Here is the latest copy of The Kearney Report. This quarters installment highlights data from Boulder County as a whole, the City of Boulder, the City of Longmont, East County including Erie, Louisville, Superior and Lafayette and Gunbarrel.

Commentary:

Do you remember the feeling when the music stopped and there wasn’t an unoccupied chair in sight? Of course I’m referring to the birthday party game of musical chairs. That feeling of frenzy and despair so often seen during those birthday parties of years past were again seen this spring and summer in the local real estate market. The cause was strong buyer demand and a lack of homes on the market, the effect was multiple offers, empowered home sellers and strong price increases. Let’s take a closer look at each of these factors.

The seeds of this years strong market were sown at the end of 2012. Just as the market was expected to take its usual course and wind down for the year sales in October, November exceeded closings in September and closings in December exceeded the previous year by 16%. When the calendar turned buyers were out in force and the common refrain was “when are more listings going to hit the market?”. It turned out that listings were in short supply all spring. The abundance of buyers was spurned by many factors the most important being low interest rates, strong overall confidence in their economic situation and a rental market that is characterized by rising rents and a severe shortfall in supply.

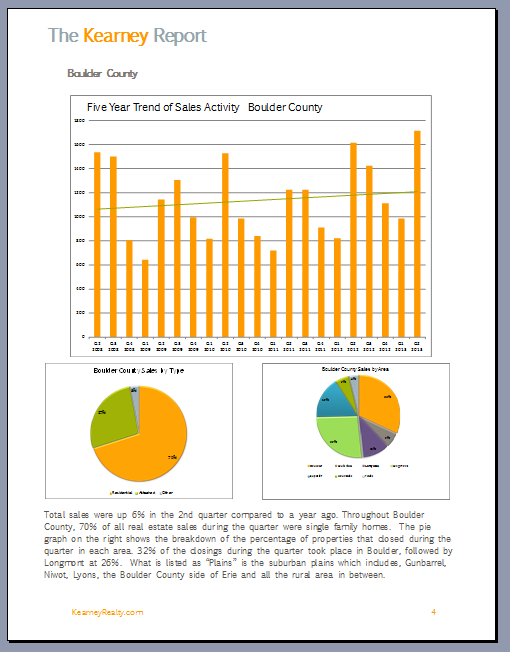

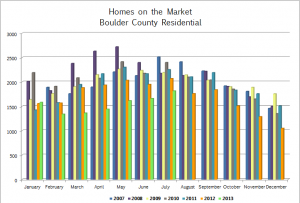

During the housing downturn of 2008 – 2011 we were fortunate that the number active listings dropped along with the number of sales. (see graph to the right) This relative balance in the market (fewer buyers – fewer sellers) allowed for our prices to remain fairly stable just as other areas were seeing a steep devaluation. We were lucky that our area didn’t see mass layoffs or other factors that forced people to sell. A majority of households in our market decided during the soft market that they would stay rather than sell and those who didn’t need to sell because of external circumstances chose to stay. That mindset has continued and even as the market has improved over the past two years the number of listings on the market has fallen. At the end of April when the market was in full swing with buyers there were 1,442 active homes on the market in Boulder County compare this to the 2,464 that were on the market at the same time of year in 2007! To further complicate matters roughly 40% of all active listings this spring had a contract pending. The results were often frustrating for buyers looking to move in a reasonable time frame.

During the housing downturn of 2008 – 2011 we were fortunate that the number active listings dropped along with the number of sales. (see graph to the right) This relative balance in the market (fewer buyers – fewer sellers) allowed for our prices to remain fairly stable just as other areas were seeing a steep devaluation. We were lucky that our area didn’t see mass layoffs or other factors that forced people to sell. A majority of households in our market decided during the soft market that they would stay rather than sell and those who didn’t need to sell because of external circumstances chose to stay. That mindset has continued and even as the market has improved over the past two years the number of listings on the market has fallen. At the end of April when the market was in full swing with buyers there were 1,442 active homes on the market in Boulder County compare this to the 2,464 that were on the market at the same time of year in 2007! To further complicate matters roughly 40% of all active listings this spring had a contract pending. The results were often frustrating for buyers looking to move in a reasonable time frame.

The outcomes of the above two factors were multiple offers on many homes, an extreme sellers market when negotiating and a healthy jump in prices. Buyers knew that they needed to act quickly when a new listing hit the market. Most buyers agents were searching multiple times per day and serious buyers were ready to leave work at a moments notice to see the next new listing. It was not uncommon to have multiple offers on a house by the end of the first day of showings. Sellers and listing agents changed strategy by mid-spring and used tactics like delaying showings until two or three days after listing or announcing when offers would be reviewed. Very hubris but effective. The results of this frenzy was that buyers were willing to pay more than the recent comparables said they should and in a short amount of time sellers were testing the market with prices that had the neighbors shaking their head. And they were getting there price! The preliminary data show that prices have risen approximately 10% this year. In some areas the increases were more towards 15 or 20%. A definite kick start out of a relatively stagnant price environment we have seen over the past half decade.

The outcomes of the above two factors were multiple offers on many homes, an extreme sellers market when negotiating and a healthy jump in prices. Buyers knew that they needed to act quickly when a new listing hit the market. Most buyers agents were searching multiple times per day and serious buyers were ready to leave work at a moments notice to see the next new listing. It was not uncommon to have multiple offers on a house by the end of the first day of showings. Sellers and listing agents changed strategy by mid-spring and used tactics like delaying showings until two or three days after listing or announcing when offers would be reviewed. Very hubris but effective. The results of this frenzy was that buyers were willing to pay more than the recent comparables said they should and in a short amount of time sellers were testing the market with prices that had the neighbors shaking their head. And they were getting there price! The preliminary data show that prices have risen approximately 10% this year. In some areas the increases were more towards 15 or 20%. A definite kick start out of a relatively stagnant price environment we have seen over the past half decade.

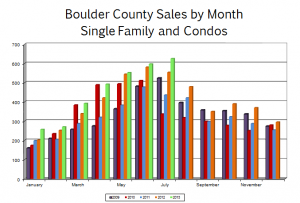

Here in mid-August it’s apparent that the market has slowed a bit. The inventory of available homes has increased a little and the under contract percentage has decreased a touch. But more telling is that there is no longer a frenzy for new listings. Interest rates have jumped nearly a point (now between 4.5 and 5%) and school is just beginning again. Sales for the year peaked in July (See 2nd graph this page) and what remains to be seen is how long and how strong this market will remain. Through July, sales are up roughly 10% from 2012 and up 38% from 2011. I would expect that we will slow a bit by the end of the year but still have more sales in 2013 than in 2012.

To view the entire 18 page report in PDF format click here.