I have just published The Kearney Report for the 1st Quarter of 2017. The entire report can be viewed below on this page or you can download the PDF link here The Kearney Report 1st Quarter 2017

I have just published The Kearney Report for the 1st Quarter of 2017. The entire report can be viewed below on this page or you can download the PDF link here The Kearney Report 1st Quarter 2017

Real Estate Market Update

The Boulder area real estate market has been one of the most robust markets in the nation over the past few years. The market has been characterized by steady sales, low inventory and rapidly rising prices. This trend continued through the first quarter of 2017.

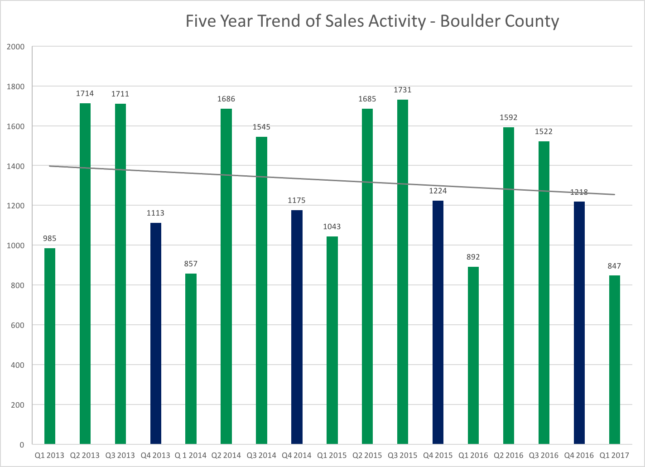

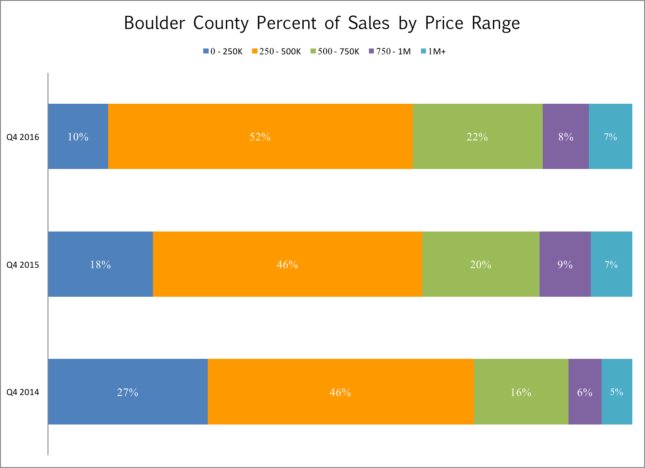

During the first quarter of 2017 there were 847 sales in Boulder County which reflects a 5% drop from the previous year. The median sales price during the quarter was $465,000 which is 9% higher than it was a year ago. Inventory, especially towards the end of the quarter and then extending into April and May has increased giving buyers more breathing room to shop for homes. During the first quarter, 35% of the sales had a price above the list price, 20% were at the asking price and 45% were below. Of those that did sell above list price the average premium paid was 4.4%. During the first quarter of 2016, 42% sold above list price and the average premium paid was 5.5%. It seems that calling this a slow down is splitting hairs but during that same period it was my experience that showings were down and the number of offers received on any one property was down as well.

Through the end of April the total number of residential sales in Boulder County is up roughly 1% with January and March exceeding last year and February and April lagging last years totals. We still do have a great influx of new residents which has been fueling the unusually strong market but whether it be higher interest rates or higher prices, or both, the activity has lessened.

You may have noticed that there are not many for sale signs out there. The inventory of “for sale” homes in Boulder County at the end of the 1st quarter is up 12% from a year ago. There are definitely more choices out there. I have seen many listings that have fit into this predictable pattern: the house gets listed for a high price compared to recent sales in the neighborhood (the hope), after 10 days or so of moderate showings and no offers (the reality) the sellers reduce the price (the chase) hoping to rekindle interest in their home. In my experience it’s more difficult to make an adjustment after 10 days and get interest than it is to price it right in the first place.

As you browse through the rest of the report you will find, for comparison purposes, a number of market measures displayed for each of the submarkets in our area. Enjoy the report.

Here is our advice for buyers and sellers in the current market.

Buyers – Interest rates are increasing slowly and with increased inventory you may be able to avoid competing for a home with other buyers. On average, homes are still selling for just below asking price. If you are patient you may reap the rewards of waiting for a seller to become motivated and find that the price that you pay is reasonable compared to the neighborhood.

Sellers – Properties are still selling however the exuberance of past years isn’t there. This may be a good time to lock in the gains we have seen in the market over the past three years. When pricing your property lean towards reality and away from greedy and you will most likely find a buyer who is on the same page. “Testing” the market can have poor results if you find your house still on the market two weeks later. Price reductions don’t have the same impact of a well priced new listing.