by Neil Kearney | Feb 24, 2015 | Boulder County Housing Trends, For Buyers, For Sellers, General Real Estate Advice, Real Estate 101

In a recent article in Forbes Magazine by Mary Meehan titled “The Baby Boomer Housing Bust“, the author makes the case that in the coming years the Baby Boomers may have a hard time selling their homes to the Millenials. She states that many Baby Boomers (people born between 1946 and 1964) will need to sell their large suburban homes to finance their retirement and that the younger buyers may not be interested in buying those homes.

In a recent article in Forbes Magazine by Mary Meehan titled “The Baby Boomer Housing Bust“, the author makes the case that in the coming years the Baby Boomers may have a hard time selling their homes to the Millenials. She states that many Baby Boomers (people born between 1946 and 1964) will need to sell their large suburban homes to finance their retirement and that the younger buyers may not be interested in buying those homes.

It’s an interesting article, especially since in the Boulder area we are seeing a strong sellers market with strong demand for any property listed. But since real estate markets change and many people are talking about how the changing demographics in America will affect housing, I thought I would explore the connection between Baby Boomers, Millenials and real estate. Here are the topics I’d like to touch on:

- Baby Boomers need to sell homes to fund retirement.

- Younger buyers, including Millennials have different attitudes regarding home ownership.

- There will be an unmatched demand for the supply of homes on the market.

According to a National Association of Realtors (NAR) 2014 Generational Trends Survey, Millennials made the most real estate purchases in 2013. Here is the breakdown:

Millennials (1980 – 1995) 31% of purchases

Gen X (1965 – 1979) 30% of purchases

Young Boomers (1955 – 1964) 16% of purchases

Older Boomers (1946 – 1954) 14% of purchases

Silent Generation (1925 – 1945) 9% of purchases

For reference, here are the latest population percentages in the United States and Boulder County: Under 18 25.7% (22.9%); 18-24 9.6% (13.4%); 25-44 30.2% (33.6%); 45-64 22% (22.3%); 65+ 12.4% (7.8%).

My takeaways from this are: The Baby Boom generation is roughly 25% of the population. I always had the perception that the 65+ cohort was a bigger percentage. I know that it’s growing, but it’s in the future, not in the present. And did you notice the low percentage of retirees in Boulder County? Just 7.8% of our local population.

Some facts about the Baby Boomers:

- The youngest of the 78 million Boomers are turning 50 this year.

- 10,000 Boomers a day are turning 65 years old, this will happen every day through 2030.

- Younger Boomers have less savings and a lower homeowner rate than older Baby Boomers.

- Boomers own 32 million single family homes.

- They have had a great run in the real estate market. Owning a home has been a great investment.

- So far, this generation has been net even in the housing market. When they sell one, they buy one. This will change but will the Millenials be ready to buy?

Some Facts about Millennials:

- They are the second largest generation.

- Despite the housing crash in 2008, 2/3 believe that owning a home is essential to living a good life.

- This generation is delaying home buying due to high student debt and a tough job market.

- Despite having a delayed start in the housing market Millenials bought the most homes in 2013 (see above).

- The U.S. housing market saw it’s first sustained downturn during many of the Millenials first buying/owning experience. This has led to a more subdued mindset about housing.

Are The Baby Boomers Ready For Retirement?

In the 2013 Retirement Confidence Survey conducted by the Employee Benefit Research Institute (EBRI), workers aged 55 and older said the following about their retirement savings:

- 60% have less than $100,000 in retirement savings

- 43% have saved less than $25,000

- 36% have saved less than $10,000

As a point of reference, of all workers surveyed:

- 76% have less than $100,000 saved

- 57% have less than $25,000 saved

- 46% have less than $10,000 saved

Despite the apparent lack of adequate savings, 70% of all workers surveyed also said they believe they are “doing a good job of preparing for retirement”—even though only 46% of all workers surveyed have a retirement plan!

According to the information above it’s clear that many Baby Boomers are not ready for retirement. Selling their family home and moving to a lower priced home and supplementing their retirement with the difference seems to be a key component to many “plans”.

Are Millenials Interested In Boomers Homes?

During the last fifteen years Baby Boomers have been purchasing upgraded homes and second homes. Generation X who are on the heels of the Boomers, are a smaller generation and after the economic downturn are in recovery mode. Gen X won’t be able to buy all of the homes that Boomers are getting ready to sell. Millenial generation home buyers have been less interested in size and more interested in location. So far, being near the action is more important that having a status symbol. This generation is large but is just getting geared up in the home buying cycle. So far, demand has met the supply of homes but as more and more Boomers sell their large homes the younger generations may not be interested in them. Especially if it’s large and suburban.

Will Supply and Demand Meet?

The latest US Census data suggests that the population in the United States will grow 27% between 2015 and 2060. As a friend of mine says “clearly there will be a set of cheeks for every seat”. In fact for the foreseeable future, home builders will need to stay busy to keep up with demand. So the question in my mind is not a question of scope but of type. There will clearly be enough home buyers to meet the seller demand but will the price range, type and location meet the buyers desires. Those Boomers with McMansions away from urban areas may find decreasing demand for that type of housing in the future.

The Local Spin

According to a recent National Association of Realtors report both Millenials and Baby Boomers see the Denver area as one of the top areas in the country to relocate to. I have found that I’m working with many more experienced home owners who are looking to the Boulder area as a place to retire. College towns are especially popular throughout the country although Boulder is rare in that the home prices prohibit less affluent people from retiring here. Millenials follow lifestyle and jobs and the Front Range of Colorado including Boulder County has plenty of both. So in my mind, as long as the lifestyle and economy stay favorable, we will still have people wanting to live in the Boulder area.

My Conclusions

As more and more Baby Boomers retire, the real estate market will take on a different character. Many Boomers will downsize and while there will be a demand for their homes, price appreciation may stagnate over time. Millenials may not have the exact same taste in homes than do the Boomers, but as the U.S. population grows towards 400 million people in the next 40 years, the demand for housing will expand. And as Will Rogers said “Buy land. They ain’t making any more of the stuff.”

Additional Articles

NAR Field Guide to Millenial Home Buyers

Why Millennials Don’t Trust Ads, Real Estate or Social Security

by Neil Kearney | Feb 2, 2015 | For Buyers, For Sellers

I just received this letter of recommendation from a recent client. I loved working with them and I’m so happy that they appreciated my efforts and the results. The website for their home that I built is located at www.SunriseRanchHome.com

“Though we find it hard to express how much we appreciate and value Neil Kearney’s professional, ethical, kind and extremely effective representation of our home, it was not difficult for Neil to describe and represent our home in a way that was extraordinary.

From the moment we met Neil, we knew we had found the realtor who was looking out for our interests and advocating a sales plan that would ensure the most for our investment. Neil took extraordinary, professional photographs of our home, and his images and words in a beautiful brochure and amazing website created for our home reflected his passion for his job and for representing his clients in a way that is unsurpassed.

You could not hope to find a more experienced, more professional realtor to get the absolute best value out of your property – but the bonus is that you will undoubtedly find a friend. Our sale and purchase experience were benefited by his calm good humor and his expert eye – pointing out the problematic stucco, or the vacant lot across the street zoned for commercial development. Neil is extraordinary at his profession – skilled, calm and phenomenal – our recommendation is without reservation, and WITH great enthusiasm.”

Brad and Cindy Taylor

Former Director of Consumer Protection for the Boulder County D.A.’s office

I always have the capacity to work with new clients, so if you are looking for the type of service that is described in the letter above please contact me to get started. 303-818-4055 cell or Neil@KearneyRealty.com

by Neil Kearney | Jan 20, 2015 | Boulder County Housing Trends, For Buyers, For Sellers, Statistics

The Kearney Report – Year in Review 2014

I have just finished compiling the year end market data and have just published “The Kearney Report – 2014 Year In Review”. If you are interested in learning about the real estate market over the past year and how it relates to overall trends over the past fifteen years, I would encourage you to view and download the report. To view the report scroll down and read it on this page. If you would like to view it as a PDF for easy printing click here. I take the time to produce the report so that my clients and you (whomever is reading this) can better understand the market. From good information comes good decisions!

2014 Boulder County Real Estate Market Summary

2014 started out very strong and continued in a healthy manner throughout the year. It was definitely a sellers market. Throughout the spring, the combination of low inventory and high demand made it difficult and frustrating to be a buyer. Multiple offers were very common and in many situations, full price wasn’t enough to win the negotiation. Throughout the spring, home values increased.

By mid June, the pressure of the market had eased a bit. All of the fundamentals in the market were still in place but just less intense. More houses were coming on the market and that supply brought the market back closer to equilibrium. The fall continued in a similar fashion with even fewer houses coming on the market. In 2014, it took on average 38 days to find a buyer and accept an offer. This is a full week quicker than 2013 and a full 49 days quicker than 2010. Low inventory and good buyer demand were the trends for 2014.

The Causes and Effects of Price Appreciation in Boulder County

Using a simple measure, median prices of homes and condos in Boulder County increased by 5.5% this year. Last year they were up 6% using the same math. FHFA the national agency which tracks home sales for the Federal Government reported that the home values in Boulder County increased in value by 8.35% for the one year period ending on September 30th (see this represented graphically on page 4 of this report). Homes have appreciated over the past three years, which has erased the affects of the economic downturn. What I’d like to touch on are the causes of the appreciation locally and the effects of the appreciation we are seeing in the market.

Boulder County didn’t go through the boom and bust cycle between 2006 and 2011 that much of the country experienced, so our recent appreciation can’t be explained by saying it is a bounce. A return to historical value. Home prices are now 17% above where they were 5 years ago. Over the past three years I point to three major factors that contributed to our appreciation; low supply of homes on the market, strong buyer demand caused by a strong local economy, low interest rates.

The supply of homes on the market comes from two main sources, resales and new construction (note we don’t have, nor have we had a large supply of foreclosure homes, this has been another source in other areas). Both sources of supply have been constricted since 2008. Existing homeowners have increasingly been sitting out of the market. Many feel that while it would be easy to sell their home it would be difficult to find an acceptable replacement. If you have enough people thinking along these lines it becomes a self-fulfilling prophecy. The economic downturn was difficult on home builders and their banks forced them to sell existing supply and to stop building spec homes. The supply of new homes was a trickle in 2009 and 2010. Builders are now up and running but they can’t keep up with buyer demand. They are also constricted by a lack of tradesman due to so much commercial construction.

The US Census Bureau estimates that Boulder County grew by 5.3% between 2010 and 2013. This means that 15,000 new people moved to our county. Given that there are on average 2.42 people in a household in Boulder County this means that there are over 6,000 new households in Boulder County over the past four years alone. People are moving here because of our robust economy and available jobs. This equation has led to the construction of many new apartment buildings, rising rents and a very tight real estate market with low inventory and rising prices.

The last factor causing appreciation is low interest rates. Affordability has two multipliers; price and cost of money. If one stays low while the other rises, affordability stays reasonable. If both rise, demand falls. For the past six years interest rates have been very low so as prices have risen the out of pocket expense is still reasonable. From the buyer’s perspective, if they need to be aggressive on price in order to get a home, they can do it because they can still easily afford the payment. Sellers have been able to ask more for their homes and buyers have had the ability to afford the payment and the will to beat out their competition.

As you browse through the rest of the report you will find, for comparison purposes, a number of market measures displayed for each of the submarkets in our area. Enjoy the report.

by Neil Kearney | Jan 15, 2015 | Boulder County Housing Trends, For Buyers, Statistics

When a home buyer comes to view property in the Boulder area they soon find out that there are trade offs to consider and compromises to make. This isn’t uncommon, buyers in all areas need to prioritize the location, size, and condition of a home.

Here is a typical progression of a Buyer who is moving to Boulder from an area where the cost of housing is less expensive and they are looking in the $300,000 – $600,000 price range.

- Assumption that they will be able to get a relatively similar home to what they have now.

- After a quick search of online home sites they soon realize that they will need to either settle for a house with a smaller lot, fewer bedrooms or that needs some work.

- They view homes in the City of Boulder and are disappointed. They either raise their target price range or start looking in the surrounding communities.

- They look at homes in Louisville, Superior, Lafayette, Erie or Longmont. Find that they can get more house for the money.

- They then are forced to re-visit and clarify their priorities.

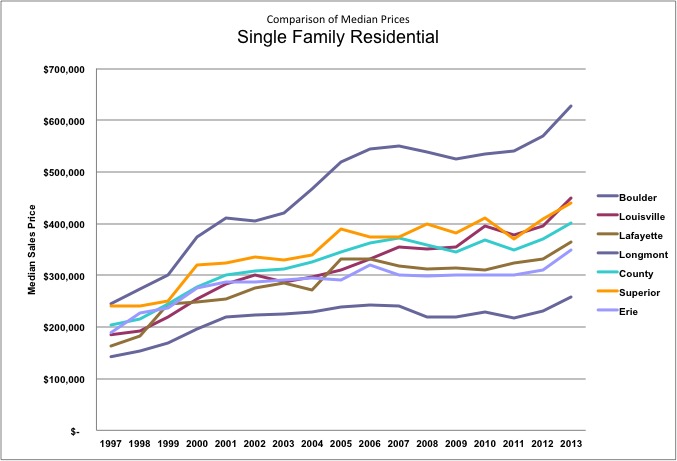

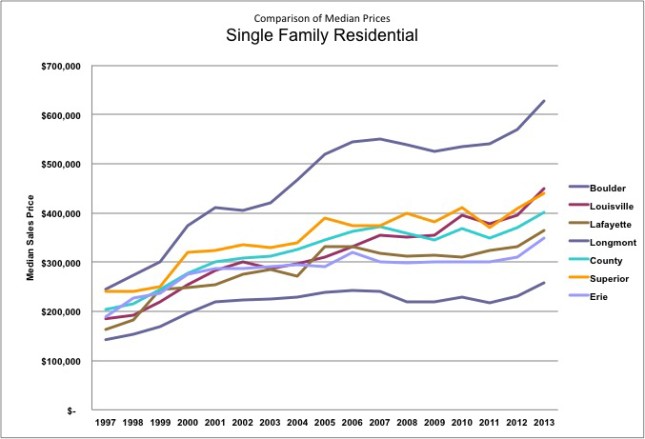

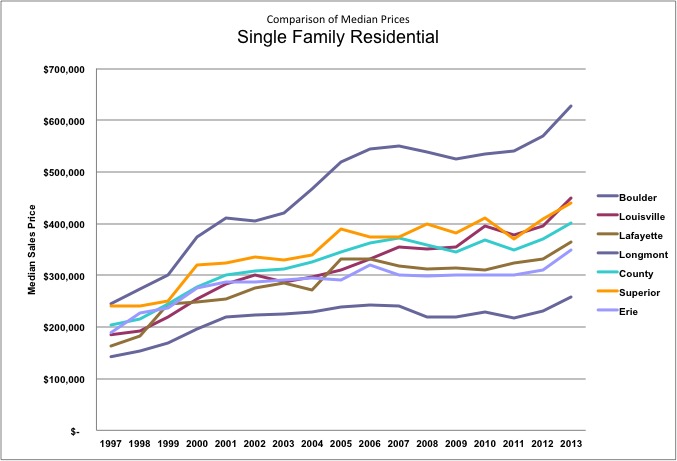

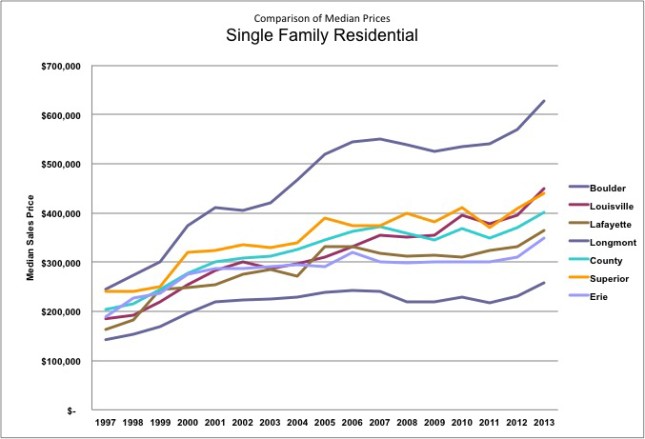

The graphs below show a comparison of median prices across the various communities of Boulder County starting in 1997. Back then, prices throughout the county had a much smaller disparity. The median price for a home in Boulder was just 20% above the county average. In the ensuing years, the gap has increased considerably. Now the median price of a home in Boulder is nearly $700,000 while the county median is just over $400,000.

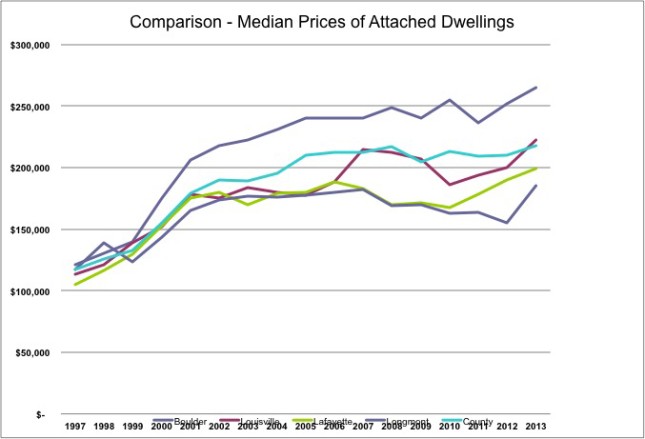

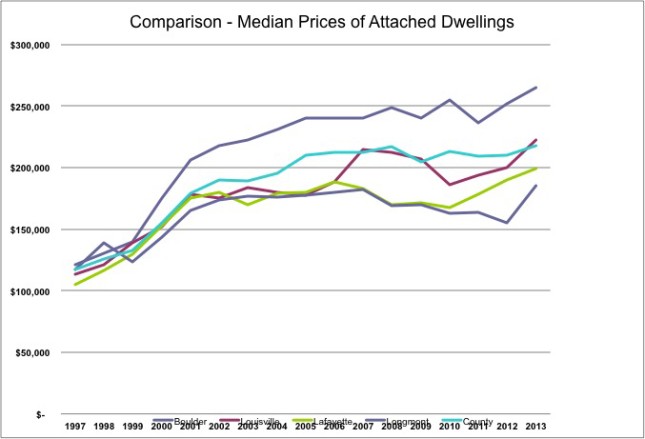

The lower graph shows the prices for attached dwellings in Boulder, Louisville, Lafayette, Longmont and Boulder County. There isn’t as much difference in condos as there is in single family homes. One reason for this is that the condos in Boulder tend to be smaller than those further east.

by Neil Kearney | Dec 18, 2014 | For Buyers, General Real Estate Advice, Real Estate 101

Here are some of the reasons why people buy their first home.

Here are some of the reasons why people buy their first home.

- Tired of paying rent / rents are rising.

- Home prices are rising and if they don’t buy now they might be priced out of the market.

- Just got married.

- Just got a great new job.

- All my friends are buying a place and it seems like a good idea.

All of these reasons are reasonable, but none of them hit on the key factors that a first time home buyer should consider when they are thinking about buying a home. They can push you in the right direction but they don’t ensure an intelligent purchase.

Buying a home is one of the best ideas you can make. It is a great long term investment, your payments are tax advantaged, with each payment you are gaining equity and you get to live in a place you can make your own. It’s a win, win, win! However, the keys to making it a good investment have much to do with your stability and your budget.

I mentioned in the previous paragraph that owning real estate was a great long term investment. Unless the market is appreciating very quickly you will be doing very well to break even if you need to sell within two years. Real estate is cyclical so not everyone gets lucky and makes the purchase right before prices take off. In many markets prices are just now getting back up to 2007 levels after a big decline. If you bought in 2006 and needed to sell in 2010 you lost money. So the first question to ask yourself when you are considering a home is: “How long will I be living in this house?” If you answer is less than five years it might be better to rent. A key to making real estate an investment, not just a place to live is the ability to wait out market cycles.

Besides geographic stability the other main thing to consider is affordability. The first step to figure out what is affordable is to take an in depth look at your finances. Examine your long term financial goals such as savings, retirement, kids college, vacations, etc., and figure out how to make it all fit within your budget. When you know your comfort level regarding monthly payment call a mortgage lender to get pre-approved. Most likely you will be approved for more than what you are comfortable paying. If you over-extend yourself with your new house you will feel burdened instead of smart. Pick a payment that is comfortable for you and that allows you to keep your savings and lifestyle goals in tact.

Some practical considerations regarding affordability:

- Plan ahead for future changes in income. Do you plan to become a one income family after you start a family? Don’t lock yourself into a payment that requires two incomes.

- Have you saved enough of a down payment? Low down payment options are available but they require an additional payment called mortgage insurance. If you have less than 20% down it might be a good long term decision to delay the purchase and save every penny you can until you have what you need.

- As interest rates rise your payment dollar buys you less house. If you are almost ready to buy and your qualification is right on the edge it might be good to lock in a home before interest rates rise. To read more about how much this can affect your payment see my article The Impact of Interest Rates on Home Affordability.

- Credit scores have a huge impact on your ability to buy a house. If you have a credit score of less than 760 your qualification or the interest rate you are offered will be negatively affected. To check your credit score for free (with no strings attached) go to www.AnnualCreditReport.com. If you find out that your credit score will negatively impact you, figure out why your have a low score and start fixing your FICO score.

by Neil Kearney | Dec 15, 2014 | Boulder Real Estate, For Buyers

Interested in learning about the different neighborhoods in Boulder? In this report I have split Boulder into eleven different areas and present the lifestyle highlights, schools, shopping districts, local recreation and real estate statistics for each area. If you’re interested in learning about where to live in the City of Boulder this is your guide.

Interested in learning about the different neighborhoods in Boulder? In this report I have split Boulder into eleven different areas and present the lifestyle highlights, schools, shopping districts, local recreation and real estate statistics for each area. If you’re interested in learning about where to live in the City of Boulder this is your guide.

It is recognized that Boulder is a great place to live but the neighborhoods in Boulder are a bit hard to characterize. Boulder was developed over time in a piece-meal fashion. The result is that many of the neighborhoods are only a few hundred homes in size. It is common to have two adjacent neighborhoods developed at different times and have completely different price ranges. While this report is not comprehensive, it will give the reader valuable information from which to start understanding the real estate market in Boulder. I have arbitrarily split up Boulder into 11 different segments. I will highlight the major neighborhoods in each area.

Boulder Neighborhood Guide – 2015to view and download the guide.

Page 4 of 16« First«...23456...10...»Last »

In a recent article in Forbes Magazine by Mary Meehan titled “The Baby Boomer Housing Bust“, the author makes the case that in the coming years the Baby Boomers may have a hard time selling their homes to the Millenials. She states that many Baby Boomers (people born between 1946 and 1964) will need to sell their large suburban homes to finance their retirement and that the younger buyers may not be interested in buying those homes.

In a recent article in Forbes Magazine by Mary Meehan titled “The Baby Boomer Housing Bust“, the author makes the case that in the coming years the Baby Boomers may have a hard time selling their homes to the Millenials. She states that many Baby Boomers (people born between 1946 and 1964) will need to sell their large suburban homes to finance their retirement and that the younger buyers may not be interested in buying those homes.