I’ve just published The Kearney Report for the 3rd quarter. The report highlights the quarterly statistics in Boulder County as a whole and then broken down into smaller segments including, the City of Boulder, East County (Louisville, Lafayette, Superior, Erie), Gunbarrel and Longmont. To view, download or print the report click this link. Kearney Report 3rd quarter 2013

I’ve just published The Kearney Report for the 3rd quarter. The report highlights the quarterly statistics in Boulder County as a whole and then broken down into smaller segments including, the City of Boulder, East County (Louisville, Lafayette, Superior, Erie), Gunbarrel and Longmont. To view, download or print the report click this link. Kearney Report 3rd quarter 2013

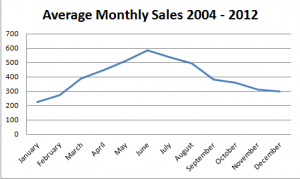

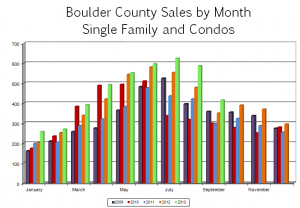

If you have been reading this report for quite some time you will know that there is some seasonality in the local real estate market. Usually we see the fewest number of sales in December and January, sales peak in June or July and the rest of the year falls into a neat and clean bell curve (see the first attached chart). Even though it is true that almost every year fits this pattern some years we see variation for different reasons. For example, in 2010 the Federal Government gave first time home buyers a tax credit of $7,000 if they would purchase a home by a certain date. This outside stimulus effected the shape of our overall market. This year the curve (green bars in the second chart) has a few wrinkles that are interesting. Among other topics I will talk about those wrinkles and see if those allow us to predict what will happen next. The report that follows is a detailed presentation of the sales statistics from the last quarter.

The year started well, buyers were out in force but there were few sellers. It was like an army having a full compliment of the needed weapons but only half a shipment of ammunition. Everything works as designed, but you just can’t fire the gun as often as you would like. And so it was with home buyers early in the year, lots of them, with very few listings to buy. As a result, the market got off to a slower than predicted start. Once sellers realized that they were needed and that they would be compensated for selling, our market flourished. From March until July the market followed a nice upward curve. In August sales predictably fell to a level similar to June. A nice stair step down. Then in September, instead of dropping to a level roughly even with May, it fell to a level most similar to March. What happened? A few factors contributed to the drop. The first factor is the fact that most buyers who had confidence in the market and wanted to buy before interest rates increased have already done so. A second reason is the school factor, many buyers want to be in place by the time school starts so they rush to make the sale happen by the end of August. The last reason was a minor cause in September but may have implications in the coming months, the flooding.

The year started well, buyers were out in force but there were few sellers. It was like an army having a full compliment of the needed weapons but only half a shipment of ammunition. Everything works as designed, but you just can’t fire the gun as often as you would like. And so it was with home buyers early in the year, lots of them, with very few listings to buy. As a result, the market got off to a slower than predicted start. Once sellers realized that they were needed and that they would be compensated for selling, our market flourished. From March until July the market followed a nice upward curve. In August sales predictably fell to a level similar to June. A nice stair step down. Then in September, instead of dropping to a level roughly even with May, it fell to a level most similar to March. What happened? A few factors contributed to the drop. The first factor is the fact that most buyers who had confidence in the market and wanted to buy before interest rates increased have already done so. A second reason is the school factor, many buyers want to be in place by the time school starts so they rush to make the sale happen by the end of August. The last reason was a minor cause in September but may have implications in the coming months, the flooding.

In mid-September the real estate market paused for a week or so while record amounts of rain fell and caused widespread flooding. The flooding caused not only a lost week in sales and listing activity; it caused major property damage, mostly in the form of flooded basements. Many pending sales were affected as damage was assessed. Easier to measure was the affect of the floods on the inventory of available homes. During the month of September the number of active homes decreased by 17% while a year ago during the same month, our inventory increased by 4%. Many homes that were on the market sustained damage and were forced off the market and others who would have normally listed their homes concentrated on cleanup rather than last minute polishing before listing their homes. We have since recovered to a normal level of new listings, but I suspect that the ripples from the flooding and it’s affects on sales volume and values won’t fully be seen for some time.

As we move into the fourth quarter we see the market slowing as we approach the holidays. This time of year many people start formulating their plans for the coming year and the factors that we are looking at which could affect the real estate market in 2014 are interest rate movement, job growth and how government posturing affects financing and transaction management. As always, if you are considering a move in the coming year it’s not too early to start our conversation.