I get curious about the real estate market too. I have a good view of what is going on from my “window” on the market. But sometimes I like to confirm what is going on by looking at the numbers. My feeling is that the market has been pretty slow since the beginning of August. The numbers confirm that it has been steady but slow with numbers comparable to last year at this time.

As I have stated recently when looking at the month end statistics, total sales are down approximately 7% but we have made big strides over the past two months in erasing that deficit entirely. Today I want to segment the market a bit more and look at the two statistics that I think best represent current activity in the market; under contract percentage and absorption rate (or inventory in months). I will look at each of these statistics over six price ranges and seven different geographic areas throughout Boulder County. If you are curious which price ranges or areas are selling the best, your curiosity will soon be quenched.

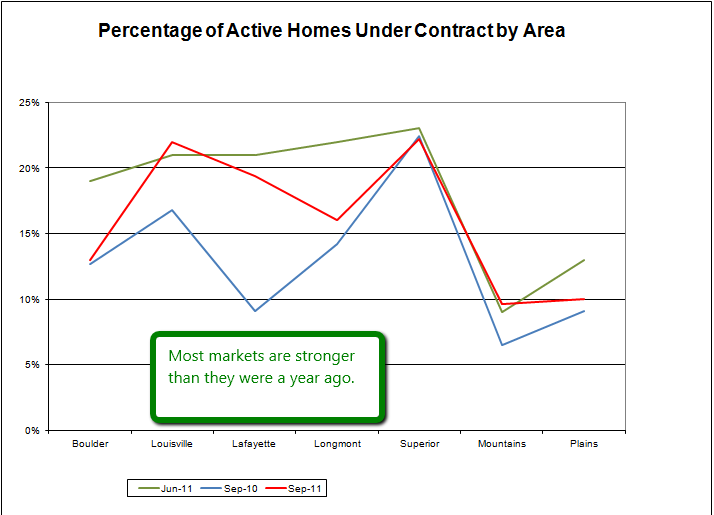

Let’s first look at under contract percentage. It is simply a quick ratio of the number of properties currently under contract to the total number of listings available. Here is a graph showing under contract percentage by area.

Boulder 13%, Louisville 22%, Lafayette 19%, Longmont 16%, Superior 22%, Suburban Mountains 10%, Suburban Plains 10%

Compared to last year the under contract percentages are stronger in 5 of the 7 markets and almost equal in Boulder and Superior.

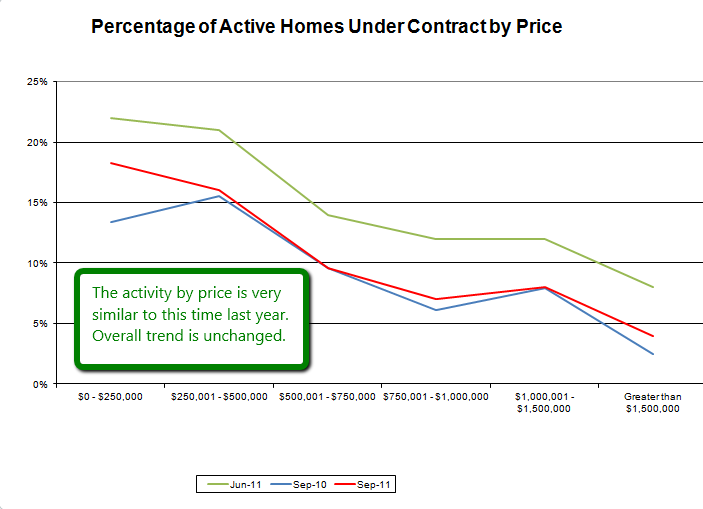

Under contract percentage arranged by price range is always interesting because the real estate market in Boulder County shows an almost linear increase as the price range rises. Or to say it another way, the market is more fluid in the lower price ranges and less liquid as prices rise. Here is how this looks.

The numbers this year are very similar to last year at this time but are slightly higher which is good. The percentages range from 18% for properties listed up to $250,000 and 4% for those listed for more than $1.5 million. The lower price ranges have a balanced market and the upper price ranges show an over supply.

Tomorrow I will talk about absorption rate.