by Neil Kearney | May 28, 2020 | Boulder County Housing Trends, Statistics

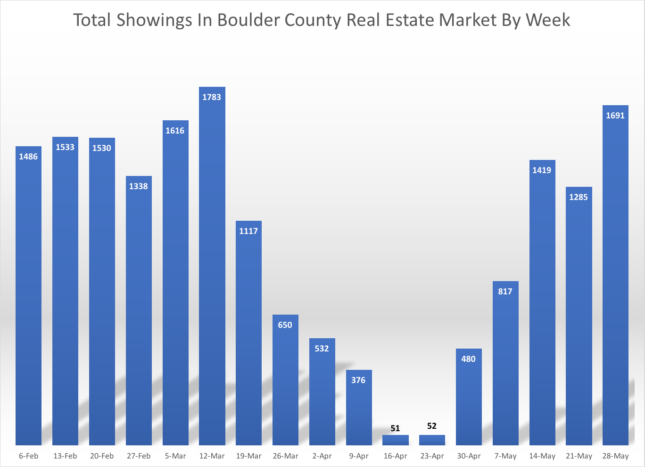

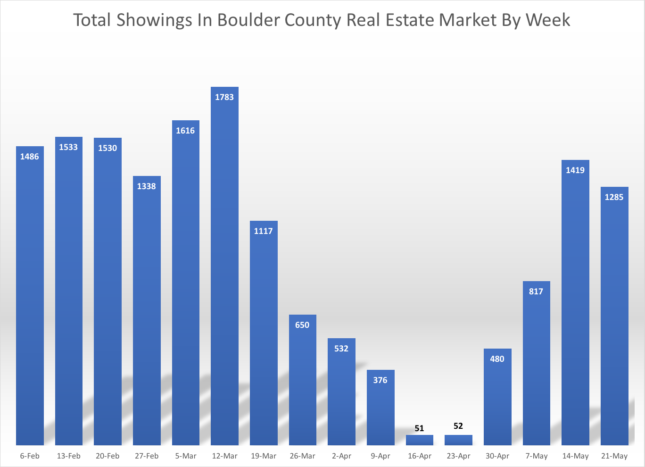

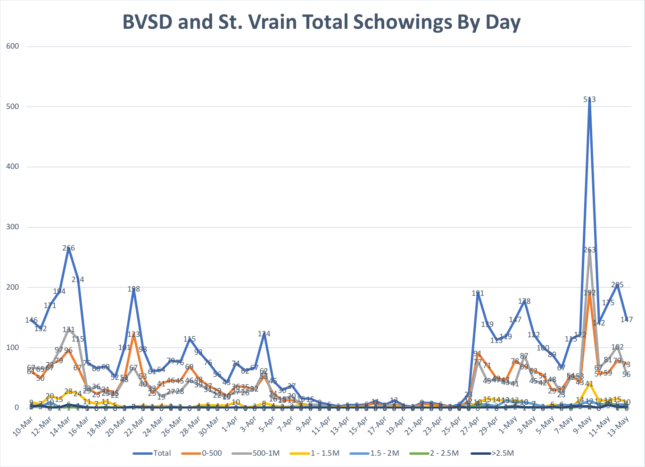

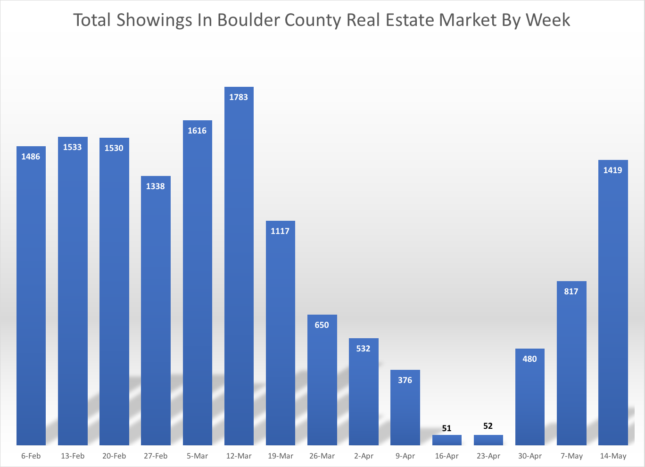

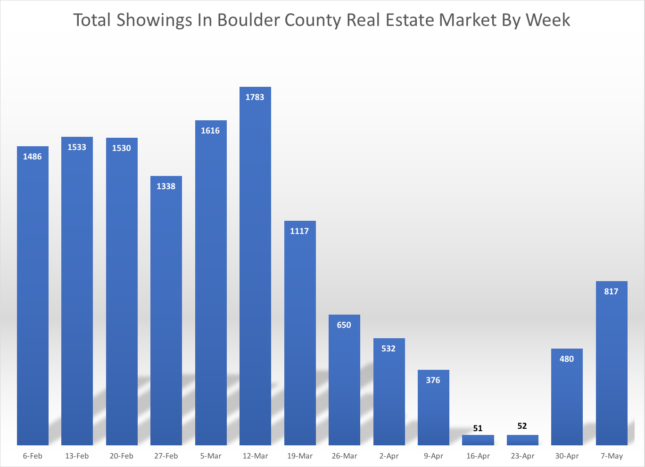

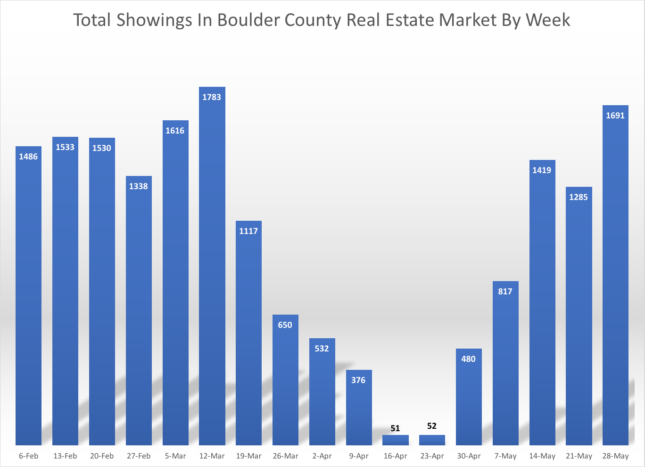

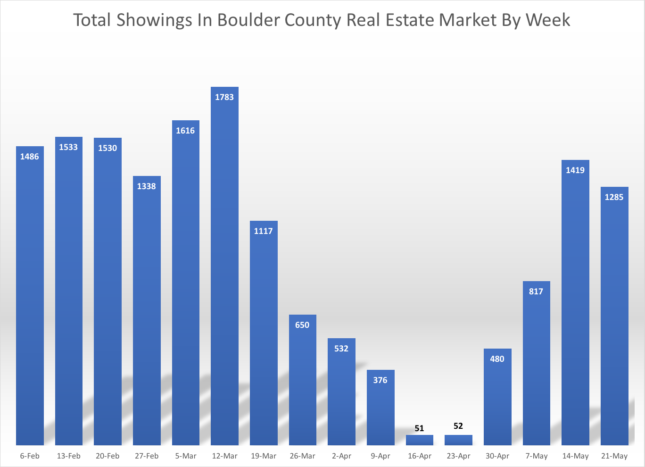

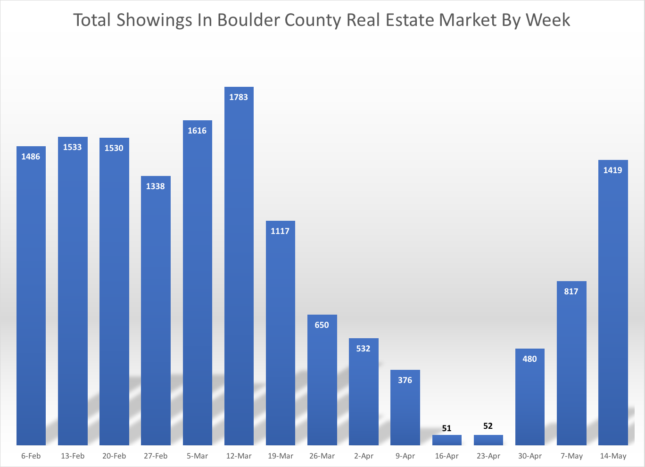

Our communities are taking steps to open up the economy. I’ve definitely noticed more traffic, filled parking spaces downtown and a few businesses using their space again in my office building. Some restaurants began to seat customers yesterday and more and more buyers and sellers are slowly coming back into the local real estate market. On an aggregate basis showings were up 31% this past week. Up to 1,691 showings (data from ShowingTime). We were last at this level in early March. Progress.

Usually Memorial Day week is fairly slow. But we saw a nice surge of new listings and the number of new accepted contracts stayed strong. Much of this activity is in the lower price ranges, but not exclusively.

Here is a breakdown of inventory and the percentage of those listings which are under contract by price. Residential listings in Boulder County.

$0 - $500k

Total Listings = 448

57% are under contract

$500k - $1 Million

Total Listings = 651

45% are under contract

$1 - $1.5 million

Total Listings = 162

23% are under contract

$1.5 - $2 million

Total Listings = 79

18% are under contract

$2 - $2.5 million

Total Listings = 41

19% are under contract

More Than $2.5 million

Total Listings = 76

9% are under contract

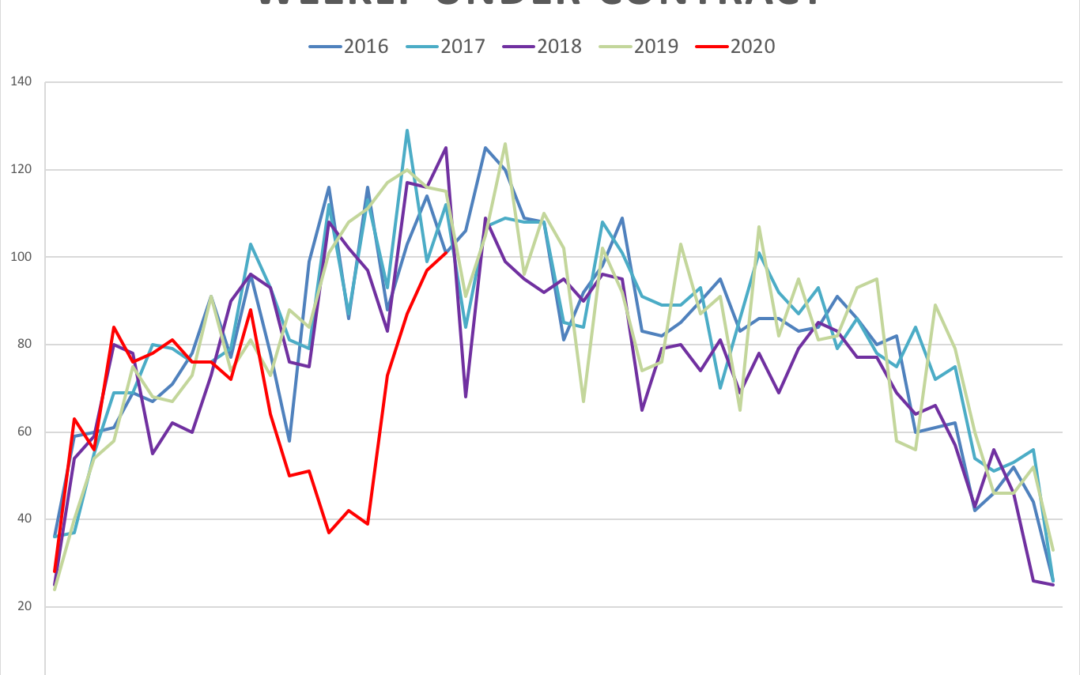

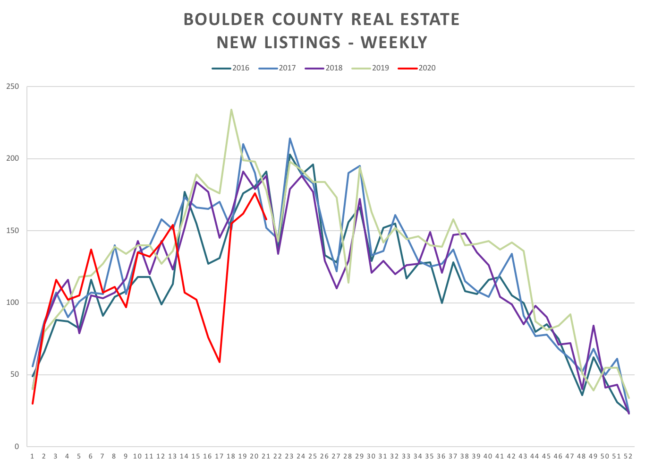

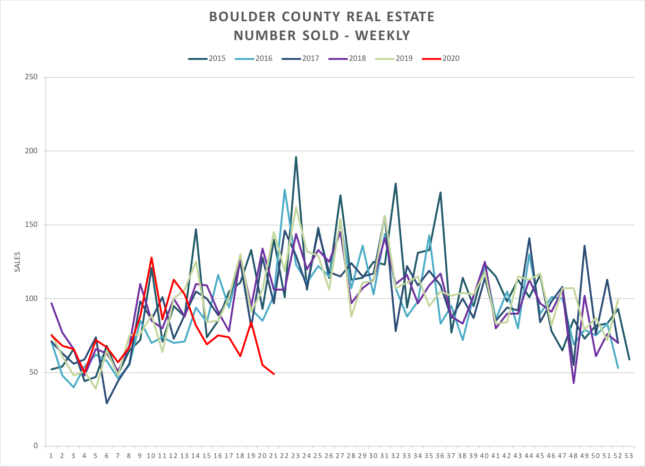

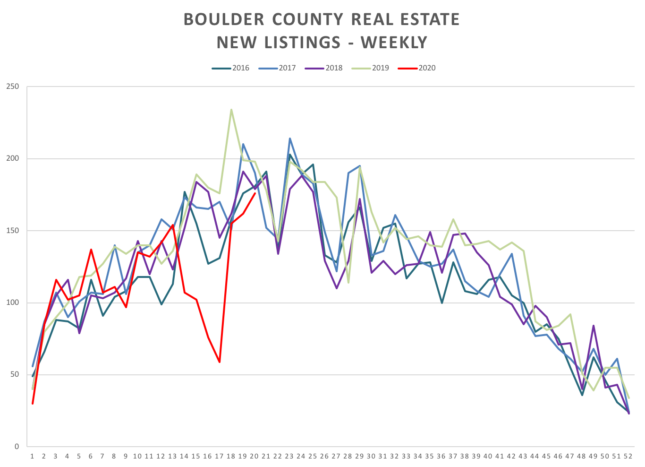

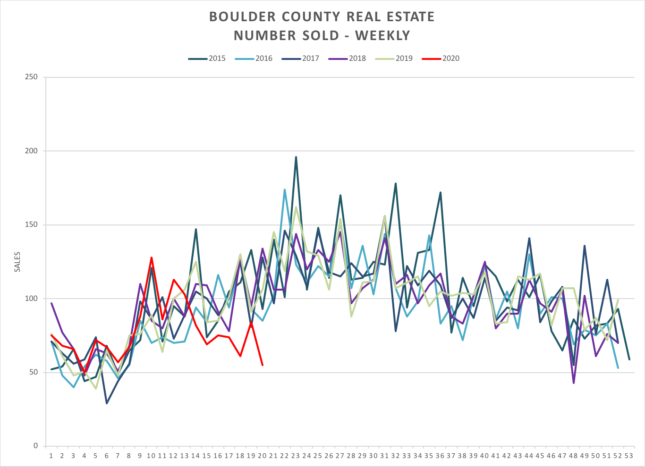

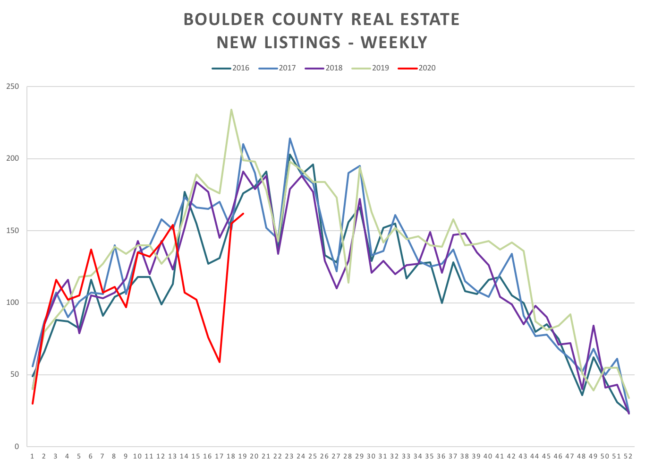

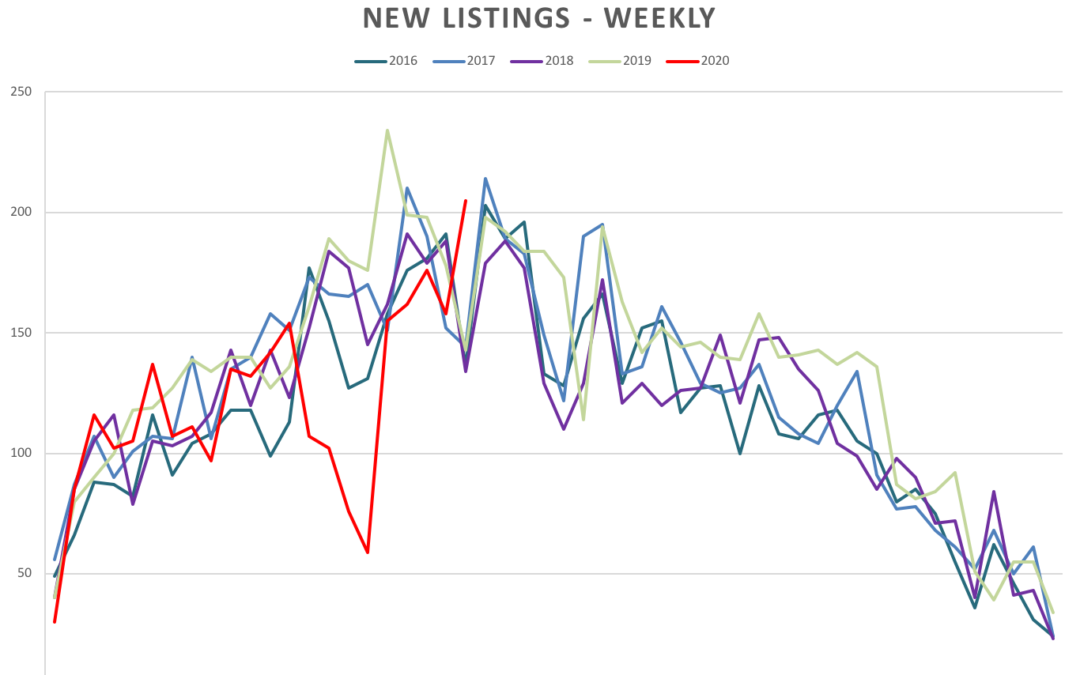

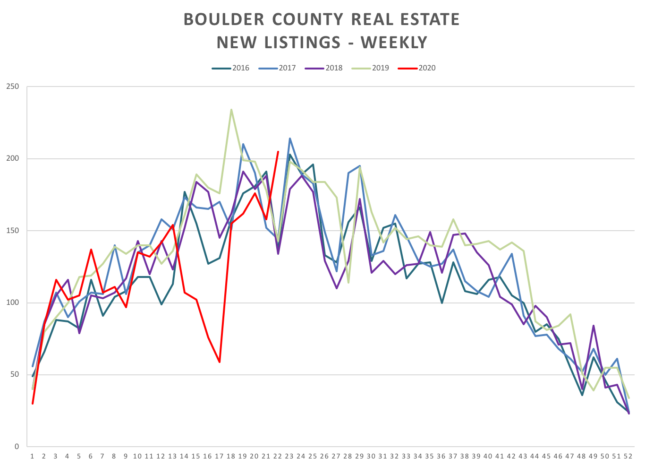

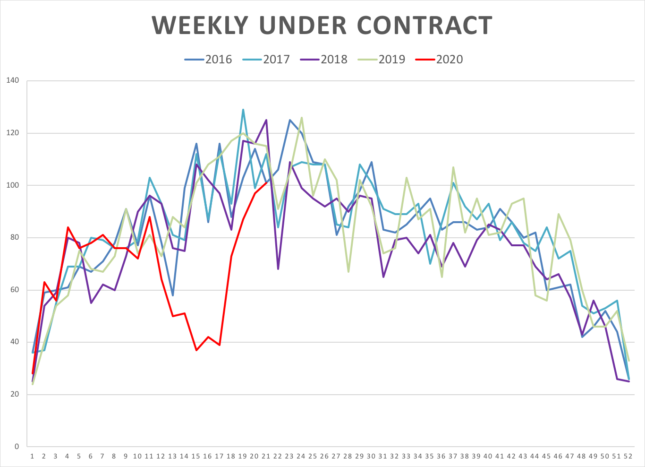

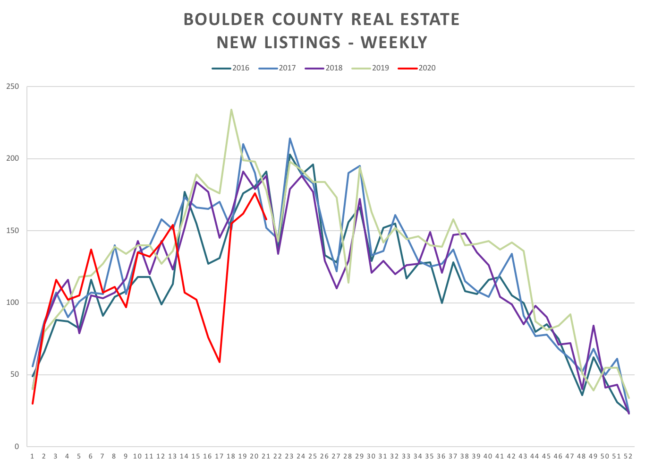

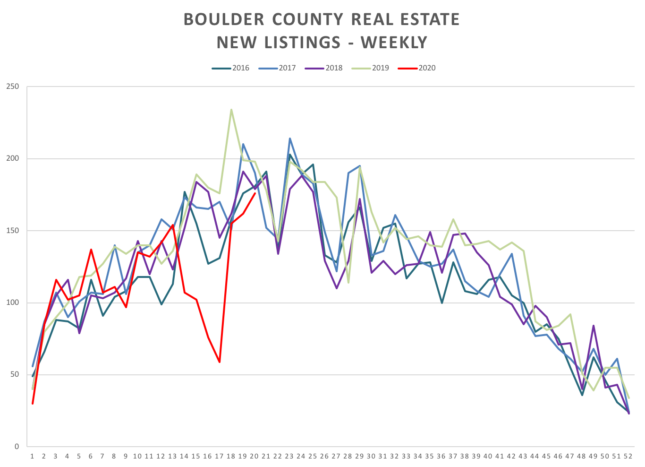

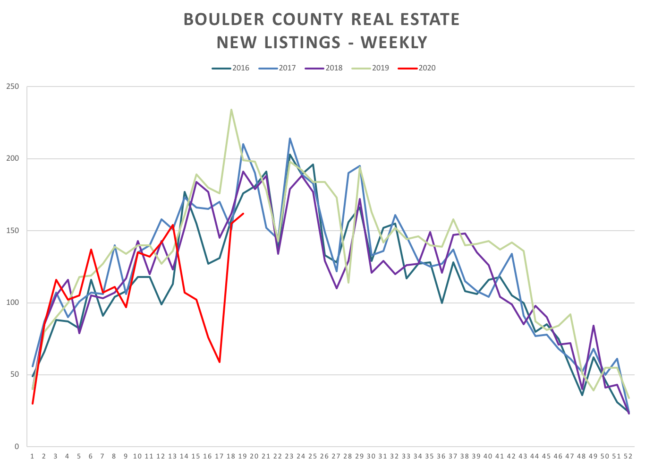

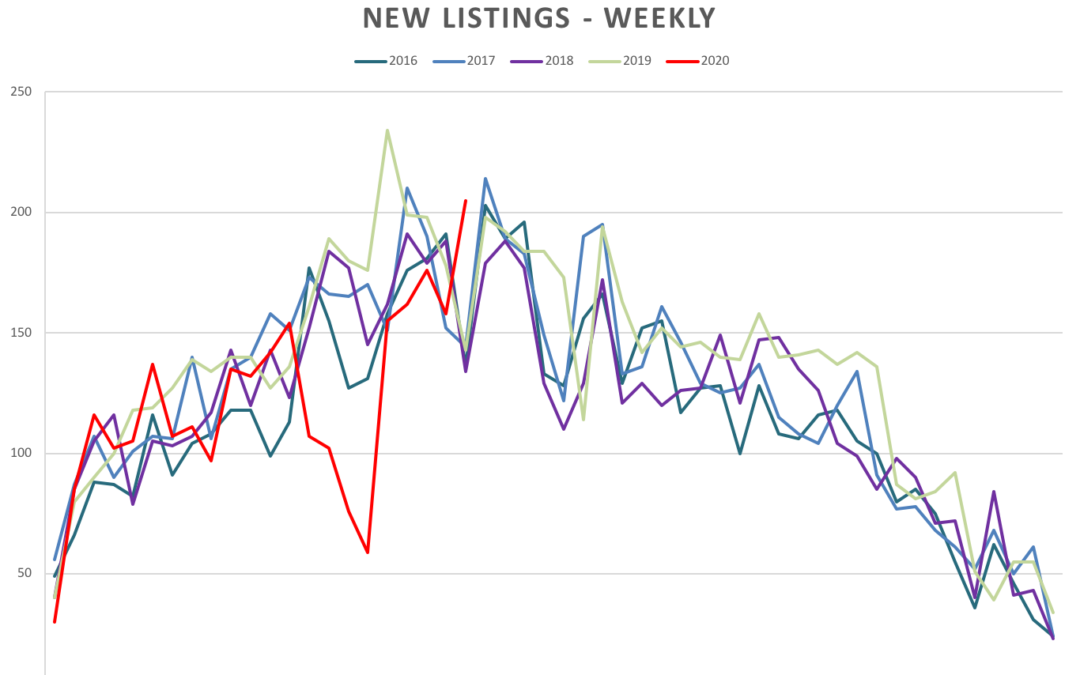

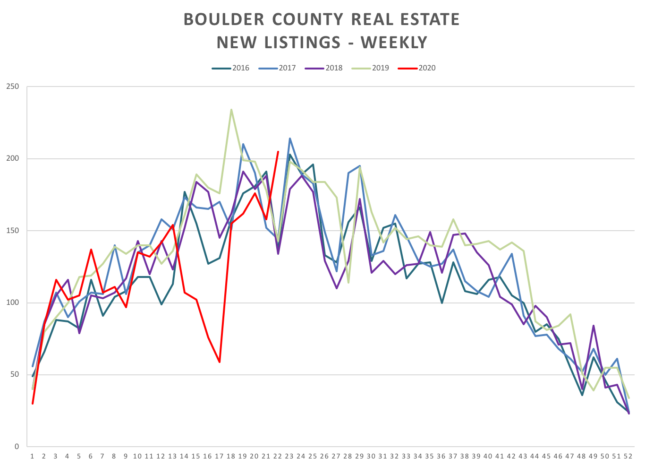

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.

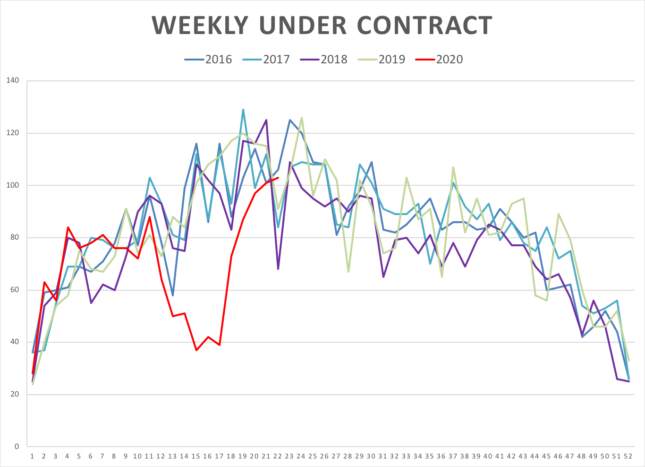

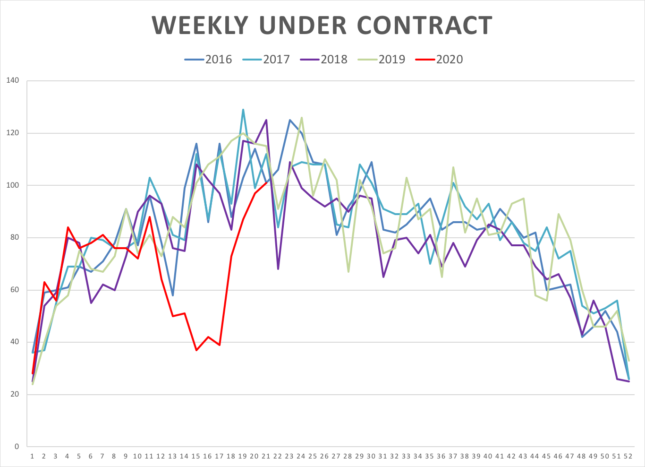

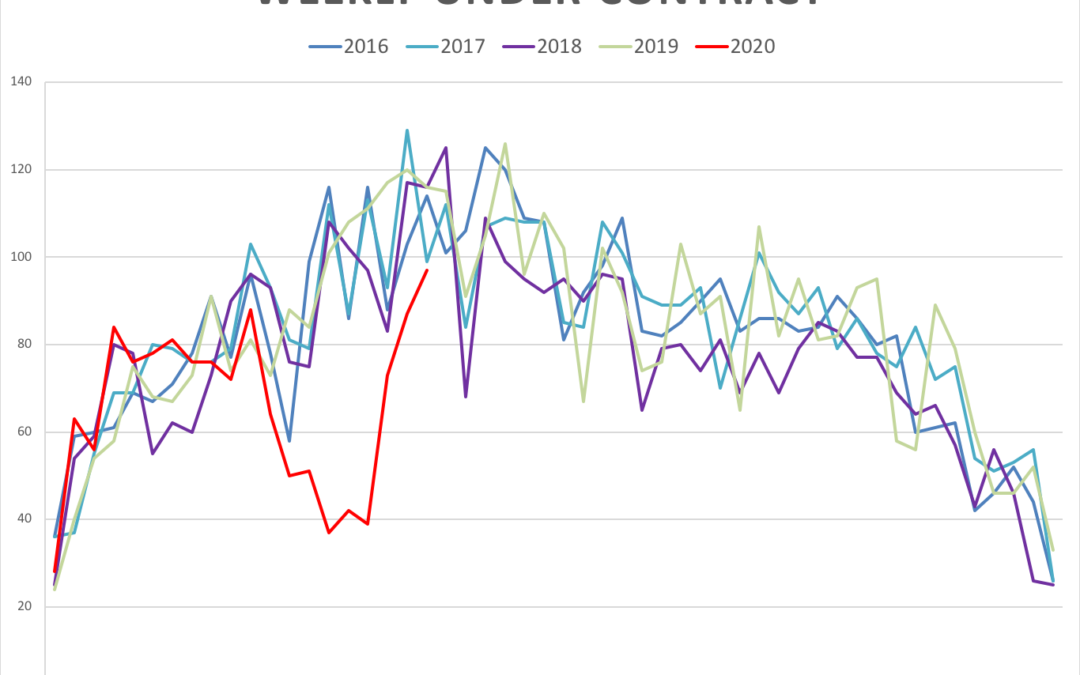

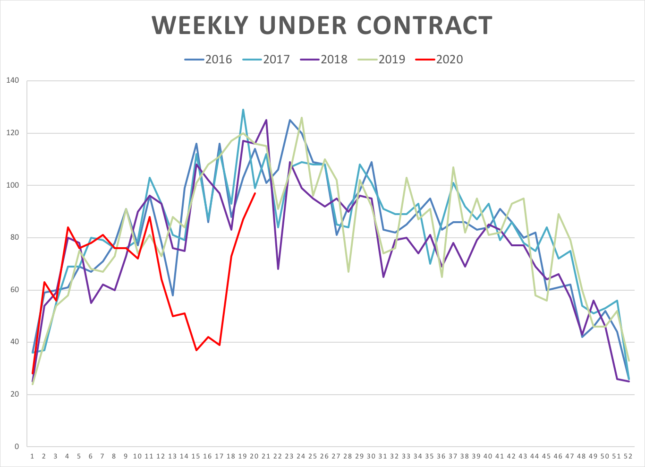

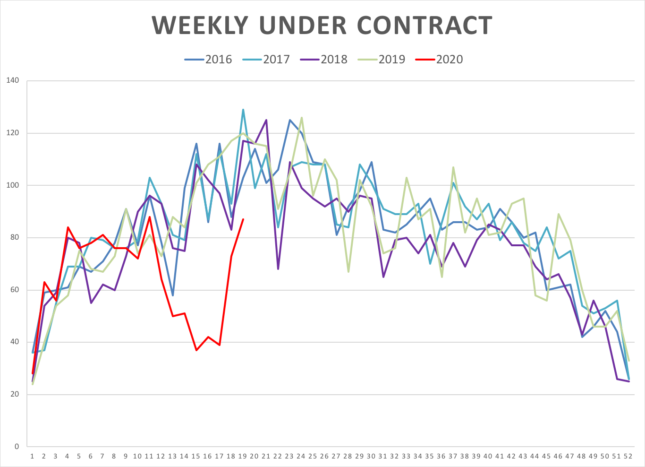

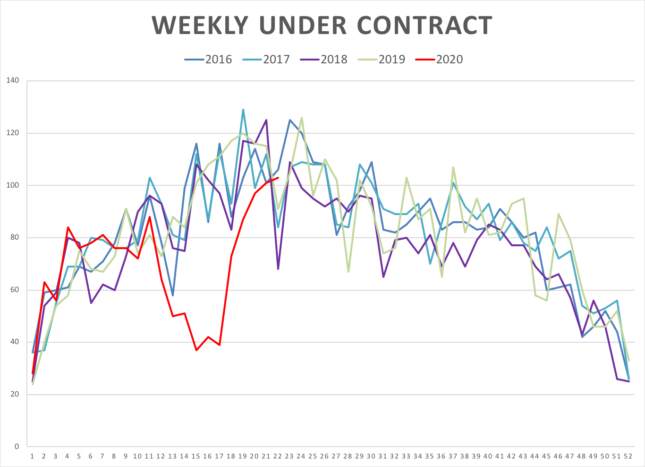

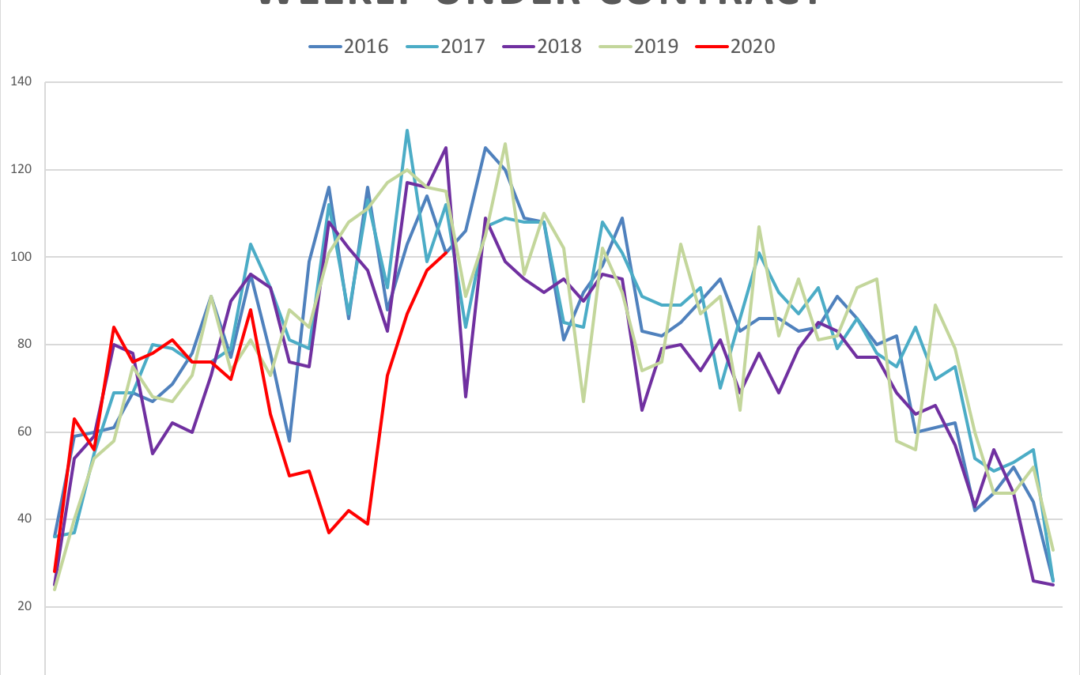

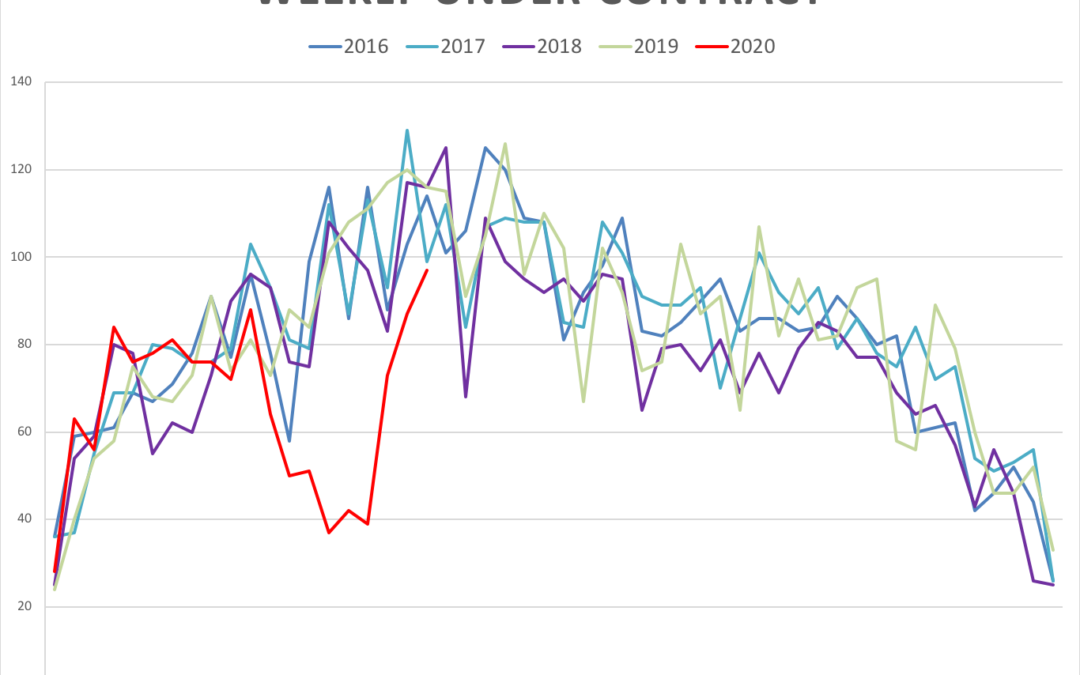

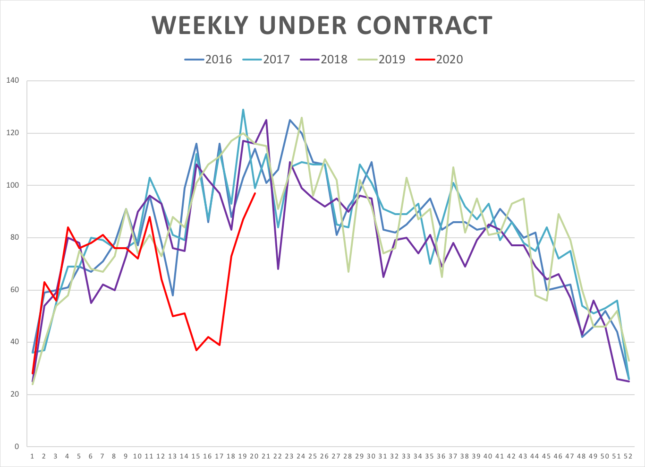

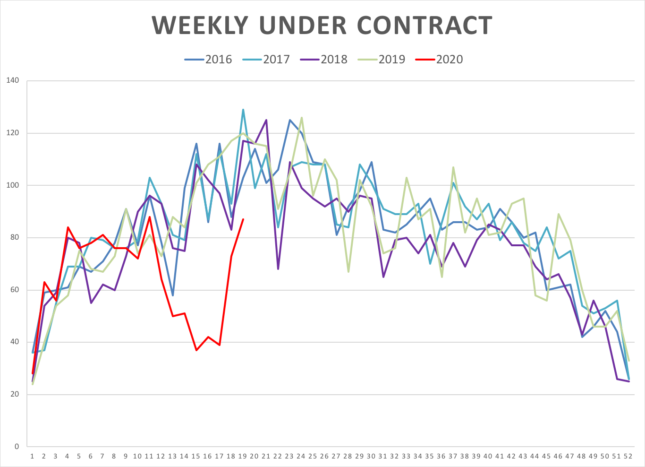

The graph directly above shows the number of listings that have gone under contract on a weekly basis. Since showings were again approved we have seen good contract activity. From the information above (orange toggles) you can see the strongest market is below $1,000,000.

As the weeks progress and as people get back to work it will be interesting to see if there is a surge in buyer activity. If not, we may see an increase in inventory. This isn’t a bad scenario since we have been low on listings for a number of years. But the risk of an imbalance (more supply than demand) is that it will take longer for homes to sell and there will be overall negative price pressure. As long as interest rates remain low and buyers can obtain mortgages, this is a good thing for buyers.

by Neil Kearney | May 21, 2020 | Boulder County Housing Trends, Statistics

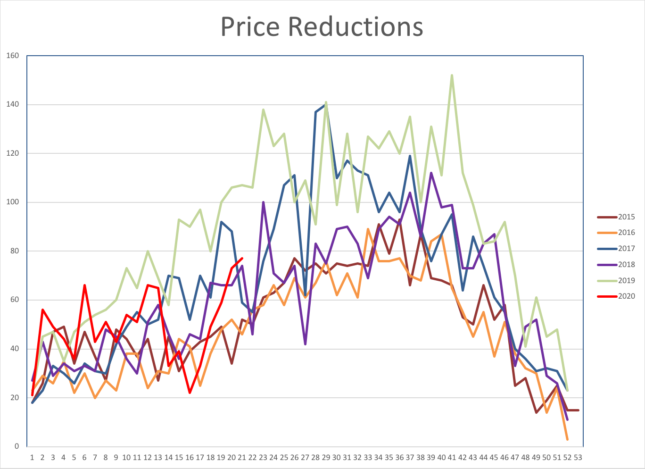

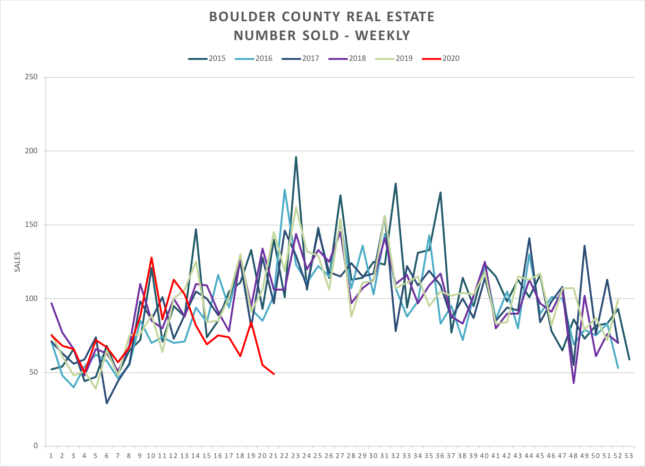

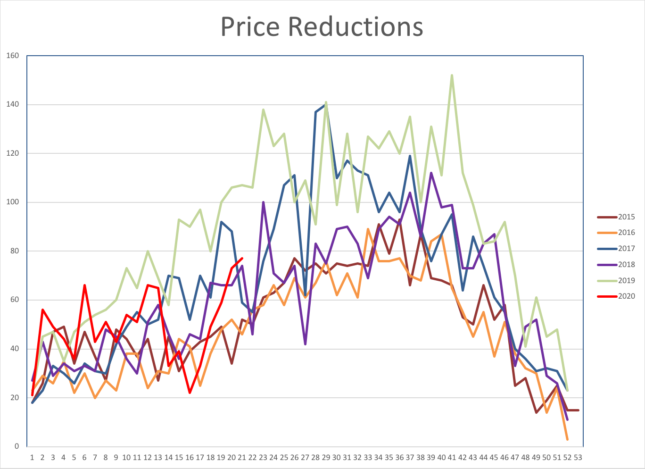

Showings on occupied listings have been up and running (with safety restrictions) for almost two weeks. It was a strong week of activity. 101 properties went under contract. This is down just 14 properties from the same week last year. There were 158 new listings during the week which is comparable to a normal year. Price reductions have been increasing as sellers get serious about selling, now that showings have resumed. Predictably the number of closings continues to slow. This is the result of the complete shut down in late March and April. For more information see the captions of the graphs below.

101 properties went under contract during the week in Boulder County.

New listings have climbed steadily over the past few weeks. Many sellers who had planned to list in March or April are now testing the market.

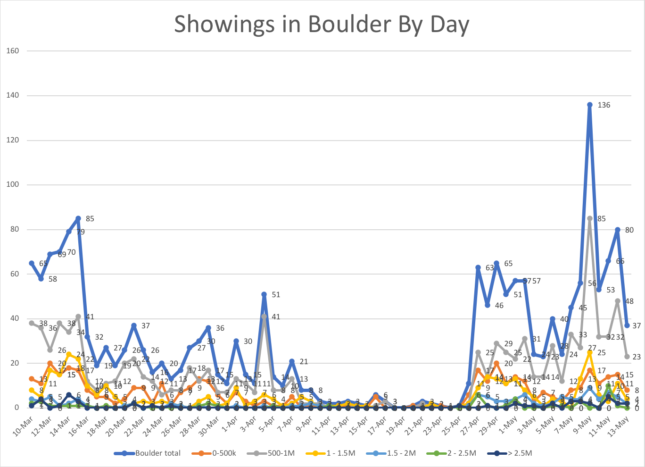

Showings for the week were active, but showed a decrease from the week before.

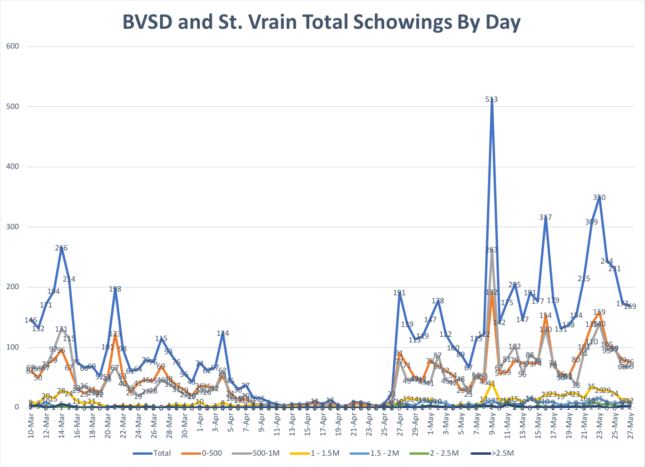

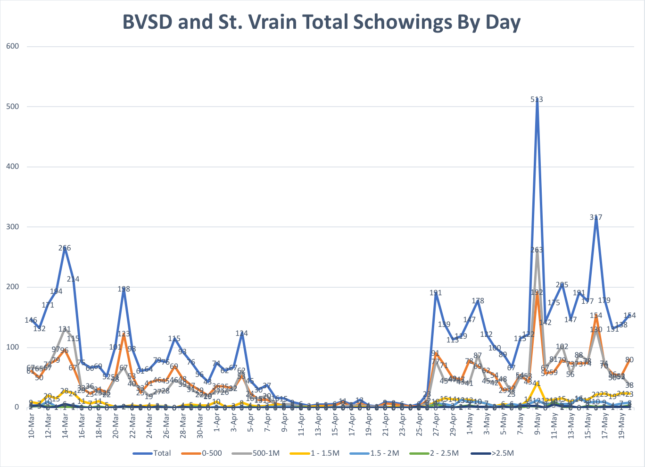

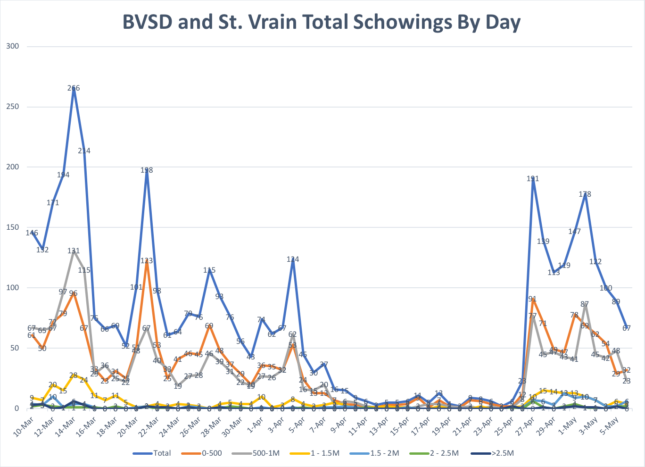

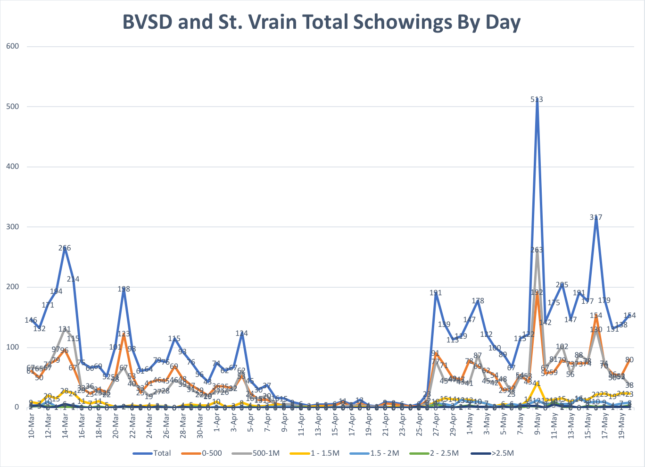

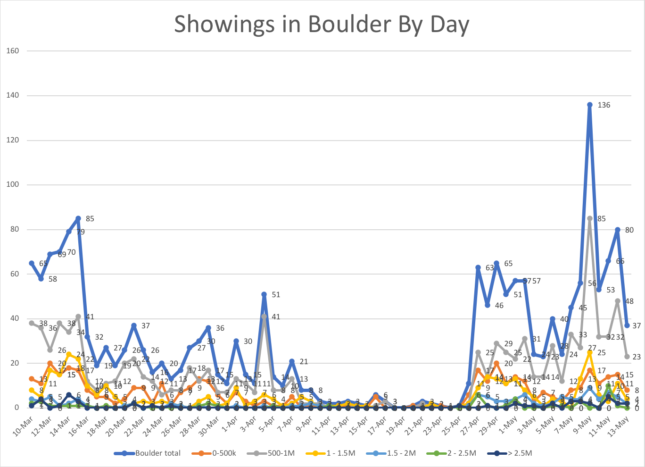

Showings are still much more active in the lower price ranges.

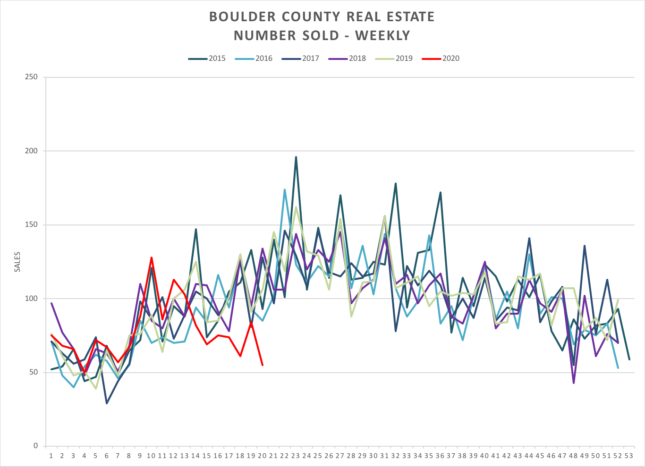

Showings happening now are the result of contracts written in March and April. We should see a decline for a few more weeks before it starts to recover.

Price reductions are a measure of the overall strength of the market. As houses stay on the market longer sellers decrease the price, trying to attract buyers.

by Neil Kearney | May 14, 2020 | Boulder County Housing Trends, Statistics

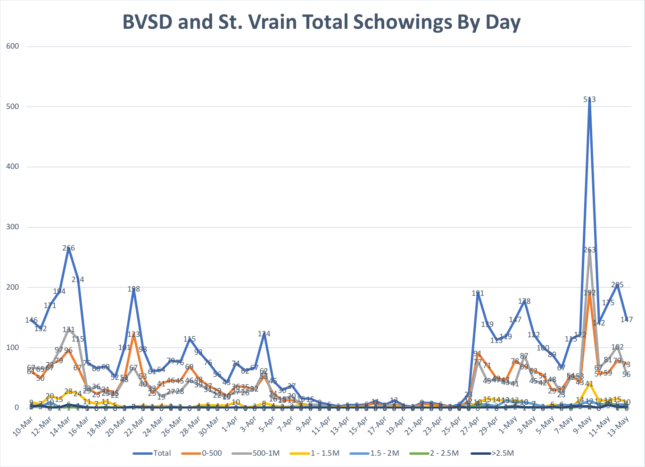

On Saturday May 9th Colorado transitioned into “Safer at Home” regulations. Certain stores and services were able to reopen and Realtors were given the ability to resume showings on occupied properties. This came with added safety measures such as cleaning surfaces before and after showings, social distancing during showings, wearing masks and gloves. The good news was that many buyers (and agents) were ready to go out into the world and view those properties they had been eyeing online. On Saturday we had a big spike. The spike was followed by a general improvement in showings and general activity. The graphs below tell the showing story.

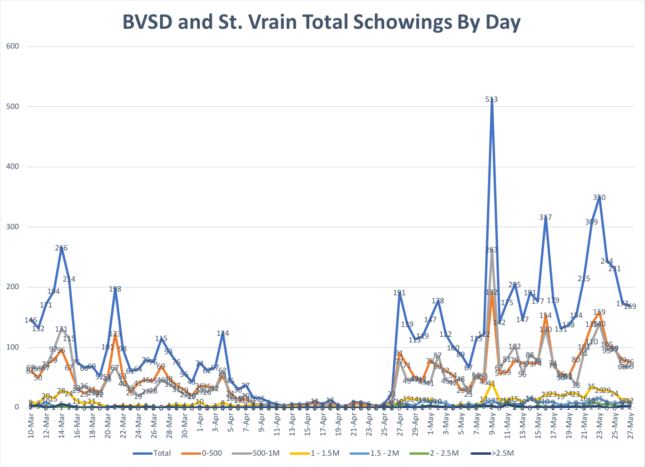

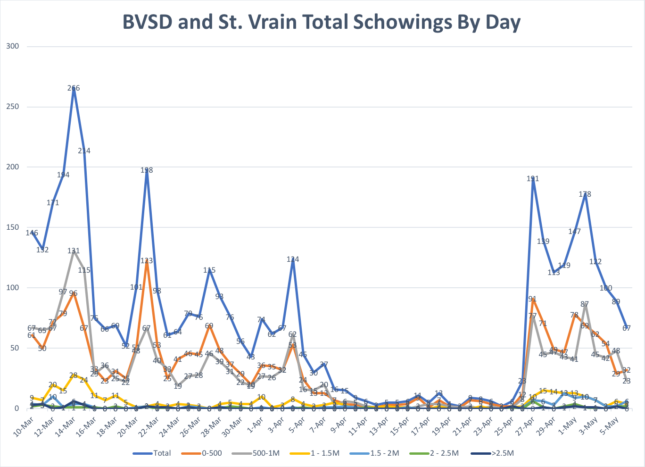

Showings in the broad Boulder area market (Boulder Valley and St. Vrain School Districts) recorded by day. Note the big spike on may 9th.

Total showings for the week in the overall Boulder Area Market set through ShowingTime.

Showings in the City of Boulder by day since March 10, 2020 set by ShowingTime showing service.

Number of Accepted Contracts Continued to Climb

The increased showings resulted in an increase in accepted contracts for the week. Last week there were 87 properties that went under contract and this week that number grew to 97. One year ago this week 116 properties went under contract. In my opinion this is really good activity!

The chart above shows the number of properties that went under contract on a weekly basis. The red line is 2020.

New listings increased significantly as Sellers who have been delaying got back in the market.

Sales are a lagging statistic. Since it typically takes 30-60 days to move from contract to closing, we are now starting to see the results of the activity in March and April. I expect the red line will be moving downward for a number of weeks.

Overall, I’m pleased with the activity in the market. It feels like we are moving forward. I’m starting to get more calls and am having planning meetings with sellers who will shortly be listing their properties. Stay safe out there and have a good weekend! Next week I may show you my haircut.

by Neil Kearney | May 11, 2020 | Boulder County Housing Trends, Statistics

We are now two months into the beginning of the financial impacts of the 2020 Pandemic. Unemployment has spiked to levels not seen in more than half a century and some states (including Colorado) are finding ways to safely get back to work. Real estate sales were down 30% in April and we will see large decreases (compared to past years) in the coming months. Showings were again allowed starting in early May and we are seeing some activity return to the market. But, like the economy in general, it will not be a straight- line recovery. I’m carefully watching showing activity and contracts written to see if buyers are coming back to the market. I’m seeing more activity in the lower price ranges and not as much in the luxury range.

After scrolling through eight slides below you will have a much better understanding of where the market is in terms of showing activity, new listings, inventory and other measures of the market. As always, please feel free to contact me directly if you have questions.

by Neil Kearney | May 8, 2020 | Boulder County Housing Trends, Statistics

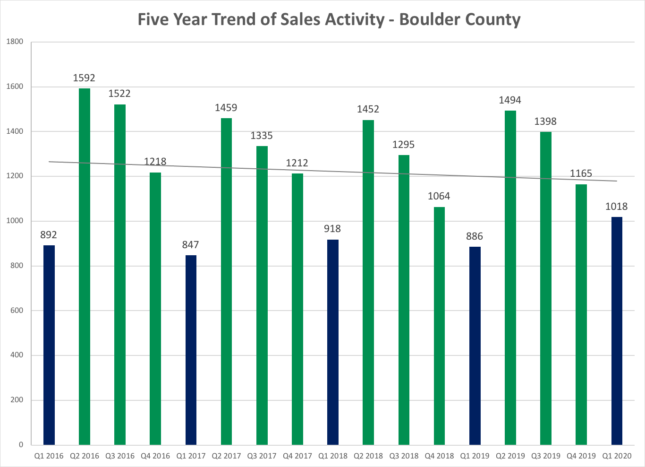

Writing about a strong first quarter from the middle of a pandemic seems a bit like reviewing the wonderful banquet enjoyed just before a tornado or earthquake. The details are factual but it just isn’t as important as what happened next. I’ll attempt to find some balance in reporting the first quarter of 2019 in context of the bigger picture.

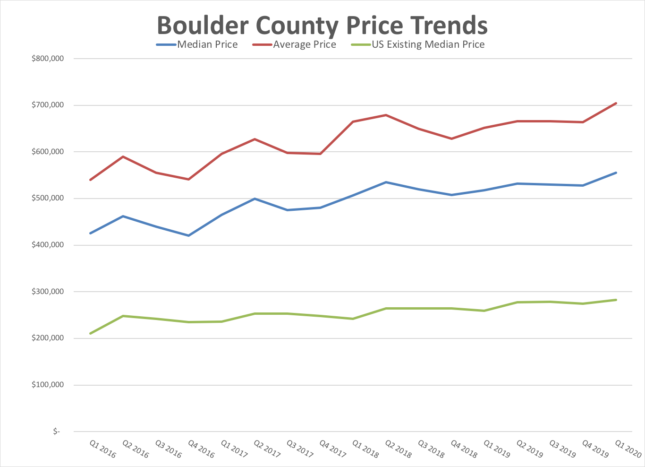

The year started out with a bang! Sales in both January and February were up over 20% compared to a year ago, buyers were out looking, interest rates remained low and we were having one of those early springs. In other words, the Boulder area real estate market was off to a quick start. March sales were not quite as strong (down 9% for the month), but for the quarter closings were up 15%. After a bit of a pause during the later half of 2019 prices were also trending higher. The economy was strong, unemployment was very low and all indicators were pointing towards another strong year.

Just as we were coming into the busiest time of the year for real estate the stay-at-home orders started to spread along with the pandemic. The stock market dropped over 30%, college kids and students of all ages were sent home and restaurants and “non-essential” shops of all kinds were closed. Real estate was deemed essential but in Colorado that meant that functions essential to a transaction already in progress could proceed. Inspectors inspected along and closings took place curbside. Most, but certainly not all transactions made it to the closing table. But by mid-March showings had dropped significantly and by mid-April they took a pause altogether.

During this time, many would-be sellers delayed their plans and many listings were pulled from the market. As I write this in very early May we have begun to show vacant homes and by this weekend we will be showing all homes but with safety restrictions. It is certainly an unprecedented time and like all facets of our society and world real estate is very much affected.

The good news is that real estate was in good shape before this all happened. Tightened mortgage requirements over the past decade have ensured that more people have equity in their homes. At this moment it looks like there will be fewer ‘distressed’ homes which will allow for a quicker recovery. As we look forward I like to go back to the basics of supply and demand. As we started the year the inventory was very low compared to the demand. Currently, with the many homes not on the market (temporarily withdrawn or delayed) the inventory is low. But going forward we may see a stretch of time when the supply of homes outpaces the demand. With over 20 million people unemployed and small business owners hurting it’s easy to imagine a scenario where it will take awhile for buyers to come back in full force. True, that many of the 20 million newly unemployed are renters, but certainly not all. Just like after the last economic crisis, it may take a while for people stop hunkering down and get back to business. The rest of this report is in regard to the strong first quarter of 2020. It’s my guess that a few years down the road we will be looking more closely at the second and third quarter of this year.

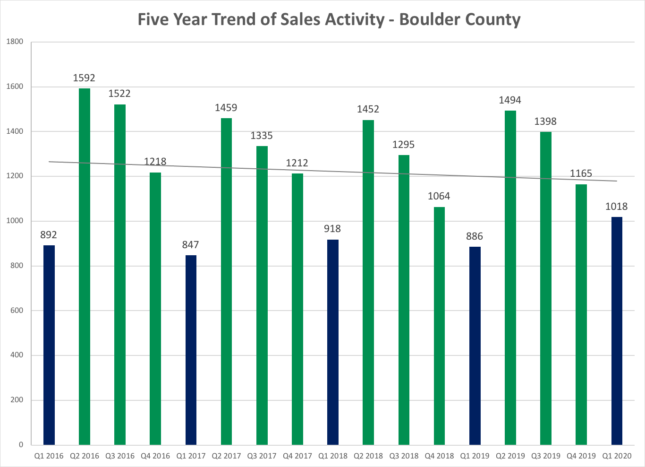

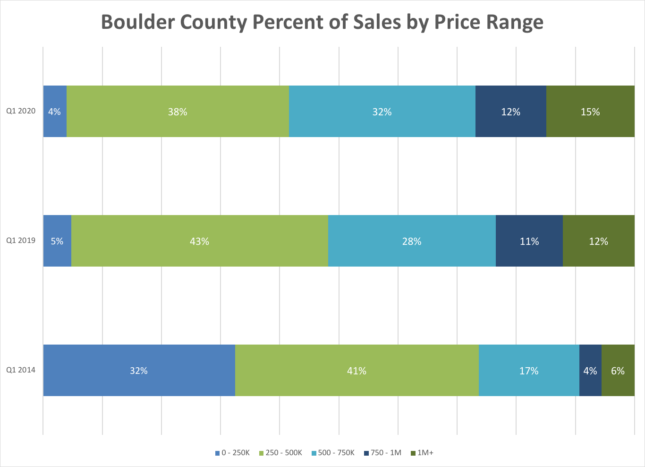

Sales in Boulder County increased by 15% during the first quarter of 2020. Although the overall trend is down, this was the fourth straight quarter of increased sales.

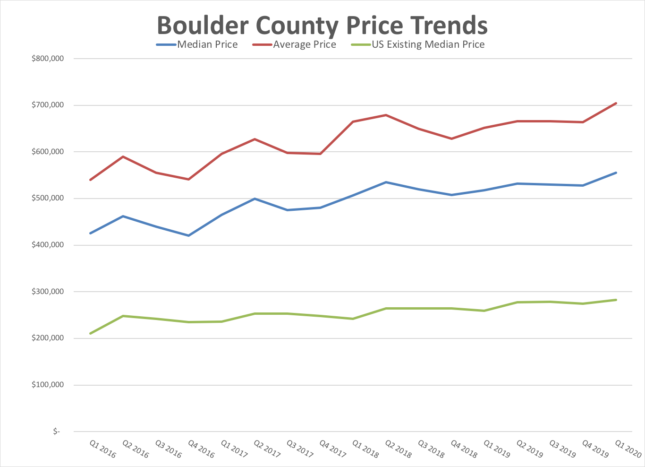

Appreciation was modest during most of 2019. Prices definitely had an uptick in the first quarter of this year.

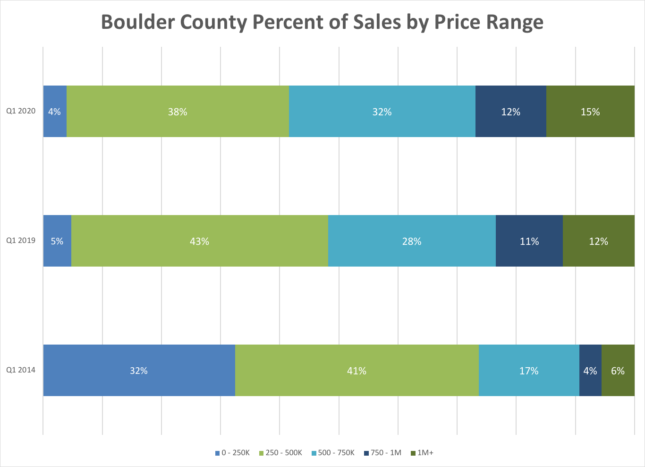

As prices have increased over time the lower price range (sales under $250,000) have been decreasing and sales in the highest prices ranges have been increasing.

For more graphs and detailed analysis take a look at the full report.

by Neil Kearney | May 7, 2020 | Boulder County Housing Trends, Statistics

Showings Open Up For Vacant Homes – Activity Improves

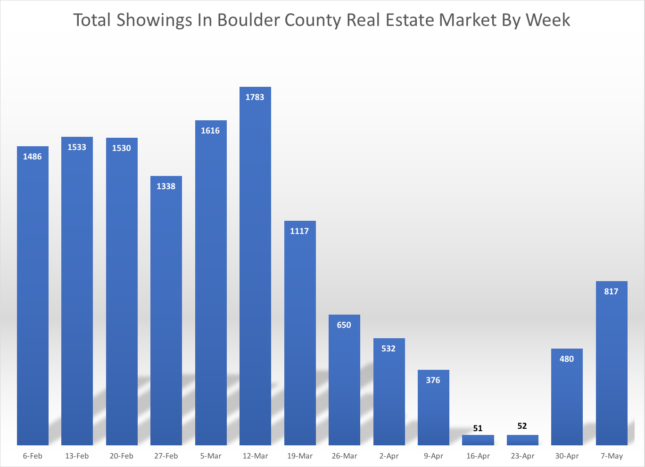

Showings for the week in the Boulder market area increased to 817 this past week; to the highest levels seen since March.

When looking at the showings on a daily basis we see that the increase in showings has not been consistently upward.

We have seen a surge of new listings the past two weeks. Many sellers who had planned to put their homes on the market in March and April are now doing so.

Along with more showings, we are also seeing a strong increase in new accepted contracts. Not quite to historical levels, but a notable increase.

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.

The graph above shows the new listings which have come on the market on a weekly basis over the past five years. The red line shows the activity this year. We have seen many new listings hit the market in May.