by Neil Kearney | Oct 3, 2013 | For Buyers, For Sellers

Why I Love Being a Realtor

Why I Love Being a Realtor

My plan coming out of college was to be a real estate agent long enough to put myself through graduate school. I did just that, and after four years of night school I had a freshly minted MBA and no desire to do anything else but to continue on my path in real estate. Sixteen years later (24 in all), I still feel the same way. I’m really lucky to love going to work every day and here is why. I get to work with great people. I get to be creative, I get to work for myself and…

On any given day and within any given day I’m a:

- CEO

- Janitor

- Customer Service Representative

- Accountant

- Web designer

- Graphic Designer

- Counselor

- Chauffeur

- IT troubleshooter

- Confidant

- Furniture Mover

- Problem Solver

- Marketing Specialist

- Blog Writer

- Public Speaker

- Video Editor

- Social Media Director

- Board Member

- Ethics Committee Chairman

- Recruiter

- Negotiator

- Decorator

- Sales Person

- Copy Writer

- Database Specialist

- Photographer

- Advisor

- Office Manager

- Transaction Coordinator

- Sign Installer

- Researcher

- Strategic Planner

- Manager

- Bathroom cleaner

- Babysitter

Each day I am responsible for putting forth a professional effort in an increasingly competitive market. The perks are many and as you can see the variety and scope of what I do are large. I’m apt to work seven days a week for weeks on end, answer work emails at 11 pm, take business calls at 7:30 in the morning. But I also get to arrange my schedule so that I can watch most of my kids games and go on vacation without asking for permission. The responsibility to my clients and my personal code of excellence are my only boss. And I wouldn’t have it any other way!

by Neil Kearney | Mar 22, 2013 | Boulder Real Estate, For Buyers

Budding trees, singing birds and swarms of home buyers. These are the signs that spring is just around the corner. The first two happen every year but this year especially home buyers are our early and in droves. As we learned from the ‘birds and the bees’, ying and yang and Marvel Comic Books, it takes opposing forces to create balance. Right now the balance of the Boulder real estate market is off kilter. There are not enough homes on the market to satisfy the demand of the buyers.

Budding trees, singing birds and swarms of home buyers. These are the signs that spring is just around the corner. The first two happen every year but this year especially home buyers are our early and in droves. As we learned from the ‘birds and the bees’, ying and yang and Marvel Comic Books, it takes opposing forces to create balance. Right now the balance of the Boulder real estate market is off kilter. There are not enough homes on the market to satisfy the demand of the buyers.

Over the past week 171 properties have come on the market in Boulder County. Already 24% of those homes have gone under contract. If you look back two weeks that number jumps to 32%. It is a fast moving market. We just listed a home in Louisville and over the three days on the market there have been 18 showings. Multiple offers are very common and many buyers are getting caught up in the frenzy. Here are the top three mistakes I see being made in this market.

Paying Too Much

When you are at the supermarket comparing products and prices is easy. For example, you want some soup so you compare the choices available and decide; what flavor, what brand, what size, etc. It is easy to decide because there are ample choices and whether you are a value shopper looking for a generic brand or are willing to pay for organic soup with a brand name, you can easily make that choice. But if you go to a remote store, like you often find near a campground with one soup choice the decision is whether paying $5 for a can of Campbells is worth it to you. The scarcity in choice allows the seller to raise price and at that price soup will be worth it for some and not worth it for others.

When you are at the supermarket comparing products and prices is easy. For example, you want some soup so you compare the choices available and decide; what flavor, what brand, what size, etc. It is easy to decide because there are ample choices and whether you are a value shopper looking for a generic brand or are willing to pay for organic soup with a brand name, you can easily make that choice. But if you go to a remote store, like you often find near a campground with one soup choice the decision is whether paying $5 for a can of Campbells is worth it to you. The scarcity in choice allows the seller to raise price and at that price soup will be worth it for some and not worth it for others.

Pardon the extended metaphor, but right now there is a scarcity in the real estate market and buyers are faced with buying decisions with limited options. In many cases the decision is, do I pay more than seems reasonable or do I wait and hope that something better comes on the market. I have seen many sellers pushing the market and some are being rewarded by buyers willing to pay high prices.

So, if you are a buyer how do you balance being competitive in this market where 18 buyers are looking at the same property within a few days and making a smart decision. The first tip is to do research like an appraiser would do. Look at the sales in the neighborhood over the past six months or year (depending upon how many have sold) and find the homes that are most like the home you are looking at. Compare the upgrades, price per square foot and I like to compare the assessed values as set by the county appraiser. After comparing the sold homes to the home you are interested in you should have a good idea if you are within a reasonable range or if you are going to be setting a new record for the neighborhood. If you are getting a loan, the appraiser hired by the bank will be doing the same analysis and they are much more conservative than the normal buyer who is newly in love and is riding an adrenaline high from beating all of those other buyers. If you have paid too much the appraisal will stop the sale. So save yourself some time and money and work with your Realtor to see if what you are paying is reasonable.

Getting Caught Up In A Scarcity Mentality

When houses are flying off of the market and you may have missed out on a home or two, it may be easy to start to think that the house you have just seen (and might just work) will be the only one and if we don’t make an offer now… Home buying is a process and sometimes there is a delicate balance between patience and action. This is where advice from a good buyers agent is invaluable. The truth is, even though you think that there will never be another house like the one you just lost out on, new listings are coming on the market all the time. A home buyer must always look forward and never dwell on houses that “might have been”. The right state of mind is one that objectively looks at the options and sees each house that doesn’t work as one step closer to the one that will work.

Not Acting Quickly Enough

In a sellers market the competition for good houses is fierce. Being a part-time buyer is frustrating and futile in many ways. In order to be successful you must be ready to pounce on a good home. Here are the steps that a buyer must take to be a active buyer, ready to buy.

- Financing Ready – You must have your ducks in a row. A lender letter is required with all offers and it is best that you are already in the process of loan approval, just waiting for the property, verification of your information and an appraisal. You also must have liquid funds for earnest money ready to go.

- Quick Information – Knowing about the homes on the market is the next hurdle. If you are waiting for the Sunday paper you are most likely missing most of the homes. What I do for my clients is to set them up with a search that automatically scourers the MLS for new listings every few hours and sends us both an email with the results.

- Quick Showings – Once you know about the new listings you need to get out there are see them quickly. Flexibility is a key and seeing promising new listings on the first day gives you an advantage. I showed a listing this week that had just come on the market at 10 am. We met at 5 pm and there were four other groups meeting there at the same time. What a zoo!

- Quick Offer – Being ready to make an offer quickly is another key. Be ready to analyze the data (see

above) and make a strong offer is key to getting an offer accepted. A few weeks back I was able to make an offer on the spot at the house by writing the contract on my IPad and having the buyers sign on the spot. The seller and listing agent were about to meet so we had a tight deadline and we were able to meet it.

above) and make a strong offer is key to getting an offer accepted. A few weeks back I was able to make an offer on the spot at the house by writing the contract on my IPad and having the buyers sign on the spot. The seller and listing agent were about to meet so we had a tight deadline and we were able to meet it.

- Be Smart- As coach John Wooden said “Be quick, but don’t hurry.” Buying real estate is a long term decision with large consequences if you don’t get it right. Be ready to make your best offer but don’t get caught up in the wave of competition.

Buying a home in a tight market is a stressful situation and under pressure it is much easier to make a poor decision. I hope the three tips above help you navigate the process a bit easier.

If you are looking for a proactive buyers agent call me Neil Kearney 303.818.4055

by Neil Kearney | Nov 7, 2012 | For Buyers

MySite Introduction Video

It’s easy to find homes on the internet. Search sites are everywhere but I know it is frustrating when the information is outdated. It also is a big job to sort through all of the homes each time to find the new listings or the price reductions. I can help! I can set up an automated search that sends new listings automatically to your email. This way you know what is happening in the market but don’t have to sort through all of the homes you have already seen or don’t care to view.

The best part is the website that goes along with the service. Each of my clients can have a personalized, password protected site in which to view all of the information available on a given home. On your MySite, you can view, sort or delete listings so that you can easily come back and view or share what you have seen. The site updates automatically so when a house goes under contract or has a price change you will know about it when you log in.

This is a great service and I would like to set it up for you. Take a look at the video above for a quick demo on how it works and how it looks. You will love it!

Just call me at 303.818.4055 or email me

PRG3ZWS4FP3M

by Neil Kearney | Oct 24, 2012 | Featured, For Buyers, For Sellers, Real Estate 101

Even though we are in a slower time of year, houses are still selling. All year I have been seeing a shortage of good listings in the  market. Right now there are 15% fewer available homes on the market than last year at this same time. This means that if a serious buyer is out looking for a nice home the cupboards are fairly empty. Right now there are many leftover homes on the market. I define leftover homes as those listings that haven’t sold for a specific reason whether it be price, location or condition. This shortage leads to heavy activity on those homes that come on the market ready to sell. Those homes are well priced, in good condition and in a location that doesn’t raise a red flag. This leads to multiple buyers being interested in the same house at the same time. Here is some advice for handling multiple offers from the buyer and seller perspective.

market. Right now there are 15% fewer available homes on the market than last year at this same time. This means that if a serious buyer is out looking for a nice home the cupboards are fairly empty. Right now there are many leftover homes on the market. I define leftover homes as those listings that haven’t sold for a specific reason whether it be price, location or condition. This shortage leads to heavy activity on those homes that come on the market ready to sell. Those homes are well priced, in good condition and in a location that doesn’t raise a red flag. This leads to multiple buyers being interested in the same house at the same time. Here is some advice for handling multiple offers from the buyer and seller perspective.

From The Buyers Perspective:

- Check to see if you have competition. Your agent will call the listing agent to announce your intention to write an offer. Make sure you know if you are competing with another buyer. At the same time have the agent ask for the sellers preferred closing date and for any items that will be excluded from the offer. All of the information below assumes that there is another offer.

- Make your decisions quickly. Getting your offer in a day ahead may make a big difference. Ask for a quick acceptance deadline.

- Do your homework: Check comparable sales and decide the maximum price you will be willing to pay. Also, think about how you would feel if you would lose this house over a couple of thousand of dollars.

- Do a thorough walk-through: When you see a house you are interested in, take your time. Check on the condition of the house, what would you need to do to make it yours. Are the systems (furnace, roof, windows) in good condition?

- Prepare a clean offer: Don’t ask for Sellers to pay for appraisal, cleaning, HOA transfer fees etc. When the seller is considering two similar offers, $50 can make a big difference and send a signal that the buyers asking for all of the small stuff will be tougher to work with down the road on inspections etc.

- Have your financing in place and make sure to include a letter from a lender along with the offer. I prefer to see a local lender who can jump in and make the closing work in a difficult situation rather than somebody who is working a toll free line.

- A nice touch is to write a personal letter to the seller explaining who you are and why you love their house. The seller has an emotional attachment to the house and wants to sell to someone who will take care of their house.

Consider an escalation clause. When the house is a good value and you know there is competition one effective method is to write in an escalation clause. This clause in the contract automatically raises the bid price if another offer beats theirs financially. For instance it could read “the offer price shall be automatically raised to a price $1,000 above any other bonefide offer, the purchase price shall not exceed $xxx,xxx”. This is where the buyer has to know how much they are willing to pay; is it full price or $5,000 over?

From The Sellers Perspective:

- If you are attracting more than one offer it shows that you have taken care of your home and priced it correctly.

- You want to make sure that all interested parties have a chance to submit an offer. Have your agent communicate to each agent who has shown the property recently to gauge interest.

- When reviewing offers look at these main points: net price to you after all closing costs, dates and terms and buyers ability to pay and close. (more…)

by Neil Kearney | Mar 19, 2012 | For Buyers, General Real Estate Advice, Real Estate 101

Once you have found a home and had a successful negotiation of the offer there are still many steps that need to be completed before you can move in. Here is a primer on the steps that take place between contract and closing from the buyers perspective.

Set The Inspection– It is the buyers responsibility to set and pay for any and all inspections on the home. There are no required

Photo doesn’t have anything to do with the subject, but I took it and thought it was cool.

inspections in Colorado. As a buyers agent or a transaction broker, I provide a list of inspectors that my previous buyers have liked, but a buyer may choose and use any qualified home inspector. It’s a good idea to ask about their services and experience as well as the insurance they carry. The buyer is ultimately responsible for any damage that an inspector may do while at the home. Most inspectors now use digital photography and provide pdf reports which are helpful during a negotiation. In our area radon is common and a radon test is an additional test that an inspector will do for a fee. Read this post to learn more about radon. Keep in mind that all inspections shall be completed prior to the inspection objection deadline as stated on the contract.

Formal Loan Application – Once there is a fully executed contract your lender can then set up a file and start moving your loan forward toward underwriting approval. At this time you will have the option to lock-in an interest rate. While you may have already provided some documentation to the lender. Once they are in the formal approval process (as opposed to pre-qualification or pre-approval) you will undoubtedly need to provide your lender documentation on income, debts, tax returns etc. Please provide these documents as quickly as possible so that any delays can be avoided down the line.

Review Paperwork – The seller will be providing (in most cases through the title company) paperwork regarding the title transfer, property taxes and the Homeowners Association. Your agent and lender will also be reviewing the title documentation for anything abnormal but it is in your best interest to review them carefully yourself or hire an attorney to review them so that you understand what you are getting when you purchase this particular property. The HOA documents will tell you the rules you are agreeing to abide by as well as the financial structure and health of the association. The turnaround time on looking at this information is fairly quick so don’t put it off.

Attend The Inspection – The inspection is the best chance for you to get to know your new home in an intimate way. Following the inspector around for a few hours will give you some good insight on the overall condition of the home as well as a thorough understanding of the conditions that you may ask to be repaired by the seller. As an agent I usually just attend the summary or get the report via email. I leave the inspection itself to the experts. Keep in mind that unless the home is brand new there will be some items that the inspector will point out. It is the inspectors job to be detailed in their inspection.

Inspection Objection with Agent – The next step in the process is to decide a course of action after the inspection. A buyer in Colorado has three choices: 1) move forward as-is and don’t ask for anything; 2) terminate the contract; 3) make a list of unsatisfactory conditions on an Inspection Notice form and present those to the seller. Work with your Realtor at this stage to strategize the best negotiation scenario. It’s best to remember that in most cases focussing on the major issues and/or safety issues will allow for the most productive negotiation with the seller. In my experience, sellers get annoyed if a buyer asks for too many trivial issues. Keep it simple, be specific and hold to the major points.

Other Items – During this entire time you will be making plans regarding moving and packing. Contact your Realtor as to when is a safe time to put non-refundable money down on any services. During this time you will also need to start contacting the local utility companies. This is especially important for those who work at home or depend upon an internet connection. One of the most important things to remember is “DON”T BUY ANYTHING!” Lenders check credit again just before closing and taking on additional debt can spoil the whole deal. Wait on the furniture, wait on the appliances, wait on the new car until after closing. At closing you will need to bring good funds to the closing. This means that you need to bring either a cashier’s check or wire funds in advance to the title company. You will get the exact amount to bring a day or two in advance from the title company via your Realtor or lender.

Closing – Finally it is the day of closing. One of the last stops before going to the title company to sign papers is back to the house for a final walk through. During this final walk through you get one last look at the house to make sure nothing has changed. You make sure that the agreed upon inspection items are complete and you make sure the items that are included are still there. The closing itself lasts about an hour and the buyer does the majority of the signing. In addition to your money make sure you bring a picture ID. The closing is a time to close up any loose ends. Connect with the seller and ask about the neighbors. It is not a time to renegotiate or hold grudges about past negotiations. After an hour or so you will get the keys and you are ready to move in.

Throughout the process it is most helpful to have an experienced Realtor there by your side to help you along and negotiate on your behalf. I have been helping buyers in the Boulder Valley real estate market for over twenty years. I’d love to put that experience to work for you.

by Neil Kearney | Mar 2, 2012 | Boulder County Housing Trends, For Buyers, For Sellers, Statistics

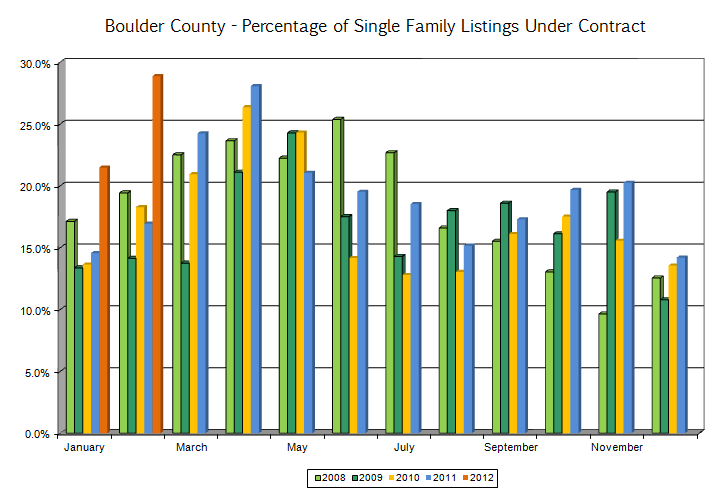

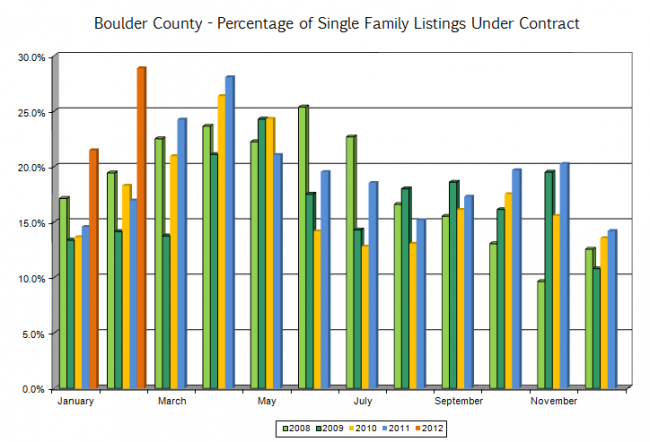

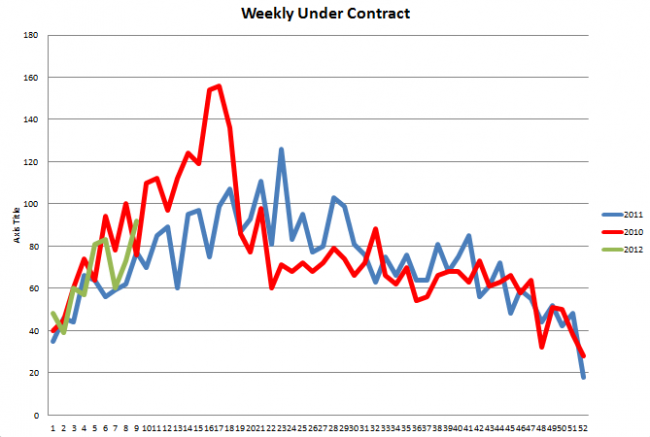

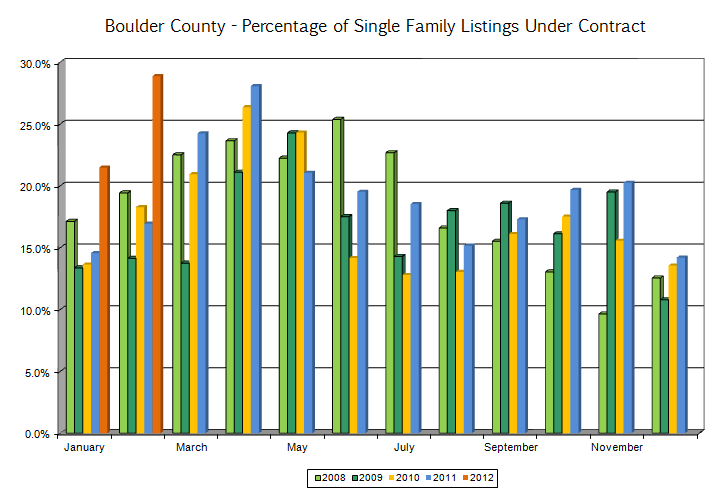

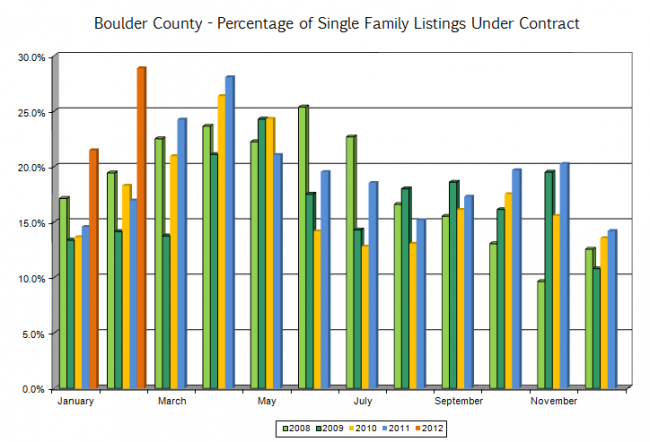

The quick answer is that the supply of new homes in the Boulder area isn’t meeting the demand right now. At the beginning of every month I run some comparative statistics and this month the results were very illustrative. The chart below shows the percentage of listings that are under contract by month from 2008 forward. Each grouping shows the under contract percentage taken on the same day of each year. Look at the big orange bar near the left side. That represents the highest percentage of homes under contract over the past five.

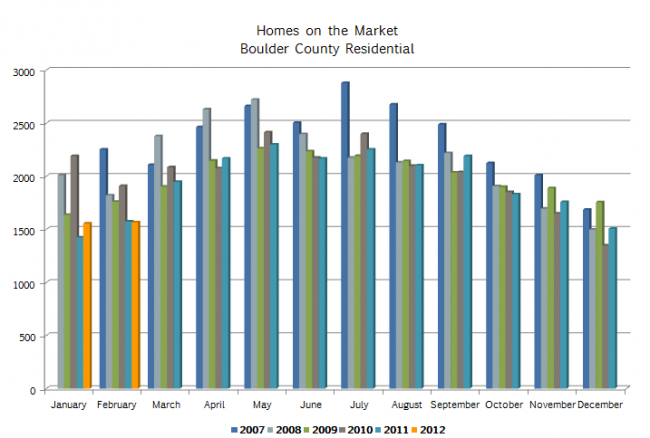

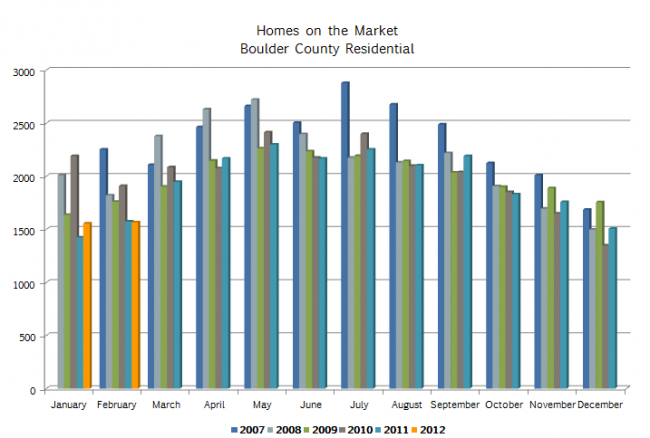

The next chart shows the total number of residential homes on the market in Boulder County. We are nearly at the lowest inventory level for any month over the past five years. Put these two conditions together (high demand, shortage in supply) and we have ourselves a pretty active market.

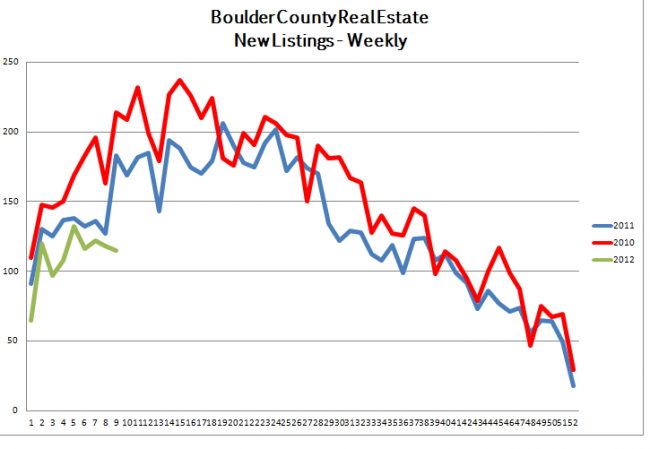

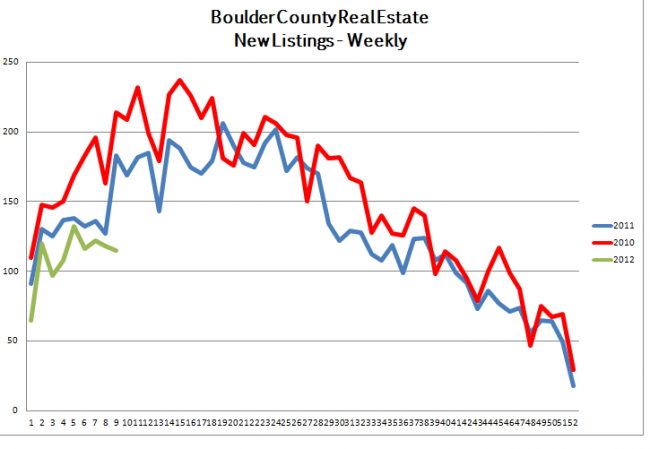

The next two graphs show activity over the past three years on a weekly basis. The first graph shows the number of homes that have been listed. We are on a lower pace of new listings than either of the past two years.

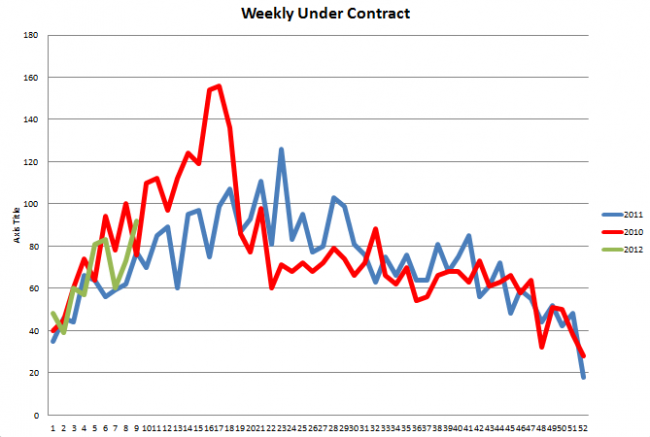

This last graph compares the number of homes that have gone under contract on a weekly basis over the past three years. It shows a much stronger market so far than we had just a year ago.

If you are looking to dip your toe into the Boulder real estate market you will need a good guide. I have been helping people find just the right place to buy and helping sellers successfully market their homes for 20 years. I’d love to put my tools to work for you.

Page 6 of 16« First«...45678...»Last »

Why I Love Being a Realtor

Why I Love Being a Realtor