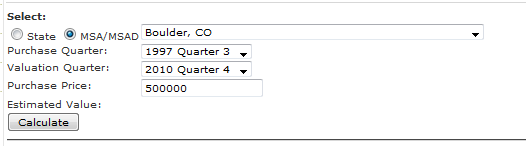

FHFA.gov has a tool for estimating home appreciation. It is called the Home Price Calculator. All you need to make it work are two bits of  information; the date and purchase price of the last market sale of a house. Using these two data points FHFA uses their database to compute an estimated current value. Here is how the input form looks.

information; the date and purchase price of the last market sale of a house. Using these two data points FHFA uses their database to compute an estimated current value. Here is how the input form looks.

This can be done on a state level, but if your MSA Metropolitan Statistical Area is tracked by FHFA the results will be more accurate if you use the MSA search. FHFA tracks over 300 MSA’s. For my case I use Boulder, CO which includes all of Boulder County. FHFA tracks home appreciation by quarter and uses these numbers to estimate a current market value given a homes sales history. Of course there are some limitations. The assumption is that the home was purchased at market value and there have been no major improvements (additions, complete remodels, etc.) which separate a house from the housing stock in general. It is assumed that houses will be improved and maintained over time but the index does not make adjustments for improvements above and beyond the normal.

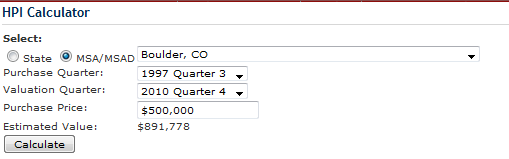

Back to the calculator. In my example the house’s last market sale was in the third quarter of 1997 and it sold at that time for $500,000. Plugging that data in to the calculator along with the valuation quarter of 4th, 2010 (the most recent available), I hit calculate and come up with an expected market value of….$891,778.

What this says is that, if this house held to the average appreciation rates of Boulder County since 1997 the current value would be approximately $891,778. So, does this mean anything? How accurate is this number?

What this says is that, if this house held to the average appreciation rates of Boulder County since 1997 the current value would be approximately $891,778. So, does this mean anything? How accurate is this number?

I ran a test to see how accurate the calculator is for Boulder Colorado. The test is limited and does not hold up to statistical scrutiny but it is a good litmus test. I tracked all of the properties that sold in the City of Boulder in January of 2011 and looked up the most recent previous sale for each property. I then entered that data into the HPI Calculator and came up with an estimated current value. I then compared the estimated value with the actual price the home just sold for.

The results were interesting. Overall the actual home appreciation within the City of Boulder was 5% greater than the expected value according to FHFA. However, the standard deviation (or variance) was quite high +- 29%. That is, on average the calculator gave a value of 5% low but for any given home that value could be off by 29%. Also, note that I threw out four outliers, two high and two low.

So in conclusion, I think that this calculator along with the many others out there can be useful in some instances. I like to use it as a third check to make sure I am thinking along the lines. But setting the price of your home by this or any other online tool is a shot in the dark. Valuation is best done by a thorough analysis of a professional. If you are interested in selling your home and are curious about the value of your Boulder County Home, call me I’d be happy to help you properly price your home.

For a similar study I did on Zillow.com click here.