When the weather gets hot and the big thunderheads grow in the afternoons along the Front Range of Colorado, there is a chance that ice will fall from the sky. Most of the time these hail storms are very localized and most of the time the size of the hail isn’t large enough to cause property damage. But when the conditions are right, the hail stones can grow to be quite large and cause massive damage to cars, roofs, fences, windows and gutters (not to mention damage to plants, flowers and crops).

When the weather gets hot and the big thunderheads grow in the afternoons along the Front Range of Colorado, there is a chance that ice will fall from the sky. Most of the time these hail storms are very localized and most of the time the size of the hail isn’t large enough to cause property damage. But when the conditions are right, the hail stones can grow to be quite large and cause massive damage to cars, roofs, fences, windows and gutters (not to mention damage to plants, flowers and crops).

Last year we had a series of hail storms in Boulder County that caused extensive damage. I was working on a number of home sale transactions when the storms took place, so I have a good sense of the contractural obligations and practical steps needed in order to keep the sale moving forward. Before I go any further I’d like to say that I’m not an attorney and I can’t give legal advice. Use this article as a guide, not as gospel.

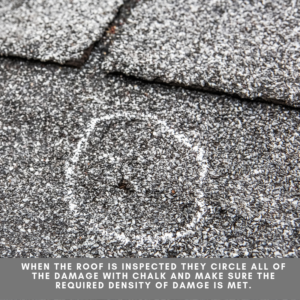

The good news is that with most roofs and with most insurance companies, if there is enough hail damage it will be covered by your homeowners insurance. Your only obligation is to pay your deductible. The first step after a hail storm that has caused damage is to call your insurance company. One clue that damage has been done (besides the earsplitting sound of hail on your roof) is that you might start seeing roof contractors in your neighborhood, they may even knock on your door and ask to inspect your roof.

If your home is listed for sale but has not yet gone under contract with a buyer, your main obligation in terms of the real estate transaction is disclosure. In addition to communicating with your agent and revising your Sellers Property Disclosure, I would recommend taking the steps necessary with your insurance company quickly so that you know if the damage is covered by the insurance policy. Once you know it is covered start taking steps so that a new roof can be installed. Having the time to interview contractors and get bids is a luxury that becomes more rare once a buyer is involved. A new roof is a good selling feature and any damage will come up during the future inspection process once you find a buyer, so taking proactive steps is a smart way to go.

If your home is listed for sale but has not yet gone under contract with a buyer, your main obligation in terms of the real estate transaction is disclosure. In addition to communicating with your agent and revising your Sellers Property Disclosure, I would recommend taking the steps necessary with your insurance company quickly so that you know if the damage is covered by the insurance policy. Once you know it is covered start taking steps so that a new roof can be installed. Having the time to interview contractors and get bids is a luxury that becomes more rare once a buyer is involved. A new roof is a good selling feature and any damage will come up during the future inspection process once you find a buyer, so taking proactive steps is a smart way to go.

If the hail storm happens after you are already under contract with a buyer paragraph 19 of the Colorado Contract to Buy and Sell Real Estate (CBS1-6-18) is a good guide as to the rights and obligations of both the Buyer and Seller. It is printed below, but here are a few of the high points:

- Once the property is under contract, the seller has an obligation to deliver the house at closing “in the condition existing as of the date of this Contract, ordinary wear and tear excepted”.

- If the damage is less than 10% of the price on the contract and the Seller can repair or replace the damaged item with something of at least similar size, age and quality, then the contract moves forward. Be sure to disclose to the Buyer what has happened and what is being done.

- If the damage is more than 10% of the price of the home or the repairs cannot be made in time to meet the scheduled closing date, the Buyer has the right to terminate the contract and get their earnest money back. Buyers rarely choose this option because if they hang in there they will get the house and a new roof.

- Paragraph 19.1 deals with property damage that will be covered by insurance.

- Option 1: If work can’t be done by the closing and Buyer and Seller do not agree to extend closing, and the Seller has received the insurance proceeds, the Buyer has the right to the insurance proceeds in the form of a credit including the amount of the deductible. In practice, if there is a lender involved they don’t like this option. They require to see the roof completed prior to the closing or an escrow set up that ensures that the roof will be done. The insurance company also holds back a portion of the proceeds to make sure that the roof is done.

- Option 2: If acceptable to the insurance company and the Buyers lender, an agreement stating that the the insurance proceeds will be assigned can be agreed to. In practice if there is a lender involved they don’t like this option for the same reasons stated above.

- Option 3: Enter into a written agreement drafted either by an attorney or the parties to the contract (Buyer and Seller, not the agent) that outlines what will happen, when it will happen, who will pay, who gets to choose the style, etc. In the transactions I worked on last year where there was not enought to to install a new roof prior to closing, this type of agreement was signed by the parties. In one case the Seller wrote it and in the other the Buyer hired an attorney to write it.

From the Colorado Approved Contract to Buy and Sell Real Estate:

19. CAUSES OF LOSS, INSURANCE; DAMAGE TO INCLUSIONS AND SERVICES; CONDEMNATION; AND WALK-THROUGH. Except as otherwise provided in this Contract, the Property, Inclusions or both will be delivered in the condition existing as of the date of this Contract, ordinary wear and tear excepted.

19.1. Causes of Loss, Insurance. In the event the Property or Inclusions are damaged by fire, other perils or causes of loss prior to Closing (Property Damage) in an amount of not more than ten percent of the total Purchase Price and if the repair of the damage will be paid by insurance (other than the deductible to be paid by Seller), then Seller, upon receipt of the insurance proceeds, will use Seller’s reasonable efforts to repair the Property before Closing Date. Buyer has the Right to Terminate under § 25.1, on or before Closing Date, if the Property is not repaired before Closing Date, or if the damage exceeds such sum. Should Buyer elect to carry out this Contract despite such Property Damage, Buyer is entitled to a credit at Closing for all insurance proceeds that were received by Seller (but not the Association, if any) resulting from damage to the Property and Inclusions, plus the amount of any deductible provided for in the insurance policy. This credit may not exceed the Purchase Price. In the event Seller has not received the insurance proceeds prior to Closing, the parties may agree to extend the Closing Date to have the Property repaired prior to Closing or, at the option of Buyer, (1) Seller must assign to Buyer the right to the proceeds at Closing, if acceptable to Seller’s insurance company and Buyer’s lender; or (2) the parties may enter into a written agreement prepared by the parties or their attorney requiring the Seller to escrow at Closing from Seller’s sale proceeds the amount Seller has received and will receive due to such damage, not exceeding the total Purchase Price, plus the amount of any deductible that applies to the insurance claim.

19.2. Damage, Inclusions and Services. Should any Inclusion or service (including utilities and communication services), system, component or fixture of the Property (collectively Service) (e.g., heating or plumbing), fail or be damaged between the date of this Contract and Closing or possession, whichever is earlier, then Seller is liable for the repair or replacement of such Inclusion or Service with a unit of similar size, age and quality, or an equivalent credit, but only to the extent that the maintenance or replacement of such Inclusion or Service is not the responsibility of the Association, if any, less any insurance proceeds received by Buyer covering such repair or replacement. If the failed or damaged Inclusion or Service is not repaired or replaced on or before Closing or possession, whichever is earlier, Buyer has the Right to Terminate under § 25.1, on or before Closing Date, or, at the option of Buyer, Buyer is entitled to a credit at Closing for the repair or replacement of such Inclusion or Service. Such credit must not exceed the Purchase Price. If Buyer receives such a credit, Seller’s right for any claim against the Association, if any, will survive Closing.

What happens if the hail damage is discovered after the closing?

What happens if the hail damage is discovered after the closing?

This happened to me last year as well. The Sellers were not aware of any damage and we had a successful closing. Soon after closing the Buyers noticed roofing contractors working on their street and had a contractor look at the roof. Damage was found. The Buyer’s contacted me and I in turn contacted the Sellers. The insurance company was called and it was determined that there was damage and that the last storm (they track these things closely) happened while the Sellers still owned the home and their policy was in place. The outcome was that the Buyers got a new roof and the Sellers had to pay their deductible and their insurance company funded a new roof.

Lessons learned:

- Keep the lender involved in the discussions. Different lenders handle this situation differently. Some allow credits and post closing escrows and some don’t.

- It’s helpful but not required to have a contractor meet the insurance adjuster at the house for the initial inspection.

- Some policies have depreciating coverage as the roof ages. This does not relieve the obligation of the Seller to replace the roof.

- After a hail storm it is really difficult to schedule contractors. Real estate contracts are time sensitive. Call quickly and be first on the schedule!

As I mentioned before, this is not exhaustive but I hope it does give you some useful information regarding hail and how it affects a real estate transaction.