It’s a Start

Wouldn’t this be a better if you lived in Hoboken? Maybe this person is looking for confirmation. Boulder – Colorado – USA – Earth …

Wouldn’t this be a better if you lived in Hoboken? Maybe this person is looking for confirmation. Boulder – Colorado – USA – Earth …

Wouldn’t this be a better if you lived in Hoboken? Maybe this person is looking for confirmation. Boulder – Colorado – USA – Earth …

Wouldn’t this be a better if you lived in Hoboken? Maybe this person is looking for confirmation. Boulder – Colorado – USA – Earth …

If you have ever purchased a home with less than 20% down you have most likely heard the term “mortgage insurance”. Mortgage insurance is required to be purchased by the buyer when the equity is not sufficient to cover the risk. Different loan types require either an up-front payment or monthly payments. The mortgage insurance companies then insure the mortgage holders from some of their loss on that house in case of foreclosure, etc. Mortgage insurance companies only lose money when values drop and they are very careful (now more than ever) where they will insure properties and what they charge for their insurance.

Mortgage insurance companies are a great source for market information. They do research throughout the nation regarding the strength of local real estate markets. I thought it would be useful to see how a few companies see the Boulder and Denver markets. It is great information from companies who have much to lose if their risk projections are wrong.

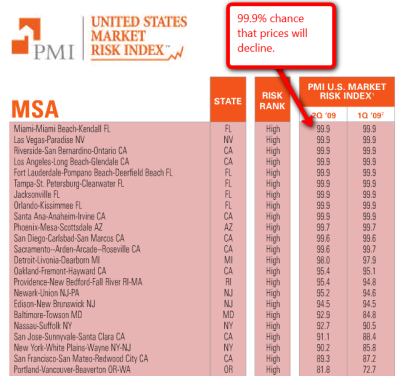

First let’s look at PMI. PMI uses a statistical model that assigns each Metropolitan Statistical Area (MSA) with a risk factor. This risk factor tells the percentage chance that the prices will fall over the next year. The chart below shows the highest risk areas. These markets show a 99.9% chance that prices will drop during the next year.

Boulder County has its own MSA and our prices have been pretty steady. Over the next year PMI says that there is only a 12% chance that prices will drop over the next year. This, for them Boulder is a low risk area.

Another company who does this type of analysis is MGIC.

MGIC ranks the largest MSA’s nationwide and gives a prediction on which direction the market is headed. They don’t rank Boulder, but they do rank Denver. Denver, which includes 11 metro counties, is listed as soft but “improving”. This is the only market in the country which is classified as an improving market. These third parties who are notoriously conservative see a brighter than average future for our area and this reinforces my optimism.

Free is my favorite amount. Donating to charity is always a good idea but we don’t always get around to it. Life sometimes gets in the way. Xcel has allocated $30,000 to donate to three Colorado charities; Habitat for Humanity, Mile High United Way and Colorado’s Low Income Energy Assistance Program. Xcel has allocated the money and now they are asking their customers where they would like the money to go.

Life sometimes gets in the way. Xcel has allocated $30,000 to donate to three Colorado charities; Habitat for Humanity, Mile High United Way and Colorado’s Low Income Energy Assistance Program. Xcel has allocated the money and now they are asking their customers where they would like the money to go.

I called, and after learning a bit more, it seems like just a nice PR effort using Xcel Foundation money. It looks like we get to donate the money but it seems to me that they were going to donate the money anyway and they are making us, their customers aware and feel good about their giving. By clicking here you can give your “vote” on where “your” $25 goes. I voted for the Low Income Energy Assistance Program.

When one hires a Realtor, one would expect that person to market their property in its best light. Right? I would assume and expect the same thing. Unfortunately, this is not always the case. If one looks very long at real estate listings on the internet you will find, like I have, many photos that are real head-scratchers.

My MLS system (IRES, one of the nations best) allows 18 photos to be entered for each listing. But I only enter all 18 if there is a compelling reason to include each photo. I take a ton of photos at my listings and then spend more time weeding through the list. If you could hear me, I sound like an optomitrist, better? better?… I then take the best photos and make sure that the brightness and contrast are optimized. Basically, I take the time and effort needed to make my listings look as good as possible.

Unfortunately, not every agent takes the same view. lovelylisting.com/ is a popular website that posts a strange or bad real estate listing photo every day from around the globe. It’s my promise to you that if you list from me, photos of your house will be found all over the internet, but not on lovelylisting.com/.

Here are a few doozies I found while recently trolling for listings. Don’t let this happen to you!

I wonder if the painting will survive the nuclear winter?

I wonder if the painting will survive the nuclear winter?  This turbo fan is awesome!

This turbo fan is awesome!

No skinny toilets in this house

No skinny toilets in this house

I’m really getting a feel for this place.

I’m really getting a feel for this place.

Interested in any of these places? I didn’t think so.

http://viewer.docstoc.com/

2009 Boulder County Real Estate Statistics –

The slides above show a comprehensive review of the area real estate market in Boulder County. Click through the slides for an annotated view of the market trends in Boulder, Louisville, Lafayette, Longmont, Erie, Superior, the Suburban Plains and the Suburban Mountains.

Here are a few highlights: