buyers able to make those purchases. The interest on the first $750,000 is still deductible. This may dissuade some luxury home purchasers to buy a less expensive home, thereby reducing the demand for the very high end.

Local and State Tax Deduction – The Boulder County Treasurer was inundated before the new year with property owners pre-paying their property tax bill in advance. This was in response to the section of the tax bill which caps the deduction for state and local taxes at $10,000. Previously, homeowners were able to deduct from their federal tax return the amounts paid for state income tax, various ownership taxes and property taxes without limit. Now the deduction is limited to $10,000. Buyers may shy away from a house with a large tax bill knowing that payment will no longer reduce their tax bill.

Other Related Items – Those who own investment real estate may be getting a tax break on their real estate investment income. Income that comes through pass-through entities such as LLC’s get a tax break. 20% of that income can be deducted. You may have heard that the capital gains exclusion time limit had been expanded to require living in a house 5 of the previous 8 years in order to use the $250,000 for a single or $500,000 for a couple when selling a principal residence, this was overturned during the last few days leaving the existing rule of occupying the home two of the past five years.

This is just a high level outline, please contact your tax professional for more details.

by Neil Kearney | Dec 5, 2017 | Boulder County Housing Trends, Boulder Real Estate, For Buyers, For Sellers, General Real Estate Advice, Real Estate 101

The Real Estate Cycle

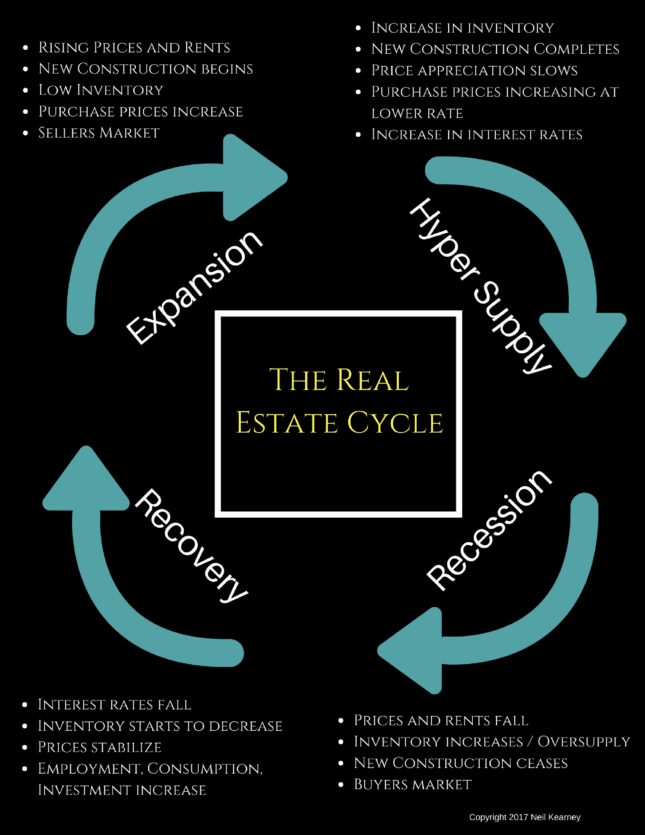

Approximately 2500 years ago Heraclitus of Ephesus said “The only thing that is constant is change”. In the moment we sometimes forget that forces larger than we can see are slowly moving culture, markets and people. Everything we see is changing, however the rate of change makes a difference. We notice more readily the melting of an ice cream cone than the erosion of a mountain. It’s normal to only take note of what we can readily see. However, there is wisdom in taking a longer view.

Real estate is cyclical. There are many factors involved, but the peaks and valleys of the real estate demand and value have been shown to have a relatively consistent cycle of approximately 18 years. Economist Homer Hoyt made a detailed study of the Chicago real estate market and the broader United States real estate market and found that it has run its course in a steady 18 year rhythm since 1800. There have been exceptions that have disrupted the normal cycle such as The Great Depression, World War II and the post war boom but on average, the business cycle and the real estate cycle have been very consistent including the 18 year cycle than ended in 2008.

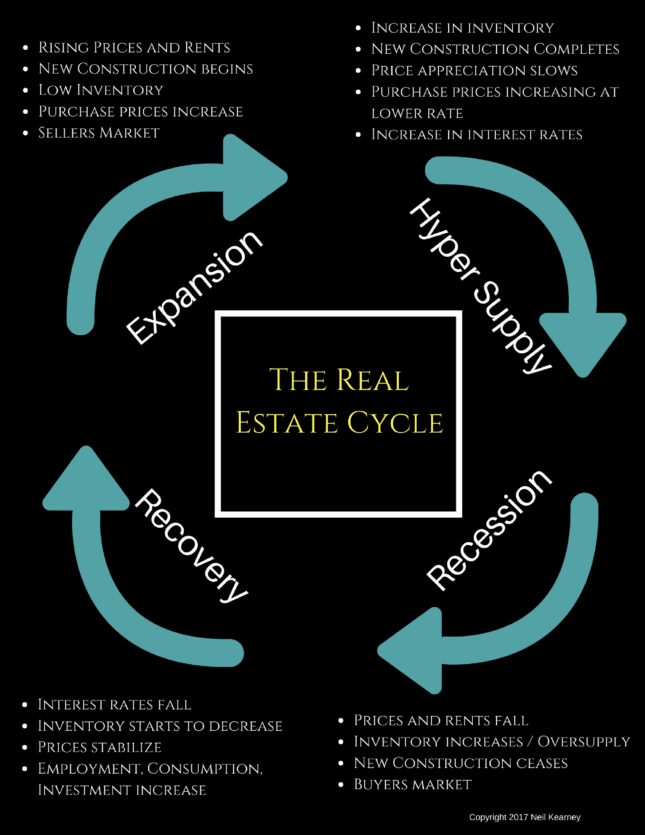

The infographic above shows the four phases of the real estate cycle. Here is more information on each of the stages of the cycle. Most studies present Recovery as the first phase of the cycle, but since the last recession was so memorable I think it makes a good starting point.

Recession

Think back to what was in the news in 2008 – 2011: Foreclosures, unemployment, short sales, mortgage reform, lowering interest rates, 40% drop in real estate sales, stock market losing value, declining home prices (Boulder was one of the few markets to hold most of its value), consumers reducing spending, rental vacancies, lower rents, incentives to buy and lease, etc. etc. The situation was shocking, many of the US real estate markets had just climbed to all time highs, buyers were using easy credit to buy multiple homes thinking that the easy money would continue indefinitely. And it did, until all of a sudden it crashed. Fortunes were lost. Especially for those who couldn’t hold on for the recovery. This was the low point in the economy and the real estate market. The signs to look for when recession is on the horizon are; interest rates are raised to slow an over heated economy, increased inventory of unsold homes, higher rental vacancies, new construction shows with more unsold inventory and higher interest rates (although some developers who are late to the party always get caught), mortgage delinquencies increase which leads to more foreclosures. During the recession it is a buyers market. Those with the wherewithal should purchase real estate at a discount.

(Boulder was one of the few markets to hold most of its value), consumers reducing spending, rental vacancies, lower rents, incentives to buy and lease, etc. etc. The situation was shocking, many of the US real estate markets had just climbed to all time highs, buyers were using easy credit to buy multiple homes thinking that the easy money would continue indefinitely. And it did, until all of a sudden it crashed. Fortunes were lost. Especially for those who couldn’t hold on for the recovery. This was the low point in the economy and the real estate market. The signs to look for when recession is on the horizon are; interest rates are raised to slow an over heated economy, increased inventory of unsold homes, higher rental vacancies, new construction shows with more unsold inventory and higher interest rates (although some developers who are late to the party always get caught), mortgage delinquencies increase which leads to more foreclosures. During the recession it is a buyers market. Those with the wherewithal should purchase real estate at a discount.

Recovery

This is the bounce off the low point. During this phase the inevitable march of population slowly increases the demand for real estate and other goods. Accumulated inventory gets absorbed, vacant rental units get rented, adult children slowly move out of their parents basements, the Fed lowers interest rates to stimulate demand. With favorable interest rates businesses expand. They hire more employees, make capital investment. During this phase, prices stabilize, excess inventory gets purchased and there is virtually no new construction (developers are licking their wounds), in the aftermath of the recession, banks are very careful about lending.

Expansion

Recovery turns to expansion when most of the available inventory has been absorbed by individuals of businesses. Rental occupancy rates are higher than average, new construction finishes are at a low and stalled projects finish out, built up foreclosure inventory is all but gone. Once the expansion is recognized developers scramble to fill the new demand by planning new projects. However, developing property takes 2-3 years from start to finish so this isn’t instantaneous, there is a lag. With very little new construction the demand for re-sale homes is very strong. This results in rising prices and in some markets the supply demand discrepancy results in multiple offer situations that further exacerbate price increases. In times of unusually low inventory during this phase (before the new construction projects which have been in development are complete) prices tend to reflect an anticipation of where the market is headed rather than the current market price. This is a sellers market. As the expansion phase matures buyers and renters have increased choices but continue to find new places to live. Positive pressure on prices slows. The real estate market falls into a phase of balanced activity. As long as the broad economic forces are stable, this phase can last quite some time. People have jobs, they start families, they buy cars, the buy houses, they buy refrigerators. Companies are making profits, they continue to invest in infrastructure.

Hyper Supply

The delineation between market expansion and hyper supply is marked by an increase in unsold inventory and and increase in rental vacancy. The projects which were started late in the expansion phase continue to come available but to an increasingly tepid response. Growth in prices is decelerating. If developers recognize the turn in the market and stop building, the coming recession can be softened considerably. In this phase, housing, rental units and office space become over built. As interest rates rise we are then led into another recession.

Where Are We Now?

First let’s eliminate where we know we are not. We are not in recession, nor are we in recovery. Over the last ten years, the Boulder area real estate market has come through the recession phase and then quickly moved through the recovery phase. I say quickly because we were fortunate not to have a big back log of foreclosure homes that needed to be sold. Since mid 2012 we have been in the expansion phase. Throughout the Denver Metro Area we have seen unprecedented construction of rental apartments. We have seen a steady stream of new residents drawn to our area by a good economy and a great lifestyle. We have seen compounding double-digit real estate appreciation that rivals the top markets in the nation. Early this summer, the temperature of the expansion seemed to have been turned down a few notches and we are now seeing a slowing in price appreciation and a bit less demand. However, our inventory is still very low and the overall economy is still doing well. We seem to be at the beginning of a cycle of increasing interest rates but a 30 year mortgage is still at around 4%. To me it seems like we are still in the expansion phase, but if each phase was a day we would be definitely in the afternoon. Here are the next signs we need to look for which would indicate a shift toward the hyper supply phase: 1) increased vacancy rates on rental properties 2) Meaningful increase in interest rates 3) Increased inventory of resale homes for sale 4) New home builders offering incentives and price reductions.

If we are to believe that the real estate cycle runs in an 18 year cycle, we would expect our next major recession in 2024. If you would like to discuss a personal strategy as it pertains to the real estate cycle I invite you to contact me. Neil Kearney, Kearney Realty Co. Neil@NeilKearney.com 303-818-4055

by Neil Kearney | Jul 6, 2017 | General Real Estate Advice, Real Estate 101

With property values increasing as steadily and as rapidly as they are in Boulder County, it should come at no surprise that property taxes are following suit. This became very clear this past May when assessment notices made their way around town informing Boulder County residents that the assessed value of their property had significantly increased by on average 26%. Although it is exciting to watch the value of your assets increase it does mean that property taxes will most likely increase for you as well.

With property values increasing as steadily and as rapidly as they are in Boulder County, it should come at no surprise that property taxes are following suit. This became very clear this past May when assessment notices made their way around town informing Boulder County residents that the assessed value of their property had significantly increased by on average 26%. Although it is exciting to watch the value of your assets increase it does mean that property taxes will most likely increase for you as well.

When discussing property taxes I believe it is helpful for anyone to have a basic understanding or concept of how property taxes are actually determined. When boiled down to the basics it is actually quite easy to understand.

Three major components go into your property taxes:

- Rate of Assessment

- Assessed Value

- Mill Levy (Tax Rate)

The Rate of Assessment for residential properties in Colorado serves as the base for property taxes as it determines what percentage of your homes actual value can or will be taxed. This can be adjusted on the state level and just recently got lowered for the first time in 14 years from 7.96% to 7.2%. The rate of assessment is multiplied by the assessed value to your taxable value. The Assessed Value is the value assigned to your home by the county assessor. This assessment is adjusted every two years based upon comparable sales in your neighborhood. The assessed value is what arrived in your mailbox in May. Finally, the Mill Levy (also known as the Tax Rate) is the percentage of the Assessed Value that is actually taxed and collected by the county on a yearly basis. The Mill Levy is set every fall and sets the amount and allocation so that the budgets for schools, emergency services, roads, etc. are met.

As taxes rise, one tax exemption that may be important for you or your family members to know of is the Senior Property Tax Exemption. With the deadline of July 15th rapidly approaching it can be helpful to understand what this exemption is, how much it could save you, and of course if you are eligible. Those that are eligible for the Senior Property Tax Exemption will receive a 50% property tax deduction on the first $200,000 of the properties value equating to between $550 and $760 of property tax savings per year.

As taxes rise, one tax exemption that may be important for you or your family members to know of is the Senior Property Tax Exemption. With the deadline of July 15th rapidly approaching it can be helpful to understand what this exemption is, how much it could save you, and of course if you are eligible. Those that are eligible for the Senior Property Tax Exemption will receive a 50% property tax deduction on the first $200,000 of the properties value equating to between $550 and $760 of property tax savings per year.

Am I eligible for this exemption?

You are eligible if you meet all three of the following requirements:

- You Were born on or before January 1, 1952

- You have continuously lived in the home starting before January 1st, 2007

- You have continuously owned the home starting before January 1st, 2007

If you happen to meet all three of the requirements and file your application before July 15th, 2017 you will first see the discount on your tax bill in January of 2018. There is no need to reapply each year as the exemption will continuously stay active as long as no disqualifying event occurs.

To see more information on the exemption or to fill out the application go to: https://www.bouldercounty.org/property-and-land/assessor/senior-exemption/

by Neil Kearney | Jun 27, 2017 | For Buyers, For Sellers, General Real Estate Advice, Real Estate 101

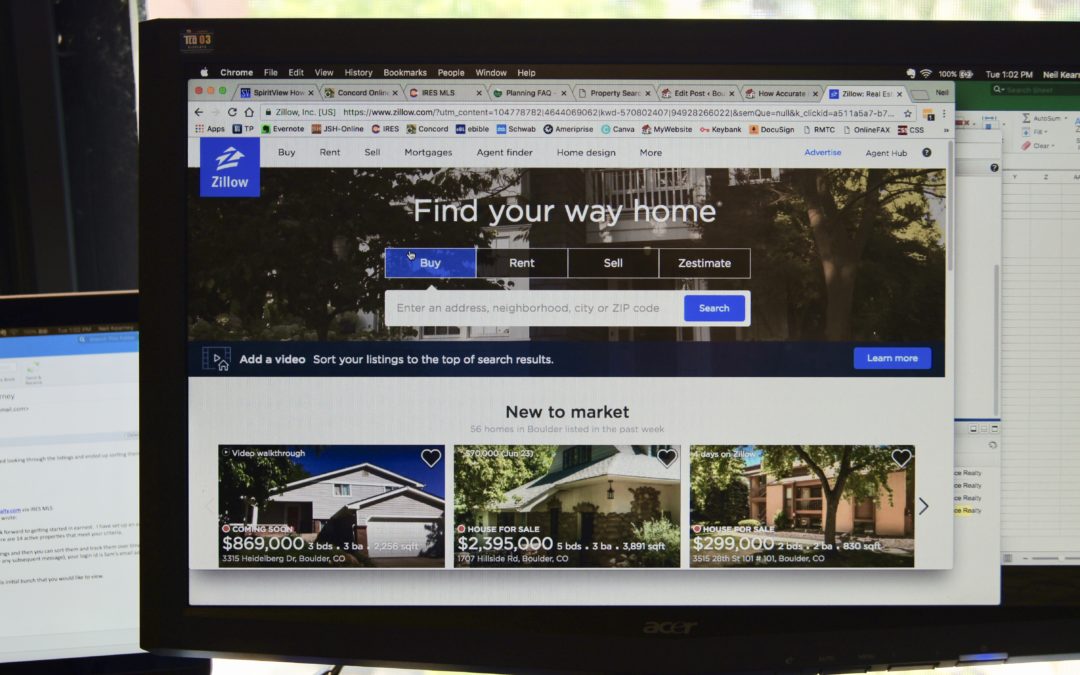

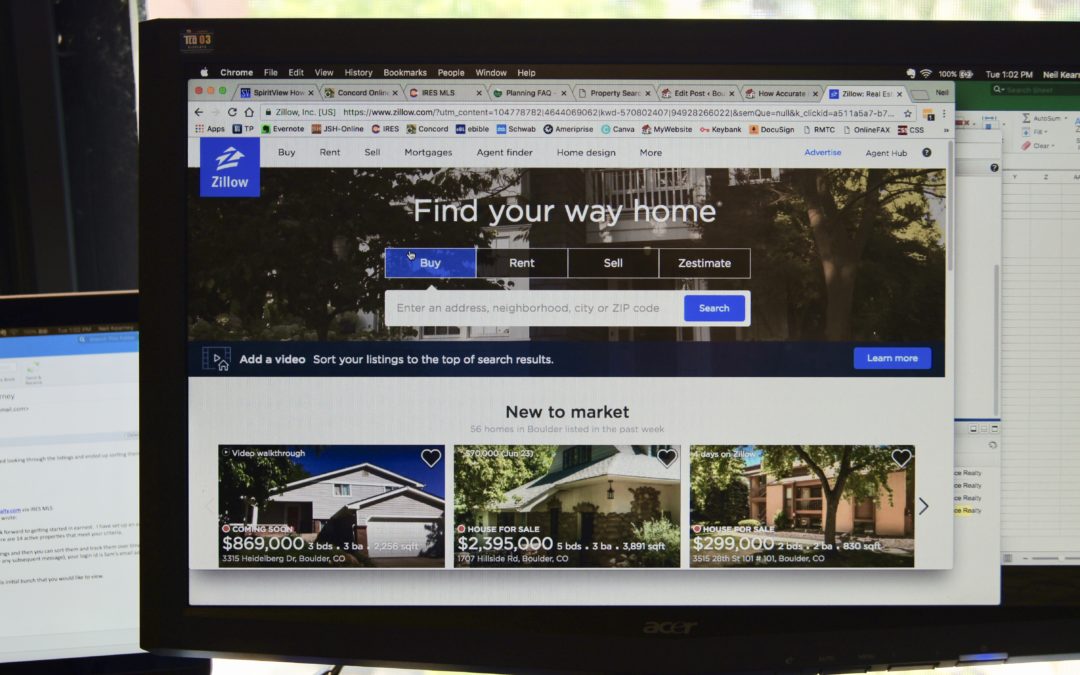

This past May, Zillow, the online real estate search company was sued by a Chicago based home building company who claimed that Zillow’s online Automated Value Model (AVM) is deceiving home buyers with prices below the true value of properties leading to frustrated sellers. Furthermore the suit claims that Zillow’s “Zestimates” are in violation of the legal description of an appraisal, which under Illinois law must be administered by a licensed appraiser. Zillow defends themselves by stating that their Zestimates claim only to be approximations not true appraisals; to which the suit responds stating that whether or not they are technically appraisals homeowners are viewing them as such leading to confusion and irritation. It will be interesting to see over the coming months how this lawsuit plays out. It’s clear that Zillow’s Zestimate and other AVM’s which are becoming common across the internet are being used by consumers to determine the approximate value of their home. But in my experience, many times this approximation isn’t close to the true market value.

This past May, Zillow, the online real estate search company was sued by a Chicago based home building company who claimed that Zillow’s online Automated Value Model (AVM) is deceiving home buyers with prices below the true value of properties leading to frustrated sellers. Furthermore the suit claims that Zillow’s “Zestimates” are in violation of the legal description of an appraisal, which under Illinois law must be administered by a licensed appraiser. Zillow defends themselves by stating that their Zestimates claim only to be approximations not true appraisals; to which the suit responds stating that whether or not they are technically appraisals homeowners are viewing them as such leading to confusion and irritation. It will be interesting to see over the coming months how this lawsuit plays out. It’s clear that Zillow’s Zestimate and other AVM’s which are becoming common across the internet are being used by consumers to determine the approximate value of their home. But in my experience, many times this approximation isn’t close to the true market value.

So just how accurate are Zestimates. In a Nationwide study conducted by Zillow it was found that their Zestimates fall within 5% of the sales price of homes 53.9% of the time, within 10% of the sales price 75.6% of the time and finally within 20% of the sales price 89.7% of the time. Back in 2007 when Zillow was just getting its footing I conducted my own research local to Boulder on the subject and found that on a whole Zillow’s algorithm was 99% accurate. However, when I took a closer look I found that there was an 18.4% standard deviation. Additionally, the outliers were up to 50% off. Although Zestimates generally do a good job when looking over a large pool of properties, their approximation for any specific property within that pool can many times be significantly off of the true value.

To read my 2007 article click here.

With home values rising as fast as they are in Boulder and with Automated Value Models such as “Zestimates” readily available, inexpensive and simple to use, it’s easy to understand why so many consumers gravitate towards them. It’s important to remember though that the very nature of AVM’s being automated hinder their ability to provide an accurate evaluation of properties all of the time. AVM’s fail to take into account many critical and influential aspects of a property that can greatly affect the value such as the current condition, recent upgrades (or the lack thereof), actual square footage, views and other details. After understanding these substantial flaws it becomes clear why AVM’s, including Zestimates often over or undervalue homes leading to users feeling mislead.

AVM’s have their place as a non-binding general view of the market when you are not considering a transaction. It’s fun to look. However, when you are considering a real estate transaction you need to bring in an experienced professional to give you a more accurate comparative market evaluation. Experienced Reatlor’s like myself can give you the broad information and experience necessary to make decisions around. If you are considering a move I would be happy to come by and give you an individual market analysis.

To read more about the case go to: http://www.marketwatch.com/story/do-zillow-zestimates-mislead-home-buyers-illinois-lawsuit-claims-yes-2017-05-22

Page 1 of 912345...»Last »

Millions of dollars are being poured into the real estate industry through venture capital and much of that money is going into a segment called “iBuying”. IBuying is when a consumer sells their home to a corporation whose business it is to purchase homes using a streamlined process for a price derived by an algorithm, The sales transactions are cash purchases and can be completed quickly. In this article I will provide a high level overview of what it is, who is involved, the nuts and bolts of the process and the pros and cons of working with an iBuyer.

Millions of dollars are being poured into the real estate industry through venture capital and much of that money is going into a segment called “iBuying”. IBuying is when a consumer sells their home to a corporation whose business it is to purchase homes using a streamlined process for a price derived by an algorithm, The sales transactions are cash purchases and can be completed quickly. In this article I will provide a high level overview of what it is, who is involved, the nuts and bolts of the process and the pros and cons of working with an iBuyer.