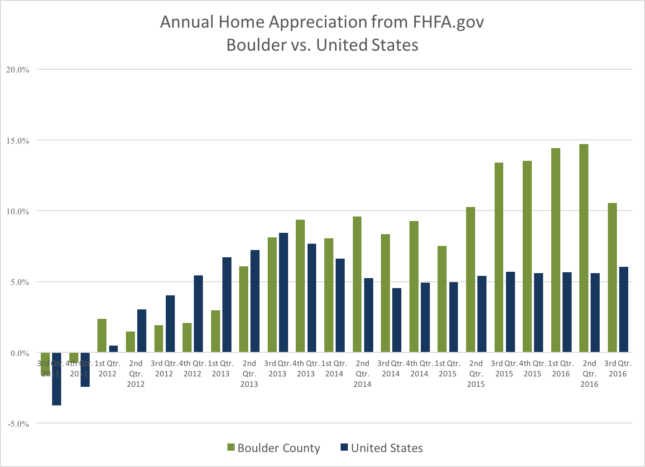

The Boulder real estate market was one of the hottest real estate markets in the nation this past year. During the second quarter FHFA.gov ranked the Boulder market, which includes all of Boulder County, the number one market for annual home appreciation. However, since the super busy spring and early summer months, the market has slowed down a bit.

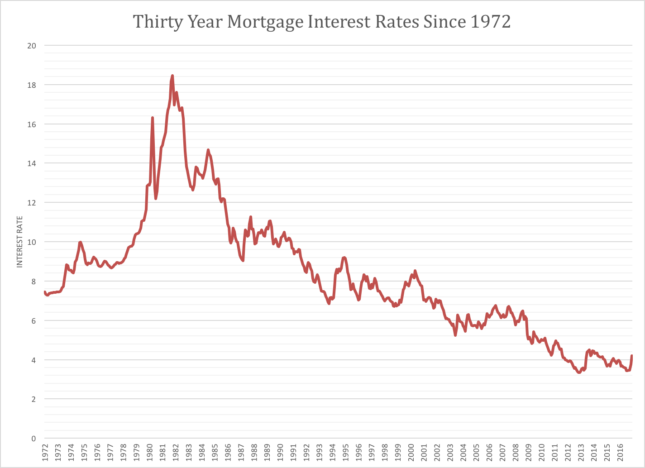

The combination of strong migration to our area, low interest rates, a strong local economy and low home inventory created the perfect storm in terms of increasing home prices. In general, 2016 was a great time to be a seller and a frustrating time to be a buyer. The remainder of this report will explore in detail the factors that affected the Boulder real estate market over the past year.

Home Price Appreciation

Strong price appreciation has been the direct outcome of the positive household creation and the lack of inventory. Strong demand and limited supply results in increased prices. According to FHFA.gov, home appreciation in Boulder County averaged 10.56% for the one-year period ending September 30th 2015. (See below) This ranked us 14th in the nation. The year end median prices for all residential sales in Boulder County showed an increase of 12% from a year ago and up 43% from the end of 2010.

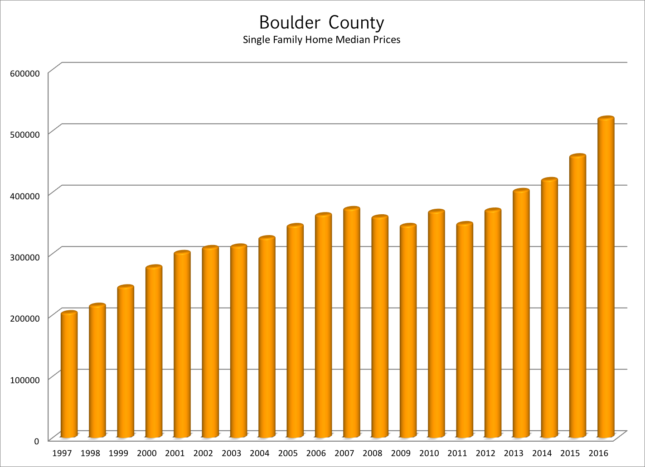

Median prices in Boulder County have increased 156% since 1996. Boulder County has been one of the most stable markets in the country. Here is a graph showing appreciation over time for single family homes in Boulder County.

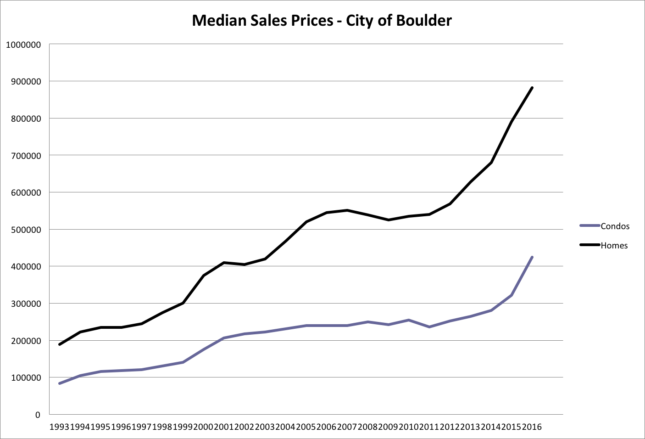

Within the City of Boulder prices of single family homes increased by 11.5% and amazingly condos and townhomes increased in price by 32%. I attribute the big jump in the condo market to the relatively low price point. The median price for 2015 was $321,600 and in 2016 it was $424,900. Still affordable for a place of your own in Boulder compared to a single family home for twice as much.

Demographics

People move to Colorado for the excellent lifestyle, outdoor recreation opportunities, the strong economy, including good employment opportunities and the climate. “Lifestyle” is the new buzzword for people when they are looking for a place to live. Increasingly people are able and willing to pull up roots and move to where they can live a healthy lifestyle. Boulder is definitely on the national radar for this type of person and has been for sometime. For example, on Livability.com, Boulder ranks #5 in the “Best Places To Live” list and #1 for “Best Cities for Entrepreneurs”. Telecommuting, e-business and a proliferation of startups is allowing many people to make their Boulder dreams come true.

Colorado is growing. From July 2015 to July 2016 Colorado’s population grew by roughly 92,000.[1] 30% of this was due to natural increase and 70% was due to net migration. [2] Colorado ranked seventh in the United States in terms of population growth as a percentage at 1.68%.[3] The population gain for Colorado is forecast to be roughly the same for 2016 and then gradually slow. The current population of Colorado is estimated at 5,540,000.[4] And it’s estimated to increase to 7.8 million by 2040.[5] All of those new residents will need housing. Boulder County has gained 97,415 new residents since 1990.

Recently there has been a shortfall in housing units. More households are being formed than housing units built. However, after a building boom of apartment buildings I feel that the pressure of the housing shortage has eased. A personal antidote may illustrate the recent change in the rental market. I recently had a condo that I own come vacant again after just one year. In the fall of 2015 I had many potential renters and was able to choose quickly from among the interested applicants. This year I offered the condo for the same price and over a three-week time frame showed the condo to just two potential renters. I did end up renting the condo for the same rent amount but in order to do so I needed to accept a tenant who I may not have if there were multiple applicants. I’m seeing more for rent signs lingering.

I have a couple of other thoughts regarding migration and population growth as it pertains to Boulder County. As prices rise, Boulder is more and more becoming a destination for the already rich. Will this trend change our town? Will the regular working person be attracted to Boulder when the prices are too high? Are we already there?

During the election three states passed recreational marijuana laws and three others passed medical marijuana laws. It has been highly under reported but the legalization of pot in Colorado has been a boon to tourism, commercial real estate and residential real estate. As we see legalization in other states Colorado will lose its uniqueness. This may precipitate an economic slow down.

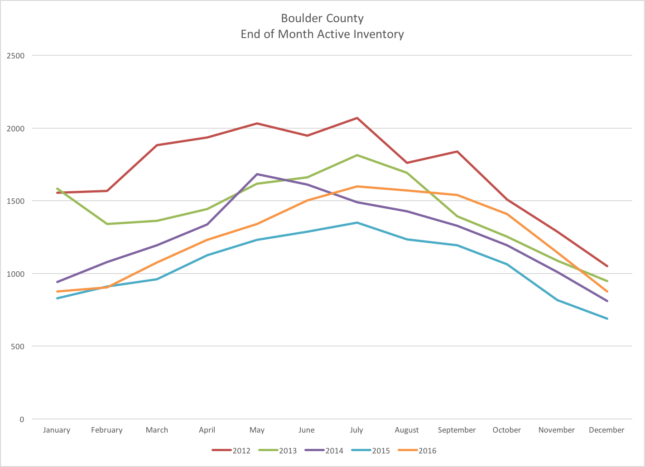

Low Inventory

Lack of inventory has been a consistent theme over the past few years. It’s not just that buyers are snatching up the all of new listings, since 2012 we have seen a steady drop in homes on the market. The last part of this year the situation improved a bit but only to 2015 levels. At the end of the year all listings were down 28% from 2012 levels and single family listings were down 60% from 2007. Maybe as prices start to level out, whenever that is, sellers will get back on the selling track.

At the end of December there were 877 total homes, condos and townhomes on the market in Boulder County. After subtracting those that were already under contract, there were just 462 available homes to view. This includes all areas and all price ranges!

Low inventory isn’t just a local phenomenon; it is a problem across the country. Here are a few of my theories for this trend. 1) Trade-up conundrum – it’s easy to sell but difficult to buy. 2) Rising prices – when prices are rising rapidly sellers think that if they just hold for a few more years they could sell for 20% more and that would make things easier for them. 3) Let’s fix up and stay instead – because of number 1 and 2 above many would-be sellers have decided that staying and making improvements is the best option. For now low inventory has made it difficult to be a buyer and been a root cause for rising home prices.

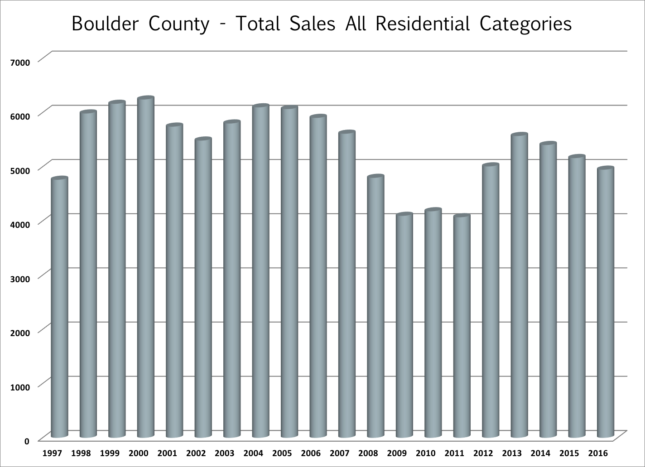

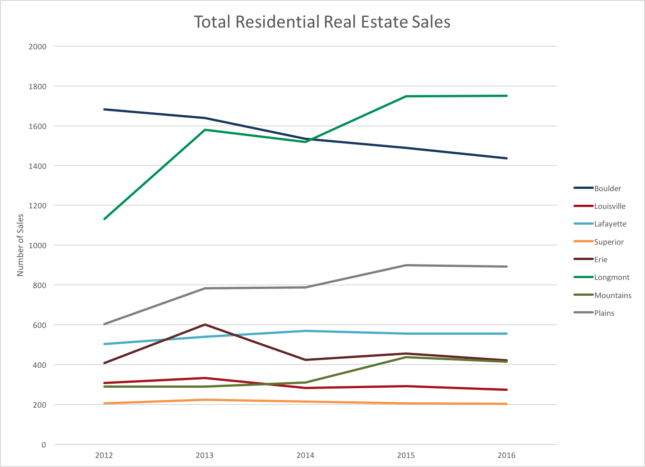

Total Sales

In Boulder County, sales were down 8% for the year. In the City of Boulder sales were down 15%. In the City of Longmont sales were down by just 3.5%. There are now more sales in Longmont than in Boulder. Low inventory while the market was very hot and then a slowing market during the later part of the year combined to stifle sales.

Interest Rates

For a number of years, we have all been expecting to see the inevitable rise of interest rates. After many years of lingering low rates we saw interest rates start to move up at the end of 2016. As we began 2016 the 30 year fixed rate was 3.87% it then fell to as low at 3.44% in August and then ended the year at 4.2%. (See Figure B) Historically this is still a great rate, but that’s little compensation for the buyer who was originally pre-qualified in August and has now realized their payment has risen $170 while they have been looking. Low rates have been a boon to the market. Allowing buyers to afford homes even as prices have risen but now that interest rates are rising as well, affordability will be a problem.

Key Statistics for 2016

- The total number of sales during 2016 was down 8% from 2015.

- County wide, the median prices for single family homes were up on average 13.4% and the prices for condos and townhomes were up an impressive 25%.

- On average it took 30 days to go under contract. This was similar to last year.

- For the year 37% of the sales sold below list price; 21% sold at list price and 42% sold above list price. However, the market did cool in the 4th quarter with 51% selling below list price; 23% at list price and 26% selling above list price. (see Figure C)

- Through the end of the third quarter, FHFA.gov showed homes in Boulder County appreciating by over 10.56% during the previous four quarters. This ranked 14th nationally.

- The average premium paid in Boulder County for those homes that sold above list price was 4.7%.

The Future

So what does the future hold? It’s always a difficult question. In the short term it seems like the market is slowing a bit. Even in the slower months of December and January there doesn’t seem to be the sense of urgency we experienced over the past few years. However, we will most likely see a fast moving spring. Buyers will be rushing to beat additional interest rate hikes and contending with low inventory.

In the long run our area still seems poised for further growth and expansion. Google’s expanded new offices won’t open for a year but it’s clear that Boulder is already “on the radar”. Not only will Google fill its offices over the next few years with an additional 1,000 employees other related businesses will be attracted to the area. Only time will tell, but it seems like Boulder’s attractiveness is still on the rise. And with it, I see Boulder’s real estate market not only sustaining but thriving into the future.

[1] www.census.gov

[2] Leeds Business School’s “Colorado Business Economic Outlook 2017

[3] www.census.gov

[4] www.census.org

[5] Colorado State Demography Office