2021 Boulder County Real Estate Market Report

The Year In Review

The residential real estate market in Boulder County was especially strong during 2021. Even though sales increased by 15% throughout the county the inventory of available homes seemed to never quite meet the demand. The effects of high buyer demand in a low inventory market were rapidly increasing prices, faster sales and a continuation of the strong seller’s market. In 53% of all sales this year buyers paid more than the listed prices. Last year it was 29%. It was a very competitive market to say the least! Frustrating to buyers, many of whom had to make offers on many homes in order to finally get one accepted. In addition to premium prices, it was typical for buyers to waive normal contingencies in the sales process such as appraisals and inspections in order to get their offer accepted.

Boulder County wasn’t the only market experiencing these same pressures. Every major market in the United Sates saw similar factors which lead to an average one-year appreciation (as of September 30th) of 18.5%! This is the highest on record. Additionally, prices rose in all 50 states and in all of the largest 100 markets.

Here are some of the key statistics for Boulder County real estate in 2021: (click on the links in each item to see the associated graph below)

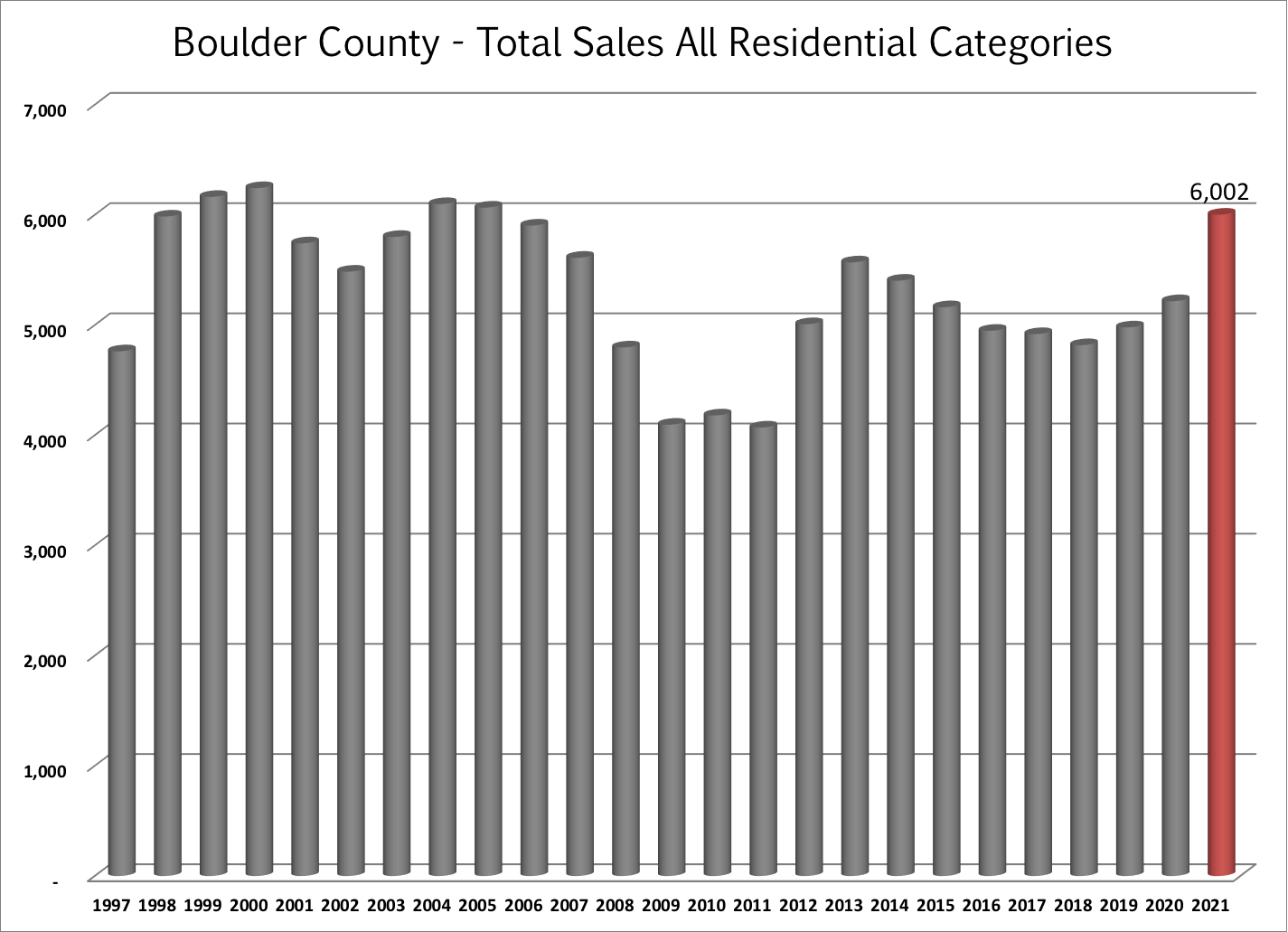

- Total sales were up 15% during 2021 to 6,002 sales. This is the highest level of sales in Boulder County since 2005 and in the top five years since 1997.

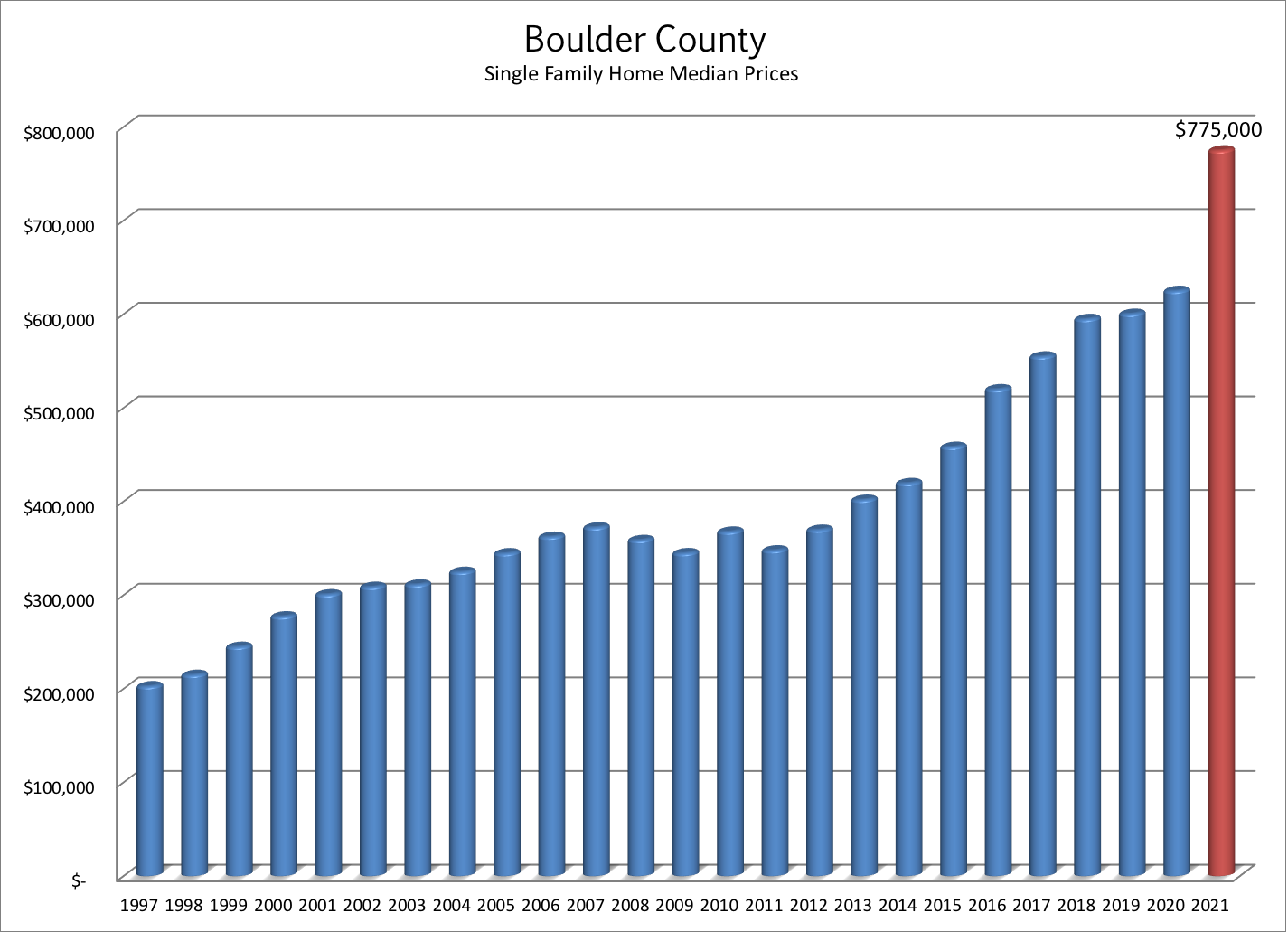

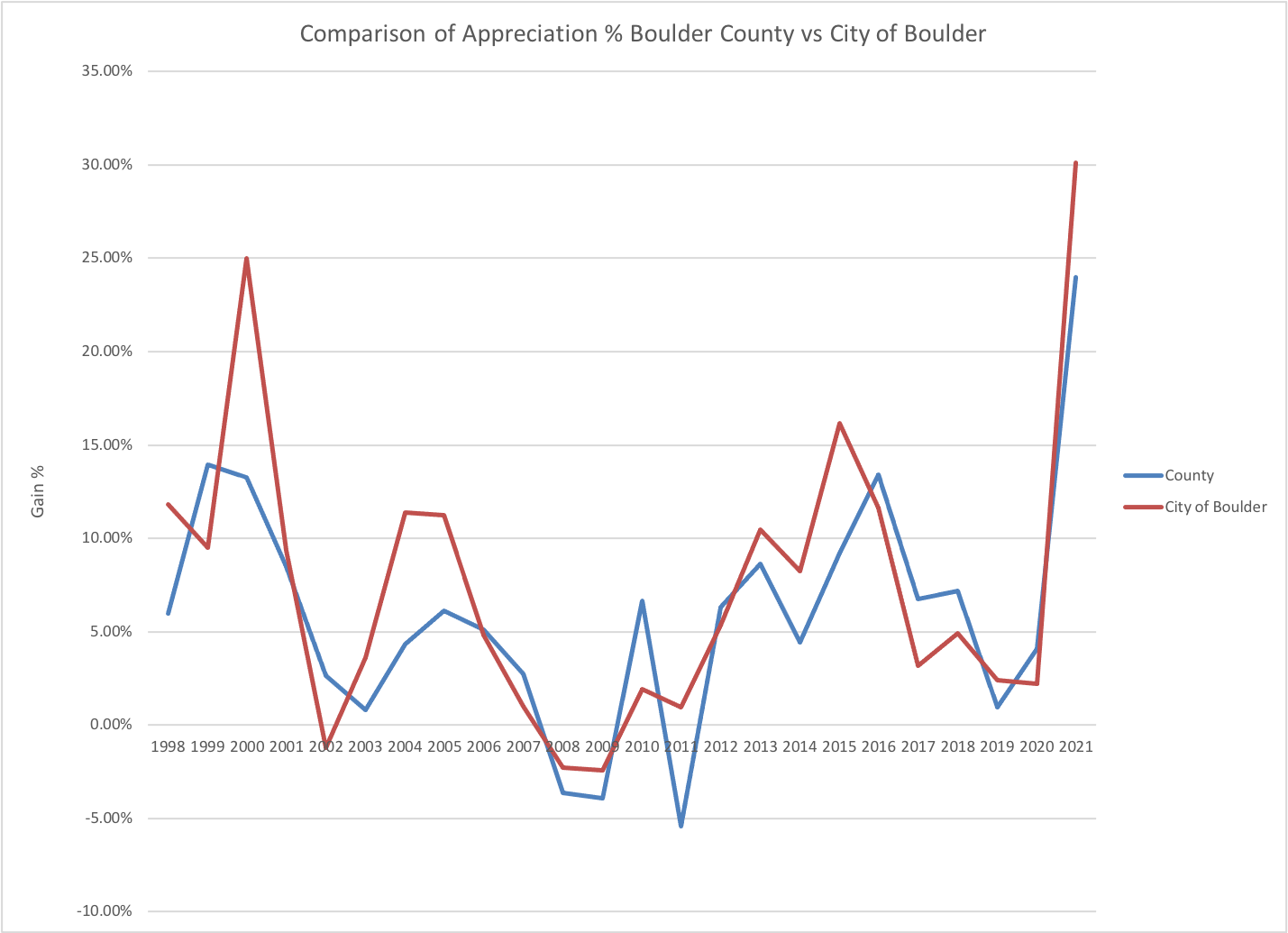

- The median price for all Boulder County single family home sales in 2021 was $775,000 which is up 24% from 2020. Click here to see a comparison of Boulder County appreciation and City of Boulder appreciation.

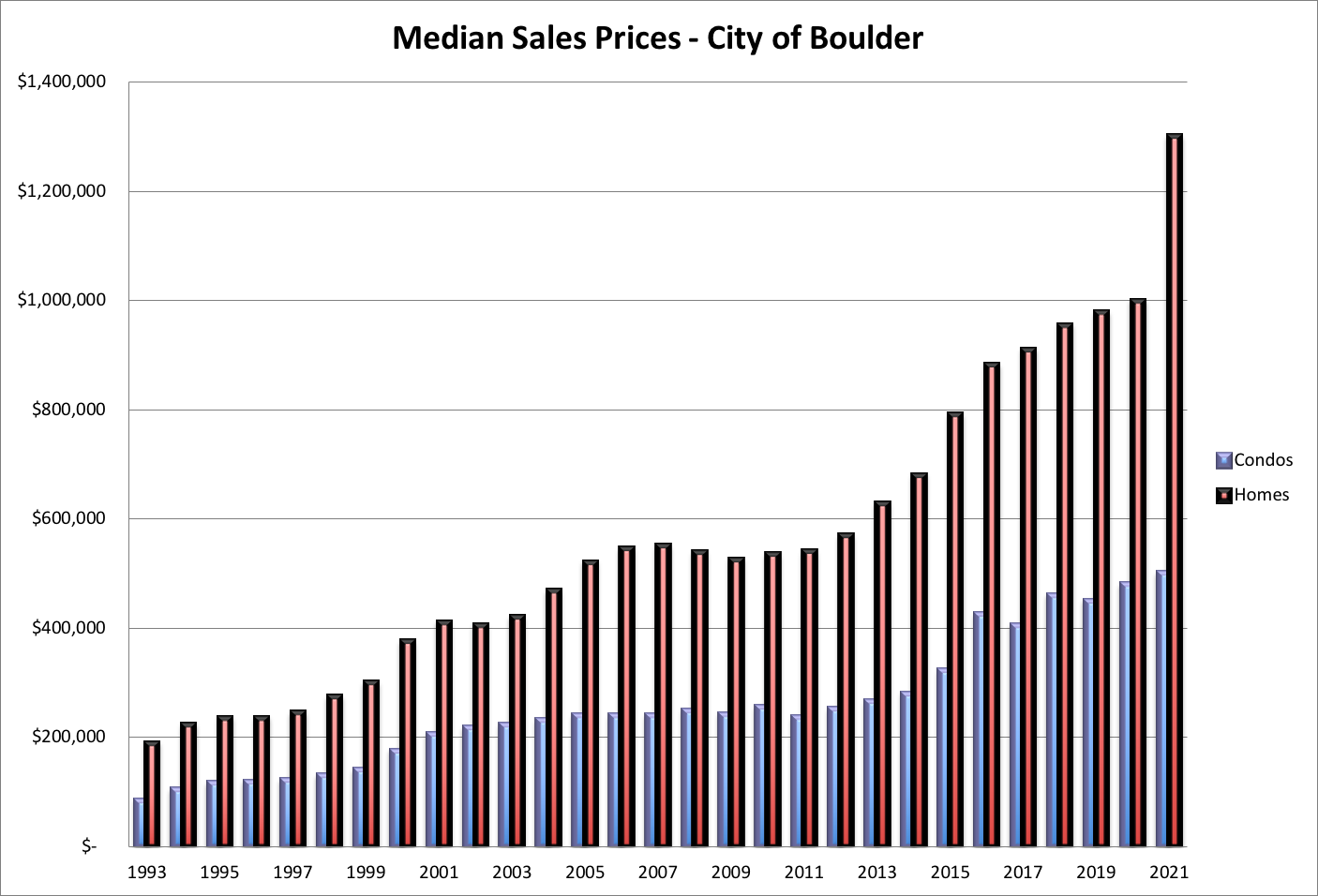

- Prices for single family homes in the City of Boulder increased by 30% and prices for condos and townhomes in the City of Boulder increased by just 4%.

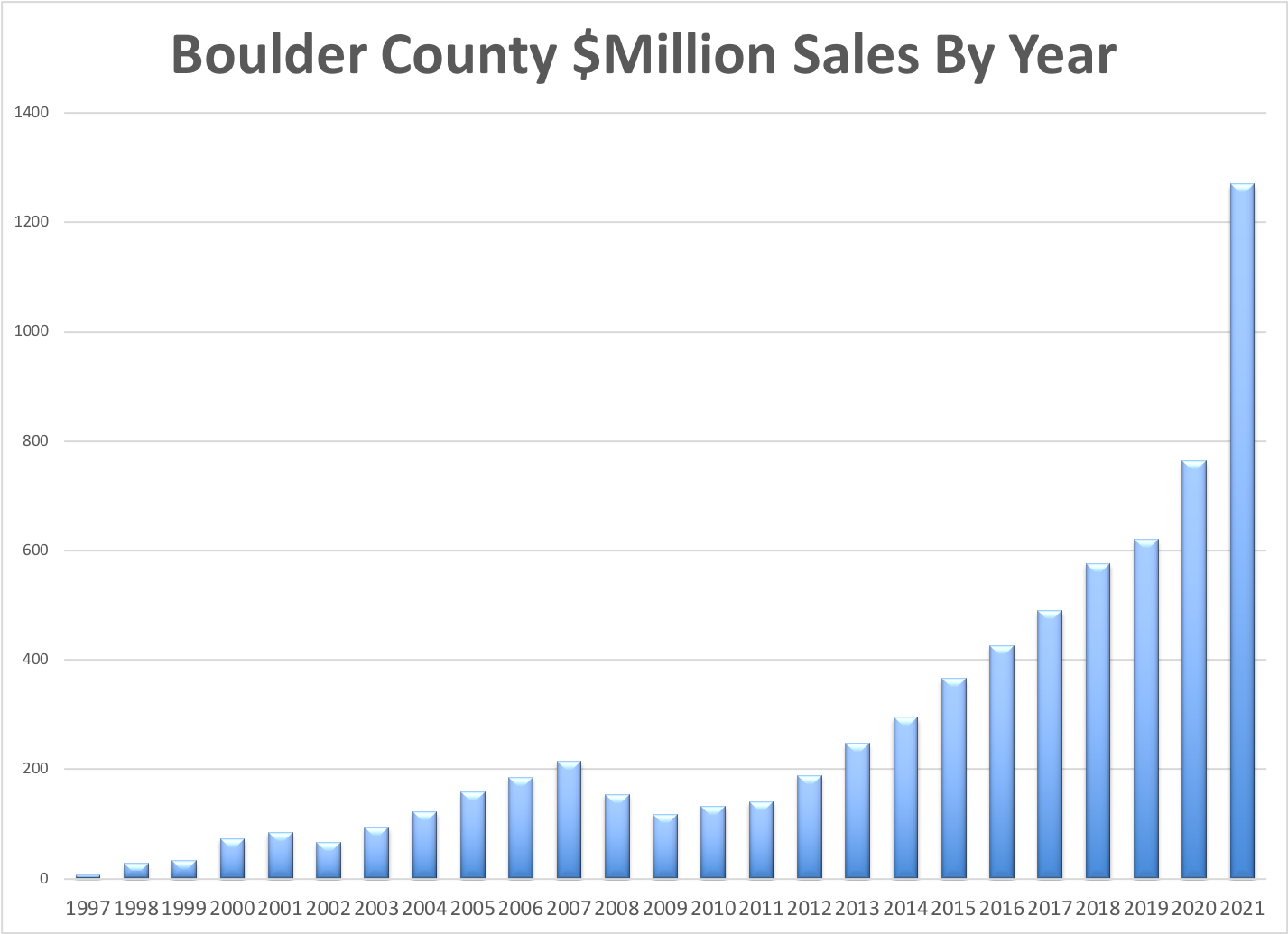

- There were 1,270 sales that exceeded $1 million during the year which is 506 more than a year ago. Not surprisingly, an all time record! See the graph on this page to see the steady climb of + $1 million sales. There are two factors at work here. First is the cumulative price appreciation. Second is the improvement in the housing stock. A $1 million home in the City of Boulder is now below average and most likely needs some work.

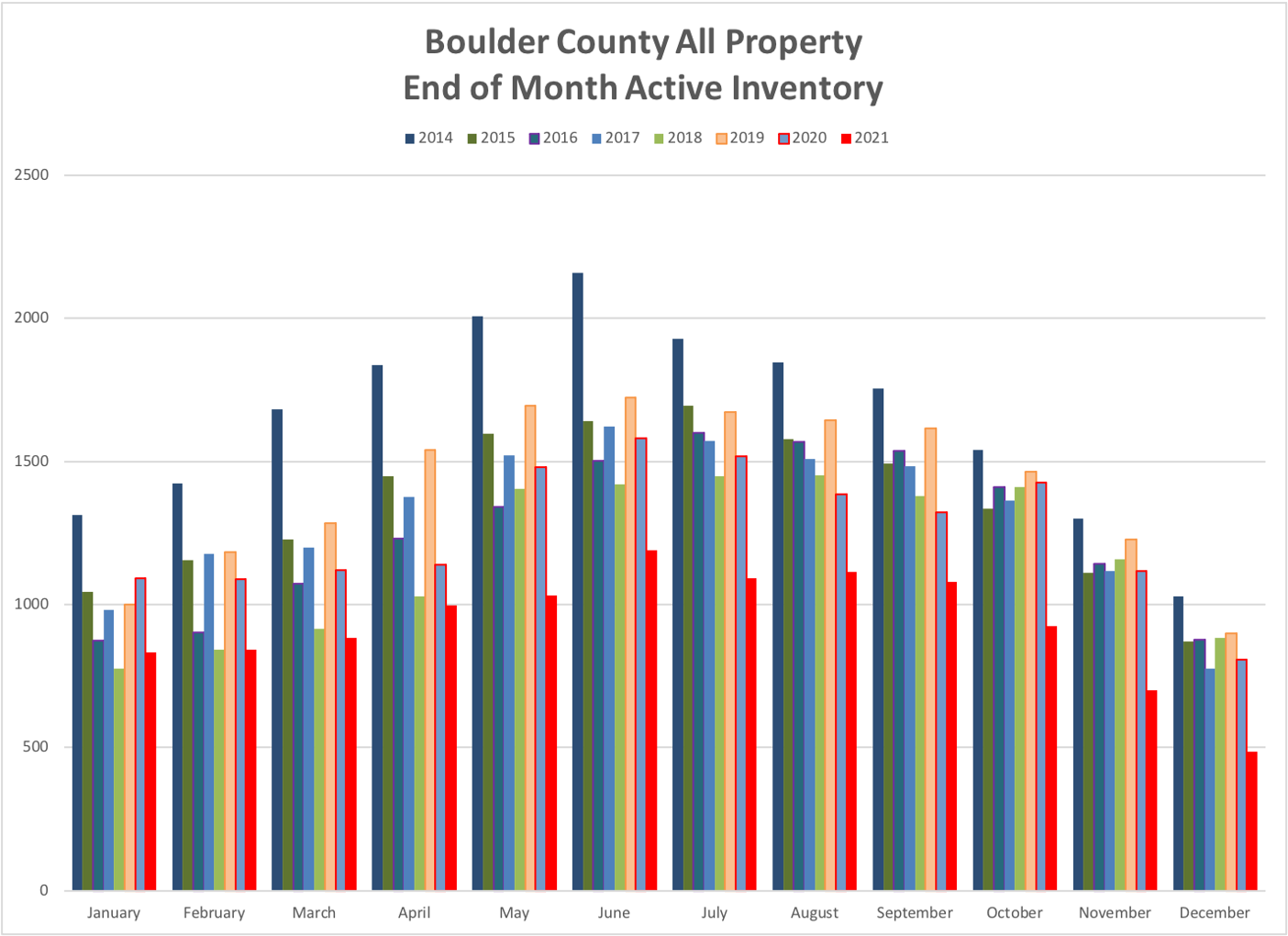

- Low Inventory – At the end of December there were just 487 properties on the market in Boulder County and 347 (71%) of those were already under contract. This is 40% less than we had a year ago and at an all-time low. Inventory not meeting demand is one of the main trends we are seeing in the market.

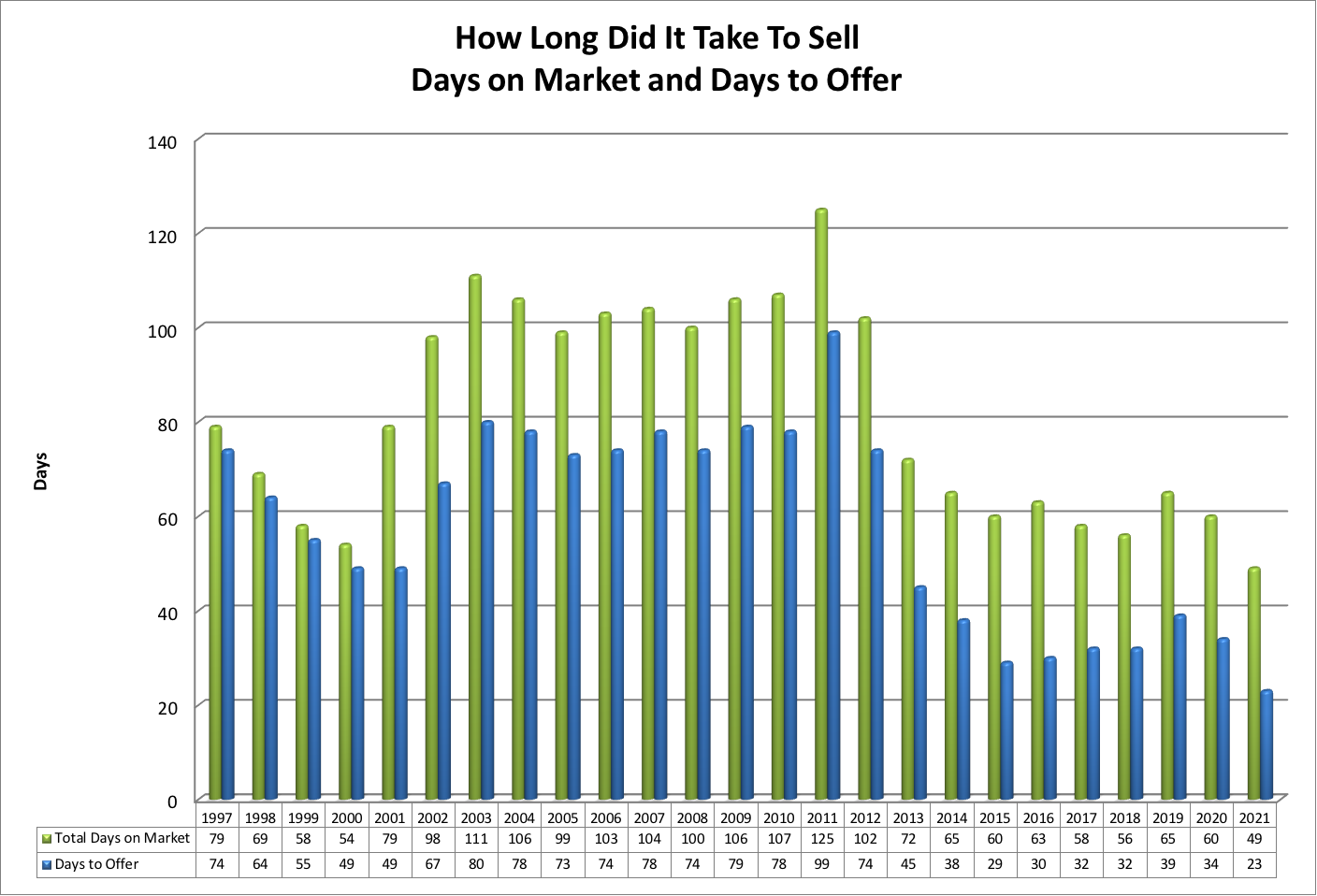

- Average days to offer – 23. Down from 34 days a year ago.

- The average sale last year closed for 2.6% above the list price.

- 53% of properties sold for a price above the list price (up from 29% last year). The average premium paid for these sales was 6.74% (up from 2.8%)

- 27% of properties sold for a price below list price.

Over the past decade owning real estate in Boulder County has been a great investment! Cumulative appreciation over the last decade is 110%.

Click here to jump to my commentary on current conditions and what we may expect in 2022.

Looking Ahead

At the end of 2021 we were already at all-time lows of inventory of available listings. Then on December 30th a wildfire burned down 1,084 homes in rural east Boulder, Superior and Louisville. To put this in perspective, there were a total of 540 sales in Superior, Louisville and east Boulder during all of 2021. We now have over 1,000 families looking for housing. Most of these residents will be looking for rental housing while they work with their insurance companies and start the re-building process which could last more than two years, but some are actively looking to buy in the area. Over the first few weeks of 2022 I have made offers for a number of clients and have found that the demand has picked up to last spring levels. The properties various buyers I have worked with competed with 14 other offers, 8 other offers, 5 other offers and 2 other offers. All went for above the listing price.

I don’t see much of a change in market conditions unless we see a rapid influx of listings to the market. Enough to satisfy the demand for a few weeks and then get a bit ahead. On the demand side, interest rates are finally creeping up slightly and they are expected to rise by a meaningful amount by the end of the year. An increase in interest rates along with the recent price jumps may take some buyers out of the market.

Here are some items I’ll be watching closely this coming year:

- Vacant lot sales in the wildfire area. I do think there will be a good number of people who will not be interested in rebuilding. After a cleanup period I will be interested how this market reacts. This is traditionally a very slow market with not many sales because of the rare nature of vacant lots in established towns. How will prices react? Will builders be interested? Will Boulder County give a moratorium on raising the taxes to vacant land rates?

- Will out of town buyers be deterred by the wildfires that struck our local suburban areas in December? Many of our buyers during and pandemic have moved here by choice. Choosing the Boulder area over other western cities like Boise, Bend, Austin and Salt Lake City. Will seeing the aftermath of the fires on the national news, which we had never before seen in these areas, deter buyers from moving here?

- Inventory of homes and under contract percentage. I track these statistics and post them each month.

- As mentioned above I’ll be tracking interest rates and their effect on buyers.