by Neil Kearney | Sep 30, 2011 | For Buyers

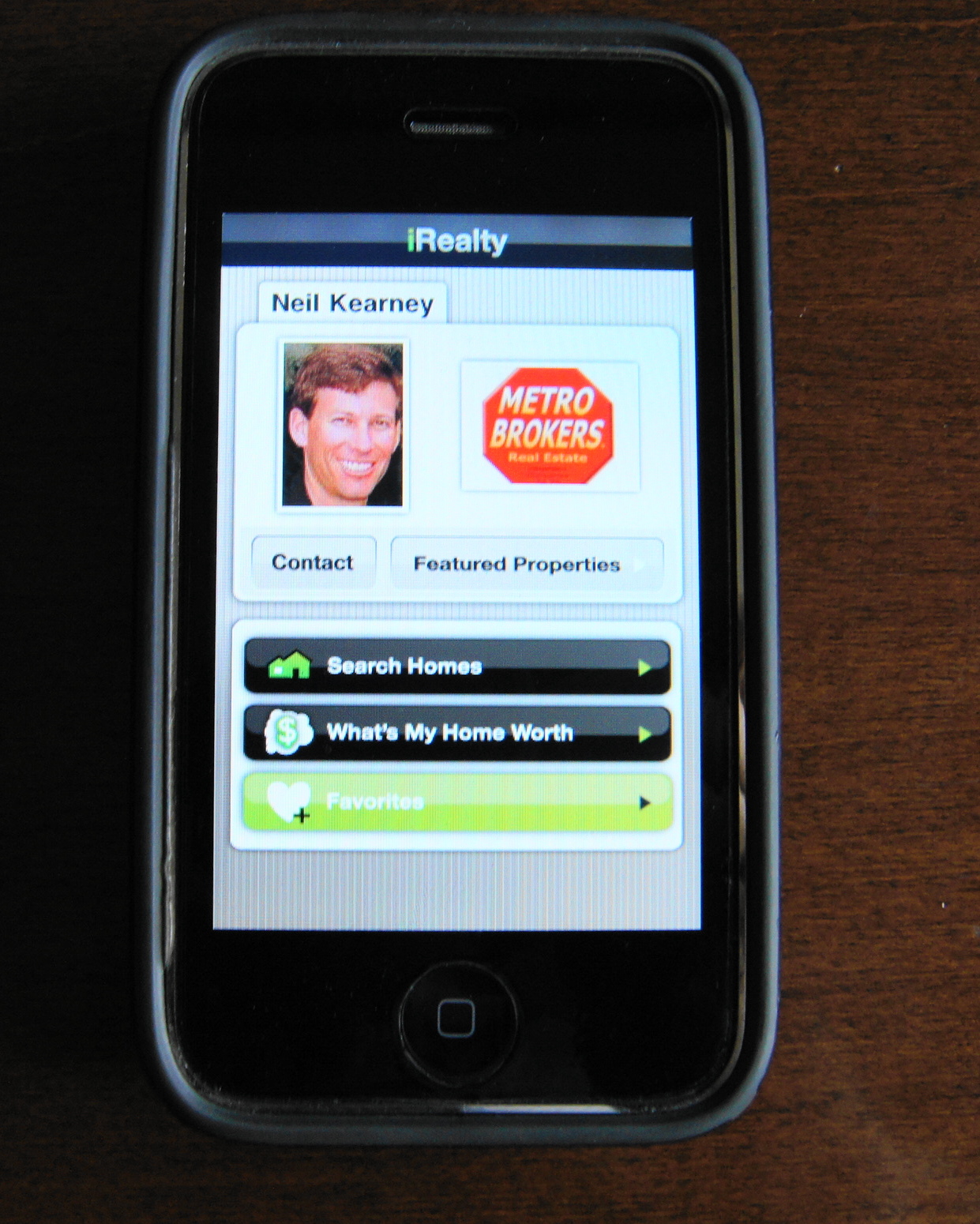

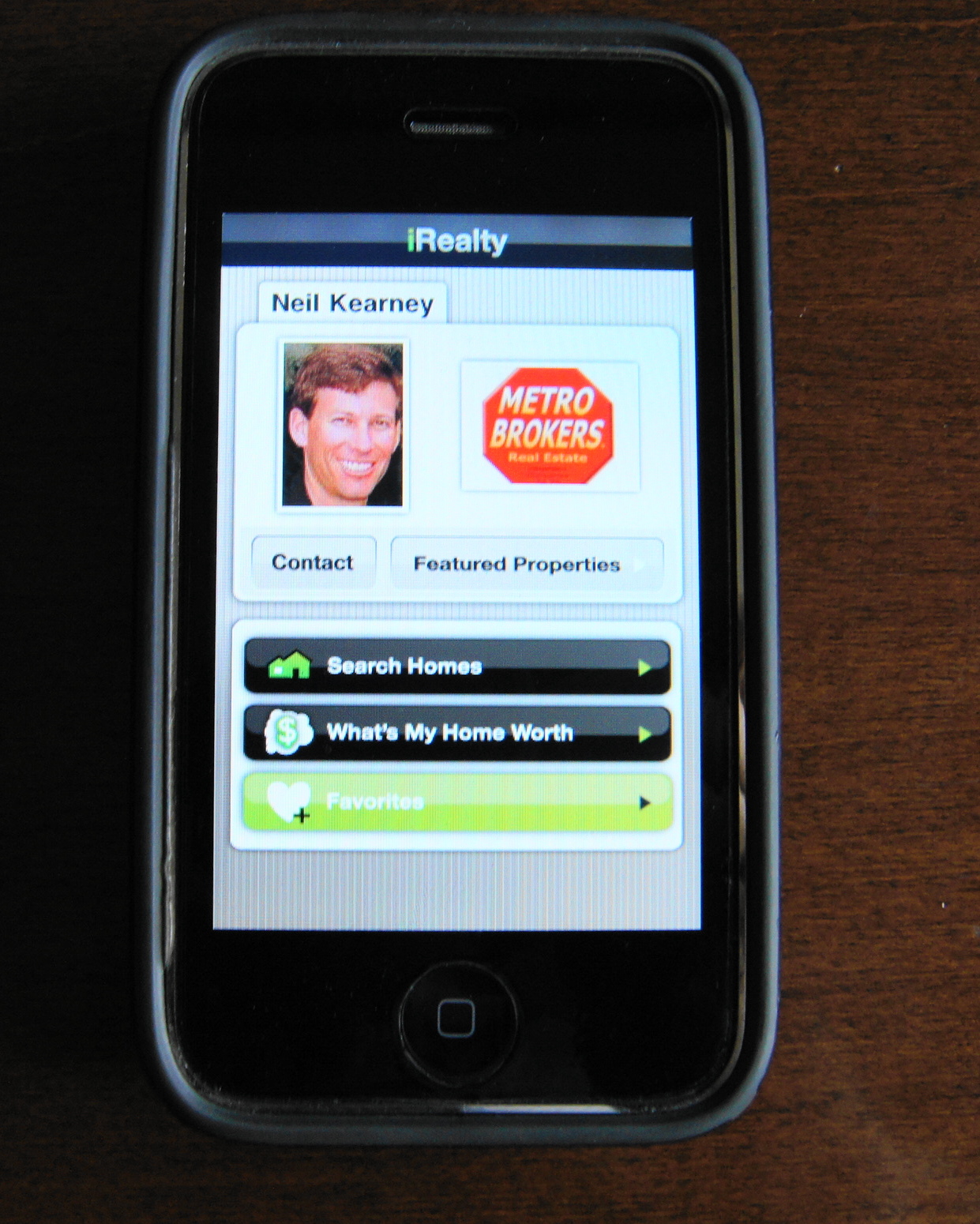

This is a mobile world. People don’t want to wait for answers when they are used to getting all of the information they need right now on  their phone. This is especially true when you are curious about a house when you are out driving around. This is why I am pleased to announce my new home search application for mobile phones! It works for iPhones and Android phones and is easy to use, up-to-date and uses data that comes directly from my local MLS. I’d love for you to use it.

their phone. This is especially true when you are curious about a house when you are out driving around. This is why I am pleased to announce my new home search application for mobile phones! It works for iPhones and Android phones and is easy to use, up-to-date and uses data that comes directly from my local MLS. I’d love for you to use it.

- GPS-based property searches

- Interactive mapping to view properties for sale in surrounding neighborhoods

- Create, maintain and share your Favorites Folder

- Create New Listing Alerts

- View comparable Sold Homes

- Share listings with your Friends and Family

- View my Featured Properties

- And much more . . .

To download the app from the iTunes store click here.

To download the app from the Android Marketplace click here.

Once downloaded the agent ID to make it work is NEIL.

If you are looking for a reliable home search tool for Boulder County use my property search located on this website. You can save your favorites!

by Neil Kearney | Sep 28, 2011 | For Buyers, General Real Estate Advice

Many times you will see “Home Warranty Included!” on a property listing. This sounds good right? But many times  prospective buyers who negotiate for home warranties have the wrong idea about what a home warranty is and what it covers. Here are some answers.

prospective buyers who negotiate for home warranties have the wrong idea about what a home warranty is and what it covers. Here are some answers.

A home warranty is basically a very limited insurance policy that covers certain home systems and appliances for a fixed time period. Usually when a home warranty is provided as a buyer incentive the warranty is good for one year after the closing. The cost of basic coverage is typically $275 – $400 and covers plumbing, heating, electrical, major appliances and water heater. There are limitations in coverage and plans do not cover preexisting conditions. Home warranties do not cover mold or structural damage.

Once the warranty is in place the new owner would call the warranty company first when an issue that requires a repair person to be called. The warranty company contracts with certain companies and sends them out to diagnose and fix the problem if it is determined to be covered. At the time of repair the owner pays a deductible. The owners share is usually around $50 to $60 per occurrence.

So is it worth it? Just like any insurance policy you need to weigh the probability of something happening and the severity of the cost if you didn’t have coverage with the cost of the coverage upfront. If someone else is paying it is definitely a good thing to have. If you are paying $400 year after year it may not pay off in the long run but it is an amount that is easy to budget and you won’t be surprised one year by needing a new furnace etc. The other consideration is the age of the home. If it is a newer home the chances of having a problem each year are relatively low. If you have an older home with older appliances the chances of needing repairs on a consistent basis increase.

Here are some home warranty providers in Colorado:

by Neil Kearney | Aug 16, 2011 | For Buyers, General Real Estate Advice, Real Estate 101

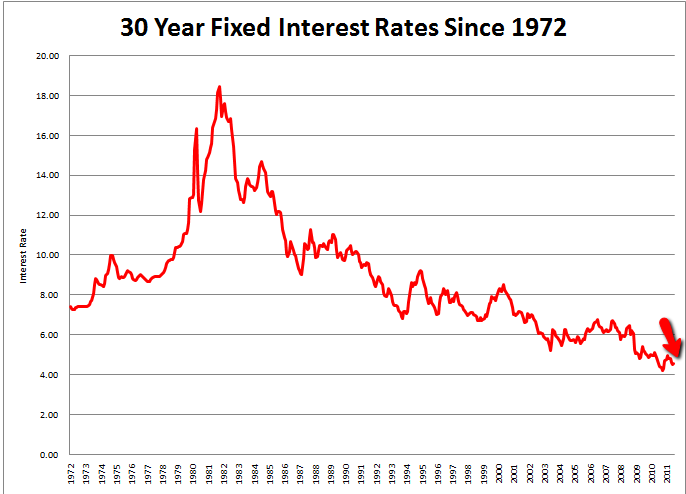

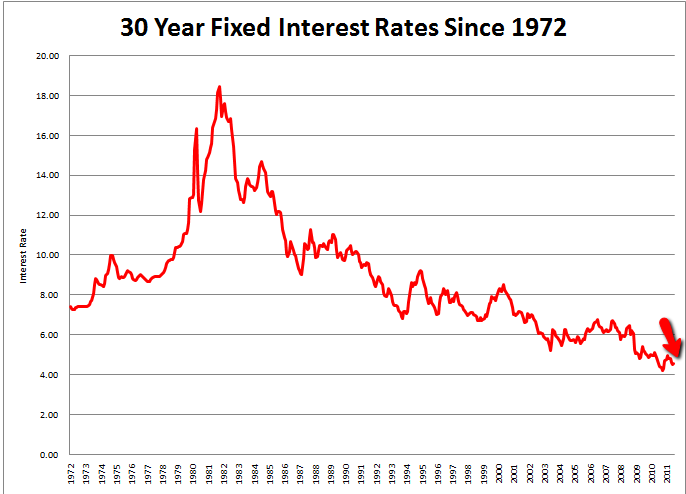

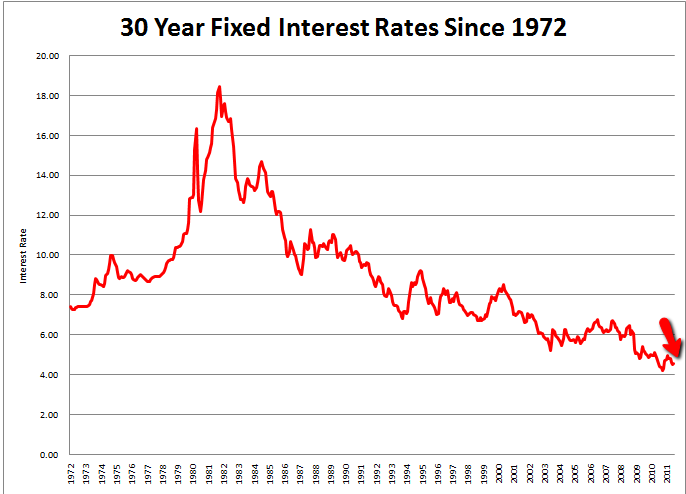

It seems like I have been saying this for years but now would be a fantastic time to buy a property. As interest rates drop the payment on the mortgage falls. What is surprising is how much. Say you have a $300,000 mortgage at 6% right now. 6% used to be a great rate. Anyway, right now for the same amount of monthly payment you can purchase a home with a $375,000 mortgage. That is $75,000 of free money! The effects can even be more dramatic if you have been in your home and have accumulated some equity. I am working with a buyer now who is purchasing a home $150,000 greater than their old home and their payment will be virtually the same. Did I say this is a great time to buy?

by Neil Kearney | May 24, 2011 | For Buyers

If you bought a home in 2002 for $400,000 your payment was approximately $2,661 not counting taxes and insurance.  Interest rates were 7%. Today, in Boulder County if that house appreciated at the average rate that same house can be purchased for $465,000. Based on today’s interest rates of 4.75%, your new payment would be $2,453. A savings of roughly 8% per month.

Interest rates were 7%. Today, in Boulder County if that house appreciated at the average rate that same house can be purchased for $465,000. Based on today’s interest rates of 4.75%, your new payment would be $2,453. A savings of roughly 8% per month.

When buyers are considering a home purchase, purchase price is fairly arbitrary unless they are paying cash. Purchase price is the answer to a series of questions about how much a buyer can afford on a monthly basis. The general rule of thumb for payment affordability is 33% of gross monthly income. Say for example a family earns $6,000 per month. Their total payments towards housing should be around $2,000. This figure should include principal, interest, taxes, insurance and HOA fees if any. Assuming no HOA fees and interest rates of 4.75% the qualifying purchase price will be around $335,000.

Let’s complicate things a bit by bringing inflation into the mix. Since 2002, inflation has averaged 2.35% per year. Since 2002 homes have appreciated in Boulder County on average 1.8% per year. All things being equal homes today are a better value than they were 9 years ago. But all things are not equal. In 2002 interest rates were 7% and now they are 4.75%. If you put these two factors together the home that sold in 2002 for $400,000 and now is worth $465,000 is 27% more affordable than it was in 2002! Buyers are getting much more bang for their buck now than they have for years.

This anomaly cannot last forever. Values will rise and home affordability as measured by a percentage of take home pay will decrease. Read this post for a related idea on why now is not only a great time to buy but a smart time to sell and buy.

by Neil Kearney | Apr 28, 2011 | Boulder County Housing Trends, For Buyers, For Sellers

For many years our average negotiation off of list price has averaged between 2 and 3 percent. Lately, buyers are pushing those ranges. Sellers are  seeing many low offers and many times those negotiations do not come to fruition. Buyers are looking for a deal, and who can blame them. Here is a list of average negotiation percentages off of list price for Boulder County across multiple price ranges:

seeing many low offers and many times those negotiations do not come to fruition. Buyers are looking for a deal, and who can blame them. Here is a list of average negotiation percentages off of list price for Boulder County across multiple price ranges:

- 0- $250k 3.1%

- $250 – $500k 3.04%

- $500 – $750k 3.82%

- $750 – $1M 4.65%

- $1M – $1.25M 5.87%

- $1.25M – $1.5M 5.56%

- > $1.5M 9.3%

by Neil Kearney | Feb 23, 2011 | For Buyers, For Sellers, Real Estate 101

You have probably seen the attached picture before – is it a picture of a young women or an old women? The answer is it depends on how you are looking at it. How you perceive it.

One definition of reality is: “all of your experiences that determine how things appear to you”. I agree with this on many levels – I believe you make your own reality and what you know and believe as well as your past experiences effect what is “real” for you. A slum dweller in India has a much different reality than a socialite living in Beverly Hills.

The key word in the definition above is experiences. I submit that this definition is not as true as it once was. Don’t worry, I will tie in to real estate in a moment.

In the past (B.C. through the 19th century), reality was based on what one actually experienced. All inputs to opinion were very localized. For example, when there was a famine, chances were that you were hungry. Perceived reality equaled actual reality. There were no outside forces to sway your perception.

During the last century, technology in all of its forms have provided us a wider set of inputs. I guess this is called globalization. We have access to and know more about more subjects. Where we used to just be concerned with our local experience, we now are fed data on an ever-broadening spectrum of subjects. Google (verb) whatever subject you can imagine and have instant access to other’s research and opinion’s. It is no longer our own experiences that form our perceived reality it is the experiences and knowledge of others.

My point is that our perceived reality may not always equal our actual reality due to the influence of non-localized information. I run into people all the time who can’t believe the sorry state of our real estate market. The problem is that they have no actual experience with the market, their perceptions are based on outside information. When people come in from out-of-town, (or locals who have not been paying attention to the trends) they assume that values have dropped at least 20%. When in fact they have remained relatively stable over the past 5 years. They come from that paradigm when they submit very low offers. It is easy for sellers to realize that these low ball offers do not fit with the market.

Right now, the media has plenty of negative news to report. There is blood in the water and the sharks are in a frenzy. Foreclosure’s in CA, value loss in Michigan, empty buildings in Florida, etc. Bad news all around, a fact. The problem is that people take that news and equate that news to all other areas. The message is that the market is bad, the conclusion is that the market is bad everywhere.

I get asked all the time what a reasonable offer would be. My answer depends upon many factors but hard data also helps bring a good perspective to the negotiations. Over the last year in Boulder County, real estate transactions have had the following average negotiation percentages in each price range:

$0 – $250k 3.15% (1,307)

$250 – $500k 2.95% (1,550)

$500 – $750k 3.99% (498)

$750 – $1 MM 5.24% (141)

$1 – 1.25MM 8.2% (58)

$1.25 – $1.5MM 8.35% (35)

$1.5 – $2MM 9.9% (22)

>$2MM 8.65% (23)

Numbers in parenthesis represent the number of sales in that price range.

Perception does not always equal reality. While the market in Boulder County is not stellar, it is much better than what you would think by listening to the news. Prices are holding, properties are selling and foreclosures are not a big part of our market. We are very lucky and I’m spreading the word! When you are ready to buy or sell give me a call. I’m here to help. Neil 303-818-4055

their phone. This is especially true when you are curious about a house when you are out driving around. This is why I am pleased to announce my new home search application for mobile phones! It works for iPhones and Android phones and is easy to use, up-to-date and uses data that comes directly from my local MLS. I’d love for you to use it.

their phone. This is especially true when you are curious about a house when you are out driving around. This is why I am pleased to announce my new home search application for mobile phones! It works for iPhones and Android phones and is easy to use, up-to-date and uses data that comes directly from my local MLS. I’d love for you to use it.