by Neil Kearney | Apr 2, 2013 | For Sellers, General Real Estate Advice, Real Estate 101, Uncategorized

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet.

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet.

I don’t sell cars, appliances or stocks so I will comment on what I know and work with every day. In a recent post I commented on the best practices of the home buyer in a hot real estate market. Today I’m going to share my ideas on how to be a smart home seller in a sellers market.

Price it Right

In the Boulder area real estate market we are seeing very low inventory and high demand. This causes a shortage of homes and results in smart sellers getting multiple offers and selling their homes for more than they thought they might.

But this isn’t happening to all sellers. Here is a scenario I’m seeing a lot right now – Mr. and Mrs. Seller recognize that the market conditions favor them so they decide to price their home 10 – 20% higher than what the recent sales in the neighborhood show. Buyers come out to see the home in great numbers over the first week and the general sentiment is that the house would be acceptable but it’s not a house they want to break the neighborhood record on and they move on. The Sellers recognize a few weeks later that they are not going to get their “dream price” so they reduce it by 5%. Still too high for the market but by this time the market wave of activity for a new listing has passed and they are chasing.

A smart seller in this market looks at the recent sales and the competition with their Realtor and decides on a fair market value. They recognize that the market will bear a good price but they know that the house must appraise and be in good condition. If it is listed at a reasonable price near market value and in good condition there is a good chance there will be multiple offers.

Take Advantage of the First Wave

As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.

As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.

At any one time there are (hopefully) many buyers who are in the market for homes in any given area or price range. In a market with low inventory they soon sift through the current listings (either in person or online) and decide that they are not willing to buy any of the current homes on the market. So they focus on what is coming on the market. Here is where a good Realtor is invaluable. This buyer cannot wait for an open house or wait for the Sunday paper. Buyers are trolling online at all times. I have automatic searches sending results to hot buyers three times a day. So when a new listing hits the market buyers flock to see if this is the “one”. If it is they want to be first. The current buyers waiting for new listings are the first wave and right now it is a strong wave that lasts 3-4 days and comes in strong. In this market it is not uncommon to have 15 showings within the first four days. These are the most likely buyers.

If a home lasts through the first wave without an offer you know something is off (price, condition, location). After the first wave passes you, as a seller, are counting on people who are new buyers and those who were not available to see the property over the first days. This is a smaller pool. You are in the backwash.

Multiple Offers

If you have priced the home correctly the hope is to get multiple offers on your home. This puts the seller in a advantageous position and with guidance from their Realtor, they can compare the merits of multiple offers and choose the best one. I find it’s best to give all potential buyers in a multiple offer situation equal information. For me, that means each offering party knows when the offers will be considered and how many offers they are competing against. As a sellers agent I encourage buyers to bring their highest and best offers and give everyone a chance to revise their offers if they choose to do so. I then go through each offer with the seller and let them decide which offer gives them the best chance to close for the most money.

Get a Backup Offer

There are many reasons that a house that is under contract doesn’t close. Here are a few:

- Buyers Remorse – This is especially common when the buyer feels pressure to make a quick offer and then feels that they have paid too much after beating out multiple bids.

- Inspection – When there is time pressure to submit an offer there is not time to look at the home carefully or to show family members. This makes getting through the inspection especially important.

- Appraisal – Just because a buyer is willing to pay a certain amount for a home doesn’t mean that the appraiser or the bank will agree. If the appraisal comes in low and the buyer doesn’t have additional funds available to mitigate the banks risk the contract will terminate unless the seller is willing to re-negotiate. And if there were multiple offers, it is a good chance that the sellers will not re-negotiate.

It’s for these reasons it is smart to encourage a backup offer. And the best time to get a backup offer is when there are multiple offers. All it takes is to create a quick counterproposal with appropriate language. It is a no risk insurance policy which is usually a win-win.

Inspection Issues

If a buyer has paid a premium price for a home it is common for them to be very picky on the inspection. They feel the home should reflect the price and unless an “as-is” clause was included in the contract you can expect to be negotiating again on some inspection issues. As a seller your negotiation position is greatly enhanced if you have a backup offer. A good gauge as you consider the buyers requests is whether another (the next buyer) would likely require the same items. If so, it might be a good idea to negotiate in good faith and move forward.

Finding a Replacement Home

The advantages of a tight market on the selling side lead to difficulty if the seller needs to find a replacement home that will not require a double move. In a strong sellers market, the sellers must have a plan of where they are going to go. Don’t get stuck in a situation where you are homeless for a period of time. Plan ahead!

Since each transaction is different it is hard to anticipate all scenarios but those are some of the major considerations when a seller is looking to list their home in a sellers market. If you are looking for expert representation in Boulder County call me, I have been successfully working in this market since 1991.

by Neil Kearney | Jan 29, 2013 | General Real Estate Advice, Statistics

The year end statistics are coming out from various sources around the country and the broad consensus is that real estate had a surprisingly strong rebound year. Here are a few recent articles that summarizes the state of real estate across the union.

The year end statistics are coming out from various sources around the country and the broad consensus is that real estate had a surprisingly strong rebound year. Here are a few recent articles that summarizes the state of real estate across the union.

The premise of this article is that nobody predicted that 2012 would see real estate price appreciation. Here are a few excepts:

Looking back at the survey from December 2011shows that around 42 panelists, of the 94 that made their predictions public, saw prices declining on a year-over-year basis in 2012. The other 52 said prices would either rise or remain flat in 2012. Panelists base their home-price estimates on what they expect the Standard & Poor’s/Case-Shiller 20-city index to show.

Even the most bullish respondent in the late 2011 survey may have understated the actual 2012 home price gain, which won’t be tabulated and released by Standard & Poor’s until late February. Constance Hunter, the deputy chief investment officer of AXA Investment Managers, called for a 4.4% gain. In October, the Case-Shiller 20-city index stood 4.3% above last year’s level. (By March, Ms. Hunter revised down her forecast, calling for a gain of just 1.7% for 2012).

It is well known and well reported that the housing sector was a key force in the economic downturn. The sub-prime mortgage mess, foreclosures, home depreciation, construction stoppages were just some of the negative subjects related to real estate over the past few years.

For most people, their home is their biggest investment and with the value of that investment so goes their confidence. During the first six years of the 2000’s the United States saw a rapid rise in home prices (that’s what a bubble is called before it is recognized as such) and with that rise came a flooding tide of confidence that spurred the economy. During 2007 – 2011 just the opposite was true. With falling sales and falling prices confidence waned and everything from construction to appliance purchases suffered.

The economists surveyed also forecast that there will be just under 1 million housing starts this year — roughly matching the 28% rise in home building in 2012. Moody’s Analytics is forecasting much stronger growth — a 50% rise both this year and next year, which it estimates will create more than 1 million new jobs.

“There’s a lot of pent-up demand for housing, and very little supply,” said Celia Chen, housing economist for Moody’s Analytics. “As demand continues to improve, home builders have nothing to sell. They’ll have to build.” She said that growth in building will mean adding not just construction jobs, but also manufacturing jobs building the appliances and furniture needed in the new homes, which in turn drives overall consumption higher.

Home sales in Boulder County were up 23% during 2012. For us this was the most sales since 2007. Nationally sales increased by 9% last year and were the best (in terms of number of sales) since 2007. Here are a few excerpts from the article.

Sales are being helped by a combination of strong market fundamentals — near record low mortgage rates, lower unemployment and a rebound in home prices, all of which are bringing in buyers into the market who had been waiting for it to hit bottom. The mortgage rates and years of depressed home prices have also combined to create the most affordable housing market on record, according to the Realtors group.

And the Realtors are predicting strong sales should continue into 2013 and beyond. It has a forecast for 5.1 million existing home sales this year, and 5.4 million next year.

The “Realtors Group” refers to the National Association of Realtors.

The improved demand for homes in December led to the inventory of homes for sale to fall to 1.82 million homes on the market, the lowest supply since January 2001. One factor in tightening supplies is a drop in foreclosures and other distressed home sales, which made up only 24% of home sales in December compared to 32% a year ago. The tighter supply, and the drop in distressed sales, have helped to lift home prices so that the median sales price for the year rose to $176,600, up 6.3% from 2011. That’s the biggest gain in prices in since the bubble year of 2005.

It’s good to see that I’m not the only one expecting a strong year this year. As I predicted last year, we were one of the first markets to recover and our recovery was stronger than most.

by Neil Kearney | Dec 14, 2012 | General Real Estate Advice

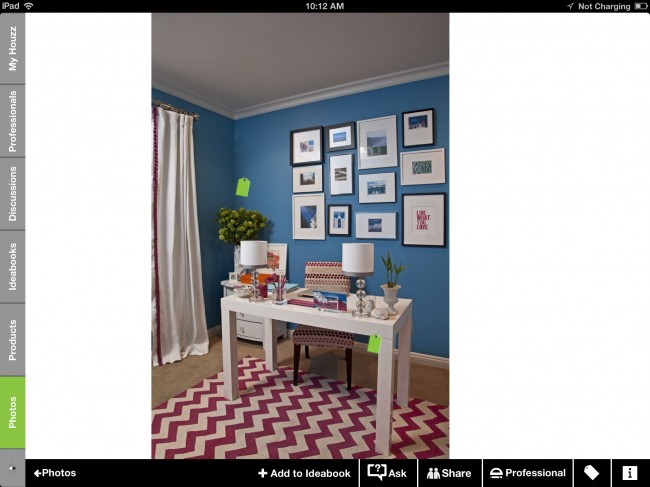

In looking at homes all the time so I see properties in all conditions. In my area most homes are well kept but only a small percentage of homes I see are “wow” properties. In order to get to the “wow” status a house must be upgraded, decorated and cared for in an integrated way. It is hard to make this happen. Many times I see a home with a beautiful upgraded kitchen but it stands by itself like Yao Ming in an elevator. While the kitchen is beautiful the baseboards are old and beat up. The hall bath is circa 1970’s and the furniture in the living room has nothing to do with the artwork. In a word the house is disjointed.

One way to move your house towards a “wow” is to look at examples of other beautiful homes and pick up ideas that would work where you live. Technology has made this much easier and recently I found Houzz.com and the Houzz app. This site allows you to search through almost 1 million tagged photos of beautiful homes and save your favorites to what they call an Ideabook.

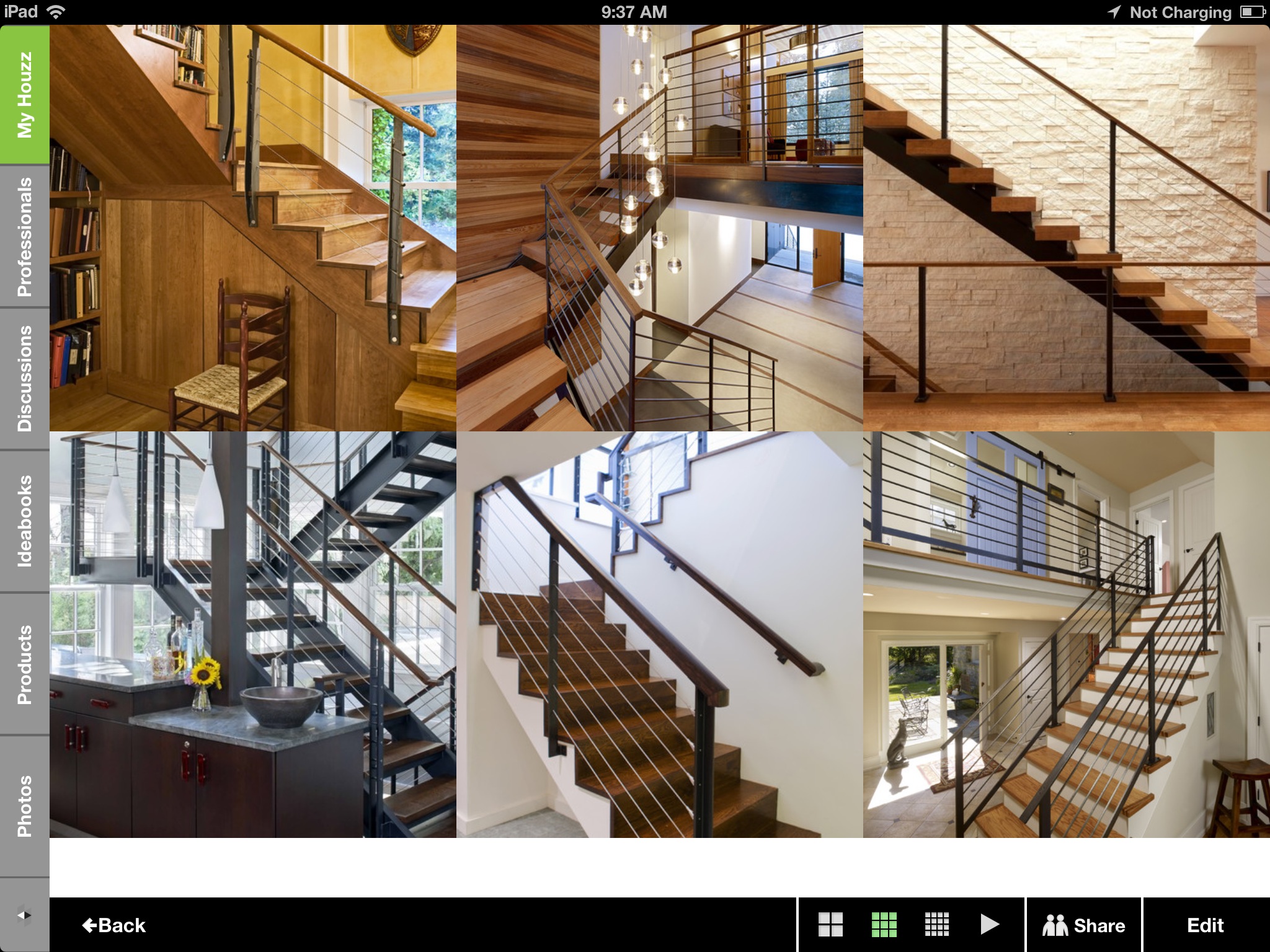

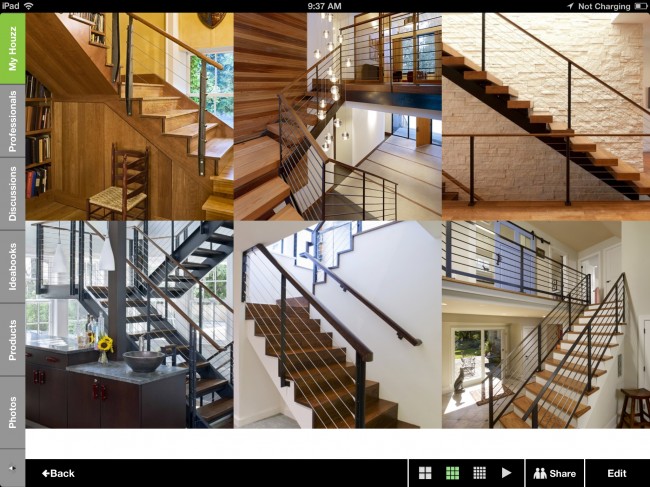

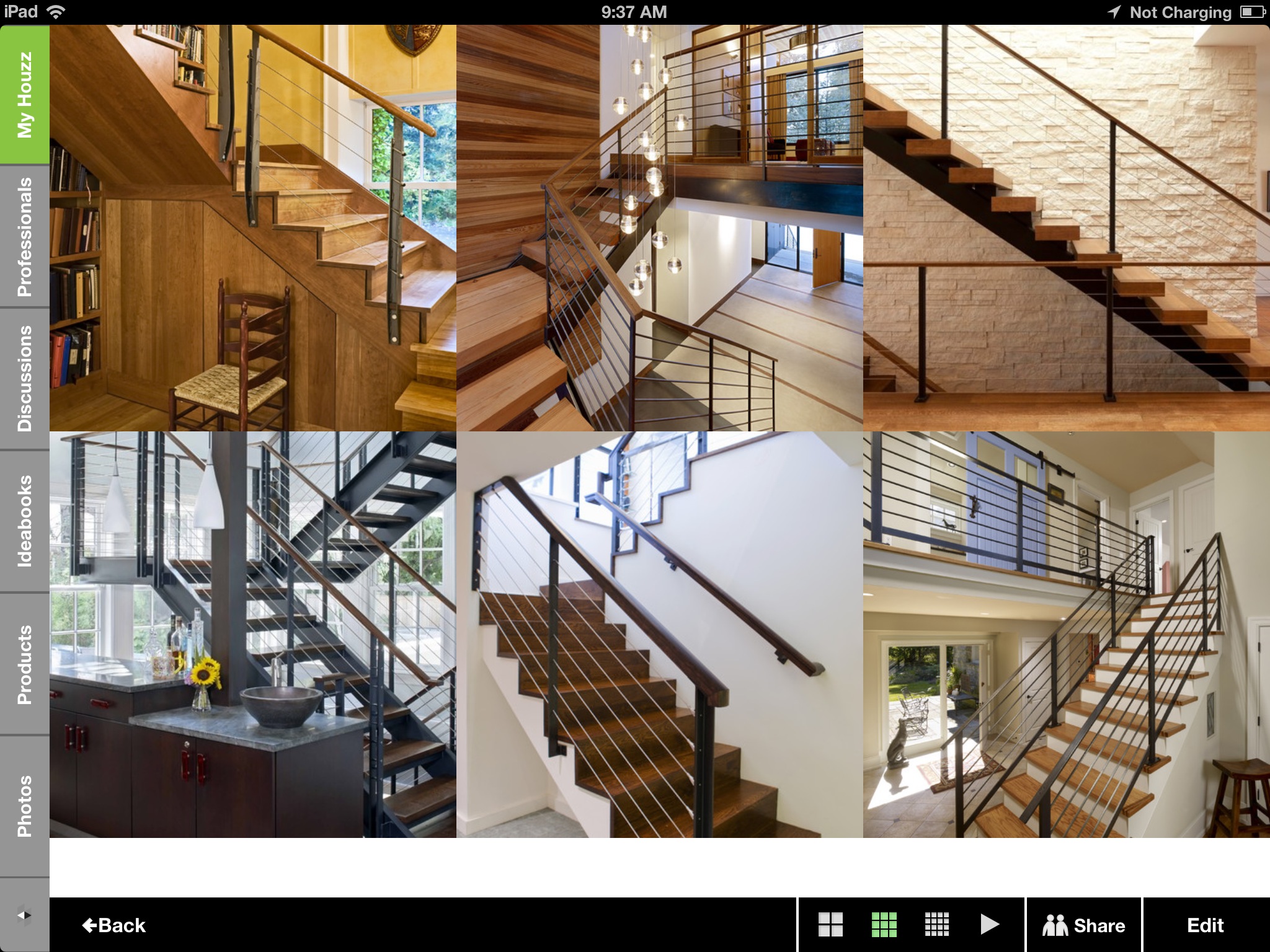

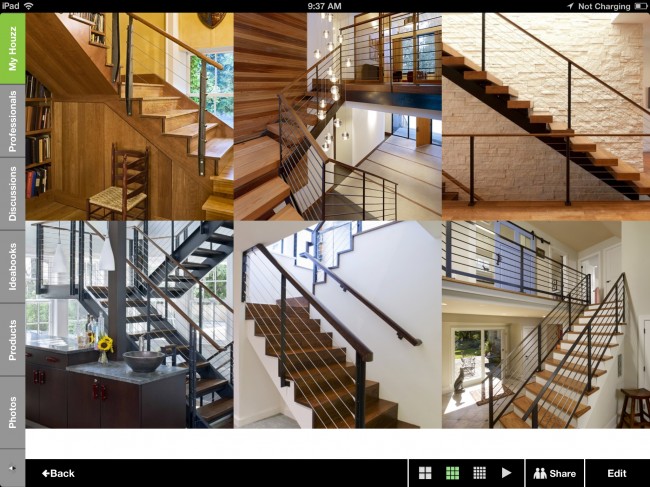

Here is a screenshot from my iPad of my ideabook titled stairway railings. When I searched for stair railings the app returned 51,177 results of beautiful pictures of stairway railings. I can then focus my search for stair railings in a certain metro area. So for example I chose Denver, and that reduced the list of stair railings to 853 photos.

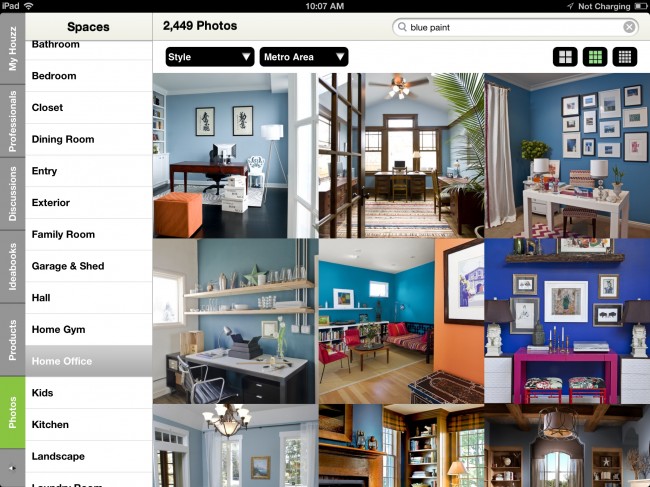

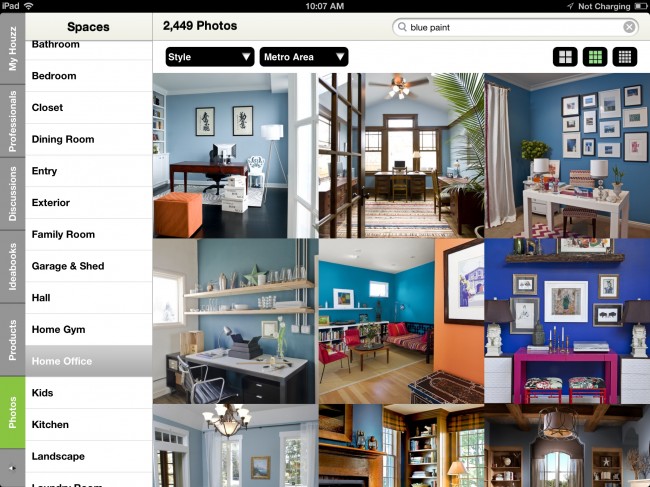

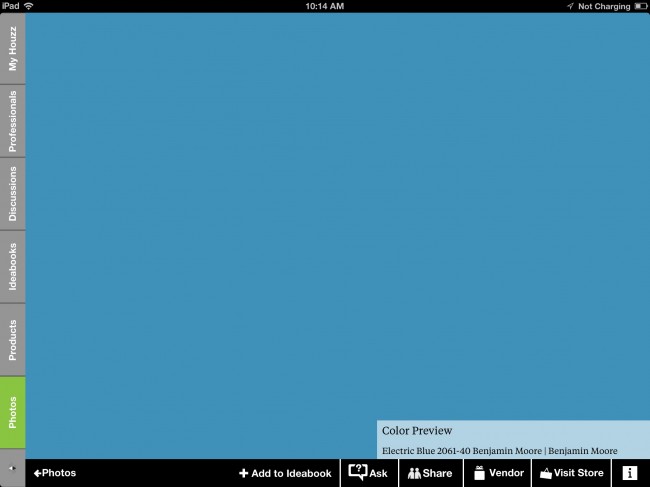

The searches can be even more esoteric. I recently searched for “blue paint” and came up with 109,970 photos. I narrowed it down to blue paint in a home office and came up with 2,449 photos.

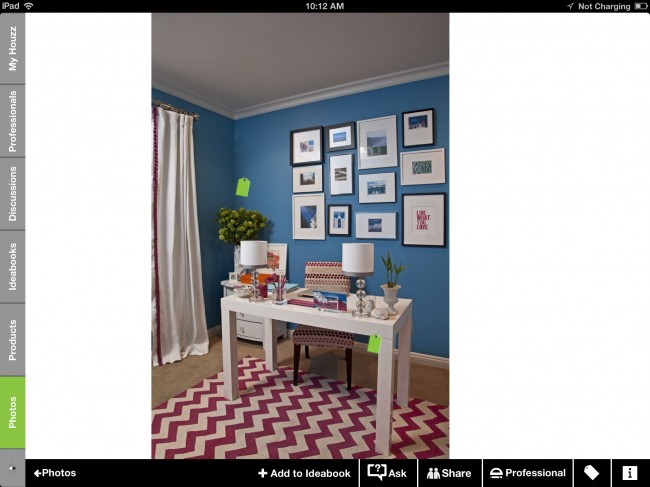

On the iPad app, once you choose one photo you can scroll through the photos by swiping your finger. As you look through the photos many of them have little green tags which are links to information on that product. Since I was looking for blue paint I found a wall color I liked, clicked on the green tag and found out what color it was and where to get it. A much better process then going to the paint store and holding up small paint squares. Here are some screen shots showing that process.

I wanted to share this with you because I know I have found it helpful with many applications recently. If you are looking to upgrade your home I would recommend Houzz.com as a great starting place.

by Neil Kearney | Mar 21, 2012 | For Sellers, General Real Estate Advice, Real Estate 101

A few days ago I went through what a buyer needs to think about and do after they have successfully placed a contract on the home.  To read that post click here. Today I’d like to talk about the sellers side of the real estate transaction.

To read that post click here. Today I’d like to talk about the sellers side of the real estate transaction.

Finding a buyer and agreeing to an acceptable price and terms with a buyer is one of the high points of a real estate transaction. No more daily showings, no more uncertainty, making plans for the future, it’s exciting stuff. But then comes the realization that you are only part way to the finish line. There is still work to be done. This is a checklist of items that the seller is responsible for between contract and closing.

Order Title Commitment – In Colorado the seller is responsible to providing the buyer a title insurance policy in conjunction with a real estate purchase. The first step of this process is ordering the title commitment. The listing agent usually handles this for the seller. This is also a great time to provide to the title officer the information on your existing loans which will need to be paid off at the closing.

Homeowners Association Documents – As per the Colorado approved real estate contract the seller will provide the buyer a copy of the relevant HOA documents. This shall include bylaws, rules and regulations, financial documents, minutes from the most recent meetings. Again, this is something that the listing agent usually tries to supply (at least I do) but sometimes the information is embedded in a members only website and the Realtor might need help with this.

Gather Paperwork – The buyer will want to have any relevant documentation regarding the home. In conjunction with the disclosure requirements the seller must supply the buyer any prior inspections or reports that give insight to the condition of the home. This would also be a good time to gather any manuals and warranties and set them aside before your packing gets into full gear.

Prepare for Inspection – Just because most of the showing activity has subsided it doesn’t mean that you are off the hook for keeping the home looking good. I would argue that the inspection is your most important showing and the house should be prepared as well as possible. In addition to the general cleanliness here are a few tips to help the inspection. Replace the furnace filter and clean the humidifier filter if you have one. Move boxes and or furniture away from access points for plumbing, heating and electrical. It is common that a buyer will perform a radon test and the protocol for a radon test is that the house will be closed up for 12 hours prior to closing as well as 48 hours throughout the test. However, it is a really good idea to “air out” the lowest level of the home prior to the closed house conditions.

Make Your Arrangements – Start making arrangements for moving, storage, packing and cleaning. Consult with your Realtor so that you are sure that you understand the timing of when you need to be out and cleaned. After the inspection it is also a good idea to contact the utility companies to let them know about an upcoming transfer in service. Once the deal is rock solid, put in your change of address request to the postal service.

Inspection Items – Once the inspection has been done and the agreements surrounding the inspection has been made, some work will need to be done. My advice here is to get the work done as soon as possible, don’t cut corners and follow the letter of the agreement to a “t”. The listing agent is there to help you get this work done if you need help.

Clean and Closing – The days surrounding closing will be busy days. You will need to pack, clean and supervise work maybe at two locations. My advice regarding how you leave the home is based on two things. Look at the contract and make sure you are doing the minimum required and then consult the Golden Rule. How would you really like a home to be left for you? When the house is really left in good shape and the buyers feel that they are being treated well, the closing is much easier for all involved.

This list is based on my experience and is from the sellers perspective for a sale in Colorado. If you hire a good listing agent, many of these items will happen seamlessly and you will be left to focus on getting your stuff packed and ready to go. I have been a Realtor based in Boulder Colorado since 1991 and I love doing those small things that make it easier for you. When you are ready to list, give me a call – Neil Kearney 303-818-4055

by Neil Kearney | Mar 19, 2012 | For Buyers, General Real Estate Advice, Real Estate 101

Once you have found a home and had a successful negotiation of the offer there are still many steps that need to be completed before you can move in. Here is a primer on the steps that take place between contract and closing from the buyers perspective.

Set The Inspection– It is the buyers responsibility to set and pay for any and all inspections on the home. There are no required

Photo doesn’t have anything to do with the subject, but I took it and thought it was cool.

inspections in Colorado. As a buyers agent or a transaction broker, I provide a list of inspectors that my previous buyers have liked, but a buyer may choose and use any qualified home inspector. It’s a good idea to ask about their services and experience as well as the insurance they carry. The buyer is ultimately responsible for any damage that an inspector may do while at the home. Most inspectors now use digital photography and provide pdf reports which are helpful during a negotiation. In our area radon is common and a radon test is an additional test that an inspector will do for a fee. Read this post to learn more about radon. Keep in mind that all inspections shall be completed prior to the inspection objection deadline as stated on the contract.

Formal Loan Application – Once there is a fully executed contract your lender can then set up a file and start moving your loan forward toward underwriting approval. At this time you will have the option to lock-in an interest rate. While you may have already provided some documentation to the lender. Once they are in the formal approval process (as opposed to pre-qualification or pre-approval) you will undoubtedly need to provide your lender documentation on income, debts, tax returns etc. Please provide these documents as quickly as possible so that any delays can be avoided down the line.

Review Paperwork – The seller will be providing (in most cases through the title company) paperwork regarding the title transfer, property taxes and the Homeowners Association. Your agent and lender will also be reviewing the title documentation for anything abnormal but it is in your best interest to review them carefully yourself or hire an attorney to review them so that you understand what you are getting when you purchase this particular property. The HOA documents will tell you the rules you are agreeing to abide by as well as the financial structure and health of the association. The turnaround time on looking at this information is fairly quick so don’t put it off.

Attend The Inspection – The inspection is the best chance for you to get to know your new home in an intimate way. Following the inspector around for a few hours will give you some good insight on the overall condition of the home as well as a thorough understanding of the conditions that you may ask to be repaired by the seller. As an agent I usually just attend the summary or get the report via email. I leave the inspection itself to the experts. Keep in mind that unless the home is brand new there will be some items that the inspector will point out. It is the inspectors job to be detailed in their inspection.

Inspection Objection with Agent – The next step in the process is to decide a course of action after the inspection. A buyer in Colorado has three choices: 1) move forward as-is and don’t ask for anything; 2) terminate the contract; 3) make a list of unsatisfactory conditions on an Inspection Notice form and present those to the seller. Work with your Realtor at this stage to strategize the best negotiation scenario. It’s best to remember that in most cases focussing on the major issues and/or safety issues will allow for the most productive negotiation with the seller. In my experience, sellers get annoyed if a buyer asks for too many trivial issues. Keep it simple, be specific and hold to the major points.

Other Items – During this entire time you will be making plans regarding moving and packing. Contact your Realtor as to when is a safe time to put non-refundable money down on any services. During this time you will also need to start contacting the local utility companies. This is especially important for those who work at home or depend upon an internet connection. One of the most important things to remember is “DON”T BUY ANYTHING!” Lenders check credit again just before closing and taking on additional debt can spoil the whole deal. Wait on the furniture, wait on the appliances, wait on the new car until after closing. At closing you will need to bring good funds to the closing. This means that you need to bring either a cashier’s check or wire funds in advance to the title company. You will get the exact amount to bring a day or two in advance from the title company via your Realtor or lender.

Closing – Finally it is the day of closing. One of the last stops before going to the title company to sign papers is back to the house for a final walk through. During this final walk through you get one last look at the house to make sure nothing has changed. You make sure that the agreed upon inspection items are complete and you make sure the items that are included are still there. The closing itself lasts about an hour and the buyer does the majority of the signing. In addition to your money make sure you bring a picture ID. The closing is a time to close up any loose ends. Connect with the seller and ask about the neighbors. It is not a time to renegotiate or hold grudges about past negotiations. After an hour or so you will get the keys and you are ready to move in.

Throughout the process it is most helpful to have an experienced Realtor there by your side to help you along and negotiate on your behalf. I have been helping buyers in the Boulder Valley real estate market for over twenty years. I’d love to put that experience to work for you.

by Neil Kearney | Feb 13, 2012 | Featured, For Sellers, General Real Estate Advice

What makes one house sell while another one lingers on the market? What causes one house to get multiple offers and another to seem to repel buyers? Is it the location? Is it the condition? Is it the marketing? (more…)

seem to repel buyers? Is it the location? Is it the condition? Is it the marketing? (more…)

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet.

Most homeowners throughout the United States are having a collective sigh of relief. The home sales market is recovering and prices are rebounding. Between good news on the home front and a strong bull stock market, many people have a positive outlook on their personal finances. This is called the wealth effect and the result is a loosening of the household wallet. As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.

As I mentioned above there is a timeline for new listings. In basic terms here is how it works and why it is important.