by Neil Kearney | May 2, 2011 | General Real Estate Advice, Real Estate 101

If you own property in Boulder County, you most likely received a 2011 Notice of Valuation in the mail this weekend. If you were like me seeing new assessed value of my property(s) was very interesting.

As you look at your valuation notice here are a few things to keep in mind:

- The property value shown as the current actual value is based on the actual value on the appraisal date of June 30, 2010.

- The current actual value is the value that taxes will be figured from beginning next January.

- The property value was computed using comparable sales from July 1, 2008 through June 30, 2010.

- The value shown is the taxable value, not an actual value that your home would sell for. The County Assessor tries to approximate this value and in recent years has become much better in doing so, but there are still many differences in particular homes which cannot be detected by the assessor.

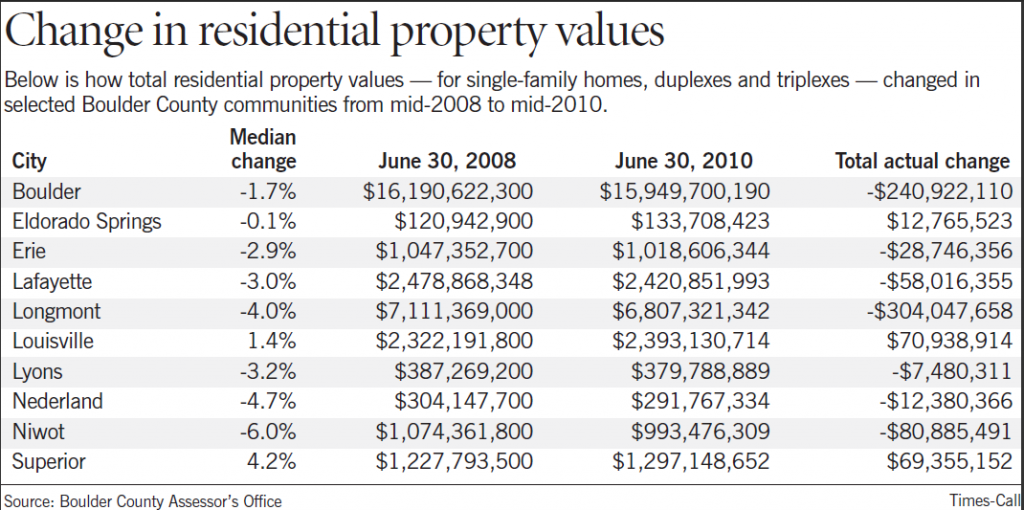

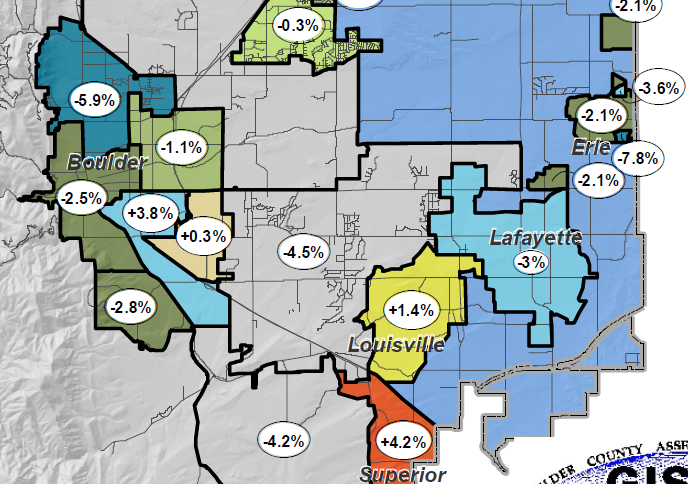

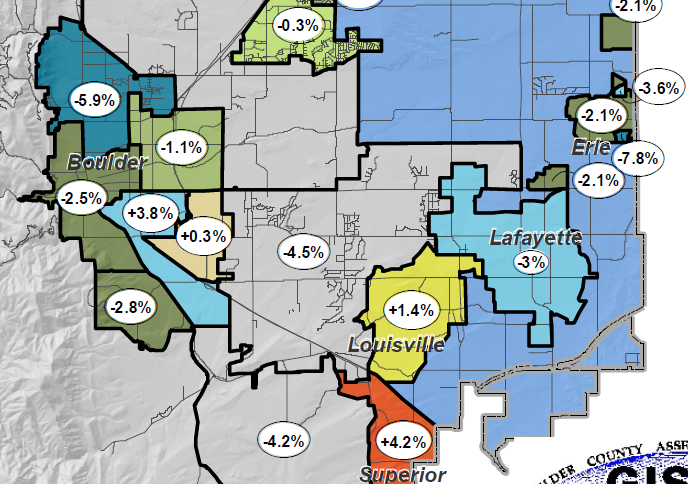

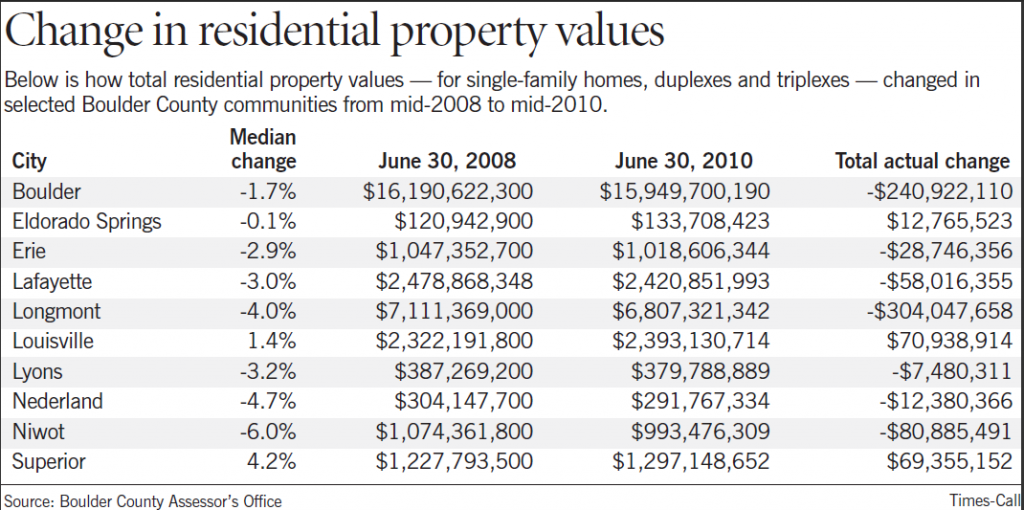

During the two year period between assessments, the average property value in Boulder County decreased by 2.6%. The values for individual areas varied widely. Here is a chart compiled by the Longmont Times Call which shows overall valuations for individual areas in Boulder County.

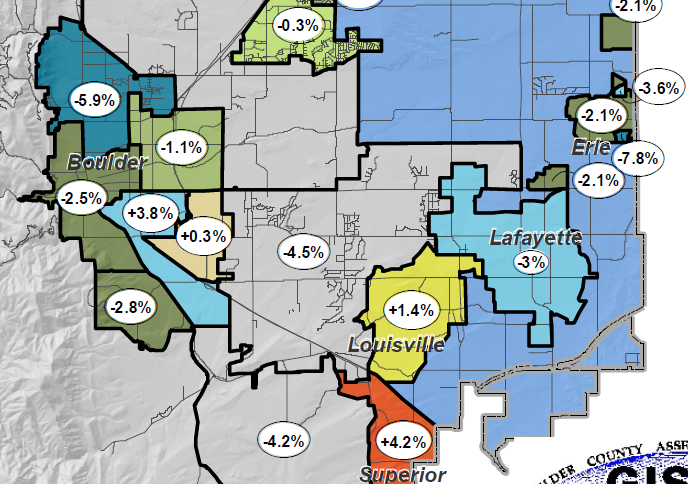

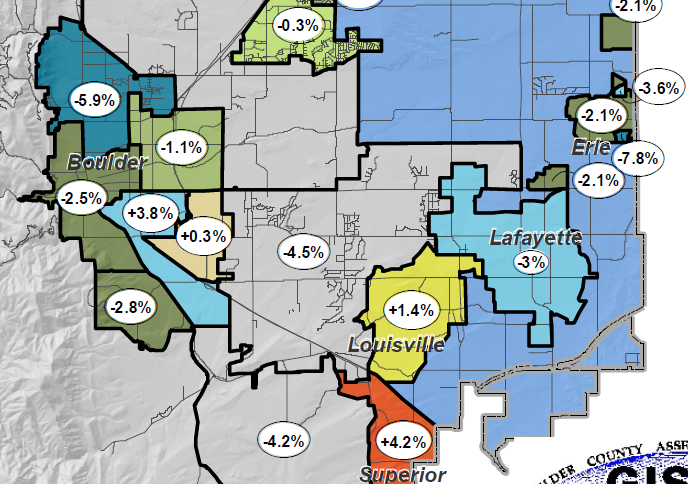

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

So how will this affect your 2011 property taxes? This is a really good question. On the Notice of Valuation you will see an estimate of property taxes. If the value of your home decreases the taxes will go down as well. This makes sense. But property taxes payable are set based on two variables; assessed value (now set) and mill levy which is to be set later in the fall. The mill levy is set every year by city councils, county commissioners, school boards and any special district directors (fire etc.) in the fall. Each of these interests have a budget to keep. Knowing that the assessments have fallen I have a hunch that the mill levy will increase. In the end taxes may not decrease at all. We will have to see.

You have the right to appeal the current actual value of your property. The appeal must be postmarked no later than June 1st 2011, so you have roughly 1 month in which to do your homework. Your appeal can be based upon two categories: the first is a discrepancy in your property description (does it say you have 4 bedrooms when you only have 3?), secondly you can disagree with the comparable sales used and provide others for consideration.

How to appeal your property tax valuation. The appeal process is outlined here and the appeal can be done online or in writing. The assessor has provided some online tools to help with the appeal process. Each comparable sale will need to be adjusted using their time trending table. They provide lists of comparable sales but they don’t show pictures. I am happy to provide some comparable sales with photos to you if you plan to appeal, just let me know.

I appealed the value of one of my rental properties two years ago. I had purchased the property right in the middle of the assessment period for $239,000 and they had assessed the property for $274,000. I provided some good comps in addition to the actual sale and they turned down the appeal. Do you have a story about your property valuation appeal? Please share it by leaving a comment.

by Neil Kearney | Apr 18, 2011 | Boulder County Housing Trends, Real Estate 101, Statistics

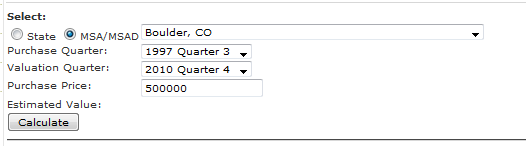

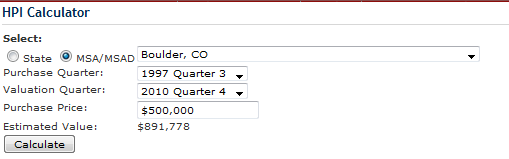

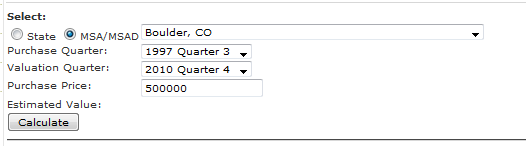

FHFA.gov has a tool for estimating home appreciation. It is called the Home Price Calculator. All you need to make it work are two bits of  information; the date and purchase price of the last market sale of a house. Using these two data points FHFA uses their database to compute an estimated current value. Here is how the input form looks.

information; the date and purchase price of the last market sale of a house. Using these two data points FHFA uses their database to compute an estimated current value. Here is how the input form looks.

This can be done on a state level, but if your MSA Metropolitan Statistical Area is tracked by FHFA the results will be more accurate if you use the MSA search. FHFA tracks over 300 MSA’s. For my case I use Boulder, CO which includes all of Boulder County. FHFA tracks home appreciation by quarter and uses these numbers to estimate a current market value given a homes sales history. Of course there are some limitations. The assumption is that the home was purchased at market value and there have been no major improvements (additions, complete remodels, etc.) which separate a house from the housing stock in general. It is assumed that houses will be improved and maintained over time but the index does not make adjustments for improvements above and beyond the normal.

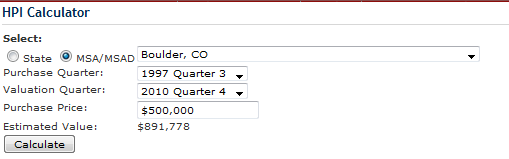

Back to the calculator. In my example the house’s last market sale was in the third quarter of 1997 and it sold at that time for $500,000. Plugging that data in to the calculator along with the valuation quarter of 4th, 2010 (the most recent available), I hit calculate and come up with an expected market value of….$891,778.

What this says is that, if this house held to the average appreciation rates of Boulder County since 1997 the current value would be approximately $891,778. So, does this mean anything? How accurate is this number?

What this says is that, if this house held to the average appreciation rates of Boulder County since 1997 the current value would be approximately $891,778. So, does this mean anything? How accurate is this number?

I ran a test to see how accurate the calculator is for Boulder Colorado. The test is limited and does not hold up to statistical scrutiny but it is a good litmus test. I tracked all of the properties that sold in the City of Boulder in January of 2011 and looked up the most recent previous sale for each property. I then entered that data into the HPI Calculator and came up with an estimated current value. I then compared the estimated value with the actual price the home just sold for.

The results were interesting. Overall the actual home appreciation within the City of Boulder was 5% greater than the expected value according to FHFA. However, the standard deviation (or variance) was quite high +- 29%. That is, on average the calculator gave a value of 5% low but for any given home that value could be off by 29%. Also, note that I threw out four outliers, two high and two low.

So in conclusion, I think that this calculator along with the many others out there can be useful in some instances. I like to use it as a third check to make sure I am thinking along the lines. But setting the price of your home by this or any other online tool is a shot in the dark. Valuation is best done by a thorough analysis of a professional. If you are interested in selling your home and are curious about the value of your Boulder County Home, call me I’d be happy to help you properly price your home.

For a similar study I did on Zillow.com click here.

by Neil Kearney | Feb 23, 2011 | For Buyers, For Sellers, Real Estate 101

You have probably seen the attached picture before – is it a picture of a young women or an old women? The answer is it depends on how you are looking at it. How you perceive it.

One definition of reality is: “all of your experiences that determine how things appear to you”. I agree with this on many levels – I believe you make your own reality and what you know and believe as well as your past experiences effect what is “real” for you. A slum dweller in India has a much different reality than a socialite living in Beverly Hills.

The key word in the definition above is experiences. I submit that this definition is not as true as it once was. Don’t worry, I will tie in to real estate in a moment.

In the past (B.C. through the 19th century), reality was based on what one actually experienced. All inputs to opinion were very localized. For example, when there was a famine, chances were that you were hungry. Perceived reality equaled actual reality. There were no outside forces to sway your perception.

During the last century, technology in all of its forms have provided us a wider set of inputs. I guess this is called globalization. We have access to and know more about more subjects. Where we used to just be concerned with our local experience, we now are fed data on an ever-broadening spectrum of subjects. Google (verb) whatever subject you can imagine and have instant access to other’s research and opinion’s. It is no longer our own experiences that form our perceived reality it is the experiences and knowledge of others.

My point is that our perceived reality may not always equal our actual reality due to the influence of non-localized information. I run into people all the time who can’t believe the sorry state of our real estate market. The problem is that they have no actual experience with the market, their perceptions are based on outside information. When people come in from out-of-town, (or locals who have not been paying attention to the trends) they assume that values have dropped at least 20%. When in fact they have remained relatively stable over the past 5 years. They come from that paradigm when they submit very low offers. It is easy for sellers to realize that these low ball offers do not fit with the market.

Right now, the media has plenty of negative news to report. There is blood in the water and the sharks are in a frenzy. Foreclosure’s in CA, value loss in Michigan, empty buildings in Florida, etc. Bad news all around, a fact. The problem is that people take that news and equate that news to all other areas. The message is that the market is bad, the conclusion is that the market is bad everywhere.

I get asked all the time what a reasonable offer would be. My answer depends upon many factors but hard data also helps bring a good perspective to the negotiations. Over the last year in Boulder County, real estate transactions have had the following average negotiation percentages in each price range:

$0 – $250k 3.15% (1,307)

$250 – $500k 2.95% (1,550)

$500 – $750k 3.99% (498)

$750 – $1 MM 5.24% (141)

$1 – 1.25MM 8.2% (58)

$1.25 – $1.5MM 8.35% (35)

$1.5 – $2MM 9.9% (22)

>$2MM 8.65% (23)

Numbers in parenthesis represent the number of sales in that price range.

Perception does not always equal reality. While the market in Boulder County is not stellar, it is much better than what you would think by listening to the news. Prices are holding, properties are selling and foreclosures are not a big part of our market. We are very lucky and I’m spreading the word! When you are ready to buy or sell give me a call. I’m here to help. Neil 303-818-4055

by Neil Kearney | Nov 15, 2010 | For Sellers, General Real Estate Advice, Real Estate 101

I get calls all the time asking for advice on whether it would be smart to do a particular remodeling project around their home.  Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Many times it is tough for me to make the call for them. I look at houses all the time and see what buyers like but in most cases improvements don’t pay off right away. For instance according the Remodeling Magazine’s Cost vs. Value Report 2010-2011 a two story addition in the Denver area will cost $155,903 and give added resale value of $118,301. This means that an owner could expect to get about 76% of the value out of that project. Not exactly a strategy from the pages of Trump – The Way to the Top.

Okay, we have established that you won’t get back all of your money if you do a home project but what if that scares you into paralysis? Say you have owned your home for 15 years and during that time you have done nothing but change the filters in the furnace. This strategy, in my opinion works even worse than improving your home right before closing. In the case of the do-nothings, the value of their home will lag behind the neighborhood in general. Their home will stay on the market longer and in the end sell for a lower price. Again not a way to get rich quick.

I think the best strategy for maximizing the value of your home over time is to make incremental changes over time. Take on a project every six months or 1 year. For example, take a six month period to remove the old wallpaper and repaint. Next, re-do the powder room by removing the wall sized mirror and replace with a framed mirror and replace the lighting. Next re-tile the master bath. After a few years your house will start looking refreshed and will be one of the nicer ones on the block. And when you go to sell it you won’t have much to do to get maximum value. Also, you get to live in a much nicer home. Not just fix it up for someone else. There is value in that!

Here is a sample of the value of Midrange projects and their pay back in the Denver market:(ranked in order of pay back percentage):

- Garage Door Replacement – cost $1,228 – cost recouped 93.1%

- Steel Entry Door Replacement – cost $1,165 – cost recouped 86.1%

- Minor Kitchen Remodel – cost $21,035 – cost recouped 79.6%

- Vinyl Window Replacement – cost $10,330 – cost recouped 77.1%

- Wood Deck Addition – cost $10,721 – cost recouped 75.1%

- Major Kitchen Remodel – cost $53,032 – cost recouped 73.5%

- Master Suite Addition – cost $100,775 – cost recouped 74.5%

- Family Room Addition – cost $79,383 – cost recouped 70.6%

- Basement remodel – cost $62,115 – cost recouped 63.2%

- Roofing Replacement – cost $17,943 – cost recouped 61.8%

For copyright reasons I can’t display the report on my website but if you would like a copy of the full report which includes midrange and upscale projects and defines the scope of each please let me know. I can send you one if you request one to neil@neilkearney.com.

To see the associated web page go here.

For more information this topic see my post on list price vs. condition.

From HGTV a before and after.

by Neil Kearney | Nov 2, 2010 | Boulder County Housing Trends, Real Estate 101

Foreclosures have been in the news for a number of years. It goes in cycles. I bought my first condo in 1992, it was a HUD

1992, it was a HUD  foreclosure. The combination of loans with adjusting interest rates, too easy credit a few years back, overly optimistic buyers, falling values and a deep recession have brought us foreclosures in waves that keep on coming.

foreclosure. The combination of loans with adjusting interest rates, too easy credit a few years back, overly optimistic buyers, falling values and a deep recession have brought us foreclosures in waves that keep on coming.

The latest in a long line of foreclosure news is the robo signer scandal, and the revelations that foreclosure sales were not processed properly therefore the sales are not valid. I’m not an attorney and I’m not an expert of foreclosure laws or proceedings but it seems to make sense that the basics should still apply. If a homeowner misses payments they are in breach of the agreement they signed at the closing. When in breach of the agreement the bank has the right to take the house back subject to the laws of the state in which the house sits. Those laws should be followed and the correct procedures should be done in the correct order but … Let’s get back to basics, the homeowner agrees to pay, and when they don’t they lose their rights to live in the house. It’s really that simple.

I favor loan modifications which seem to work better for everyone. But it seems that many of the loan modifications haven’t worked. The easy credit prevalent in the mid-decade approved people who can’t or won’t keep to a credit promise, modified or otherwise.

Once the bank has the house back they need to take enough due diligence so that the deed is conveyed correctly. And what if they don’t? Just as they have with the robo signers. I think that to negate sales and muck up the process with minutia is a disservice. Make the corrections that are needed to clear title and move on. Get it right, don’t take another victim by throwing the baby out with the dirty bath water.

by neil kearney | Oct 16, 2010 | Real Estate 101

The recent fires have brought an interesting question to mind. Would you know exactly what you lost if you lost everything? Sure you would remember your TV and your car and your appliances and your bed. But would you remember the silver serving dish in the cabinet or what is on your storage shelves or every picture on every wall?

We make assumptions like our house will always be there when we return or that we would remember what we have. Well, both of these are just assumptions. Material possessions don’t rule my life but I wouldn’t want to be wracking my brain for six months trying to remember so here is a tip. Do a home inventory and store it somewhere safe.

I haven’t checked the security of it but I have found an online solution that can work in conjunction with photos and videos to keep track of your possessions. This will significantly speed up the time needed to settle an insurance claim and will help you determine if you have the appropriate amount of coverage. The site is www.KnowYourStuff.org and it is free. Check it out and just do it.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas.

You can see that the property valuations in the Boulder decreased by 1.7%, decreased by 4% in Longmont, but increased by 4.2% in Superior. Values in Niwot showed the most depreciation as they dropped 6%. Graphically it is even more interesting when they broke it down into geographical areas. Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.

Within the City of Boulder the assessed values varied from an increase of 3.8% in the Martin Acres area to a decrease of 5.9% in Northwest Boulder which includes, Dakota Ridge, Wonderland Hill and the Holiday neighborhoods.