by Neil Kearney | Nov 15, 2010 | For Sellers, General Real Estate Advice, Real Estate 101

I get calls all the time asking for advice on whether it would be smart to do a particular remodeling project around their home.  Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Okay, we have established that you won’t get back all of your money if you do a home project but what if that scares you into paralysis? Say you have owned your home for 15 years and during that time you have done nothing but change the filters in the furnace. This strategy, in my opinion works even worse than improving your home right before closing. In the case of the do-nothings, the value of their home will lag behind the neighborhood in general. Their home will stay on the market longer and in the end sell for a lower price. Again not a way to get rich quick.

I think the best strategy for maximizing the value of your home over time is to make incremental changes over time. Take on a project every six months or 1 year. For example, take a six month period to remove the old wallpaper and repaint. Next, re-do the powder room by removing the wall sized mirror and replace with a framed mirror and replace the lighting. Next re-tile the master bath. After a few years your house will start looking refreshed and will be one of the nicer ones on the block. And when you go to sell it you won’t have much to do to get maximum value. Also, you get to live in a much nicer home. Not just fix it up for someone else. There is value in that!

Here is a sample of the value of Midrange projects and their pay back in the Denver market:(ranked in order of pay back percentage):

- Garage Door Replacement – cost $1,228 – cost recouped 93.1%

- Steel Entry Door Replacement – cost $1,165 – cost recouped 86.1%

- Minor Kitchen Remodel – cost $21,035 – cost recouped 79.6%

- Vinyl Window Replacement – cost $10,330 – cost recouped 77.1%

- Wood Deck Addition – cost $10,721 – cost recouped 75.1%

- Major Kitchen Remodel – cost $53,032 – cost recouped 73.5%

- Master Suite Addition – cost $100,775 – cost recouped 74.5%

- Family Room Addition – cost $79,383 – cost recouped 70.6%

- Basement remodel – cost $62,115 – cost recouped 63.2%

- Roofing Replacement – cost $17,943 – cost recouped 61.8%

For copyright reasons I can’t display the report on my website but if you would like a copy of the full report which includes midrange and upscale projects and defines the scope of each please let me know. I can send you one if you request one to neil@neilkearney.com.

To see the associated web page go here.

For more information this topic see my post on list price vs. condition.

From HGTV a before and after.

by Neil Kearney | Sep 15, 2010 | For Buyers, For Sellers, General Real Estate Advice

The recent fires in our area bring to my mind the importance of homeowners insurance. During my 19+ years of selling real estate in and around Boulder homeowners insurance has never been a big part of the transaction. Years back it was a last minute detail, many times lined up the day before closing. Now there is a specific deadline on the contract in which the buyer has the right to cancel the contract if reasonable (in the buyers subjective opinion) homeowners insurance is not available for the property they want to purchase. Usually this contingency period is 10 – 14 days after an accepted contract.

Most people think about insurance in two ways. For 99% of the time they want to know they are covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

covered without paying too much (that’s why the save 15%… commercials have mass appeal). Having coverage brings peace of mind. Once you have a claim your perspective changes. If you have good coverage you are thankful and if you don’t you kick yourself for being cheap. Just think of the 166 families who have come home to their home and possessions which are now a pile of ashes. The pit in your stomach is deep enough without the nagging fear that your coverage is lacking.

So, with this in mind I asked my friend and insurance agent Ryan Brooks from Allstate to give some quick tips on making sure you are adequately covered. Here are a few tips:

- Don’t just shop for the cheapest plan out there. Yes it will save you on a monthly basis but this approach is penny wise and pound foolish. In case of a catastrophic loss you could be lacking some important coverages.

- The best scenario in setting up a policy is to sit down with an agent (not online) and go over your specific situation. Ask questions and tell them about your personal situation. Do you have art, expensive jewlery, memorbilia? Telling the claims adjuster after a fire will not fly, it needs to be disclosed in advance.

- Here are a few items that you want to make sure you have on your policy.

- Cost of Living – this coverage gives you money to live in a home of similar size and quality while your home is being re-built or repaired. If you don’t have this coverage it can quickly cost you tens of thousands of dollars.

- Adequate Liability Coverage – Make sure you have enough liability coverage. In most cases this is $1,000,000 or more. This covers you if someone would slip and fall off your deck during a party, etc.

- Building Codes Coverage – This coverage is especially helpful in the case of an older home. This allows for modification of the house to meet current code if the covered repair needs to be re-worked in order to meet code. Think of an old home with a steep pitched roof.

- Condo Coverage – If you are a part of a homeowners association there is most likely a master HOA policy which covers the structure. However, this policy does not cover the individual owners possessions, or the interior finishes (drywall, plumbing , cabinetry, carpet). Make sure your condo insurance has adequate building structures coverage which will rebuild the interior of the unit. Many times this is capped out at 10% of the contents coverage and this is not enough.

- Loss Assessments – Speaking of condos. Loss assessments coverage covers you if a covered loss (roof, liability) on the part of the HOA results in a special assessment. This coverage runs around $10 a year and is well worth it.

- Sewer and Groundwater – Losses from sewer backup and water coming into the home are not usually covered unless there is a specific rider on the policy.

- Personal Property – Make sure the limits on your policy grow over time. The amount of personal property a typical household has grows ever time. We have much more in our home when we are 60 years old than when we were 20.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Once good insurance is in place you can rest easy. Many pay insurance their whole life and never take out, but for those who have a significant loss, insurance is well worth it.

Tip: Take an extensive video of your home, including closets, drawers, garage etc. and store either online (private Youtube) or in a safe deposit box. This will be a good inventory of personal property and will allow you to remember items that would have slipped your mind. Everything has value make sure your homeowners insurance is up to snuff.

by Neil Kearney | Aug 11, 2010 | For Buyers, For Sellers, Real Estate 101

A recent advertising campaign had the slogan “Make sure your agent is a REALTOR”. The campaign was paid for and developed by  REALTORS who wanted to differentiate themselves from those real estate agents who are not REALTORS. Still, I don’t think the public gets it fully. “Aren’t all real estate agents REALTORS?” the public may think. This is like saying “aren’t all colas Coke” or “isn’t all tissue Kleenex?

REALTORS who wanted to differentiate themselves from those real estate agents who are not REALTORS. Still, I don’t think the public gets it fully. “Aren’t all real estate agents REALTORS?” the public may think. This is like saying “aren’t all colas Coke” or “isn’t all tissue Kleenex?

Currently there approximately 35,000 people in Colorado with a license to sell real estate. Of those people approximately 23,500 are REALTOR, meaning they are a member of the National Association of Realtors (NAR). So what is the difference and why should you care.

To start the explanation we go back to 1913 when The Code of Ethics (The Code) was first adopted by NAR. The Code is a document to which all REALTORS swear to abide by and be held to. The backdrop of the creation of The Code was an era of the fraudulent subdivision, the fake city addition, the multiple “first” mortgage, the “net” listing, and a myriad of other “get rich quick” schemes involving the sale of land.”1 It was a time before state regulations regarding real estate and the time when “buyer beware” really meant something. The Code was written on the premise that REALTORS should serve the public and being a REALTOR meant that you upheld a higher standard of business practices.

Nearly 100 years later The Code of Ethics is still going strong. It is a living document meaning that it is in a constant state of review and revision. Each year new interpretations and or Standards of Practice are added to The Code. It is as relevant now as it was 97 years ago.

The Code works because it includes both the ideals on which we should base our real estate practice and a mechanism for hearings, education and discipline where needed. The Code gives the public and our real estate peers a way to stand up for principle and make a stand for what is right.

The Code of Ethics is a document which includes 17 Articles organized under three main headings; ‘Duties to Clients and Customers’, ‘Duties to the Public’, and ‘Duties to REALTORS’. Each article is further explained by specific Standards of Practice which give clarification to the intent of the articles. The basis of all articles in The Realtor Code of Ethics is the Golden Rule “Whatsoever ye would that others should do to you, do ye even so to them”.

So what happens when in your opinion a REALTOR acts unethically? The public as well as fellow Realtors can file an ethics complaint with the local REALTOR association in which the offending agent is a member. There is then a pre-defined procedure in which the complaint is processed. The complaint is taken very seriously and is handled confidentially by a panel of peers. The first step is the Grievance Committee which determines if a hearing should take place. The Grievance Committee acts as a grand jury. If the complaint is determined to be valid, the next step is a full hearing which replicates a court of law. The outcome is not criminal but an offending REALTOR can be punished.

So, what does it matter if your agent is a REALTOR or not? Both are licensed and can help you buy and sell real estate but only a REALTOR has pledged to serve the public ethically and consistently, and is willing to be upheld to this standard by a panel of their peers. To me it is more than that. REALTORS have made a commitment to serve the public and to conduct business in a way that the public expects.

I am privileged to have been chosen to be the chairman of the Grievance Committe for the Boulder Area REALTOR Association this year. To me how business is conducted does make a difference.

To read The Code online click here.

1 – Article – “The Realtor’s Code of Ethics – A Gift of Vision, 1978 William D. North.

by Neil Kearney | May 25, 2010 | For Sellers, Real Estate 101

Deciding to sell your house is a big decision. Once you have decided to place your house on the market putting your houses ‘best foot  forward’ is one important step to getting it sold. Here is a link to an article which addresses this subject. Of course I’m always happy to come out and take a look at your house and let you know what I think needs to be done. In my experience you are much better off doing the work in advance than waiting for a negotiation with a buyer that might never come.

forward’ is one important step to getting it sold. Here is a link to an article which addresses this subject. Of course I’m always happy to come out and take a look at your house and let you know what I think needs to be done. In my experience you are much better off doing the work in advance than waiting for a negotiation with a buyer that might never come.

Visit houselogic.com for more articles like this.

Copyright 2010 NATIONAL ASSOCIATION OF REALTORS®

by Neil Kearney | Apr 21, 2010 | For Sellers, General Real Estate Advice

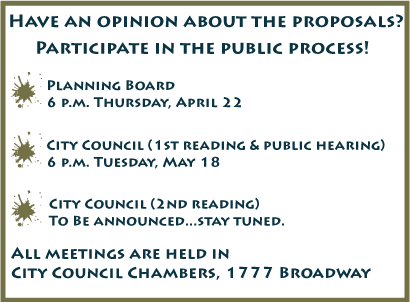

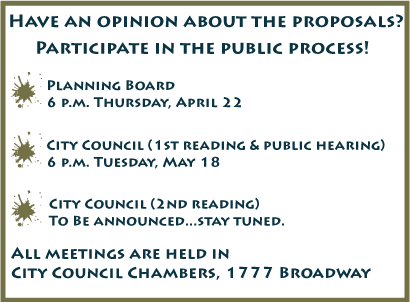

In 2006 Boulder’s City Council adopted the Climate Action Plan (CAP). The CAP is a set of strategies designed to reduce the overall greenhouse gas emissions within the City of Boulder. The CAP followed the decision of the council to adopt the principles set forth in the Kyoto Protocol, an agreement not ratified by the United States Federal Government. Within the City of Boulder taxpayers approved to be taxed for the purpose of funding energy efficiency programs (a first in the U.S.).

designed to reduce the overall greenhouse gas emissions within the City of Boulder. The CAP followed the decision of the council to adopt the principles set forth in the Kyoto Protocol, an agreement not ratified by the United States Federal Government. Within the City of Boulder taxpayers approved to be taxed for the purpose of funding energy efficiency programs (a first in the U.S.).

“At a Nov. 18, 2008 City Council Study Session on the CAP, council identified strategies needed to reduce greenhouse gas emissions to meet CAP objectives. One of the primary strategies for reaching this goal is to reduce energy use in buildings. Since 2007, several energy efficiency measures were implemented for residential and commercial buildings in new construction, remodels and additions that exceeded 2006 International Energy Conservation Code (IECC) minimum standards.

Addressing energy efficiency in existing rental housing and existing commercial buildings has been the focus of the 2009/2010 work plan. Proposed changes to the Housing Code and Rental License Code, including options for energy efficiency requirements, have been developed as part of the broader effort to improve energy efficiency across all building types in the city. The energy efficiency proposal for existing rental housing has been scheduled for consideration first to coincide with the updates to the Housing Code and Rental License Code. These proposed changes directly address the issues of long-term public health and safety, consistent with the stated purpose of the housing code.” (source bouldercolorado.gov )

On the table right now is a provision which would force energy effiency upgrades to roughly half the housing units in Boulder. 47% of the housing stock within the city limits is rental property. The City currently has a rental licensing program which up until now has been concerned with the habitibility and safety of the rental units and welfare of the tenants. The City has proposed an expansion of the rental licensing program which would force owners of rental units to do upgrades that would make their properties more energy efficient. The expected burden for each unit in order to make various upgrades is estimated to be up to $2,000.

If passed there would be two ways to comply. The first is to demonstrate that the property is already energy efficient. The second is to make a series of upgrades to the property to satisfy a set requirement. The SmarReg proposal is not yet approved but if you would like to have a voice in the wording or implementation of the rule, now is the time.

This will definitely burden landlords with an increased bureaucratic process with increased fees and a large up front costs. It will benefit renters in the short term who will pay lower utilities but they end up paying higher rent in the long run. The landlords and tenants are secondary in the minds of the City Council. The environment is number one.

by neil kearney | Apr 15, 2010 | For Sellers

As I was driving through town yesterday I passed this pile of twigs stacked by the side of the road. It made me laugh because a stack of wind blown branches to most is a burden, something to be dealt with which involves a trailer and scratched forearms. But these industrious folks decided that instead of trashing or composting the skinny limbs they would re-brand the lot from trash to treasure. “Free Firewood”! A bit optimistic don’t you think? But in their minds someone might love it and then we wouldn’t have to deal with it. And so it is with real estate.

As I was driving through town yesterday I passed this pile of twigs stacked by the side of the road. It made me laugh because a stack of wind blown branches to most is a burden, something to be dealt with which involves a trailer and scratched forearms. But these industrious folks decided that instead of trashing or composting the skinny limbs they would re-brand the lot from trash to treasure. “Free Firewood”! A bit optimistic don’t you think? But in their minds someone might love it and then we wouldn’t have to deal with it. And so it is with real estate.

Sales are up significantly this year but this doesn’t mean that every home out there is in any danger of selling anytime soon. Many sellers over the last few years assumed that just by listing their beloved home their would be a buyer ready willing and able to take over the old homestead for top dollar. When a seller says, “We like it, don’t see anything wrong with it. So we think it should sell for at least as much as the Jones got for theirs.” I start thinking that this could take awhile. Especially when their idea of updated is the new linoleum installed when Jr. graduated from high school.

When demand is high, the best homes get the most attention. But what constitutes “best”? In my mind, a marketable home ranks high in three categories; price, condition of the house and cleanliness.

- Condition of the house has a lot of components which include: regular maintenance, tasteful and modern finishes, neat landscaping, etc. Good condition is something that cannot be pulled together in an afternoon.

- Cleanliness needs to be overdone. It’s not fun to have your house show ready every day but you don’t want your house to be nicknamed “the dirty one” or “the smelly one” by potential buyers. I don’t think I have ever had a buyer pick the “smelly one”.

- Price is very subjective from a sellers standpoint but buyers seem to get it. From a buyers perspective it is all about how one home compares to another and how they all stack up. If the condition or cleanliness don’t stack up buyers will be looking for a lower price. Price seems to solve all objections, the trick is figuring out the mix.

This is where many sellers don’t get it. They have a pile of sticks (figuratively) and they want the same price as a neatly stacked load of cordwood.

Page 7 of 13« First«...56789...»Last »

Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.