by neil kearney | Mar 3, 2008 | For Buyers, For Sellers, Statistics

S&P/Case-Schiller vs. OFHEO

S&P/Case-Schiller and OFHEO (Office of Federal Housing Enterprise Oversight) both publish a “national” price index. The Case-Schiller index has been getting much play on national media lately. Their most recent index shows a huge drop in appreciation during the 4th quarter. Unfortunately, this index only represents data from 20 metropolitan areas in 13 states. It is weighted toward higher priced homes and it is designed to overstate housing up’s and down’s. OFHEO’s index contains data from 291 metropolitan areas in all 50 states. Real Estate is local and the more data points you have the better the focus. I think the OFHEO index should be used more by the media. It tempers the extremes and gives a clear picture at the local level. In my next post I will give the latest data for Boulder County presented by OFHEO.

by neil kearney | Jan 22, 2008 | Boulder County Housing Trends, For Buyers, For Sellers

Colorado Real Estate

Opportunity Knocks

Part 1: The Pond and the Lily Pad

Suppose you live in a large apartment building overlooking a 1.5 acre (65,536 sq. ft.) pond owned by the city. The city gardener wants to improve the looks of the pond and to improve the fish  habitat so he plants a 1 square foot patch of pond lily. Let’s assume that this is a very fast growing type of pond lily and that its area doubles every week. After the first week there are only two square feet of lily pads. Nothing really to notice. After 4 weeks there are 8 square feet of lily pads, still no one living in the apartment building would notice. After 8 weeks, the growth of lily pads is 256% but still even the most observant people would not recognize this as a trend. Only after 13 weeks when lily pads fill an eighth of the pond would the early trend spotters usually notice the difference in the landscape. Just two weeks after the early adopters see the lily pads growing the pond is half full. At this point, the media discovers the lily pad situation and reports the explosive growth. One week later the pond is full of lily pads. It took fifteen weeks of very slow deliberate growth to fill half of the pond and only one week to fill the other half. When would you notice the lily pads in the pond? Ask yourselves these questions: Are you too busy to look in the pond? Do you know enough about lily pads to understand what your looking for? Do you see the lily pads but don’t care until you hear about it in the news?

habitat so he plants a 1 square foot patch of pond lily. Let’s assume that this is a very fast growing type of pond lily and that its area doubles every week. After the first week there are only two square feet of lily pads. Nothing really to notice. After 4 weeks there are 8 square feet of lily pads, still no one living in the apartment building would notice. After 8 weeks, the growth of lily pads is 256% but still even the most observant people would not recognize this as a trend. Only after 13 weeks when lily pads fill an eighth of the pond would the early trend spotters usually notice the difference in the landscape. Just two weeks after the early adopters see the lily pads growing the pond is half full. At this point, the media discovers the lily pad situation and reports the explosive growth. One week later the pond is full of lily pads. It took fifteen weeks of very slow deliberate growth to fill half of the pond and only one week to fill the other half. When would you notice the lily pads in the pond? Ask yourselves these questions: Are you too busy to look in the pond? Do you know enough about lily pads to understand what your looking for? Do you see the lily pads but don’t care until you hear about it in the news?

Part 2: Tech Bust

Did you or someone you know buy a tech stock at the height of the boom? It was hard not get swept up in the fantastic media stories highlighting the huge IPO’s, the instant millionaires and the next big thing. Everywhere you went people were talking about how much money they have made by buying the stock of a company you had never heard with no sales and no product. The popular sentiment was “can’t lose”, “get in quick”, “if I could only get in on more IPO’s”, “nowhere but up”, “we are in a different era”… Obviously, this did not last and the lesson I took away from that era was that once ‘everyone” is talking about something, it is too late. In order to profit you must be a forward thinker, not influenced by the media. If you wait for the media to catch on, the trend is almost past and it is too late. The question is whether you are a forward thinker or a follower.

Part 3: Opportunity

Do you ever look back and wish you had bought real estate when it was more affordable, or just before the market took off in the 90’s, or before the rates went up. Now is the time to make up for those past mistakes. Now is a great time to buy real estate! Have you ever heard the phrase “buy when everyone else is selling”? These are the times when the smart money will be buying real estate. The national media has locked in to the housing story and will not let go. Locally, our paper is printing national stories with local bylines. People seem frozen by the negative news, waiting it out on the sidelines.

The CU Business Research Division in their recent 2008 Colorado Economic Forecast noted that “…the situation in this state is fundamentally different” (than the rest of the country). We did not participate in the recent excessive appreciation fueled by speculation that many other areas of the country had over the past four years. Our area is well ahead of the recovery curve. In my opinion our cycle is already in the process of turning. The news is gloom and doom but if you realize that real estate is local you can start separating truth from fiction. It is my hope to bring you that truth about our local market in this newsletter and it is my further goal to get you to see that the pond is just beginning to fill up with lily pads.

As always, we value your loyalty and friendship and I value your loyalty and friendship and am always available to answer any of your real estate questions. Neil Kearney 303-413-6624

by neil kearney | Jan 15, 2008 | Boulder County Housing Trends, For Sellers, Real Estate 101

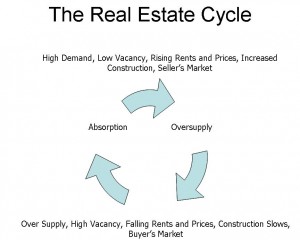

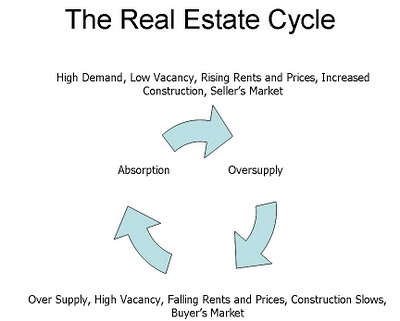

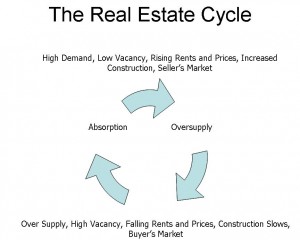

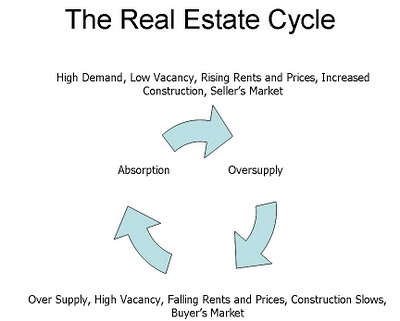

The Real Estate Cycle

I found this graphic on a power point slide I had put together a few years ago. Looking at it again, I firmly believe that we are in the “absorption” phase characterized by the arrow on the left side. Many of the symptoms of the bottom of the market have already happened and are improving. Rents have fallen but are now improving. Housing permits were down 26% last year. Vacancies have fallen, both in commercial and residential rentals.

I found this graphic on a power point slide I had put together a few years ago. Looking at it again, I firmly believe that we are in the “absorption” phase characterized by the arrow on the left side. Many of the symptoms of the bottom of the market have already happened and are improving. Rents have fallen but are now improving. Housing permits were down 26% last year. Vacancies have fallen, both in commercial and residential rentals.

It is still a buyers market and sales are not happening as quickly as some sellers would like but we are working again toward the top. Inventories are down and now is a great time to buy before prices spike again.

Have a great day!

by neil kearney | Nov 13, 2007 | For Buyers, For Sellers, Real Estate 101, Statistics

What is the value of a home? The quick answer is what a Buyer will pay for it. Most people when they ask that question are looking for n exact value or at the very least a range. Traditionally people have called Realtors or appraisers to answer  the question “how much is my house worth”. Today getting a value is only a few key strokes away. A persons home is most likely their largest investment and people are understandably curious about where their investment stands. This curiosity leads to lots of traffic for the website Zillow.com.

the question “how much is my house worth”. Today getting a value is only a few key strokes away. A persons home is most likely their largest investment and people are understandably curious about where their investment stands. This curiosity leads to lots of traffic for the website Zillow.com.

I hear it all the time, “Zillow has my house valued at X”. Many times, this value is incorrect and I then have to work extra hard in proving what I think is the correct value. Therefore, I thought I would run some numbers and see how accurate Zillow.com actually is in my market. This is what I found:

The Method:

- Find all homes that have sold in the City of Boulder for the past month. (there were 58, so this is a limited sample size)

- Obtain the estimate of value from Zillow.com.

- Compare the sold value to the Zillow value in the form of a ratio.

- Find the standard deviation to find out how accurate each value is. The larger the standard deviation the more each of the values in the data set varied. For example if you found the the Zillow value was 100% correct with a standard deviation of 1%, you would know that Zillow was nearly perfect.

The Results:

There were 58 sales of single family homes in the City of Boulder between October 12th and November 11th. The price ranged from $245,000 to $2,800,000.

- The average ratio of Zillow prices to actual sold values was 99.4%. To put it another way, if you looked at the average Zillow.com price it would be just .6% lower than the actual value. Good right? Not so fast.

- The average was nearly right on the money but the individual values ranged from 158.2% of value to 48% of value a huge dispersion. The Standard Deviation for the entire data set is 18.4%. In other words the values are 99% correct +- 18%. A huge discrepancy. On a $600,000 home that would mean a the Zillow estimate is $600,000 +- $108,000.

- I next broke up the data set into three equal groups; sales up to $500,000, Sales up to $715,000 and the remaining 19 sales up to $2,800,000.

- For the lowest price range the Zillow value was 100.7% with a standard deviation of 10%.

- For the middle price range the Zillow value was 103% with a standard deviation of 14.6%.

- For the top price range the Zillow value was 94.8% with a standard deviation of 26.07%.

Conclusions:

- In the Boulder market Zillow is better at estimating the value of lower priced homes.

- As the prices rise the variables of bedrooms and baths matter less and the finish quality as well as intrinsic values such as location and view become more important. These later qualities are not easily picked up by a mathematical algorithm.

- Overall, Zillow is a fun way to look at a home but the accuracy varies so much that if you are serious in getting the right value you still need to call a Realtor or appraiser.

by neil kearney | Oct 25, 2007 | For Buyers, For Sellers

Some Views On Negotiation

A good negotiator is someone who always gets what they want. Right? I say, not always. Being a good negotiator to me is someone who can give themselves or their clients the best chance to achieve their goals. Giving you the best chance does not always mean you will get exactly what you want. In order to achieve sustained success a negotiator must go for Win-Win, no Win-

Lose. A successful negotiation substantially meets the goals of all parties involved.

Right now in the real estate market buyers have the perception that they may be able to get a great deal on a home. It is true that there is more inventory out there and a portion of those sellers are quite anxious to sell. I have seen lately many offers well below full price and it takes a delicate touch to try to meet somewhere in the middle. Here is what I try to do to give the offer the best chance to come together.

- Do our homework – find out what is reasonable. What have other houses actually been selling for? How much is the average negotiation off of full price?

- Establish goals – What would be an acceptable outcome. Begin with the end in mind and you have a good chance to get there.

- Understand the situation – Try to understand what situation your counterpart is in. Understanding is power. With every contact, I try to learn a bit more about where the other people are coming from. Many times, after making an offer it is the first counter that gives you the most information.

- Keep the lines of communication open – As a Realtor I need to represent my clients to the best of my ability but I have found that being adversarial to the other side doesn’t get you anywhere. I try to keep on very good terms with the other agent. I find that this helps in coming to a successful closing. If we become adversarial along the way it is very hard solve all of those little details that come up along the way. I try to treat other Realtors well, so the next time we are working together they can tell their clients I am easy to work with and to expect a smooth transaction.

- Remember that every situation is different – You never know what is in the head of someone else. You can guess someones motivations but you never know what someone is thinking. Don’t try to guess, try to learn, understand and adapt.

- Anticipate – I find that I am really able to help my clients by anticipating what may happen during a certain transaction. If we can talk about different scenarios before they happen they are easier to solve when they come up.

by neil kearney | Jun 27, 2007 | For Buyers, For Sellers

Video Sewer Line Inspections

Purchasing a home is a huge undertaking and is most likely your  largest investment. It is therefore wise to do everything in your power to minimize your risks. The first step is to hire a competent Realtor, that is where I come in. Your Realtor can then lead you through the process of intelligent due dilligence. Some common items to consider: Is the asking price justified for comperable sales? How does the homes condition compare to others on the market? Are there any obvious flaws? What is the potential resale potential of the home? If the property is part of an HOA, can I live with the rules and the assessments? Can I live with the neighbors? etc…

largest investment. It is therefore wise to do everything in your power to minimize your risks. The first step is to hire a competent Realtor, that is where I come in. Your Realtor can then lead you through the process of intelligent due dilligence. Some common items to consider: Is the asking price justified for comperable sales? How does the homes condition compare to others on the market? Are there any obvious flaws? What is the potential resale potential of the home? If the property is part of an HOA, can I live with the rules and the assessments? Can I live with the neighbors? etc…

Once these basic questions are answered a buyer usually then looks at the home more in depth. In our area a general home inspector is hired to look at plumbing, roof, electrical, appliances, foundation, drainage, furnace, etc. If there are any “red flags” he recommends that the buyer bring in a specialist to assess the situation and possibly bring in a bid. Another usual inspection in our area is a radon test. Usually the inspector administers the test for an added fee and provides the results of a 48 hour test.

Another inspection that is seldom used but very useful in older homes is the sewer line inspection. Some plumbers have a special camera that video tapes the sewer line as it exits the house, runs under the yard and enters the city line. The cost is usually around $300 but if it is an older home or one with a bunch of trees in the front yard it can be well worth the cost. At the conclusion of the rest the buyer ends up with a video of their sewer line with any breaks in the line marked in the yard. Costs to re-do a sewer line are usually above $4,000 so this is something that is best found out before closing.

The image above actually shows roots growing into a sewer line.

I found this graphic on a power point slide I had put together a few years ago. Looking at it again, I firmly believe that we are in the “absorption” phase characterized by the arrow on the left side. Many of the symptoms of the bottom of the market have already happened and are improving. Rents have fallen but are now improving. Housing permits were down 26% last year. Vacancies have fallen, both in commercial and residential rentals.

I found this graphic on a power point slide I had put together a few years ago. Looking at it again, I firmly believe that we are in the “absorption” phase characterized by the arrow on the left side. Many of the symptoms of the bottom of the market have already happened and are improving. Rents have fallen but are now improving. Housing permits were down 26% last year. Vacancies have fallen, both in commercial and residential rentals.