by Neil Kearney | Apr 9, 2021 | Boulder County Housing Trends, Statistics

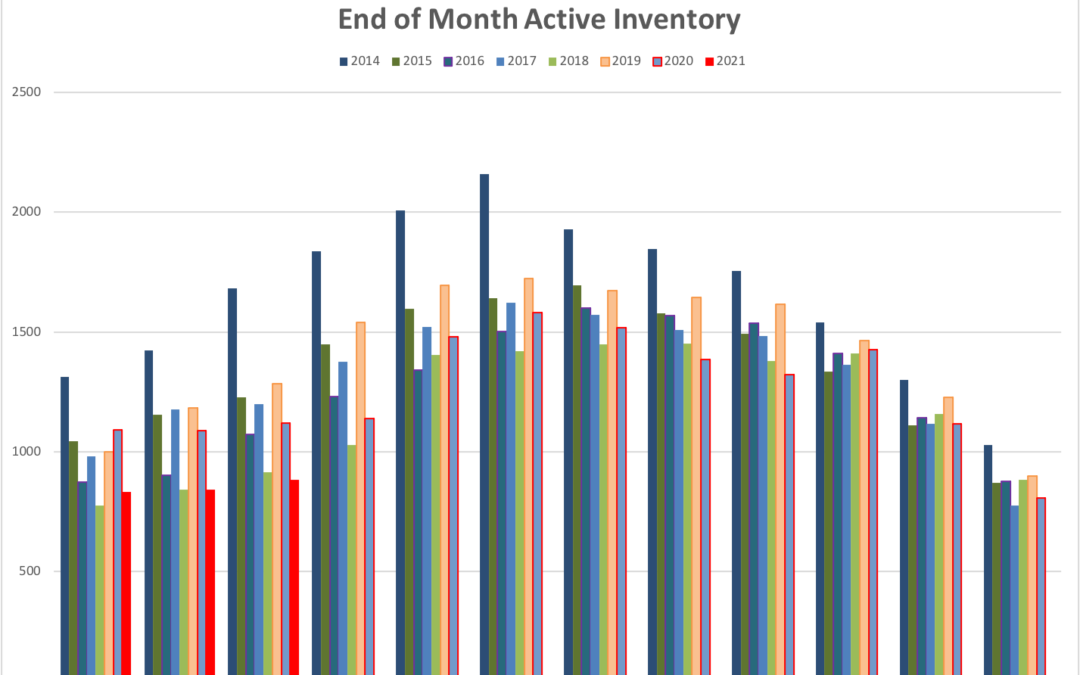

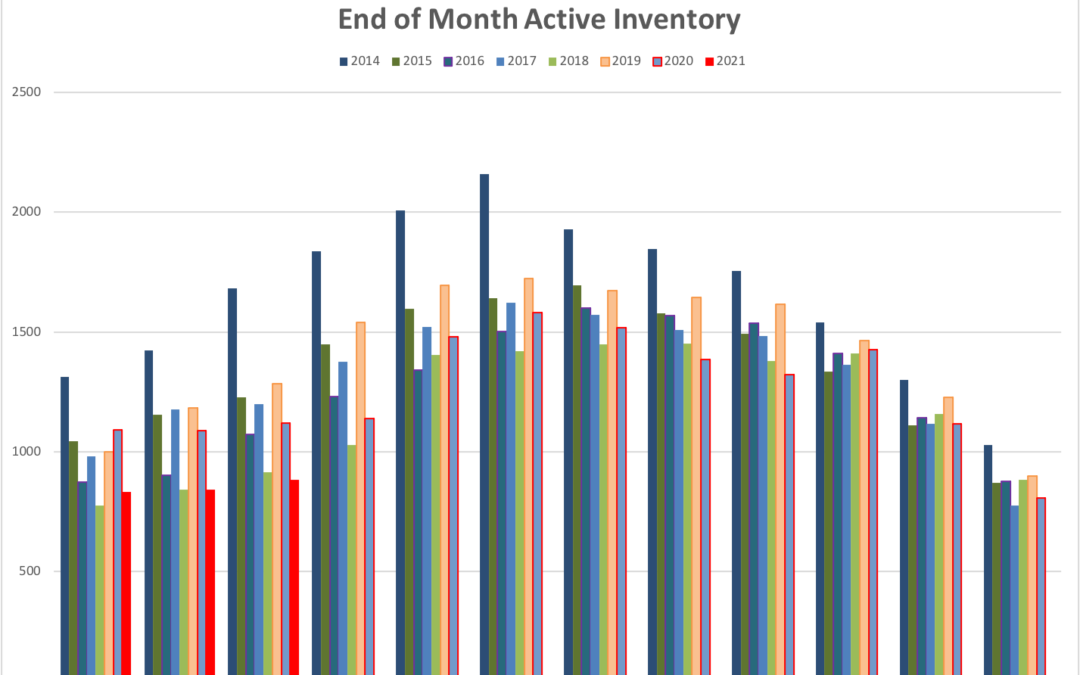

WOW! We are seeing unprecedented market conditions in the Boulder County real estate market. A strong and fast moving, sellers’ market is causing a spike in prices. Inventory is still low and at the end of March 69% of the ”on market” homes were already under contract. Two years ago at this same time 43% of listings were under contract. Most well priced homes are going under contract very quickly with multiple offers. It’s not uncommon for buyers to waive the right to object to a low appraisal and taking houses in ”as-is” condition.

55% of the sales in March exceeded the list price of the home. The average premium over the list price was 6% or almost $42,000! Appreciation is moving quickly!

Take a look at the annotated slide show below to get more details and see the trend charts for the month.

by Neil Kearney | Jul 11, 2019 | Boulder County Housing Trends, Statistics

The strong sales in May were not backed up by a strong June. My personal statistical records upon which this report is based, goes back to 2004 and June’s sales were the lowest of the group. On the street, I’m seeing large price reductions on high priced homes and other homes are sitting on the market longer than in the past. There are currently 23 homes on the market in Boulder County with a list price of at least $5 million. Just one of those is under contract and there have been two sales so far this year in that range. It’s not uncommon for the market to start slowing down this time of year. See the annotated slideshow below for more details.

by Neil Kearney | Aug 3, 2017 | Boulder County Housing Trends, Statistics

I have just completed the latest edition of The Kearney Report for the second quarter 2017. The goal of this report is to give you a quick understanding of the statistics and trends in the Boulder County real estate market.

I have just completed the latest edition of The Kearney Report for the second quarter 2017. The goal of this report is to give you a quick understanding of the statistics and trends in the Boulder County real estate market.

You can view the entire report below or you can download the PDF here. The Kearney Report 2nd Quarter 2017

Real Estate Market Update

During the second quarter of 2017 the Boulder area real estate market continued to be a strong sellers market, but towards the end of the quarter there was a change in the market. In this summary I will discuss these trends as well as discuss what we might expect to see during the third and fourth quarter of the year.

During the second quarter of 2017 there were 1,459 sales in Boulder County which reflects an 8.3% drop from the same quarter of the previous year. The median sales price during the quarter was $500,000 which is ironically 8.3% higher than it was a year ago. Inventory this year has been been consistently higher than the past two years and this has given buyers more choices when looking. This was especially true at the end of May when the levels of active inventory were above 2016 and 2015 levels, equal to 2014 levels and just below 2013 levels. During the second quarter, 41% (50%) of the homes sold for a price above the list price, 22% (20%) were at the asking price and 36% (30%) were below. When comparing this years numbers to last years, which are shown in parenthesis, it’s clear that the market has stepped back a bit from the record market of a year ago. Of those that did sell above list price, the average premium paid was 3.76% which is down from 4.4% a year ago. Still an impressive number of homes selling above list price, but there were fewer that did and those buyers that had to pay a premium paid less of one.

Through mid May the market was cruising along, homes were selling quickly and there didn’t seem to be much inventory in most price ranges. A week before Memorial Day we felt a shift in the market. New listings that we expected to sell quickly sat on the market. We started to see more price reductions and before long it wasn’t uncommon for houses to be on the market for 20 or more days where before 7-14 was the norm before finding a buyer. Since there is a 30-45 day gap between when a house goes under contract and when it closes Mays statistics still looked good, sales down just 1.8%. However, sales dropped by 12% in June and at the end of June the percentage of properties that were under contract compared to all active listings had fallen over 14 percentage points compared to a year ago and were at 44%.

The slowdown in the market may be just seasonal. It is normal to experience a slow down in the market over the summer as people go on vacations and enjoy all that Colorado has to offer in the summer. However, a slowdown in the middle of May is earlier than usual. It could be that after three years of a relentless seller’s market buyers needed a break. The true test will be in September when, over the past three years we have felt momentum build again until the holidays. We’ll keep you posted.

The Boulder County real estate market has been one of the most robust markets in the nation over the past decade. According to FHFA.gov Boulder ranks 28th in the nation over the last five years in appreciation. When I looked at the markets that have outpaced us over the past five years I found many markets that are more “boom and bust” than ours. I then looked at cumulative returns over the past 10 years and found that the Boulder market was a close second only to Denver, above San Francisco and Portland. We have been blessed by a steady upward trending market without the up’s and downs that typically accompany high growth. Real estate is cyclical and it will be interesting to see where we are in the cycle over the next few years. Enjoy the report!

by Neil Kearney | Apr 17, 2015 | Boulder County Housing Trends, Statistics

I’ve just published The Kearney Report for the First Quarter 2015. To download and view the entire report in PDF click here  The Kearney Report 1st quarter 2015

The Kearney Report 1st quarter 2015

Real Estate Market Update

The broad trends we have been seeing in the market over the past three years have accelerated. Declining inventory and increasing prices, are now making it very difficult for buyers and move-up sellers. The trends that make it so great to be a seller have not only continued in 2015 thus far, they have accelerated.

At the end of March in 2010 there were 1,724 single family homes on the market that didn’t already have an offer on them. At the same time in 2013 there were 818 homes available. This year there were just 413 homes in all of Boulder County on which a buyer could make an offer. If a home is properly priced and marketed, it is very typical for it to go under contract within a very short time frame.

Multiple offers have been very common. Of the 884 sales in the quarter, 32% sold for greater than full price and 19% sold for exactly asking price. The average premium paid for those homes that did sell above the list price was 3.6%. The largest premium paid was 19% over the list price. On average, homes in Boulder County appreciated around 8% last year. This year we seem to be on a similar track. In some areas we are seeing year-over-year gains of around 20%!

Buyers, who are still enjoying low interest rates, are rushing to get something purchased before the rates rise (it seems like we have been waiting for quite some time). This pressure, added to the fact that there are not many houses to see make it easy to get caught up in the competition of multiple offers. Buyers are worried about being priced out of the market as prices and interest rates rise.

Even though we have seen a 9% drop in the number of new listings, total sales for the quarter increased by 24%. Just like a person climbing Mt. Everest dips into their fat reserves in order to keep expending energy, our housing market has sold up the existing inventory in order to sustain sales. The good news is that we have a strong and desirable real estate market, the bad news is that there have not been enough sellers to meet demand.

Some possible reasons that homeowners are not becoming sellers:

- The Catch-22 scenario – A potential seller refuses to list their home for sale until there are other homes on the market that they are interested in buying. But of course others don’t come on the market because they too are waiting for a few reasonable options to stay on the market long enough. It’s an intellectual spiral.

- Baby boomers are staying in their homes longer than in the past. Possible reasons: a) Overall better health. b) Their homes have appreciated and they are bumping up against the capital gains limits.

- Homeowners have locked in low rates/payments. While we haven’t yet seen a big gain in interest rates, many homeowners are tickled with their current situation and are happy improving their home rather than moving to a new one. This is especially true for those who purchased between 2008 and 2011 before home appreciation ramped up again.

Here is our advice for buyers and sellers in the current market.

Buyers – It takes alertness, patience and persistence to find a home right now. Competition is fierce and you must be ready to see new listings within the first few days on the market. We, as your Realtor can help you keep abreast of the market by sending you instant updates when listings hit the MLS and then quickly analyze the value of each house as you consider a competitive offer. In addition to making offers above full price, many buyers have waived contingencies to make their offers attractive to sellers.

Sellers – It’s a great time to be a seller! A property that is competitively priced, shows well and is marketed professionally often receives very strong offers and in many cases multiple offers. As listing agents, we have been helping our clients set pricing strategies, set advantageous listing and marketing schedules and hopefully sort through the merits of multiple offers. The difficulties for sellers are in selling one home and buying another. This can be more easily done by getting a temporary rental or arranging bridge financing to allow for a purchase before the sale.

As you browse through the rest of the report you will find, for comparison purposes, a number of market measures displayed for each of the submarkets in our area. Enjoy the report.

by Neil Kearney | Jan 29, 2014 | Boulder County Housing Trends, Statistics

Each quarter I prepare a report on the Boulder area real estate market that puts into context how the market for homes is performing. I’ve just completed the latest iteration of The Kearney Report and the year end provides even more data for explanation and analysis. The Kearney Report is designed to give the reader a broad statistical view of the Boulder County real estate market by giving both the broad view and delving into the details. I will be presenting some of the breakout sections in the coming days but in the spirit of full transparency, today I’m releasing the full report. The text that follows is the summary letter on page two. To view and/or download the entire report in the form of a PDF click here Boulder Market Report Year End 2013.1

The Economics of Real Estate

The Economics of Real Estate

Last year in this space I spoke of the recovery of the local real estate market. If the market is likened to a large ship, 2012 was a year where much of the work went into changing directions. By the end of the year the turn was made and it was full speed ahead into 2013. The beginning of 2013 was characterized by a very robust market where buyers were out in force and sellers were reaping the rewards of an improved market and multiple offers. Throughout the spring, sales were strong but new listings were scarce. This brought into play the basic supply/demand curve you may remember from Economics 101. The basic concept of this principle is that if demand exceeds supply then the cost of those goods will naturally increase. We definitely saw this in action. It wasn’t uncommon to have five offers on a home with bidding going well above the asking price. This gave the next seller in the neighborhood to ask even more for their home and many times their “aggressive” price was rewarded with a quick offer. The market frenzy continued until June when buyer demand slowed and more sellers decided to take advantage of the market. Below is a quick summary of the market in 2013. To get a full view of what is happening in the various market segments, I encourage you to study the graphs and explanations included in this report.

The number of residential properties that sold in Boulder County was up 9.7% during the year. Each month sales were higher than the previous four years until fall when the market slowed a bit after the flooding. The number of sales in the price range below $250,000 were down slightly but all other price ranges showed increased sales. The greatest increase was seen in the luxury segment where sales above $1.5 million increased by 65%.

Prices increased throughout our market area. The median price of residential real estate rose by approximately 9% during 2013. This is the largest single year gain we have seen since 2000 when our market was among the best in the nation. Through the third quarter, the national market increased by a similar amount (8.44%). The largest price gains were seen in the markets that were most depressed during the recent downturn. For example, prices in Las Vegas were up by 22.5% last year but they are still down 25% over the past five years. For comparison, Boulder County was up 8.11% (according to FHFA.gov) for the past year and up 7.44% over the past five years. Our one year appreciation ranks our market 60th out of approximately 300 market areas. The tide is rising.

The big story for the year was low inventory. Throughout the year buyers had very little to choose from and by the end of the year the number of active listings was down 37% from just two years ago. To go back to the ship analogy, the waters are clear but we can’t run the engines at full speed because we are low on fuel. In order for the recovery to continue we will need the supply of homes to more closely match the demand. Otherwise, would be buyers will turn into renters in frustration. If you have been thinking about selling but have been putting it off, we would love to explore that possibility with you and let you know if it makes sense for you.

The remainder of this report gives a detailed view on many segments of the local real estate market. If you don’t see your neighborhood represented please give us a call we can run the numbers for your specific area.

Page 1 of 812345...»Last »