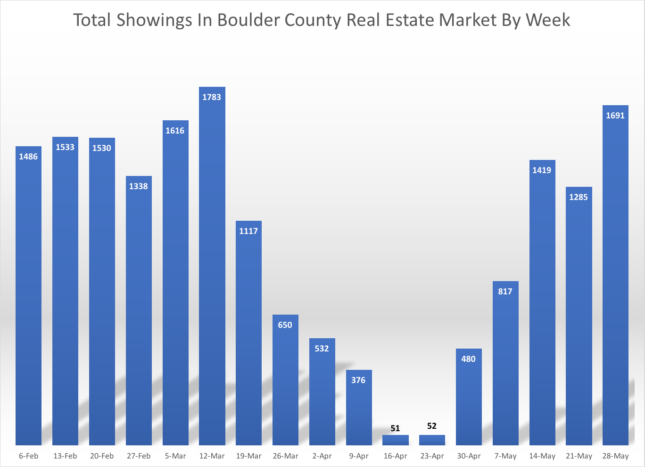

Our communities are taking steps to open up the economy. I’ve definitely noticed more traffic, filled parking spaces downtown and a few businesses using their space again in my office building. Some restaurants began to seat customers yesterday and more and more buyers and sellers are slowly coming back into the local real estate market. On an aggregate basis showings were up 31% this past week. Up to 1,691 showings (data from ShowingTime). We were last at this level in early March. Progress.

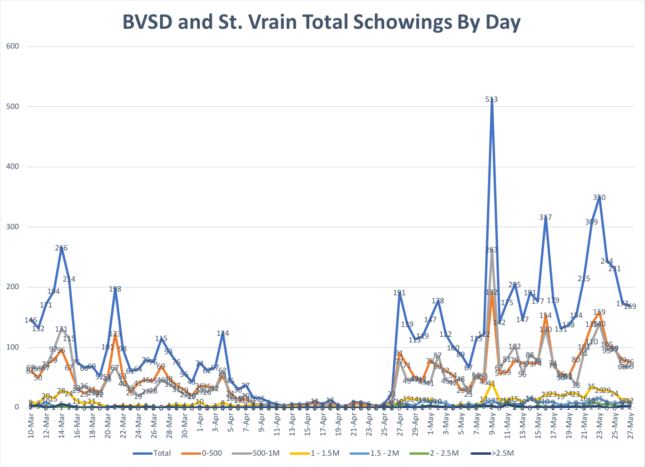

Usually Memorial Day week is fairly slow. But we saw a nice surge of new listings and the number of new accepted contracts stayed strong. Much of this activity is in the lower price ranges, but not exclusively.

Here is a breakdown of inventory and the percentage of those listings which are under contract by price. Residential listings in Boulder County.

$0 - $500k

Total Listings = 448

57% are under contract

$500k - $1 Million

Total Listings = 651

45% are under contract

$1 - $1.5 million

Total Listings = 162

23% are under contract

$1.5 - $2 million

Total Listings = 79

18% are under contract

$2 - $2.5 million

Total Listings = 41

19% are under contract

More Than $2.5 million

Total Listings = 76

9% are under contract

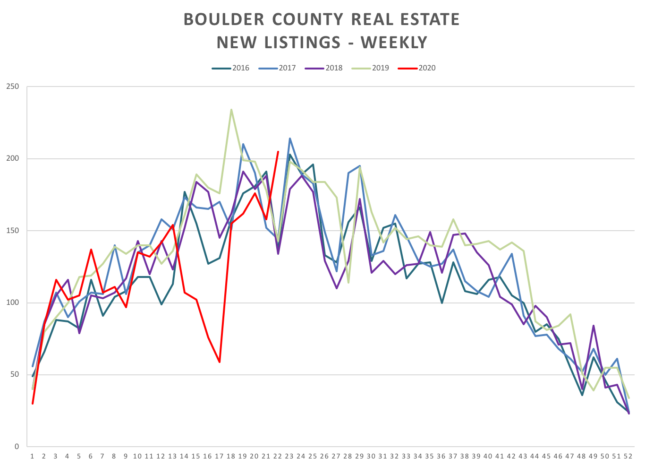

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.

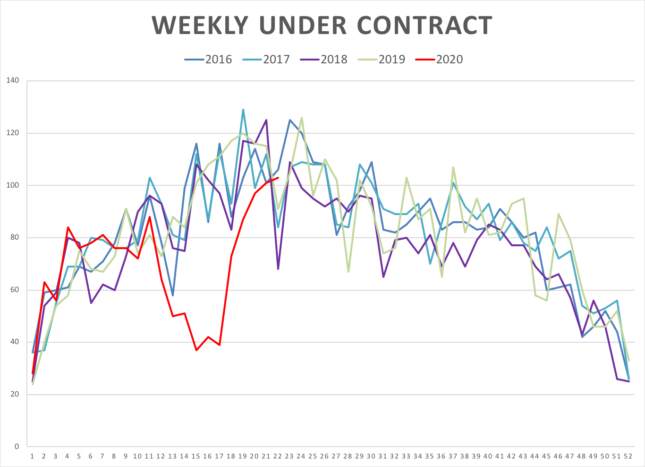

The graph directly above shows the number of listings that have gone under contract on a weekly basis. Since showings were again approved we have seen good contract activity. From the information above (orange toggles) you can see the strongest market is below $1,000,000.

As the weeks progress and as people get back to work it will be interesting to see if there is a surge in buyer activity. If not, we may see an increase in inventory. This isn’t a bad scenario since we have been low on listings for a number of years. But the risk of an imbalance (more supply than demand) is that it will take longer for homes to sell and there will be overall negative price pressure. As long as interest rates remain low and buyers can obtain mortgages, this is a good thing for buyers.