Where Did All The Homes For Sale Go?

Where Did All The Homes For Sale Go?

It seems that the headlines around the country in stories written about real estate inevitably have two major themes; low inventory and increasing prices. And for anyone who is familiar with economics at all this isn’t a surprise. They should go hand in hand. Given equal demand, a decrease in the supply of any good will result in an increase in the price of that good. The technical term is scarcity. It results not only in a buyer paying more for something but in most cases they also have to demonstrate patience as they wait for delivery. But this equation doesn’t always end up with the same number of transactions taking place. Many of the would-be buyers get discouraged with the process of the purchase and decide to make other arrangements.

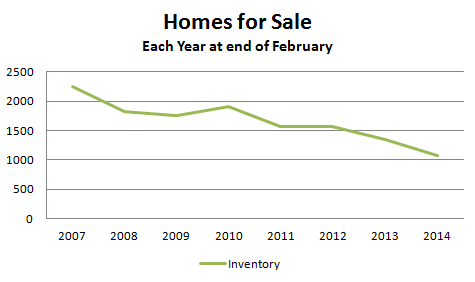

In the real estate world “other arrangements” mean that a would-be buyer decides to stay where they are or decide to rent instead of buying a new home. The market isn’t operating efficiently and in the end, the result is fewer sales. We are already seeing all of these variables come into play: lower inventory, higher prices, fewer sales. Here in Boulder County inventory is down approximately 50% from the same point five years ago.

The question that I haven’t seen adequately answered is “where did all the homes for sale go?” I don’t have ‘the’ answer but here are my ideas on the reasons why inventory of homes for sale has steadily decreased both nationwide and locally.

- Financial Distress – When homeowners don’t have enough equity or cash to sell a home they have three choices; pursue a short sale, let the home go into foreclosure or keep making the payments and hang on to the house until their equity rises to a point where their costs to sell are covered. Prices have risen and we are through the worst of the latest foreclosure wave but the most recent recession was deep and home prices did fall to a point where the recent appreciation in many areas is just now making up the accumulated loss. If you bought in 2005 – 2007 chances are that your equity vs. selling cost equation is still about breaking even. Therefore, the mindset for many people is, that I have made it this far and prices seem to be headed in the right direction so if I hold on a bit more it will be even better. Many in financial distress either can’t afford to sell or are waiting for more appreciation.

- Trade-up Conundrum – For homeowners hoping to trade-up to a larger, more expensive, or different house there are two parts of the equation, selling and then buying. Right now the selling part is easy. In the Boulder County area if you have a decent house you can sell your home for a good price in fairly short order. But once you sell you must find a new home, and fast. There are two problems here. 1) Low inventory means that a buyer has very few choices on the buying end and it might take a double move to make it work. 2) Prices are rising and there might not be enough equity (see #1 above) to put into the new home to make the financing and monthly payments work.

- Investment Buyers – When a new listing does come on the market competition between buyers is tight. Exasperating this competition is the proliferance of investors who many times make cash offers. More buyers means that it takes even more new listings to satisfy the demand.

- Rising Prices – I had a prospective seller do some quick math at the kitchen table recently. He knew that prices had risen approximately 9% over the past year on his $500,000 home. This meant that every month his home was going up another $3,750. There are some serious assumptions in this equation, but I don’t doubt that many homeowners do the same math. The answer to this optimistic equation for them is “let’s stay here another year and sell it next year for $50,000 more”. I love the optimism, but this type of thinking doesn’t work in perpetuity. If you follow the housing market, the stock market, the commodity market or any other free market, you know that these forward looking assumptions are easier to make than they are to collect on.

- No Place To Go – “Sure we could sell our house, but where would we go?”. These words are echoing across the area, and alas the nation. Instead of taking the plunge into the market, these would-be sellers/buyers then decide to do nothing, thereby fueling the self-fulfilling spiral of even lower home inventory. In our area this is further exasperated by a lack of rental homes that in a different market take up the slack if the logistics don’t work just perfectly.